Your five choices:

- Take tax free cash worth up to 25 per cent of the value of your total pot and invest the rest to produce an income stream of income

- Invest your entire pension pot to produce an income stream

- Take tax free cash and invest the rest in an annuity which will pay you a guaranteed income for the rest of your life – or use the whole amount to buy an annuity

- Take all of your pension as cash in one go (you might do this with a small pot)

- Take your pension pot in a series of cash lump sums

If you have a defined contribution pension, at some point you have to decide how you’re going to take it. You have several choices and each one makes a difference to how much income you extract from your pot and how other family members benefit.

If it all seems a bit of a chore, be glad you have to do it. What you are doing is using pension freedoms, a concept introduced by the government in 2015 to give people more choice and control. Now you can take your pension in a way that suits you, including taking it all in one go as cash, or even preserving it to pass down to your children.

You are allowed to access your pension pot at any point from the age of 55 (or 57 from 2028), even if you are still working, although taking a pension early might not be a good idea – you would be cutting off future growth and removing a wrapper which allows your funds to grow tax free.

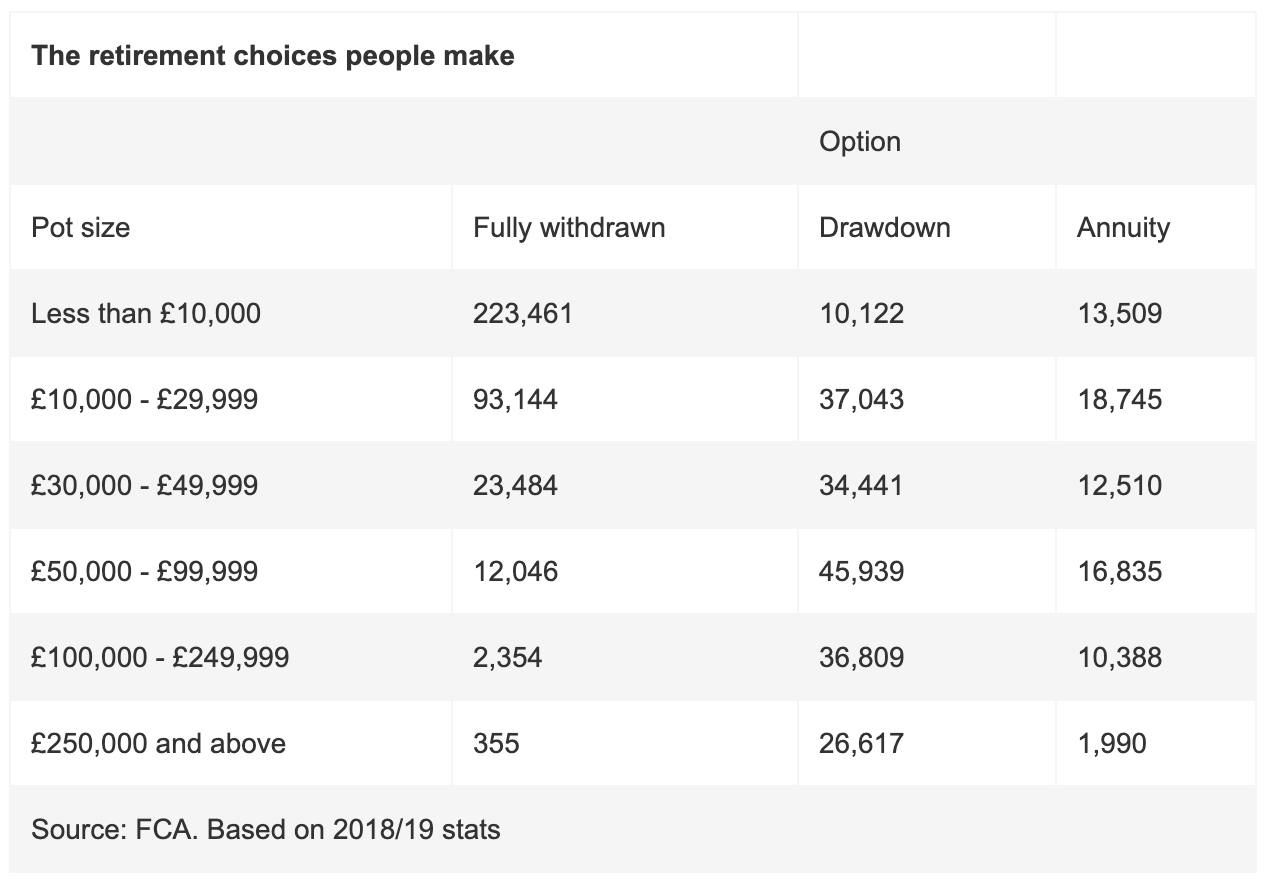

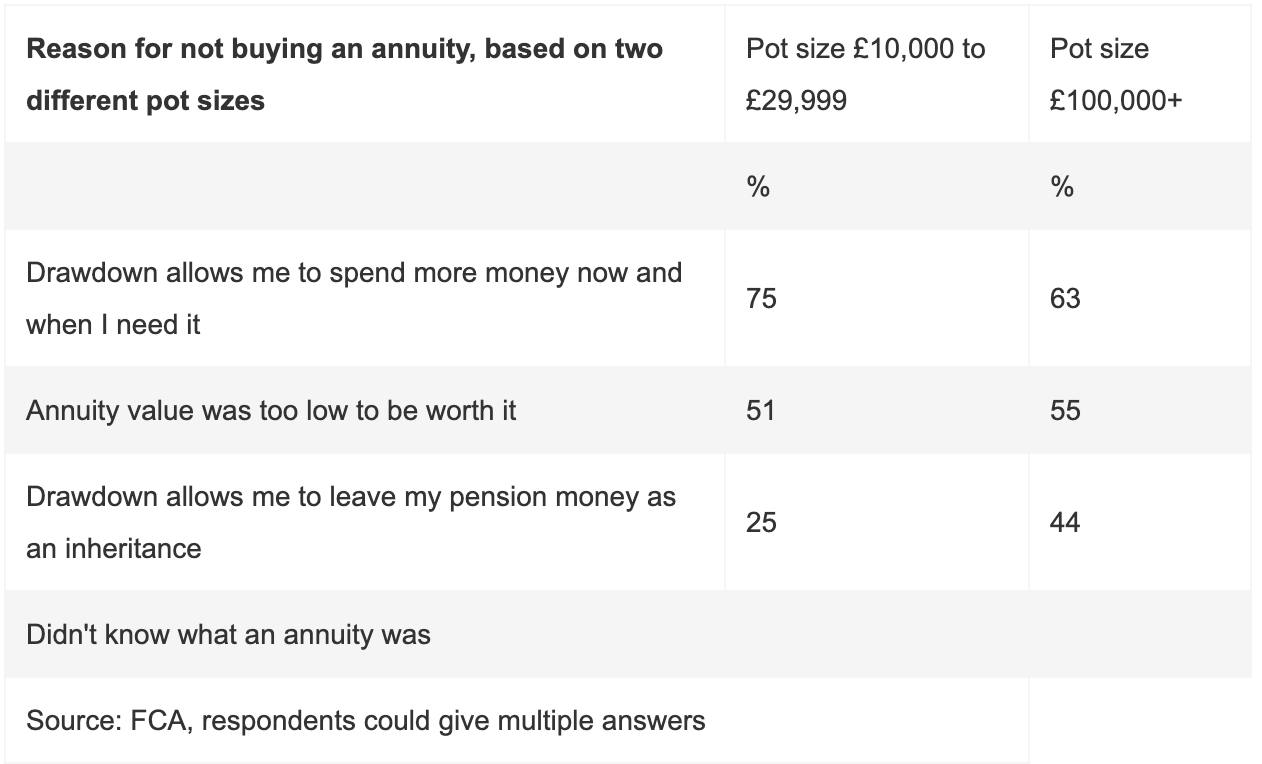

