Key characteristics

- Falling requirements from financial dependents

- High levels of disposable income

- Between five and 10 years from retirement

Your children have left home (or have at least stopped absorbing all your spare income), you’ve taken a decent chunk out of your mortgage and your monthly savings are starting to look a lot healthier. These are the prime accumulation years for a self-invested personal pension (Sipp) – a chance to take plenty of risk, which combined with regular contributions can see it achieve steady compound growth, and set you up for a comfortable retirement.

To get started, get to know Sipps by reading our full guide

This asset allocation model assumes all your other needs – paying down a mortgage, funding children through higher education and general lifestyle expenses – are taken care of out of earned income.

If you’re more than five years from retirement, there should be enough time for a portfolio to recover from market falls before you start drawing from it. Of course, you may still feel uncomfortable taking risk, in which case one of our more conservative asset allocation models may work best for you. You should also consider a move to a less high-risk asset weighting in your strategic asset allocation the nearer you get to retiring.

What’s in it?

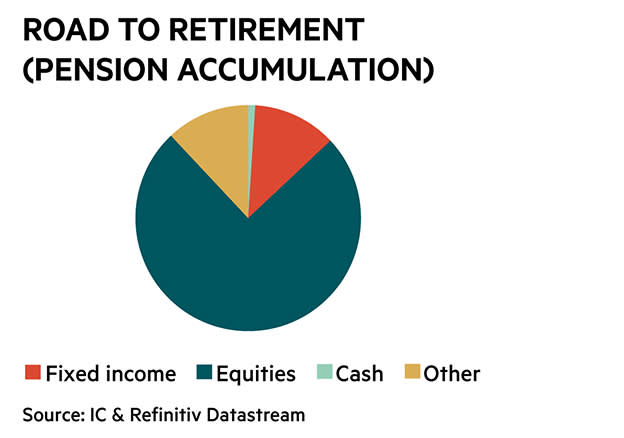

Cash – 1%

There is a slither of cash, which is just to reflect that you may have some residually after managing other holdings.

Other – 12%

In this allocation, other assets refer to a broad range of non-listed assets, which investors can use to either balance risk (the prices of some assets may move differently to shares during stock market turbulence) or look to for higher reward (real estate and private equity can generate big returns over the long term).

Fixed Income 12%

Fixed income investments are there to hopefully cushion stock market falls, but also to reflect times when there are opportunities for good returns on offer from riskier investments, such as corporate bonds, in this asset class.

Equities – 75%

Because this is a portfolio hived off from the rest of your wealth until you retire, it is reasonable to go for growth more aggressively in the accumulation phase and have a high weighting to equities (stocks and shares).

How risky is this asset allocation?

Unless you need to sell your portfolio right away then a fall in its value doesn’t equate to a realised loss, when you sell at below the value you invested at.

Our back-tested asset allocation (to 1976) had a worse peak-to-trough fall of 38 per cent, compared with a worst fall of 47 per cent for a mix of UK and world shares.

Clearly, that’s a terrible drop and it took the allocation model over three years to recover its previous high. Although, in a Sipp, you’d be making regular contributions, with the newer purchases benefiting more on the upside when the assets invested in recover.

Nonetheless, the impact of market falls in the short term mean it’s important to reassess your portfolio strategy every couple of years once you get closer to retirement.

Next steps

It may be this strategy is too risky for you. If that’s the case, have a look at our Medium Risk strategy and some of our other specialist asset allocation models.

Consider drip-feeding your portfolio

There are different ways to drip-feed savings in your portfolio that can spread the risk of being unlucky with market timing. Read our guide to drip-feeding here.

Pick your Sipp provider

The first step in setting up a Sipp is picking the right platform. The rising popularity of Sipps means many providers now offer accounts, meaning there is a big range of prices and options on offer.

Click here to read our Sipp cost comparison and platform ratings.