The market volatility of the past few months and uncertainty over what is going to happen has underscored the value of having exposure of good quality companies that are in a better position to survive near term challenges and grow over the long-term. A good way to invest in these have been certain global equities funds whose managers have selected the right ones.

Experienced manager

Rigorous investment process

Focus on resilient companies

Good performance so far

Concentration risk

Short track record

A new but promising option in this area appears to be LF Blue Whale Growth (GB00BD6PG563) which launched in 2017.

Although the fund is new its lead manager, Stephen Yiu, has 17 years' investment experience. He worked in Hargreaves Lansdown’s investment team until 2007, and in the following decade at asset managers New Star, Artemis and Nevsky Capital. He founded Blue Whale in 2017.

Mr Yiu and his team of five invest in 25 to 35 of what they think are the best companies. They select them from a universe of only around 100 so that they can spend significant time analysing each potential investment. They try to invest in companies which have the ability to grow, will benefit from structural growth trends and are able to significantly grow profits over time.

They also like companies to have a valuation that seems attractive relative to their future growth and profitability. And if they think an existing holding has become too expensive or its prospects have changed they sell it. For example, they reduced the fund’s holding in Amazon (US:AMZN) this year and removed holdings that they felt would be negatively affected by the Covid-19 pandemic. And they held more cash at the end of 2019 enabling them to top up their highest conviction holdings during the sell-off in 2020.

They select companies primarily on the basis of their individual merits such as strategy, growth prospects and competitive advantages. But they also monitor the competitive environment and the actions of industry rivals, to ensure that their holdings are not under threat from changes in technology or regulations.

The fund's investment team considers how events could impact the expected future cash flows of their holdings, including by stress testing cash flows and earnings. Mr Yiu recently said: “The majority of companies in our portfolio have passed such a “macro stress test” and this was why our portfolio fared better than the broader market over the course of the last three years.”

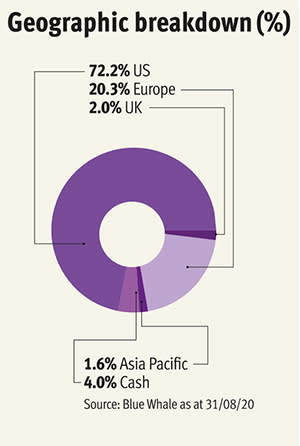

LF Blue Whale Growth is not well diversified by sector or geography, with over 60 per cent of its assets in technology companies and nearly three quarters in the US at the end of August. Its 10 largest holdings accounted for 54.5 per cent of its assets, increasing concentration risk, because if any one of these does not do so well it will have a greater effect on the fund’s overall return than if it was more diversified.

However, Mr Yiu and his colleagues are very selective about what they invest in and do not invest in technology companies they think are not competitively positioned. For example, the fund generally does not hold hardware companies. Although it is currently focused on the US its managers are careful about the quality and valuation of the companies they pick there. And its 10 largest holdings at the end of August only featured three of the 10 largest stocks in the S&P 500 index.

The fund made a positive return in 2018 when global equity indices such as MSCI World and FTSE World, and the Investment Association (IA) Global sector average made negative returns. The fund has also out performed these benchmarks in 2019 and so far this year, and this has added up to strong cumulative total returns.

The fund has a global remit and its managers have demonstrated their willingness to sell holdings if they believe that their prospects are no longer as good and to invest in ones that look better.

So if you are looking for growth over the long term and exposure to a basket of high quality, resilient companies, LF Blue Whale Growth Fund still seems like a good option. Buy. LW

| LF Blue Whale Growth (GB00BD6PG563) |

| Price | 173.87p | Fund size | £520.55m |

| IA sector | Global | No of holdings | 25 |

| Fund type | Open-ended investment company | Ongoing charge | 0.89% |

| Set-up date | 11-Sep-17 | Yield | 0.00% |

| Manager start date | Stephen Yiu 11/09/2017, Daniel Allcock 01/10/2019 | More details | www.bluewhale.co.uk |

| Source: Morningstar as at 11 September 2020. |

| Performance |

| Fund/benchmark | 3 month total return (%) | 6 month total return (%) | 1 year total return (%) |

| LF Blue Whale Growth | 9.93 | 31.68 | 22.86 |

| MSCI World index | 3.92 | 17.12 | 6.10 |

| FTSE All World index | 4.06 | 16.73 | 5.97 |

| IA Global sector average | 4.50 | 18.11 | 7.26 |

| Source: FE Analytics as at 10 September 2020. |

| Top 10 holdings (%) |

| Microsoft | 8.2 |

| Adobe | 7.86 |

| Visa | 6 |

| Autodesk | 5.4 |

| Amazon.com | 5.19 |

| Mastercard | 4.91 |

| PayPal | 4.73 |

| Dassault Systemes | 4.57 |

| SAP | 4.55 |

| Intuit | 4.45 |

| Source: Morningstar as at 30 June 2020 |

| Geographic breakdown (%) |

| US | 72.2 |

| Europe | 20.3 |

| UK | 2 |

| Asia Pacific | 1.6 |

| Cash | 4 |

| Source: Blue Whale as at 31/08/20 |