The tables below show what most people do with their pension pots. As you can see, drawdown outsells annuities. There are two reasons for the popularity of drawdown. When people see the income they will get from an annuity, even though it’s a guaranteed amount, they often choose to take their chances with drawdown. The second reason is that money transferred into drawdown can be inherited by children, family or friends which cannot happen with an annuity.

The table also shows that a lot of people take entire pension pots as cash. What the chart doesn’t show however is that 90 per cent of people taking a pension pot as cash in one go actually have another pension source for example a defined benefit scheme.

Making the most if your options

1. The Drawdown option

If you choose the drawdown option, your pot of money will be invested in a range of assets so that it can be replenished as you take an income.

The advantages of drawdown are that it is super-flexible: you can withdraw as much or as little money as you wish, your money has a chance to keep growing and any money you don’t spend can be left to your family and friends. Whatever is left in your pension pot in drawdown can be passed on free of inheritance tax and if you die before the age of 75, your beneficiaries won’t have to pay income tax on it either.

But there are risks. Your pot might perform badly in drawdown, restricting how much income you can withdraw. You could outlive your pot.You might be targeted by scammers eager to get their hands on your pot of money.

You also have to work out how much is safe to take each year. If markets fall and dividends are axed, then you could be in danger of outliving your pension pot. You could arrange for an adviser or drawdown provider to manage the pot for you but you will incur management fees. Alternatively our model asset allocation can help ensure you make the right decisions. Click here to find out more.

