Almost exactly 145 years ago, a fictional character left his fictional house on Saville Row, for a fictional voyage around the world. Once again, the Investors Chronicle will attempt to turn fiction into fact with the help of the wonderfully worldly investment trust sector. So please join us as we follow in the footsteps of Mr Phileas Fogg’s 80-day circumnavigation of the globe and go Around the World in Eight Investment Trusts.

This will be the sixth year the IC has taken readers on this particular investment adventure. In the five preceding years the Around the World strategy has more than doubled the value of a notional (or should that be fictional) investment, assuming income was reinvested and all money was switched from one portfolio of trusts to the next on the day of publication of each new Around the World selection.

While the Around the World strategy has comfortably out-gunned the market, Fogg fans may pooh-pooh such returns given the wager that set this most meticulous gentleman around the world saw him double his £20,000 stake in just 80 days. However, when it comes to investing one should never overlook costs. Indeed, as well as the £20,000 Mr Fogg put down as his stake in the bet, he stuffed another £20,000 (the other half of his fortune) in a carpet bag for expenses, meaning a total of £40,000 of capital was tied up in the venture.

Once all of Mr Fogg’s costs were tallied up (from overpriced elephants to bribes for ferry engineers) he found he had only added £1,000 to his £40,000 fortune. As the table below shows, assuming annual costs of 1.5 per cent, the Around the World strategy would have had an impressive effect on £40,000 wagered over five years, and its compound average 80-day growth rate of 3.4 per cent after costs actually beats Mr Fogg's 2.5 per cent.

£40,000 invested

| Year from Oct | FTSE All Share | FTSE World | Index Blend | Around the world IT s | Around the world IT's with 1.5% charge |

| Oct-12 | £40,000 | £40,000 | £40,000 | £40,000 | £40,000 |

| Oct-13 | £48,488 | £49,629 | £49,059 | £50,103 | £49,351 |

| Oct-14 | £48,081 | £52,162 | £50,105 | £50,340 | £48,842 |

| Oct-15 | £50,776 | £55,877 | £53,293 | £58,753 | £56,149 |

| Oct-16 | £57,442 | £74,203 | £65,530 | £75,495 | £71,066 |

| Nov-17 | £64,858 | £84,004 | £74,089 | £90,582 | £83,989 |

Source: Thomson Datastream

Last year’s selection of eight trusts delivered strong returns as a group, with the most contrarian looking pick at the time – TR European growth – proving the out-and-out star performer.

2016 Performance

| Trust | TIDM | Total Return (28 Oct 2016 - 1 Nov 2017) |

| Crystal Amber | CRS | 13% |

| FTSE All Share | - | 13% |

| TR European Growth | TRG | 58% |

| FTSE Europe ex. UK | - | 19% |

| JP Morgan Asian | JAI | 28% |

| FTSE Asia Pacific ex. Japan | - | 14% |

| Schroder Japan Grth | SJG | 19% |

| FTSE Japan | - | 10% |

| BlackRock Latin America | BRLA | 3.0% |

| FTSE Emerging Markets | - | 21% |

| Gabelli Value Plus | GVP | 11% |

| S&P 500 | - | 25% |

| Lowland | LWI | 15% |

| FTSE All-Share | - | 13% |

| Scottish Investment Trust | SCIN | 13% |

| FTSE World | - | 13% |

| Trust Average | 20% | |

| Index Average | 16% | |

Source: Thomson Datastream

In keeping with Mr Fogg’s cool-headed and mathematical approach to life, the Around the World strategy is based on an unemotional stock screening process, which assesses trusts for value and momentum. These are the two key factors that academic research suggests are most likely to have an influence on predicting future returns. While the precise nature of the screen was refined three years ago, the approach has been fairly consistent. Consistency is in the spirit of Phileas Fogg, who “whatever he did was so exactly the same thing that he had always done before, that the wits of the curious were fairly puzzled”.

UK

Standard Life UK Smaller Companies

There is a clear UK focus among the highest ranking trusts from this year’s screen, with a particular emphasis on UK smaller companies. The discounts commanded by UK smaller company trusts seem likely to illustrate a fear that while the UK economy has held up reasonably well since the Brexit vote, the naysayers will have their day. Small-caps are seen as particularly vulnerable to any economic slowdown because they tend to be more domestically focused than larger companies, which tend to be more exposed to international markets and currencies. That means developments in the Brexit process that are judged to be positive should help UK smaller companies. What’s more, in a situation of uncertainty, as we have now over Brexit, the market has the tendency to take an overly pessimistic view. That makes UK small-caps an interesting, albeit risky, contrarian play.

