Key steps:

- Join your workplace pension scheme

- Take your allowances and pick your product

- Select the right broker or investment platform for your needs

Everyone has two ways of making money (three, if you include an unlikely sweep in the National Lottery): we can work for it, or we can make it work for us.

Most of us are only making use of the former. We go to work, receive our salary, spend some and leave the rest in the bank where it does very little. Everyone can make their money work harder by investing it, whether that is in low risk bonds, stable property or a whole host of alternatives. And nowhere can the rewards of saving be as great as an investment in the stock market.

Step One: Take your allowances

It’s important to use your allowances. Take maximum advantage of work pension schemes and as much of your annual Isa allowance (£20,000 in the 2020-21 tax year) to grow your investment pot tax-free. You could also chose to manage your own additional pension pot in a Sipp or Lifetime ISA.

The type of account you chose will reflect your investment goals:

Isa – keep it simple, this account is ideal for those with general savings goals (BASIC)

Lifetime Isa (Lisa) – for those saving for a house or their retirement (BASIC)

Sipp – personal pension savings (BASIC)

Dealing platform – general savings account for those who have maxed out their annual ISA allowance (INTERMEDIATE)

Spread betting – investors don’t own the underlying asset, but ‘bet’ on a spread of prices offered by the broker (ADVANCED)

Contracts for difference (CFD) – used by investors who want to hedge their investments (ADVANCED)

For those starting out, keep it simple, pick an Isa account and make sure you make the most of the tax benefits on offer.

Click here to read our Isa Guide

Click here to read our Sipps Guide

Step Two: Pick your platform

Whether you want to open an Isa, Sipp or invest in international stocks, your first port of call is an investment platform.

The range of platforms available in the UK today means you should be able to find one which suits your needs. If cost is your priority, our guides show where you can find the cheapest providers; or if service is important, we have ranked the platforms accordingly. We have also answered your key questions on Isas, Sipps and international investing, to help you get going.

Step Three: Make a deposit

You can either deposit a lump sum into your investment account, or drip feed monthly savings. This will depend on how much capital you have available and the state of the markets.

Generally, it is good to deposit as much money as you can afford into your account as early as possible as the longer it is invested for, the longer it can accumulate. But it is also good to get into the habit of saving a little bit into your investment account every month.

A CAVEAT: In a sell-off it is best not to deposit all your savings in one go, drip feeding your portfolio can help you take advantage of weak markets.

Click here to read our review of how to drip feed your savings into your investment account.

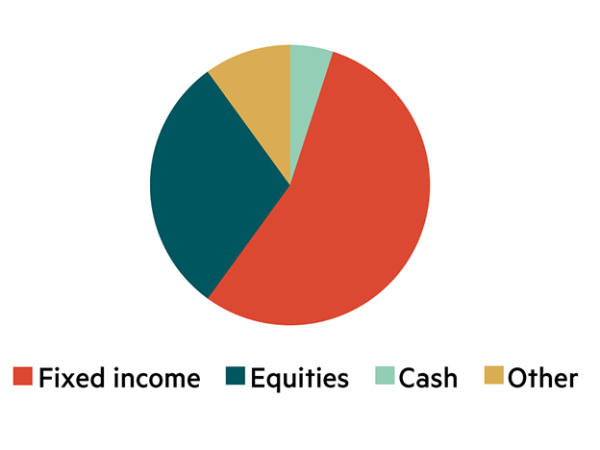

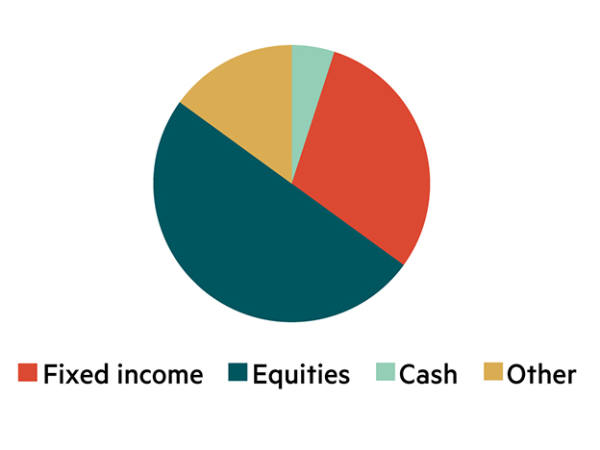

Step Four: Pick your assets

When you’ve cleared all the logistical hurdles required to set up your investment portfolio, you need to pick the assets to actually invest in. This is the most fun part of investing – getting to know funds and companies can be fascinating – but it is also time consuming and getting it wrong can have the negative consequences for your wealth.

To help get your started, we have created various lists of assets for you to consider. Click here to read our guide to the assets which are the heart of your investment portfolio.

Want more?

Download our ultimate guide to a brighter financial future for far more hints and tips about getting started in investing.