A reader considers taking on higher investment risk to help fund a property purchase

Sipp, Isa and trading account invested in funds and shares, workplace pension, cash, residential property.

Build up necessary capital to buy home worth up to £1m, supplement pension income to finance reasonable life style, cash to cover emergencies

Barbara is 73 and works part time for £19,000 a year, but expects to leave her job soon. She also receives about £13,000 per year from two former workplace pensions. She has just started taking her state pension, which pays out over £20,300 a year as she delayed taking it and topped it up.

Her home is roughly worth between £600,000 and £700,000, and mortgage-free.

“I would like to buy a better primary home with a value of up to £1m,” says Barbara. “But I would still like to have enough capital to supplement my pension income, lead a reasonable lifestyle and cover emergencies.

"I do not have enough capital to make moving house worthwhile at present. So I am prepared to take higher investment risk than would normally be advisable at my age to build up the necessary capital. I am in good health and fit, and suspect that the bull run might have a bit longer to run. So some investments could be higher risk now and lower risk later on. I would say that I have a medium to high risk appetite now, and would be prepared for the value of my investments to fall by up to 25 per cent in any given year.

"When I have bought a better property the remaining capital could be invested in lower risk, income-generating investments.

"I started investing very small amounts about 20 years ago, which I have built up. I now have an individual savings account (Isa) worth about £287,000 and a self-invested personal pension (Sipp) worth £123,000 which I manage myself. I also have about £25,000 in cash.

"Because I am still working part-time, I do not take income from my investments and try to maintain a reasonably balanced portfolio. I discuss ideas with three friends with whom I am in an investment club, and read the finance sections of newspapers and financial magazines.

"I recently noticed that I was sitting on a lot of dogs [poorly performing investments] and had let things slip badly. So, with more spare time as a result of being in lockdown, I have done quite a lot of trading recently.

"This has included adding Fidelity Special Situations (GB00B88V3X40), Fidelity Special Values (FSV) and Fulham Shore (FUL). I am now thinking of investing in BlackRock Gold and General (GB00B99BDY18) and Rio Tinto (RIO)."

