- Scottish Mortgage continued to race ahead in the six months to the end of September

- Lockdown trends have favoured this growth portfolio

- An analysis of the strengths, and possible risks, facing the trust

The runaway market rally that took hold at the end of March may have left plenty of active funds in the dust, but some investor favourites have simply gathered further momentum.

Such is the case for Scottish Mortgage Investment Trust (SMT): the half-year report released by the global equity fund this morning points to an astonishing net asset value (NAV) gain of 76 per cent in the six months to the end of September, well ahead of the 24 per cent rise in the FTSE All World index. The trust’s share price total return over this period is roughly in line with the NAV increase. However, investors would do well to remember the nature of exposure – and risk – within the portfolio.

Success stories

Like many of the funds run by Baillie Gifford, Scottish Mortgage has benefited from heavy exposure to big tech, both in the US and China. Its biggest positions at the end of September were Amazon (7.9), Alibaba (6.1) and Tencent (5.5). It also holds a stake in Tesla (US:TSLA) (12 per cent of assets). But more broadly, the trust’s huge gains stem in part from a focus on trends that have accelerated amid the global pandemic.

Names such as Amazon, Alibaba and Shopify benefit from a digital commerce boom, while the likes of Tencent, ByteDance and Alphabet are winners in the realm of social media and digital entertainment. Scottish Mortgage has also focused on new forms of food provision via holdings such as Meituan-Dianping and Delivery Hero, new working practices via Workday, Slack and Zoom, and financial services via names such as Ant Group and TransferWise.

While the trust’s half-year financial report noted that some “oddities” of the pandemic would fade away over time, co-manager Tom Slater argued that several portfolio holdings had made considerable progress over the six-month period, giving greater clarity on “both the size of opportunity and the companies’ ability to execute”.

The huge gains made by Tesla this year have certainly raised eyebrows, but the team pointed to “significant operational progress” at the firm. “It has successfully added capacity and the production ramp of its latest model has progressed far more smoothly than for any of its previous vehicles,” Mr Slater noted. “Demand for its products is strong and the response from its traditional competitors remains muted.” As noted, Tesla remains the trust’s biggest holding, even after the team sold more than 40 per cent of their shares over the six-month period for diversification reasons.

The team also used the report to make the case that clarity had emerged around other holdings. Mr Slater argued that Wayfair, the US furniture retailer, had “moved decisively into profitability after an extended investment phase”. The company, a 1.5 per cent position in the portfolio at the end of September, has previously attracted plenty of debate – and short interest – due to cash burn and questions around its business model.

The Scottish Mortgage team also made the case that food delivery names Meituan-Dianping and Delivery Hero had answered “important questions” about their future. The former has grown to become the dominant food delivery company in China, with Covid-19 also driving up demand for its other delivery services, including grocery and general merchandise. Delivery Hero has “restructured the geography of its business” with a focus on high-growth markets.

New pastures, new risks?

Some of the comments and portfolio activity outlined in the report point to a search beyond the likes of US tech for the growth stories of tomorrow. Mr Slater noted that Wayfair, Delivery Hero and Meituan “serve to illustrate the growing number of opportunities we have to invest in digital businesses of scale beyond the giant western platforms”.

This should prove critical, given that the investment managers have shown less conviction in some of the FAANG stocks in recent history. The team disposed of its remaining holding in Facebook over the six-month period covered by the report, having previously raised concerns about the social media platform’s time spent dealing with various crises. They also reduced the trust’s stake in Amazon, the first time the team has done so for reasons other than portfolio diversification. Amazon does still represent a major portfolio holding.

“Whilst we have huge respect for Amazon’s vision and ability to execute, its starting capitalisation of over $1.5 trillion (£1.1 trillion) makes the path to large future returns more challenging,” Mr Slater said.

