India offers the potential for strong growth, as we highlighted in our recent tip on Aberdeen New India Investment Trust (ANII) in the issue of 22 March 2019 and our interview with Avinash Vazirani, manager of Jupiter India (GB00BD08NQ14) in last week's issue.

Strong manager record

Focus on quality companies

Strong long-term returns

High growth potential

Diversified exposure

Can lag in rising markets

But as well as offering potential high growth, India is a high-risk emerging market. This means that a single-country India fund is not suitable for investors who have smaller investment portfolios made up of a small number of funds, each of which accounts for a substantial amount of their portfolios. A single-country emerging market fund should only account for a small percentage of large investment portfolios.

But if you have a smaller portfolio you don't need to miss out on India's growth potential. You can get exposure via a broad Asian or global emerging markets fund that has meaningful exposure to Indian equities, allowing you to benefit from their growth. And as these types of funds are not wholly exposed to India you will not end up having a substantial chunk of your investment portfolio allocated to a high-risk emerging market.

Options include Stewart Investors Asia Pacific Leaders (GB0033874768), which has about 31 per cent of its assets in India. The fund’s manager, David Gait, has only run it since 2015, but has a very good long-term track record on other funds including Pacific Assets Trust (PAC) and Stewart Investors Asia Pacific Sustainability (GB00B0TY6V50).

Analysts at fund research company FE say: “Overall, performing better than the peer group composite. Over a long track record, the manager has, period by period, consistently managed to outperform the peer group. Good stockpicking has had a material positive impact on results, which have tended to be relatively better in a falling market.”

The fund’s co-manager is Sashi Reddy, an experienced investment analyst responsible for providing research support to managers with a main focus on Indian equities.

They invest in quality, cash-generative companies that are in good financial health. They also consider the valuations of the companies they invest in. This means the fund typically outperforms in falling markets, and over the long term – the timescale you should have if you invest in Asian equities – this approach has resulted in strong total returns.

“Mr Gait focuses mainly on larger companies in Asia and Australasia, excluding Japan, with a focus on high-quality, shareholder-friendly businesses,” say analysts at wealth manager Tilney. “His experienced team is particularly sensitive to corporate governance issues and engages with management on both direct business and socially responsible practices. Few companies pass Gait’s stringent criteria, but those that do typically stay in the portfolio for many years. This more cautious approach has led to consistently strong performance in most time periods since launch in 2003.”

Stewart Investors Asia Pacific Leaders' managers look to invest in companies run in a sustainable way with regard to issues such as climate change, food and water shortages, and management and governance. So the fund could be of interest to investors wanting to take a more ethical approach.

Although investing in higher-quality companies means the fund can lose less than peers when markets are falling, it also tends to lag in rising markets, such as in 2016 and 2017, albeit with double-digit returns. The fund also includes exposure to higher-risk areas such as emerging markets, which could add to its volatility. And it is fairly concentrated in its 10 largest holdings, which account for about 44 per cent of its assets. If any one of these had problems it would have more of an effect on the fund’s overall returns than in the case of less concentrated funds.

However, Stewart Investors Asia Pacific Leaders’ managers’ focus on finding good quality, well-managed companies mitigates some of this risk. And although their strategy can lead to the fund lagging in the short term it has stacked up to strong, long-term outperformance.

So if you want to tap into the growth potential of Indian and Asian emerging markets, Stewart Investors Asia Pacific Leaders is a good way to get diversified exposure to these via experienced managers with a proven record. Buy.

Stewart Investors Asia Pacific Leaders (GB0033874768)

| PRICE | 756.2p | MEAN RETURN | 12.44% |

| IA SECTOR | Specialist | SHARPE RATIO | 0.97 |

| FUND TYPE | Open-ended investment company | STANDARD DEVIATION | 11.70% |

| FUND SIZE | £6.9bn | ONGOING CHARGE | 0.88% |

| No OF HOLDINGS | 39* | YIELD | 1.09% |

| SET UP DATE | 01.12.03* | MORE DETAILS | www.stewartinvestors.com |

| MANAGER START DATE | David Gait 01/07/2015, Sashi Reddy 01/06/2016 |

Source: Morningstar, *Stewart Investors.

Performance

| Fund/benchmark | 1 year total return (%) | 3 year cumulative total return (%) | 5 year cumulative total return (%) | 10 year cumulative total return (%) |

| Stewart Investors Asia Pacific Leaders | 10.51 | 40.53 | 71.87 | 283.03 |

| Stewart Investors Asia Pacific Sustainability | 13.42 | 49.18 | 92.23 | 357.57 |

| Pacific Assets Trust share price | 15.78 | 46.88 | 99.66 | 329.62 |

| MSCI AC Asia Pacific ex Japan index | 5.77 | 54.97 | 64.41 | 200.48 |

| IA Asia Pacific ex Japan sector average | 5.17 | 53.56 | 65.18 | 193.98 |

Source: FE Analytics as at 15 April 2019

Top 10 holdings (%)

| Tata Consultancy Services | 6.1 |

| Unicharm | 5.60 |

| CSL | 5.00 |

| Tech Mahindra | 5.00 |

| Mahindra & Mahindra | 4.6 |

| Oversea-Chinese Banking | 4 |

| Delta Electronics | 3.9 |

| President Chain Store | 3.8 |

| Hong Kong & China Gas | 3 |

| Housing Development Finance | 2.8 |

Source: Stewart Investors as at 31 March 2019

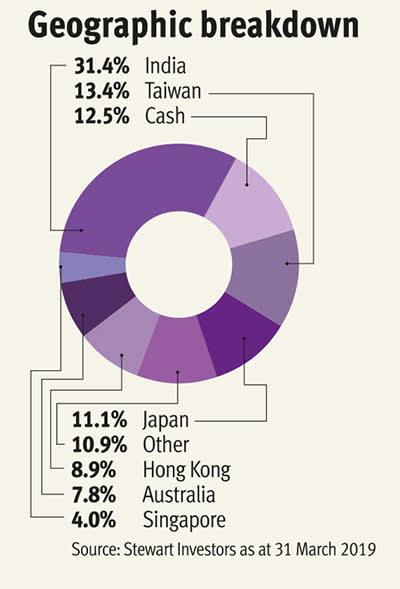

Geographic breakdown (%)

| India | 31.40 |

| Taiwan | 13.40 |

| Japan | 11.10 |

| Hong Kong | 8.90 |

| Australia | 7.80 |

| Singapore | 4.00 |

| Philippines | 3.50 |

| US | 1.90 |

| Thailand | 1.70 |

| Other | 3.90 |

| Cash | 12.50 |

Source: Stewart Investors as at 31 March 2019