- A flexible bond fund that can provide useful portfolio diversification

- Strengths and weaknesses to consider

Diversification

Experienced managers

Flexible approach

Focus on macroeconomic factors

Can invest in riskier bond markets

Fixed income assets have once again proven their worth as portfolio diversifiers, with US government bonds making strong gains amid the initial uncertainty over the outcome of the US election. But the high prices of government bonds and unpredictability of current events mean that betting on this sub-sector of the asset class may not always be a useful diversification strategy. As we have stressed before, flexible bond funds may be a better way to navigate changing market conditions.

Some highly defensive funds such as Allianz Strategic Bond (GB00B06T9362) are run specially to be diversifiers to the equity part of your portfolio. A flexible bond fund with a highly regarded approach that also does this is M&G Global Macro Bond (GB00B78PGS53). It has less of an explicit focus on diversification than Allianz Strategic Bond but can still offer some protection from equity market volatility. Unlike funds in the Investment Association (IA) Sterling Strategic Bond sector, it is not required to invest the majority of its assets in sterling-denominated debt. So M&G Global Macro Bond can also offer a level of currency diversification that not all flexible bond funds are able to.

The fund, run by experienced managers Jim Leaviss and Claudia Calich, seeks to provide a combination of income and growth by holding government and corporate debt from around the world. Mr Leaviss and Ms Calich select holdings by conducting in-depth analysis of individual bond issuers and assessing macroeconomic factors.

M&G Global Macro Bond offers a good level of diversification. The fund held debt from 116 different issuers at the end of September, with a spread of bond exposures. Some 57 per cent of its assets were in government bonds on a net basis, with 19 per cent in investment grade corporate bonds and nearly 15 per cent in emerging market debt. More than a third of the fund’s assets were in the US at the time. Its management team can also use derivatives.

Importantly, the fund has the flexibility to move across different parts of the bond market as situations change. In September, for example, it benefited from government bond exposure as investor nerves pushed prices up. However, the fund's investment team made changes such as reducing exposure to both investment grade and high-yield corporate bonds. They also switched some of their euro currency exposure into US dollar exposure, following a strengthening of the former.

This fund could play various roles in an investment portfolio. It could serve as a source of diversification against your equity exposure or provide contrasting currency exposure to any allocations to sterling bonds. With Covid-19 and Brexit-related uncertainty still hanging over the UK, this could pay off.

M&G Global Macro Bond has proved defensive at times of stress. From 24 February to 21 March, a period that captures some of the most violent moments of this year’s equity sell-off, the fund made a 6 per cent sterling gain.

M&G Global Macro Bond is run for a total rather than income return, so it is less attractive as an income play. Its stated distribution yield was just 0.8 per cent at the end of September. And it may not always prove as defensive as some other flexible bond funds given its focus on riskier parts of the fixed income market such as emerging market debt.

However, if high income is not your primary objective, your risk appetite is high enough to tolerate exposure to riskier types of debt and you are looking for diversification via bonds, M&G Global Macro Bond is still an option. It is flexible, and offers broad exposure that could compliment both equity and sterling exposure in a portfolio. Buy. DB

| M&G Global Macro Bond (GB00B78PGS53) |

| Price | 167.14p | Sharpe ratio | 0.82 |

| IA Sector | Global Bonds | Standard deviation | 6.42% |

| Fund type | Open-ended investment company | Ongoing charge | 0.78% |

| Fund size | £1.5bn | Yield | 1.55% |

| No of bond issuers in portfolio | 116 | More details | mandg.co.uk |

| Set-up date | 15 October 1999 | ||

| Manager start date | Jim Leaviss: 15/10/99 |

| Source: Morningstar, 9/11/20 |

| Performance |

| Fund/benchmark | 1-year total return (%) | 3-year cumulative total return (%) | 5-year cumulative total return (%) | 10-year cumulative total return (%) |

| M&G Global Macro Bond | 9.23 | 17.62 | 44.84 | 72.34 |

| IA Global Bonds sector average | 5.22 | 10.65 | 34.04 | 46.69 |

| Source: FE, 6/09/20 |

| Asset breakdown (%) |

| Government bonds | 57.0% |

| Investment grade corporate bonds | 19.0% |

| High-yield corporate bonds | -2.8% |

| Securitised debt | 1.8% |

| Emerging markets | 14.7% |

| Cash | 10.2% |

| Source: M&G, 30/09/20. All figures are given on a net basis (can include derivative use), which can lead to negative numbers. |

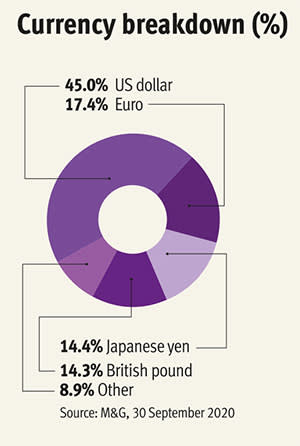

| Currency breakdown (%) |

| US dollar | 45.0% |

| Euro | 17.4% |

| Japanese yen | 14.4% |

| British pound | 14.3% |

| Indonesian rupiah | 1.9% |

| Mexican peso | 1.6% |

| Norwegian kroner | 1.4% |

| Malaysian ringgit | 1.4% |

| Peruvian nuevo sal | 1.4% |

| Other | 1.2% |

| Source: M&G, 30/09/20 |