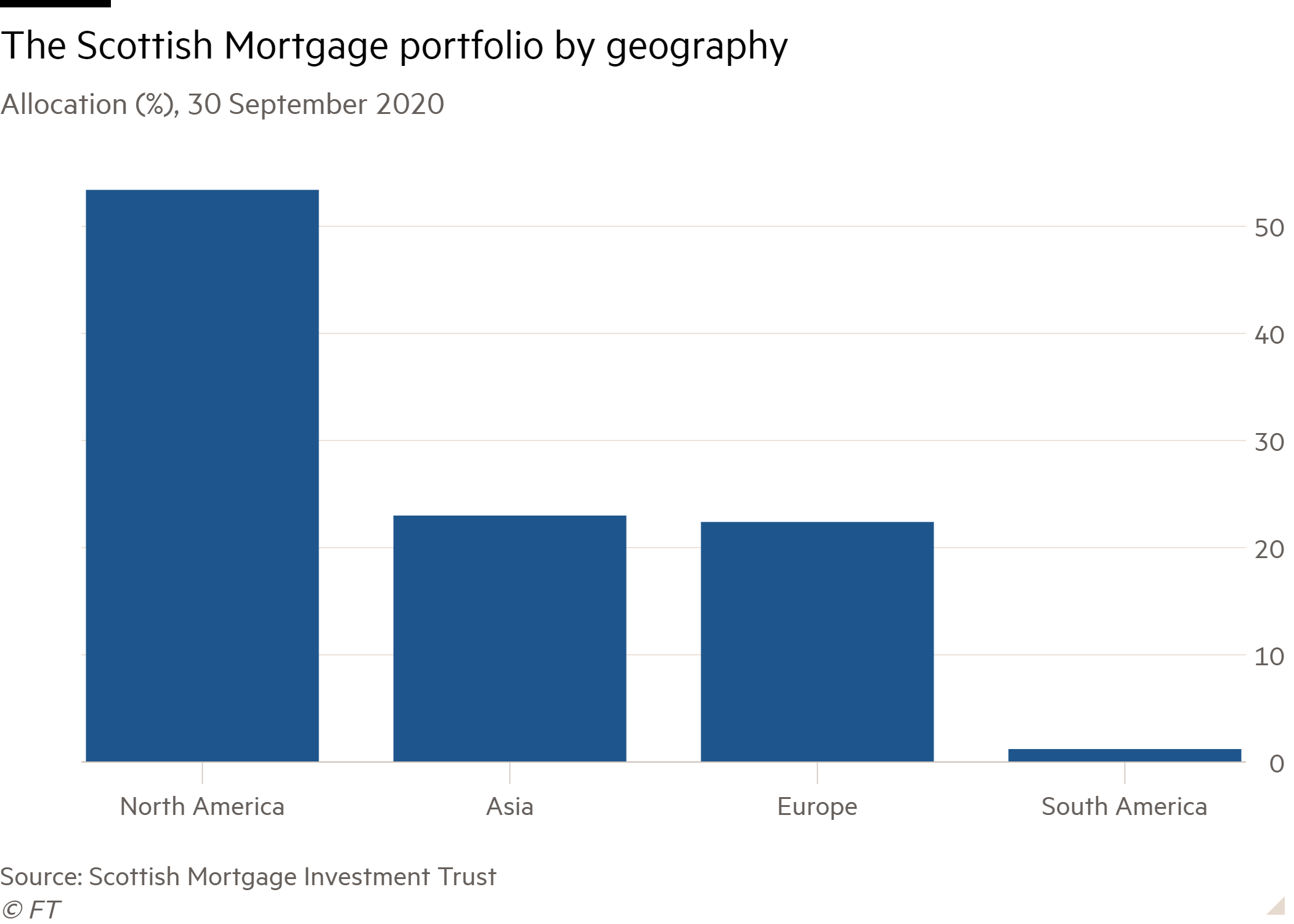

Scottish Mortgage's search for growth has led it not just to Asia, but also into the unlisted equity space, which has represented a growing area of focus for the team in recent years.

Here, however, may lie some of the risks. Unlisted stocks can be more opaque, while the team’s confidence in hotly debated names such as Tesla and Wayfair may prompt some concerns. Investors might also question whether 2020’s winning stocks, and sectors, can maintain their momentum.

Notably, some have even flirted with the idea of Scottish Mortgage shares looking vulnerable to a pullback. In August analysts at Stifel, the broker, suggested that while Scottish Mortgage represented a good core holding, the massive gains of this year could prompt some to take profit. Possible challenges for the trust could include a rotation from growth stocks to value, a change in US policy towards the tech sector and questions about the lofty valuations applied to tech and growth shares.

“We do think there is a good case to take some profits and lock in some gains,” the team said. “Experience suggests to us that trust NAVs and share prices don't rise in a straight line indefinitely.”