Key Characteristics:

- Long-term investor in the prime earning years of their career

- At least five years from retirement

- Investable savings between £250k and £1m

Managing a personal investment portfolio that’s worth over £250,000 can be enjoyable and rewarding, but it also requires discipline and focus.

There are some circumstances – for example you have suddenly inherited money, or you are recently retired and are managing your own pension pot – that require special consideration. It is worth consulting some of our lifestyle asset allocation models to see if these are more appropriate to you. If you are an inexperienced or nervous investor, you should build up your knowledge before you start investing (the IC has plenty of guides to help you) and it might be worth starting off with a small DIY portfolio so that you can gain some experience.

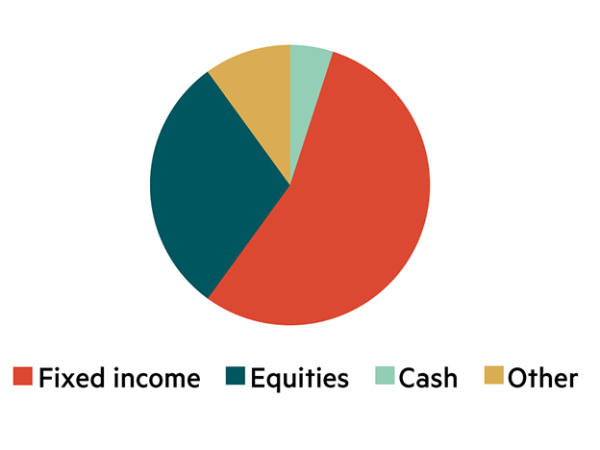

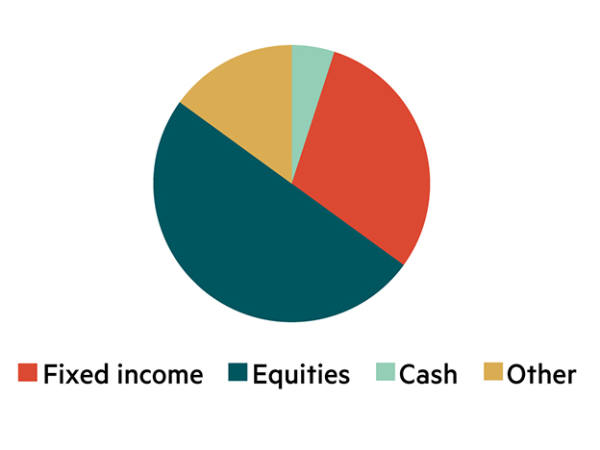

We are assuming this strategic asset allocation is for a long-term investor with an earned income that takes care of their needs; they are also in the prime earning years of their career and still at least five years off retirement. The strategy is an evolution of our £51k to £250k portfolio size asset allocation model, but whereas that could be considered medium risk, at this stage we are tending towards an adventurous asset allocation.

Investors with £251k to £1m don’t need such a high percentage of the portfolio in cash. Holding 5 per cent in cash means at least £12,550 at the lower end of the range anyway. Aside from any uninvested money in your portfolio, you should always have a separate cash pot (often recommended as six months’ worth of salary) set aside for emergencies.

Discipline is important for stockpickers

You’ll still be investing in funds for your fixed income allocation and it makes sense to use funds with the right structure and can easily buy and sell their holdings (such as investment trusts) for your investments categorised as ‘Other’, too.

When it comes to equity (company) investment, funds are still a good idea for a broad exposure in both familiar or unfamiliar markets, but there may be some companies that you really want a piece of directly. This is great, too, but remember: discipline is important – you don’t want an unwieldy portfolio of whim purchases.

Also, when picking shares in individual companies, you don’t want to overload the portfolio with racy small-cap stocks. The lion’s share of your equity allocation should be larger high-quality companies that compound away in value over time.

There should be a balance when buying individual shares between the holding not being too big or too small. No one individual stock holding should be worth more than about 5 per cent of your total allocation to shares in the portfolio (so not more than 3 per cent of the overall portfolio in this asset allocation model). You also don’t want to waste your time with anything less than about £5k per holding and even then, too many holdings of such size can quickly become overwhelming and make the portfolio hard to manage properly.

Some Investors' Chronicle readers have a high risk appetite and may have a high-octane portfolio of speculative stocks. This can be fun, intellectually challenging and very rewarding, but it’s high risk and should only be done with a demarcated pot of fun money you can afford to take a hit on if you make a terrible call on a company.