Key characteristics

- Reliable salaries

- No financial dependents

- Newly on (or near) the housing ladder

You’re young, comfortably employed and, perhaps for the first time in your life, you have cash left over at the end of every month. You might want to put it aside for a holiday, maybe a house, or your future family. Whatever your priorities, it would be nice if your money would work as hard as you do.

To make your money go further than it will do in the bank, you need to take your first steps onto the investing ladder. But deciding what to invest in isn’t easy.

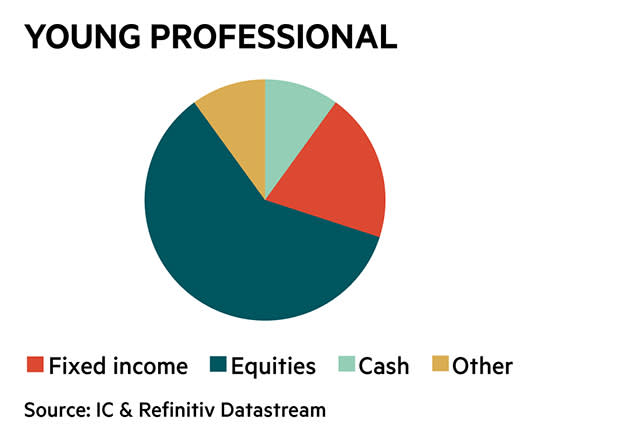

Our model asset allocation is adventurous – aimed at young professionals with no financial dependents or immediate need for cash. That is because, as young savers you have a long time to let your investments grow. So, if that holiday, house or wedding is expected within the next two to five years, make sure you have a big enough pile of readily available cash to match your spending needs.

What’s in it?

Young professional investors might sit anywhere on a broad spectrum in terms of their understanding of risk, portfolio size and spending requirements. There is plenty of scope to flex these model allocations and find what’s right for you.

We are assuming that this model includes a young professional’s entire portfolio of savings, including money in or set aside for a house, inherited money and salary.

Cash: 10-30%

If you’re saving for a house deposit and you expect to buy within the next five years, it might be best to sit on a larger pool of cash.

Other: 0-20%

This varies, as young investors' circumstances depend to a large extent whether they are on the housing ladder. It's worth remembering, if you do own a home, then your equity exposes you to the UK property market already, so you might want to consider this when choosing the types of investments you fill your 'other' allocation with.

We also include high risk investment in the ‘other’ category, including investment in unlisted companies. Young investors with a long time horizon can afford to invest in these higher risk assets.

Fixed income: 10%

As most younger investors will have jobs, this asset class is less significant than for other age groups in terms of income, but it is useful for managing risk – investment in bonds is lower risk than equities, but also likely lower reward.

Equities: 60%

This asset class will generate strong returns when times are good but in a long bear market (a period when the trajectory of share prices is down) your portfolio value can stay below its previous peak for a while. Remember not to be afraid of periods of weakness though, because if your time horizon is long enough, your investments should bounce back.

Next Steps

Take your allowances

It’s important to use your allowances. Take maximum advantage of work pension schemes and as much of your annual Isa allowance (£20,000 in the 2020-21 tax year) to grow your investment pot tax-free. People ages 18-40 qualify for the Lifetime Isa scheme whereby the government tops up a portion of your savings per year.

Click here to read our ISA Guide

Click here to read our guide to Sipps

Pick your platform

Whether you want to open an Isa, Sipp or invest in international stocks, your first port of call is an investment platform.

The range of platforms available in the UK today means you should be able to find one which suits your needs. If cost is your priority, our guides show where you can find the cheapest providers; or if service is important, we have ranked the platforms accordingly. We have also answered your key questions on Isas, Sipps and international investing, to help you get going.

Click here to read our ISA platform comparison

Click here to read our Sipp platform comparison

Click here to read our comparison of platforms for international investment