It may be unprecedented for oil producers to pay commodity traders to take crude off their hands, but the supply and demand dynamics which forced West Texas Intermediate (WTI) prices into negative territory are standard fayre. Events from history can therefore teach us a lot about what we might expect next from oil prices. Though it should be emphasised that the events that gave rise to the current market dynamics are most certainly unique.

Oil and the global economy

Demand for crude oil and other hydrocarbon-based fuels is cyclical with peak supply usually reserved for the cold winter months when demand is high. The supply level helps to determine the crude oil inventories, which along with anticipated demand, provide the central levers for the price mechanism.

But because of oil’s direct influence on the global economy, those levers often give way to market manipulation. Countries with large industrial bases, such as the US and China, hold substantial strategic reserves which can be released to dampen rising crude oil prices.

But while numerous academic studies have established a direct correlation between oil prices and the general level of economic activity, it is sometimes difficult to discern whether oil prices are being shaped by the wider economy or vice-versa.

Falling crude prices lower production costs for businesses, particularly those which are heavily dependent on oil inputs. This is often accompanied by rising investment in the economy, along with increases in employment levels and discretionary incomes. An expanding economy will trigger increased demand for crude oil.

But let prices fall for too long and oil exploration companies have no incentive to keep drilling, potentially constricting future replacement barrels and giving rise to long-term inflationary pressures.

Lessons from the last price crash

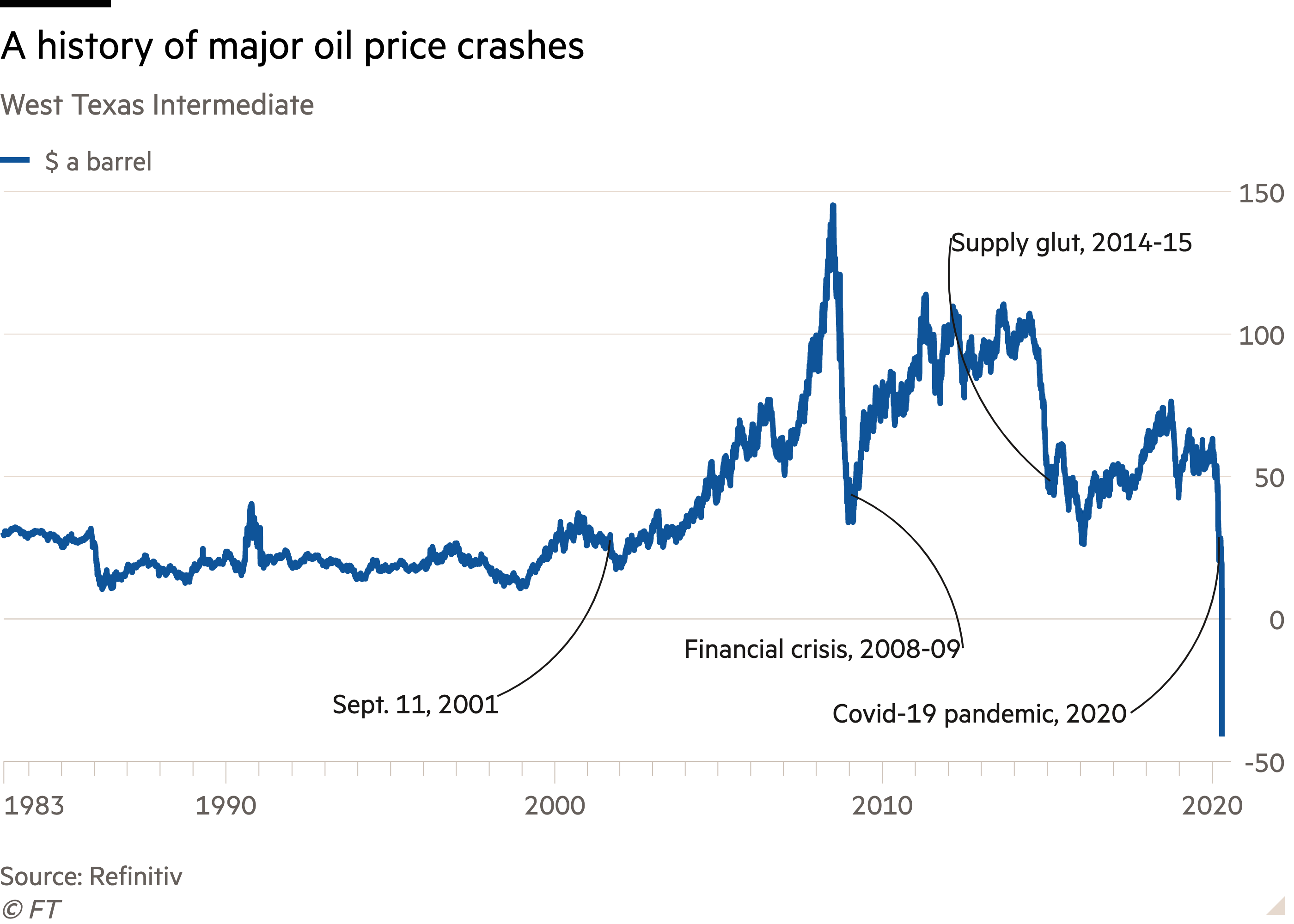

The last dramatic pull-back in crude prices occurred midway through 2014. The price for a barrel of Brent crude had been retracing since the global financial crisis, regularly eclipsing the $100 mark from 2011 onwards. But from June 2014 through to February 2016, prices fell by 73 per cent from their previous peak of $125 a barrel in March 2012.

The price collapse in 2014 was a long time coming. The previous decade had witnessed an accelerating increase in North American shale oil production on the back of improvements in lateral drilling and fracking techniques.

Strengthening output from other producers outside of the Organisation of the Petroleum Exporting Countries (Opec) also fed into fast-expanding reserves, placing downward pressure on prices.

Saudi Arabia, the de-facto leader of the cartel, is seen as the swing producer in oil markets due to its spare capacity, the extent of which is still open to debate. Until recently, the 'desert kingdom' was intent on defending its share of the market by refusing to cut production, thereby guaranteeing a crude oil glut, which would ultimately force lower-margin producers (such as US shale producers) to the wall once prices slipped below breakeven for an extended period.

The world was awash with crude oil and the outlook for prices would deteriorate further with the lifting of international sanctions against Iran, at a time when markets already appeared to be oversupplied by as much as 2.2 million barrels a day. And rather than stimulating global growth, the oil price collapse was accompanied by an economic slowdown in 2015 and 2016.

Oil’s centrality to the global economy, combined with the fact that it is often produced in politically unstable locales increases the risk of price volatility. Geopolitical issues such as the Yom Kippur war have had major impacts on supply levels and prices, while terrorism, natural disasters and regime change are all deterministic factors on the oil price. But it is doubtful whether too many analysts had factored in the prospect of an enforced closedown of much of the world economy.

History shows us that it takes time to clear the glut in oil markets, by which point the likely winners will be shipping brokers and large oil trading groups like Vitol Holding BV and Trafigura. These traders store excess crude (often in offshore super-tankers) for delivery months down the line when prices are expected to recover. Traders employed this strategy during the 2014 rout and prior to that in the aftermath of the global financial crisis. The good news for investors in both Royal Dutch Shell (RDSB) and BP (BP.) is that both oil majors have large in-house trading units, which will help to mitigate the current slump in crude prices, at least to an extent.