If you're building up a diversified, long-term growth portfolio Japanese equities could be worth a look. At the moment, their valuations are cheap relative to their own history and other developed markets. And there are arguments in favour of this market other than its relative cheapness.

Good performance

Valuation discipline

Smaller company potential

Experienced manager

Potential volatility

“Returns on equity [of Japanese equities] are above 9 per cent, and dividends and share buybacks are at record highs as corporate governance improves,” add analysts at research company FundCalibre.

Although the US has a trade dispute with China, it has agreed a trade deal with Japan that will allow in more agricultural imports from the US and avoid new tariffs on Japanese car exports to the US.

And since current prime minister Shinzo Abe came to power in late 2012 he has pursued his 'Abenomics' programme, addressing problems such as stagnant growth, unfavourable demographics and debt via monetary policy, fiscal stimulus and structural reform. Opinion polls suggest that he is likely to remain in power for the foreseeable future, so should be able to continue these structural reforms, which should benefit Japanese equity markets.

A good way to get exposure to Japanese equities could be Axa Framlington Japan Fund (GB00B7FSWP64). This has been run since 2010 by Chisako Hardie, who has 28 years of investment experience. Since she started running the fund it has outperformed the Topix and FTSE Japan indices, and Investment Association (IA) Japan fund sector average, in five out of eight full calendar years, and it is also on track to beat them this year. This has translated into strong cumulative total returns and considerable outperformance over longer periods.

“This fund has a clear and logical strategy, and is well diversified,” say analysts at FundCalibre. “Although AXA Framlington Japan favours growth, its valuation discipline means it is less extreme in terms of style than some of its peers. Performance has been consistently excellent during Ms Hardie's tenure.”

Ms Hardie and her team look for companies with long-term growth prospects that do not rely on what is going on in the wider economy. They often hold investments for many years, but sell them if they consider that they have become fully valued. For example, in October they sold GMO Payment Gateway (TYO:3769) because its share price had reached levels they felt were difficult to justify. They had held this stock for several years and it had contributed significantly to the fund’s performance.

Their valuation discipline pushes them towards smaller companies, where they often find higher structural growth at a better price. So although the fund holds companies of various sizes, it often has a bias to smaller ones. For example, at the end of October, it had about 40 per cent of its assets in companies with a market cap of less than $2.5bn (£1.9bn), 25 per cent in those with a market cap of between $2.5bn and $10bn, and 34 per cent in ones with a market cap of more than $10bn. The exposure to smaller companies means that the fund has greater potential for growth than if it just focused on large-caps, and the all-cap approach means it has a wider range of opportunities to choose from.

Japanese equities have historically been volatile and Axa Framlington Japan’s exposure to smaller companies increases the risk of this.

In October, the Japanese government increased the consumption tax from 8 per cent to 10 per cent, which could reduce consumer spending in the short term. And global growth appears to be slowing, which could also have a negative effect on the Japanese economy and stock market.

However, Axa Framlington Japan is well diversified, with 92 holdings at the end of October, limiting the impact of any one stock on its returns. And the fund's 10 largest holdings only accounted for about 14 per cent of its assets.

The fund’s managers look to invest in companies that do not rely on what is going on in the wider economy, so even if there is a slowdown its holdings could still grow.

So if you are a long-term investor building a diversified global equity exposure, AXA Framlington Japan Fund could be a useful addition as it looks well placed to deliver strong growth over this time frame. Buy.

AXA Framlington Japan (GB00B7FSWP64)

| PRICE | 277.1p | MEAN RETURN | 9.11% |

| IA SECTOR | Japan | SHARPE RATIO | 0.65 |

| FUND TYPE | Unit trust | STANDARD DEVIATION | 12.70% |

| FUND SIZE | £212.75m | ONGOING CHARGE | 0.84% |

| No OF HOLDINGS | 92* | YIELD | 0.60% |

| SET UP DATE | 29/02/1984* | MORE DETAILS | www.axa-im.co.uk |

| MANAGER START DATE | 16-Apr-10 |

Source: Morningstar as at 10 December 2019. *AXA Investment Managers.

Performance

| Fund/benchmark | 1-year total return (%) | 3-year cumulative total return (%) | 5-year cumulative total return (%) | 10-year cumulative total return (%) |

| Axa Framlington Japan Fund | 9.54 | 29.3 | 99.64 | 196.47 |

| FTSE Japan index | 9.6 | 20.93 | 69.58 | 130.57 |

| Topix index | 9.67 | 22.42 | 74.62 | 140.69 |

| IA Japan sector average | 11.67 | 23.24 | 75.94 | 143.61 |

Source: FE Analytics, as at 9 December 2019

Top 10 holdings (%)

| Softbank | 1.54 |

| Lasertec | 1.46 |

| Hitachi | 1.40 |

| Nidex | 1.40 |

| Ulvac | 1.39 |

| Sony | 1.38 |

| Hulic | 1.38 |

| Kaga Electronics | 1.38 |

| Fujitsu | 1.33 |

| Horiba | 1.32 |

Source: Axa Investment Managers, as at 31 October 2019

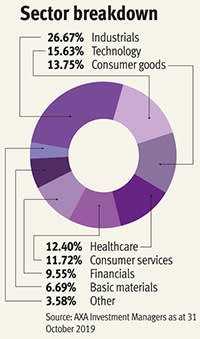

Sector breakdown (%)

| Industrials | 26.67 |

| Technology | 15.63 |

| Consumer goods | 13.75 |

| Health care | 12.40 |

| Consumer services | 11.72 |

| Financials | 9.55 |

| Basic materials | 6.69 |

| Telecommunications | 1.54 |

| Cash | 1.03 |

| Utilities | 1.01 |

Source: Axa Investment Managers, as at 31 October 2019