2. The Annuity option

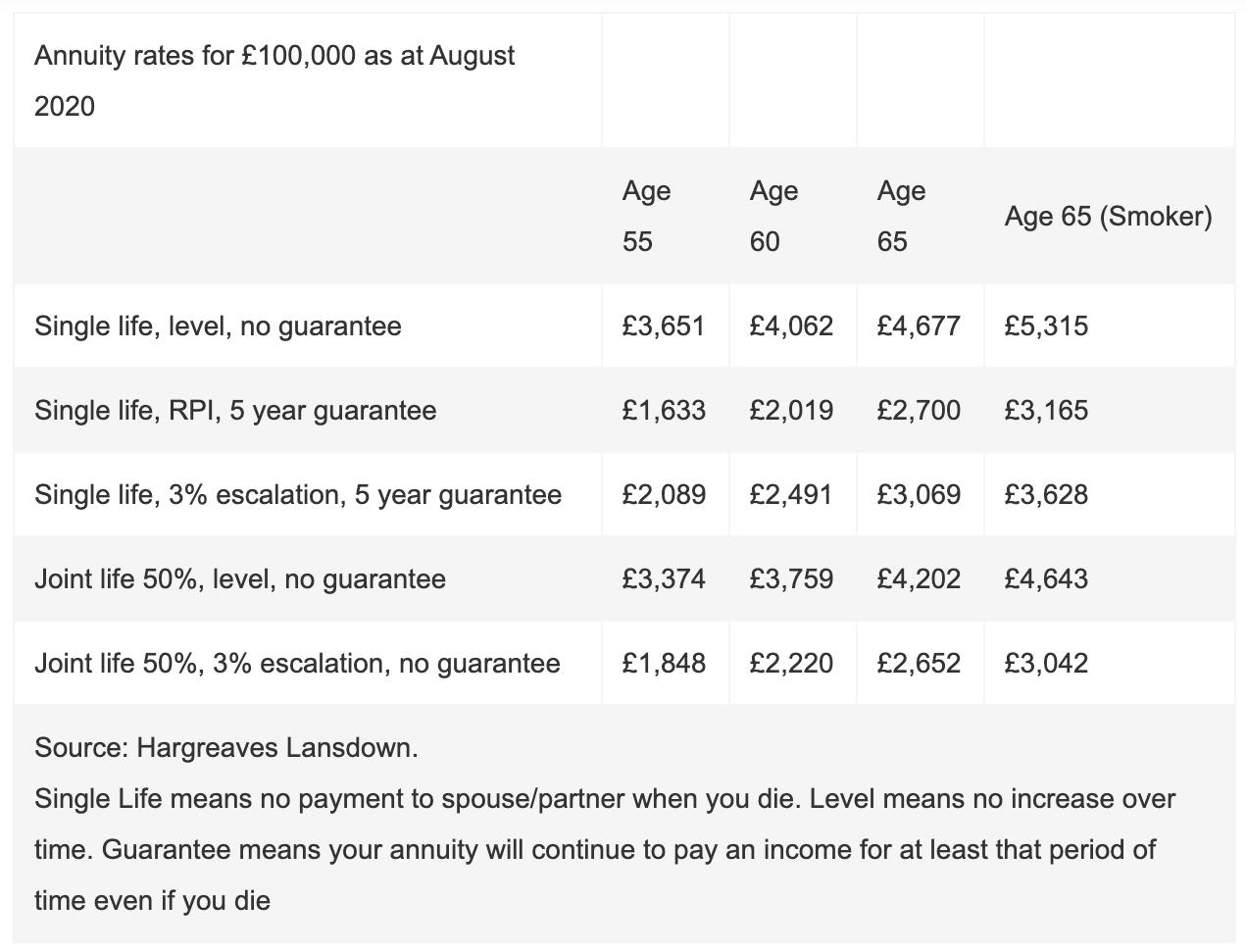

An annuity is a policy which will pay you a guaranteed fixed (or rising) income for the rest of your life, no matter how long you live. If your pension is managed by one of the big insurance groups, they will give you a quote but they are also obliged to remind you that you can and should shop around as you might be able to get a better quote elsewhere.

The big advantage of an annuity is that you won’t have to worry about how your funds are performing or how long your money will last. You will know exactly how much income you are going to receive each month.

The downside however is that the income you will receive could be very low indeed. This is because annuity rates are determined by factors such as long term interest rates and how long you are likely to live - expect lots of questions about your state of health and note that this is not the time to boast about being in rude health. If you are in poor health, smoke or used to, you could secure a higher income. If you need a to provide for a partner, or wish to inflation proof the income, this will affect the amount you receive.

The other thing to consider with annuities is that when you die, there will be nothing to pass on to your family even if you die soon after buying a standard policy.

3. The Cash option

Rather than just taking a 25 per cent tax free cash lump sum from your pension pot, some people choose to take their whole pot as cash, or in a series of lump sums (these are referred to as uncrsytallised funds). You might decide to do this with one of your pension pots, and to use this money to pay off a mortgage, for building work, setting up a business, travelling or other luxuries.

But it’s not a good idea to do this with your main or only pension, unless it amounts to quite a small sum. Firstly, your money will not be able to grow and you risk living in poverty in later life, and second, you could lose a significant sum in tax. Although you can take 25 per cent of of your pension pot tax free, the remainder is taxed as income (unless the pot is a 'Small Pot', worth less than £10,000). If you withdraw a large cash sum it will be added to all your other income for that year and you could end up having to pay 45 per cent tax on it.

So many people have been tempted to cash in their pensions following the arrival of pension freedoms that HMRC has admitted that it is taking in £4bn more than it had originally estimated would be paid by people accessing their pension pots.

You can work out exactly how much tax you will pay on cash lump sums here.