The upturn in global growth that kicked off in 2016 benefited most stock markets, in particular those in the Asia Pacific region. Over the two years to 31 December 2017, MSCI All Country Asia Pacific ex Japan index rose 81 per cent, making it the best performing major region globally.

Cheaper valuations

Excellent performance record

Growth potential in many sectors

Downside mitigation

Volatility

But so far this year, in particular since May, this region has not done so well. MSCI All Country Asia Pacific ex Japan index is flat in the year to date, compared with positive returns for the US, UK and Japanese stock markets. But although Asian share prices have weakened over the past few months, many believe this is overdone.

Asian companies' share prices have struggled because of their reliance on exports, which are at risk due to tensions in global trade, fuelled by US president Donald Trump's imposition of tariffs on certain goods into the US. In addition, share prices in these regions tend to struggle as the US dollar strengthens, because historically governments and companies in this area have been exposed to US dollar debt, and a stronger US currency and rising interest rates make repayments more difficult.

But Asian countries, including emerging markets, are not most at threat from a rising dollar. Asian economies have reduced their reliance on US dollar debt as their own currencies' status has increased globally. And while trade wars and tariffs are detrimental, this is the case for companies in most parts of the world.

So the recent slump in Asian equity valuations could provide a good entry point. The region still has scope to do well despite strong returns in recent years, and an allocation to this area could also diversify any Latin American, African and Middle Eastern emerging market exposure – regions that are more susceptible to dollar strength.

Veritas Asian Fund (IE00B02T6J57) looks like a good way to access Asia Pacific equities. Ezra Sun has run it since 2004, since when it has returned 630 per cent – almost double the return of MSCI AC Asia Pacific ex Japan index and the average return for funds in the Investment Association (IA) Asia Pacific ex-Japan sector.

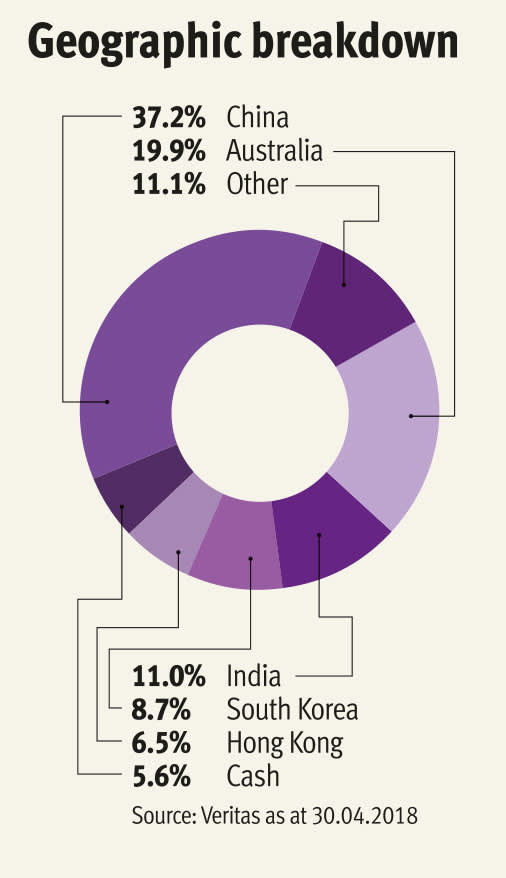

The fund is relatively concentrated, with only 42 stocks. But these are diversified across regions, with 47 per cent in developed economies and 53 per cent in emerging economies. China is the fund's largest country exposure, accounting for 37 per cent of assets, and it also has substantial weights to Australia, India and South Korea.

Veritas Asian is the top-performing fund in the IA Asia Pacific ex-Japan sector over one and three years, in part due to its 23 per cent allocation to tech stocks, which have driven the region's returns. However, Gavin Haynes, managing director at wealth manager Whitechurch Securities, thinks other sectors will now also experience strong growth.

"Valuations are not cheap following the sustained period of rising markets, but the region does not look expensive versus developed markets and offers a wide range of enticing growth opportunities," he adds.

Such a change should benefit Mr Sun's strategy as the fund also has big weightings in financial services and healthcare, while also having defensive positions in consumer staples stocks.

This blend has enabled the fund to outperform the index in both rising and falling markets. In the year to date, MSCI AC Asia Pacific ex Japan index and the IA Asia Pacific ex-Japan sector average are down 0.43 per cent and 0.88 per cent, respectively. But Veritas Asian has returned 4 per cent. And over the two years to the end of 2017 the fund returned 66 per cent, versus 59 per cent for the index and the IA Asia Pacific ex-Japan sector average of 57 per cent. Over three years, the fund has captured 138 per cent of the market's rise, but only 57 per cent of the fall.

Despite this, Asia Pacific equities are not for the faint-hearted and if you invest in this area expect volatility, as the region includes both emerging and developed markets. Asia Pacific is also susceptible to investor sentiment, and due to uncertainty over global trade there is a greater chance of loss with Asia Pacific equities over a short period than with US or UK equities.

But if you have a high risk tolerance and can hold for the long term, a small allocation to Asia Pacific equities would offer access to some of the world's fastest-growing economies and companies across a range of sectors. And Veritas Asian Fund gives access to these via a proven and successful strategy. Buy. TL

Veritas Asian Fund (IE00B02T6J57)

| PRICE | 680,940p | MANAGER START DATE | 18.10.2004* |

| IA SECTOR | Asia Pacific ex-Japan | MEAN RETURN | 18.83% |

| FUND TYPE | Open-ended Investment Company (Oeic) | SHARPE RATIO | 0.91 |

| FUND SIZE | £1.5bn | STANDARD DEVIATION | 0.14% |

| No OF HOLDINGS | 42* | ONGOING CHARGE | 1.17% |

| SET UP DATE | 18.10.2004* | MORE DETAILS | veritas-asset.com/funds |

Source: Morningstar as at 25.06.2018, *Veritas as at 30.04.2018

Performance

| Fund/benchmark | 1-year total return (%) | 3-year cumulative return (%) | 5-year cumulative return (%) |

| Veritas Asian Fund | 17.33 | 76.79 | 138.30 |

| IA Asia Pacific ex-Japan sector average | 6.24 | 45.57 | 71.16 |

| MSCI All Country Asia Pacific ex-Japan index | 6.63 | 46.19 | 73.79 |

| MSCI Emerging Markets index | 4.51 | 39.92 | 56.08 |

Source: FE Analytics, as at 25.06.2018

Top 10 holdings as at 30.04.2018 (%)

| Tencent Holdings | 4.3 |

| Aristocrat Leisure | 4.1 |

| CSL Limited | 3.9 |

| Treasury Wine Estates | 3.80 |

| Ping An Insurance | 3.70 |

| AIA Group | 3.70 |

| HDFC Bank | 3.6 |

| Jiangsu Hengrui Medicine | 3.6 |

| CP ALL | 3.5 |

| LG Household & Health Care | 3.5 |

Source: Veritas

Geographic breakdown as at 30.04.2018 (%)

| China | 37.2 |

| Australia | 19.9 |

| India | 11.0 |

| South Korea | 8.7 |

| Hong Kong | 6.5 |

| Thailand | 4.7 |

| Taiwan | 3.3 |

| Singapore | 1.6 |

| Indonesia | 1.5 |

| Cash | 5.6 |

Source: Veritas