Key Characteristics:

- Long-term investor with earned income

- Investable savings between £5k and £50k

There are a few reasons you might have a sum of £5,000 to £50,000 to invest: you could have inherited some money, received a bonus from work, just been made redundant or even won some money. Depending on your age and the size and source of your regular income, you may also want to consult some of our lifestyle-specific asset allocation models, which may be more appropriate in terms of your needs and the risks you are prepared to take.

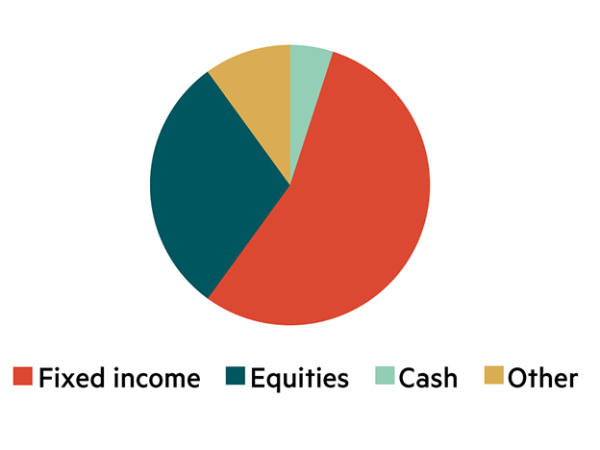

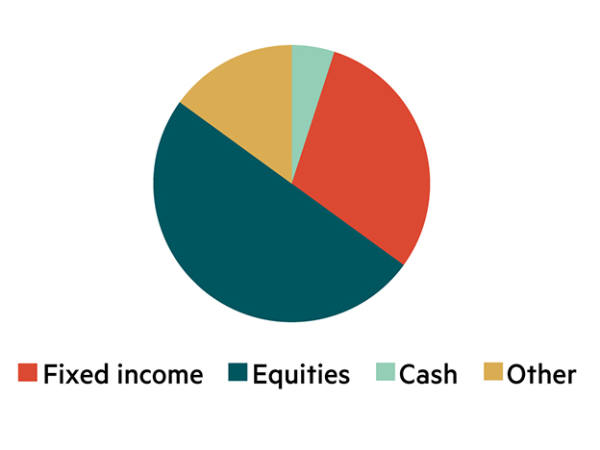

We are assuming this strategic asset allocation is for a long-term investor with an earned income that takes care of their needs and they are in the early stages of accumulating wealth. The strategy is based on our Medium Risk model, but with slightly more cash to reflect the fact that an early-stage investor will want some flexibility as they add the building blocks to their portfolio.

Getting started investing and steadily building your pot

Although the rise in platforms and technology will allow you to invest in fractions of a share, if you are starting with a smaller portfolio, it is best to begin by investing in funds. You should keep this asset allocation in your mind as a goal for sensible portfolio management once your investment pot is getting towards the £50,000 mark.

Read our full guide to getting started in investing here.

It’s always a good idea to have a minimum amount that you’ll invest before buying individual company shares. Portfolios that have lots of small holdings are unwieldy and hard to manage. It’s better to know where you want to get to and have a handful of equities in mind; then build up to the asset allocation just investing in these. Many platforms will offer a cheaper rate for regular additional investments but where this isn’t cost-efficient, invest in individual funds in £2,500 increments. Aim to always keep at least £2,500 in cash up towards your target £5,000 cash allocation for this model. This means there is some dry powder to add shares, bonds or alternative (other) assets when they are attractively priced.

You can find out more about the different assets we recommend for your portfolio in this guide.

You should have a cash pot separate to this investment portfolio for emergencies. It is commonly advised that you should have six months of your gross salary saved as cash before you think about investing although this depends on commitments and what you earn.

Next Steps

Take your allowances

It’s important to use your allowances. Take maximum advantage of work pension schemes and as much of your annual Isa allowance (£20,000 in the 2020-21 tax year) to grow your investment pot tax-free. People aged 18-40 qualify for the Lifetime Isa scheme whereby the government tops up a portion of your savings each year.

Click here to read our ISA Guide

Click here to read our guide to Sipps

Pick your platform

Whether you want to open an Isa, Sipp or invest in international stocks, your first port of call is an investment platform.

The range of platforms available in the UK today means you should be able to find one which suits your needs. If cost is your priority, our guides show where you can find the cheapest providers; or if service is important, we have ranked the platforms accordingly. We have also answered your key questions on Isas, Sipps and international investing, to help you get going.

Click here to read our ISA platform comparison

Click here to read our Sipp platform comparison

Click here to read our comparison of platforms for international investment