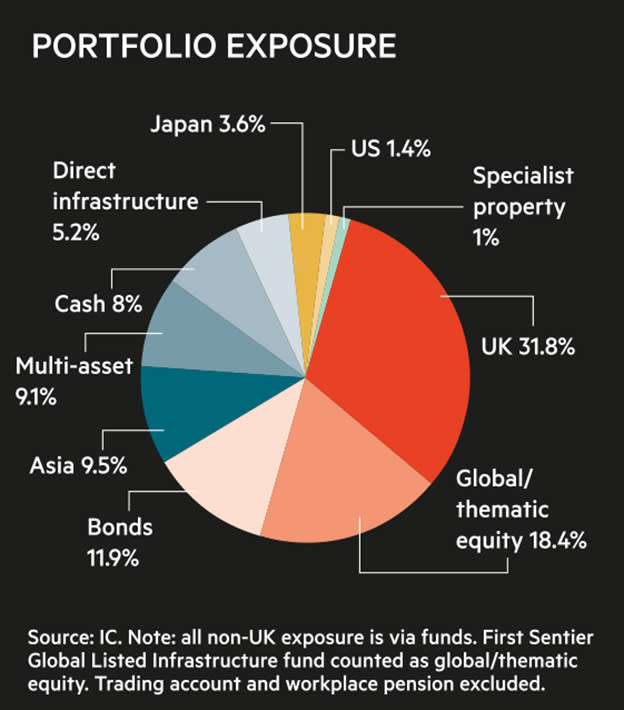

| Barbara's total portfolio | ||

|---|---|---|

| Holding | Value (£) | % of portfolio |

| Cash | 34,877 | 7.9 |

| Artemis Income (GB00B2PLJH12) | 31,809 | 7.2 |

| Jupiter Asian Income (GB00BZ2YND85) | 31,045 | 7.1 |

| Caledonia Investments (CLDN) | 29,492 | 6.7 |

| Invesco Tactical Bond (GB00B8N45T82) | 28,097 | 6.4 |

| Fidelity MoneyBuilder Income (GB00BBGBFM09) | 23,647 | 5.4 |

| Marlborough Multi Cap Income (GB00B907VX32) | 22,759 | 5.2 |

| First Sentier Global Listed Infrastructure (GB00B24HJL45) | 21,675 | 4.9 |

| Smith & Williamson Artificial Intelligence (IE00BYPF3314) | 20,821 | 4.7 |

| Renewables Infrastructure Group (TRIG) | 17,063 | 3.9 |

| Lindsell Train Global Equity (IE00BJSPMJ28) | 16,295 | 3.7 |

| Threadneedle UK Equity Income (GB00BDZYJT97) | 12,929 | 2.9 |

| Henderson Smaller Companies Investment Trust (HSL) | 11,191 | 2.5 |

| ASI Asia Pacific Equity (GB00B0XWNG99) | 10,371 | 2.4 |

| AVI Global Trust (AGT) | 10,766 | 2.4 |

| LF Lindsell Train UK Equity (GB00BJFLM156) | 9,997 | 2.3 |

| RIT Capital Partners (RCP) | 9,977 | 2.3 |

| Mercantile Investment Trust (MRC) | 9,272 | 2.1 |

| BlackRock Throgmorton Trust (THRG) | 9,016 | 2.0 |

| JPMorgan Japanese Investment Trust (JFJ) | 8,594 | 2.0 |

| Man GLG Japan CoreAlpha (GB00B0119B50) | 7,031 | 1.6 |

| Baillie Gifford American (GB0006061963) | 6,270 | 1.4 |

| Rolls-Royce (RR.) | 6,101 | 1.4 |

| Octopus Renewables Infrastructure Trust (ORIT) | 5,703 | 1.3 |

| WisdomTree Battery Solutions UCITS ETF (CHRG) | 5,441 | 1.2 |

| Fidelity Special Situations (GB00B88V3X40) | 5,093 | 1.2 |

| Fidelity Special Values (FSV) | 4,951 | 1.1 |

| iShares Global Water UCITS ETF (IH20) | 4,925 | 1.1 |

| Home REIT (HOME) | 4,342 | 1.0 |

| Ceres Power (CWR) | 4,255 | 1.0 |

| Marks and Spencer (MKS) | 3,164 | 0.7 |

| Workplace pension | 3,000 | 0.7 |

| ITM Power (ITM) | 2,237 | 0.5 |

| Trading account | 2,000 | 0.5 |

| Fulham Shore (FUL) | 1,902 | 0.4 |

| Powerhouse Energy (PHE) | 1,884 | 0.4 |

| Ilika (IKA) | 1,855 | 0.4 |

| Total | 439,846 | |

| Biggest direct and indirect holdings | |

|---|---|

| Name | Exposure (%) |

| Rolls-Royce | 1.51 |

| Ceres Power | 1.06 |

| Marks and Spencer | 0.79 |

| Samsung | 0.77 |

| Taiwan Semiconductor Manufacturing Company | 0.67 |

| Source: IC/FE | |

NONE OF THE COMMENTARY BELOW SHOULD BE REGARDED AS ADVICE. IT IS GENERAL INFORMATION BASED ON A SNAPSHOT OF THIS INVESTOR'S CIRCUMSTANCES.

Chris Dillow, Investors' Chronicle's economist, says:

You say you’re thinking of taking more risk than is usual for someone of your age. I’m not sure this is wise.

I don’t say this because of your age. The idea that we must all have safer portfolios as we get older is a myth: yes, there are some people for whom it is true, but there are others for whom it is not. Do not feel the need to obey some daft rule about reducing risk as you age.

Instead, the problem is that taking on more risk might not pay off now. The dividend yield on the FTSE All-Share index is below its long-term average: historically, this has been a great lead indicator of returns over the medium term. The global ratio of prices to money is high, which has been another good predictor of poor returns in the past. And it’s not obvious that the world economy will recover fast enough to validate some of the big rises we’ve seen in cyclical stocks such as miners in the last few months.

