Key Points:

- Buying shares allows you to share in the success of the company you invest in

- Listed companies are traded constantly and can be easily bought and sold by individual investors

- New platforms have made it easier for investors to buy shares in foreign companies

When you buy a share, you become a part owner of the company. You share in the company’s successes and failures and you technically get a say in how it is run.

Not all companies are open to ownership by anyone. Companies choose to sell parts of themselves to the public if they want to raise money or their profile. When a company goes public, they sell a handful of shares onto the stock market in what is called an initial public offering (IPO).

Once a company’s shares are listed, they are traded constantly. Stock markets operate much as any other market does: buyers pay their money in exchange for shares, sellers offer their shares to other buyers, traders help facilitate the transactions.

Price is based on supply and demand. Put simply, if a company is performing well, demand for its shares will be high and the price will rise. If a company is performing badly, demand for its shares will fall and current owners might want to sell their shares, meaning the price will fall.

Investors can buy the shares of companies that are listed on public stock markets either directly or indirectly via funds (more on that in another guide). As a basic rule of thumb, direct investment is a better option for investors with a large pot of savings which can be split across multiple companies – you don’t want all your fortunes tied to the success of just one company. Indirect investment is a cheap and easy way of allowing you to spread your money across multiple companies and industries.

Find out more: shares under the spotlight

How can companies make me money?

There are two keys ways your wealth can accumulate when you invest in companies: capital growth and dividends.

Capital growth refers to the increasing value of your investment. For example, if you bought a company share at 10p and the company performs well, demand for its shares might increase, raising the value of your share to 15p. If you then sell that share at 15p, you will have made a 50% return.

Overall, the value of public companies listed in London has risen 20 per cent over the last ten years.

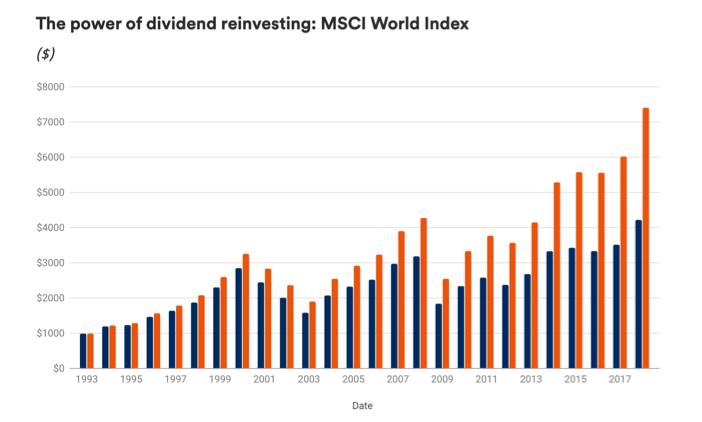

The second way companies can add to your wealth is in the payment of dividends. This is when highly profitable companies pay extra cash they have generated back to their shareholders, usually twice a year. In the UK, dividend account for a lot of the total investor return: in 2019, the FTSE All Share generated capital growth of 13 per cent and a total return of 19 per cent when dividend income was added.

The IC guide to company annual reports

Become a better equity investor with Phil Oakley’s insights into company annual reports - the most important document in any investors' toolkit.

The IC guide to company valuations

Algy Hall's ultimate guide to calculating, understanding and analysing company valuation

Which companies can I invest in?

In the UK, most public companies are listed on the London Stock Exchange – the UK’s (and indeed, Europe’s) biggest market for buying and selling company shares. The London Stock Exchange (LSE) was formed in 1773 when all the regional stock markets in the UK merged. Today, much of the LSE’s trading is done online, but the organisation still has a physical presence in the City of London.

The London Stock Exchange is made up of two different markets: The Main Market – home of larger, better established companies – and AIM – the junior market, which was formed in 1995 as a home for smaller, fast growth companies.

Similar stock exchanges and markets exist all over the world. In the US, the largest market is called the New York Stock Exchange (NYSE) which houses companies with a total value of over $18trn. NASDAQ – the world’s first purely electronic market – is also found in New York and is home to many fast growing, innovative technology companies.

UK investors can buy and sell shares from almost any public market in the world.

Click here to compare investment platforms for foreign investment

Click here to download our ultimate guide to investing in the US - the world's biggest stock market

Click here to read our tips on investing in Asia

5 share buying need-to-knows

1. Investing is for the long term

There is no doubt about it, investing in the stock market can make your money go further.

But it is unreasonable to assume that a company is going to make you money overnight. The best companies will take your investment and nurture it over the long term to turn it into greater profits. Less than five years is not enough time to expect meaningful gains from your investment.

So, before you invest in the stock market, you should consider your goals. For example, if you are going to want the money for a house deposit in a couple of years, now is not the right time to be investing in the stock market and you should consider other options.

2. Share prices can go down as well as up

There has never been a moment in the history of global stock markets where the market is worth less than it was ten years previously. But there have been blips in the interim periods.

You’ll see warnings almost everywhere you go in the investment world: “share prices can go down as well as up”. Financial services companies are obliged to remind you about the risks of investing in the stock market, which can be a very volatile place.

3. Risk is crucial for better returns

Taking risk is important if you want to make your money go further.

Risk averse people can leave their money in the bank where it will be protected from volatility but it is unlikely to grow (and therefore will be losing real value in an inflationary environment). Those willing to take slightly more risk can buy fixed income assets such as bonds, which will provide stable, unexciting returns over a long period. But if you’re willing to take on the excitement of the stock market, the potential returns are enormous.

4. Investing isn’t free

It is vital to pay close attention to what you pay for products and services. You need to think of charges as a corrosive liquid eating away at your profits and to take steps to avoid it or minimise it as much as possible.

So, to avoid handicapping the performance of your investment portfolio, always check charges. If you manage a portfolio of shares, you will need to use an investment platform. Although the cost of these platforms has come down considerably in recent years, many financial services companies come with a whole host of costs which can be tricky to navigate, including inactivity, dealing and administration fees.

Our investment tools can help you navigate charges and ensure they don’t eat into your returns.

5. Tax considerations

In the same way that your salary is taxed, most types of investment income are also subject to various taxes: dividends face income tax, profits made from share price growth are subject to capital gains tax.

An individual savings account (Isa) can help you sidestep the tax implications of investing. Money in an Isa won’t be subject to capital gains tax on any capital growth and you won’t have to pay tax on any income received, such as dividend payments. Everyone in the UK has an annual Isa allowance of £20,000 which renews every tax year (ending in April).