Standard Life UK Smaller Companies (SLS) is not ignoring the risks associated with an uncertain economic outlook. The manager has been focusing on lower-risk small-caps and those that continue to show strong earnings momentum. There has also been a significant reduction in exposure to UK cyclicals since the Brexit vote. The fund has an excellent track record based on the combination of an in-house stock screening process, known as 'the matrix', and the manager’s own discretion. Fans of the trust were recently buoyed by news that its highly respected long-time manager, Harry Nimmo, plans to stay on until at least 2022.

EUROPE

JPMorgan European Smaller Companies

This time last year, it was Europe rather than the UK that the screen highlighted as the most desirable place to be and, like the UK now, Europe 12 months ago stood out as a contrarian bet. As well as the issue of Brexit, at the time investors were gripped with anxiety about upcoming elections and the possibility of significant populist gains. However, those elections have not produced the outcomes investors had most feared and economic conditions across the region have continued to strengthen since the Brexit vote. This improving backdrop, combined with the relative value offered by European shares at the time, led to investors flocking to the region.

Following the strong run over the past 12 months, smaller companies are considered one part of the European equity market that still offers decent value. JP Morgan European Smaller Companies (JESC) makes an interesting play on the theme due to its active use of gearing to enhance returns. The trust also boasts an experience and respected management team.

EMERGING MARKETS

India Capital Growth Fund

The Around the World screen’s emerging market choice is a trust focused on India. On Mr Fogg’s journey around the world, India is where he bravely rescued Aouda, the woman who was to become his wife and bring him a gain far greater than the dues from any wager: happiness.

While India Capital Growth Fund (IGC) cannot promise investors quite such transcendental rewards, it does offer exposure to what some consider the world’s most dynamic economy, combined with the thrills and spills of smaller-cap investing. At the end of September 57 per cent of the portfolio was invested in smaller companies, which the manager defines as those with market caps below $2bn. Meanwhile, just 12 per cent of assets were invested in large-caps – market caps of $7bn or more. While small-caps can be risky, especially in less developed markets, the trust’s manager screens stocks to assess whether its holdings have adequate liquidity. The management team also has plenty of on-the-ground expertise, which it uses to target big themes through bottom-up stockpicking. The portfolio is relatively concentrated, with the top 20 holdings accounting for about two-thirds of assets at the end of June 2017. The trust is looking to increase interest in its shares, and potentially reduce the discount they trade at, by moving from the Alternative Investment Market to the main list.

The reform agenda of India’s Prime Minister Narendra Modi has been exciting overseas investors, but also giving them pause for thought. The government has pushed through major tax reform this year and has also attempted to tackle corruption by removing large denomination notes from circulation – so-called 'demonetarisation'. While the general thrust of these policies has been welcomed by investors, the potential for such bold reforms to disrupt economic activity giving rise to increased government borrowing has also intermittently spooked the market – as has recently been the case. There is also some nervousness about the general level of Indian equity valuations.

ASIA PACIFIC

Invesco Asia Trust

With developed equity markets trading at lofty valuations, Asia Pacific has recently been regarded by investors as somewhere it is possible to find relatively attractive value. Invesco Asia Trust (IAT) has a value-focused stockpicking approach, and the good news is that its experienced manager is still finding plenty of good investment opportunities. Over the long term the fund has a strong track record for NAV growth and it also boasts an unbroken record of dividend growth stretching back over 15 years.

A wider than usual discount has helped earn the trust a place in the Around the World screens picks. This could prove of particular note because the discount, at the time of conducting the screen, falls outside the trust’s own target range of 10 per cent. The trust has been active in controlling the discount in the past, although it has decided to move away from tender offers to address the issue and instead will concentrate on repurchasing shares in the market, which the board believes is a more effective policy.

JAPAN

Schroder Japan Growth Fund

Sentiment towards Japanese equities has been tainted recently by North Korean missile tests and bellicose rhetoric from both its leader and the president of the United States. But this flare-up aside, there are many reasons to feel relatively positive about the outlook for Japan. Indeed, the country’s recent record of six quarters of successive GDP growth is the best run for 12 years. Meanwhile, President Shinzo Abe, credited widely as the architect of the reforms that are powering the current economic recovery, has just successfully won a snap election, which should further strengthen his hand in pushing through economic change. From a corporate perspective, meanwhile, the earnings outlook is strong, corporate governance continues to improve, and equity valuations look less of an issue than in other developed markets.