I would, then, be wary of taking extra risk. And you might not need to do so, because house prices might not rise much further, if at all. Their recent increase reflects the release of pent-up demand after the first lockdown and the stamp duty holiday. Unless the government takes further measures to support the market, prices could slip back. What’s more, with unemployment likely to rise this year, you might find a property that’s a (relative) bargain because somebody is unlucky enough to be a forced seller.

Back in the late 1980s, some friends of mine were worried that house prices would rise so much that they would no longer be able afford a property so they took on big mortgages to buy – and found themselves living in hovels with negative equity. Don’t make that sort of mistake.

You should also be careful about shifting to lower-risk income stocks. This time last year, investors thought that BP (BP.) and Royal Dutch Shell (RDSB) offered low-risk income. They were disappointed. A high yield is usually a sign that something is wrong with a stock – either it is unusually risky (often because it is exposed to recession risk) or it is thought to offer poor growth prospects.

Yes, there’s a strong case for buying low-risk stocks. We have huge evidence that these outperform on average over the long run. But even these are not entirely safe: if the market falls so, often, do they. Do not, though, chase income. You can create your own dividends by selling stock when you want to: what matters is total return, not income.

I’m pleased to see that you’ve been selling some dogs. Remember that equities are prone to momentum: fallers on average often keep falling. So carry on cutting losers. If you must be reasonably fully invested, you need some form of risk management.

James Norrington, specialist writer at Investors' Chronicle

Your desire to move home means you must consider the dynamics of the UK property market as well as global equity and bond markets ahead of your retirement. The end of the stamp duty land tax (SDLT) holiday is cited as one factor that could cool house prices, along with the knock-on effects of higher unemployment as government support schemes wind down.

For you the issue is whether downward pressures will be greater in the price band you’re buying into compared to the one you’re selling out of. Depending on where you’re leaving and where you want to go to, maybe you can take a bite out of that £300k or so differential on the move.

Your patience might be rewarded if the housing market shifts in your favour, however that could be a case for moderating your investment risk rather than increasing it. You want the economic factors that affect UK house prices to be mitigated in your portfolio. If housing market risk is to the upside, then the £600k equity in your current home still gives you exposure. If that risk plays to the downside, a well-diversified investment portfolio could see you better placed to be upwardly mobile in property.

The immediate priority should be maintaining your standard of living in retirement. Thanks to your ability to take tax free sums from your Sipp or withdraw money completely tax free from your Isa, this can be done by selling investments of less value than the £19,000 gross that you get from your part-time job. This means you probably need to grow your portfolio by an average of 3.5 per cent plus inflation each year, which requires taking moderate risk.

The best approach to investing is a total returns one and selling bits of holdings to create income. In bad years you’ll not want to liquidate capital and crystallise losses, which sacrifices compounding power when times are good. So manage your portfolio to enable you to take less during periods when its value has fallen. Some distributing fixed income funds are a good way to maintain a minimum payment from the portfolio (and avoid drawing down capital) to top up the pensions.

Strategic bond funds are a vital core holding for this reason and because they mitigate the volatility of riskier equity funds. Equities should be the growth engine of your portfolio and it’s good that you have cleared out the dogs that were underperforming.

Global growth themes such as clean energy, healthcare, cloud computing, robotics, 5G infrastructure, battery technology and payments offer investors a powerful source of future returns. It’s good to see some of these themes in your portfolio. But keep an eye on underlying holdings, and make sure that your funds aren’t too skewed towards the risk of smaller companies or unlisted investments.

Such investments should compound away for years and aren’t so dependent on what happens in the UK economy. So you shouldn’t be thinking about chasing more risk to keep up with UK house prices, the focus should be on ensuring the equity risk you have is smartly allocated. There should be no conflict between a portfolio that is geared to meet your income needs and compounding away capital gains to keep the door open to a house move.

As an alternative, some advisers could push you towards taking a Lifetime Mortgage that uses the equity in the new property to settle what your estate owes the finance provider when you die. Lifetime mortgages are good for people who have very little pension savings and whose only asset is their home, but you have more options.