Key characteristics:

- Young family

- Unpaid mortgage

- Small disposable income

- Between 20 and 50 years old

People with substantial expenses (such as bringing up a family) and financial liabilities (like paying a mortgage) may struggle to continue to set money aside to invest if they’re not on a big salary. It is hard but staying in the habit of investing is worth it for the long term.

Nowadays, everyone is auto enrolled in their company pension scheme and in the first instance it is important not to opt out and ensure you pay in as much as you need to get the maximum contribution from your employer. That taken care of, your other personal investments should be made with a holistic appreciation of your overall financial position. And be sure to make them in a tax efficient vehicle, like an individual savings account (Isa).

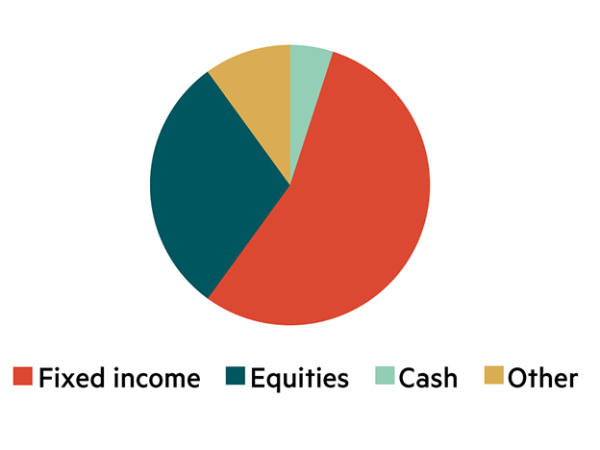

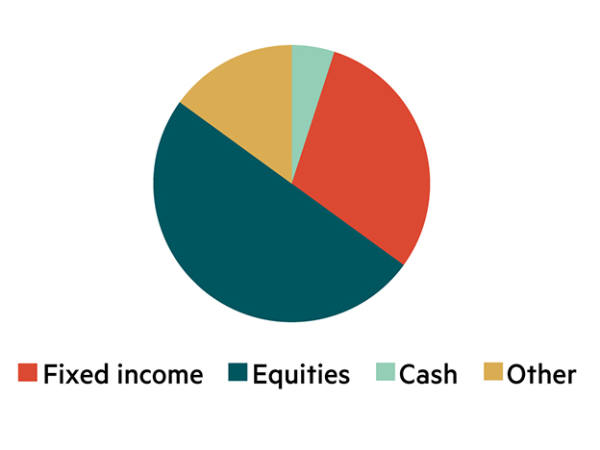

What’s in it?

Cash – 20%

Normally, we’d say think of your cash emergency pot as separate to your investment portfolio, but when you’re struggling to save, you need to think about your wealth holistically. It’s advised that people have a cash savings pot of about six months’ worth of either their salary or regular monthly expenses. But once you have an appropriate-sized cash cushion, cash can have less of a weighting in your portfolio.

Once you have that cash cushion, provided you’re comfortable with it, then as a younger investor and assuming you don’t need to withdraw anything from the rest of your portfolio, you can take more risk.

Other – 20%

This includes the equity in your property if/when you buy it.

Fixed Income – 20%

An income booster is welcome for struggling savers, but as most younger investors will have jobs, this asset class is less than for other age groups in terms of income, but it is useful for managing risk.

Equities – 40%

This asset class will generate strong returns when times are good but in a long bear market (a period when the trajectory of share prices is down) your portfolio value can stay below its previous peak for a while. Remember not to be afraid of periods of weakness though, because if your time horizon is long enough, your investments should bounce back.

Next Steps

Take your allowances

It’s important to use your allowances. Take maximum advantage of work pension schemes and as much of your annual Isa allowance (£20,000 in the 2020-21 tax year) to grow your investment pot tax-free. People ages 18-40 qualify for the Lifetime Isa scheme whereby the government tops up a portion of your savings per year.

Click here to read our ISA Guide

Click here to read our guide to Sipps

Pick your platform

Whether you want to open an Isa, Sipp or invest in international stocks, your first port of call is an investment platform.

The range of platforms available in the UK today means you should be able to find one which suits your needs. If cost is your priority, our guides show where you can find the cheapest providers; or if service is important, we have ranked the platforms accordingly. We have also answered your key questions on Isas, Sipps and international investing, to help you get going.

Click here to read our ISA platform comparison

Click here to read our Sipp platform comparison

Click here to read our comparison of platforms for international investment