The Schroder Japan Growth Fund (SJG) is run by highly experienced manager Andrew Rose and has a solid track record. While Mr Rose operates from London he relies on a sizeable team in Japan who undertake about 3,000 company meetings a year providing significant on-the-ground knowledge. The portfolio is relatively diverse and unconstrained when it comes to sector allocation and the size of company invested in.

NORTH AMERICA

North American Income Trust

North America provided considerable excitement for Mr Fogg and his travelling companions, from gun fights on trains to close encounters with wolves while riding a wind-propelled sleigh. US markets are, by comparison, eerily calm at the moment. They are also in the second-longest bull market on record and equity valuations are very high by historic standards. Some are worried this combination of apparent complacency and stretched valuations could provide a set-up for a nasty correction. What’s more, there are genuine reasons to fear rising interest rates, and the winding down of quantitative easing could act as a trigger for a sell-off. That said, robust economic conditions, stubbornly subdued wage inflation, the prospect of tax cuts and a 'continuity' appointment to chair the Federal Reserve all provide encouragement for bulls.

North American Income Trust (NAIT), which was founded over a century ago in 1902, ploughs its furrow away from some of the racier parts of the market. Its focus is on reliable dividend-paying stocks, predominantly from the S&P 500. The trust can hold bonds as well as cash, but with yields at anaemic levels the fixed-interest portion of its portfolio has reduced to just 2.4 per cent. The trust also repurchases its own shares at management’s discretion as a discount control mechanism, not that the shares look particularly cheap at the moment.

UK INCOME

Merchants Trust

Merchants Trust (MRCH) can trace its history back to within a couple of decades of Mr Fogg’s around-the-world voyage in 1872. And the trust, since being founded in 1889, has, like Mr Fogg, travelled widely, having started its life investing in US railroads. But for many years now it has offered far more homely comforts based on a well-diversified portfolio of reliable high-yielding UK-listed shares.

The trust pays quarterly dividends and boasts a 35-year track record of unbroken dividend increases, although it has had to pay dividends from reserves (ie payments not covered by income from its investments) in some of those years. The company has been boosting its dividend-paying power recently by taking advantage of low interest rates and refinancing debt. It recently secured £35m for 35 years at 2.96 per cent. The trust has a highly experienced manager and believes Brexit has created some clear value opportunities in the shares of some UK-focused companies.

THE WORLD

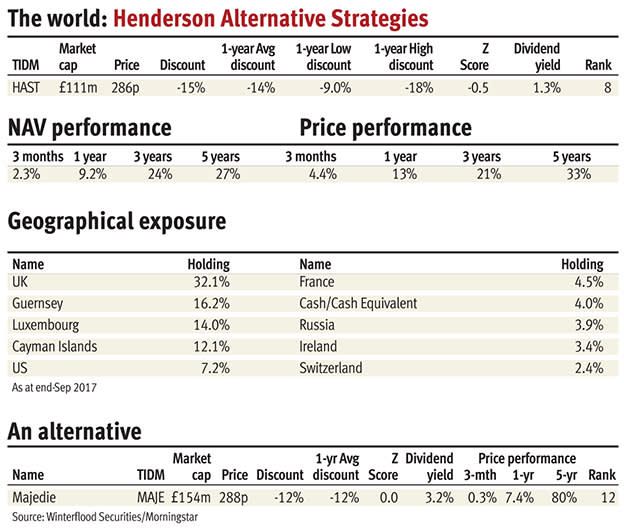

Henderson Alternative Strategies

With a seemingly unassailable equity bull market powering through its ninth year, it would be easy to overlook the virtues of Henderson Alternative Strategies (HAST). The trust offers international exposure to a number of asset classes and strategies, including long/short hedge funds, private equity, specialist credit, property and emerging markets. The spread of investments means the performance of the trust has the potential to hold up better in the event of an equity market sell-off.

The fund, which has had incarnations as Scottish Value, SVM Global and Henderson Value, was taken over by Henderson Janus in April 2013. The managers took three years to overhaul the trust’s portfolio and finished the job about a year ago with the aim of running a concentrated pool of 30 to 40 investments. The improved performance this year could bode well, and suggests the trust has a chance of meeting its performance target of 8 per cent annualised returns on a rolling three-year basis. There is also a continuation vote scheduled for early next year, which could help narrow the discount the shares trade at to NAV. What’s more, the board of the trust could move to bring the discount in before the vote. In both 2014 and 2016 the trust made tender offers for 10 per cent of the shares.