With its 42.5 per cent market share, Hargreaves Lansdown (HL) is the big beast of the UK’s do-it-yourself investment platform market. Many readers of this title will be among its 1.5m clients, and some may have even read our various missives questioning the sustainability of its business model. In short, Hargreaves provides a service that is trusted by huge numbers of people, but at a price which does not always seem compelling. Is it all just a clever marketing exercise propping up margins destined to contract?

Strong brand in a growth market

Debt free, very cash generative

Flexible income model

Excellent client retention

Active Savings portal

High fees, big competition

Founder share sales

We think not, even if revenue margin compression seems possible or even likely in the coming years. Neither are these two views contradictory, because Hargreaves sits atop one of the great secular growth stories in finance: the use of investment platforms by ever-greater numbers of savers in the ever-growing UK savings market. This means it should be able to swallow growing pressure on prices thanks to scale and operational gearing.

Judging by current market sentiment – reflected in a price to cash flow ratio of 23, a five-year low – this seems like a contrarian view. The shares have failed to hang on to ground first broken in the autumn of 2017, and barely outperformed the FTSE All-share Index in the five years to December 2020. That seems odd for a company that routinely posted after-tax profit margins above 50 per cent and a 27 per cent average return on assets over the same period. While analysts expect fee pressure and slightly higher costs to hold back profits over the next two financial years, bottom line growth should resume at pace thereafter.

Market is losing faith in margins and returns | |||||||

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2016-2020 Avg |

Price Change (%) | -19.5 | 48.6 | 2.6 | 4.7 | -21.2 | -0.2 | 3.0% |

+/- FTSE All-Share (%) | -31.9 | 39.6 | 15.6 | -9.5 | -8.7 | -2.8 | 1.0% |

+/- Industry (%) | -1.0 | 10.7 | 6.7 | -53.5 | -32.0 | -9.2 | -13.8% |

Post-tax profit (£m) | 177 | 212 | 236 | 247 | 313 | 283 | 14.9% |

PTP Margin (%) | 45.6 | 54.4 | 52.8 | 51.5 | 56.8 | 48.5 | 52.2% |

ROA (%) | 23.5 | 26.6 | 30.8 | 28.0 | 27.8 | 22.3 | 27.4% |

ROE (%) | 72.2 | 75.5 | 66.5 | 57.4 | 61.6 | 51.3 | 66.6% |

Source: FactSet; 2021 is YTD or estimates | |||||||

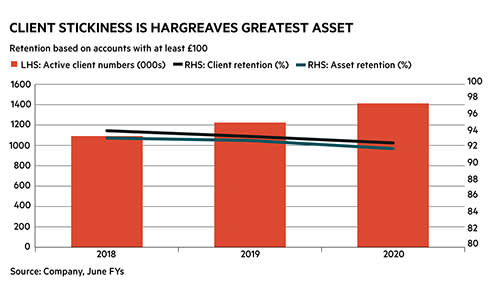

A beaten-up valuation (at least relative to the historical average) is also at odds with recent performance. Whatever you make of Hargreaves’ value-for-money (more on which below), it added 222,000 customers in the 2020 calendar year, and hung on to 92.9 per cent of clients in a period marked by extreme financial market turbulence and, for many investors, reams of spare time to compare and settle on a preferred financial service provider.

On one hand…

Granted, like any service provider, the group also relies on some client inertia. An ongoing 0.45 per cent annual charge on the first £250,000 of funds held with Hargreaves is pricier than that of key rival AJ Bell (AJB), whose YouInvest platform charges 0.25 per cent. Ongoing charges of up to 1.56 per cent on Hargreaves’ own multi-manager funds, even before the annual 0.45 per cent platform fee, look particularly steep against the 0.22 per cent flat charge on Vanguard’s LifeStrategy portfolios. Share traders may save money with ii’s all-you-can-eat price model, too, versus Hargreaves’ charges of up to £11.95 per deal.

Beyond fat margins and chunky prices, there are concerns about lower-quality earnings. For example, in the year to June 2020 just over 12 per cent of client assets on the platform were held in cash, and contributed 17 per cent of the £551m in revenues generated in the period. This was very profitable business, as Hargreaves simply held clients’ cash in higher-yielding accounts, banking the interest on billions of pounds.

This seems less terrible when you consider that banks routinely earn greater margins (albeit with greater risk) from customer deposits, and that it is ultimately up to platform users to move their cash into higher-yielding products or accounts. But much of these margins have now gone as interest rates have dipped. At the same time, recent hiccups in customer service – be it on the dedicated phone dealing line, or platform outages during bouts of market volatility – have all added to the perception of “high cost, poor service, quasi-monopolistic behaviour”, to borrow the words of one investor group.

At the same time, Neil Woodford’s not-so-long march from exile and back into the headlines was another unwelcome reminder of the goodwill chewed up by Hargreaves’ long-term promotion of the stricken fund manager. Optically, none of the above has been helped by several major share sales by founder Peter Hargreaves, who this month sold a £300m stake to institutional investors. Although the former chief executive still owns 19.7 per cent of the FTSE 100 group, it’s fair to say that the market took the discounted placing as a negative.

…on the other

However, to characterise Hargreaves as a mere beneficiary of investor inertia is neither fair to the business or its customers. A more charitable and balanced take is that the company’s dominant and growing market position is evidence of a client base that feels secure and empowered by a strong proposition to help them manage their money.

Increasingly, these customers are also younger, and their needs are changing. But while it’s important not to lump investors into one group, it’s also worth remembering that most people are risk averse and cautious with their money. Sure, cryptocurrencies, leveraged equities and meme-led investing may be in vogue, but that’s a drop in the pond compared with the £300bn sitting in low- or no-interest cash individual savings accounts (Isas).

Pensions reforms and the auto-enrolment scheme mean growing numbers are aware of the need to get their 'savings working harder', to borrow Hargreaves’ tagline. To this end, the launch of Active Savings – a portal giving savers the flexibility to easily move between fixed interest rate products – represents an opportunity to cement the brand and wider platform in the minds of customers who otherwise wouldn’t view themselves as investors.

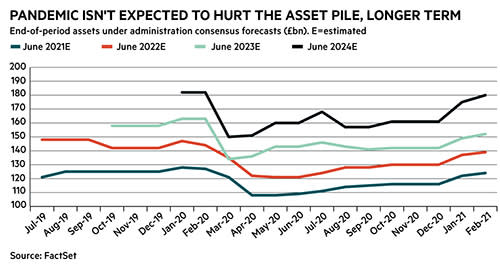

This, together with strong client flows in recent quarters, go a long way to explaining why forecasts for assets under administration have rebounded and are set to climb in the coming years (see chart).

Cash savings are also one of many intensely competitive areas. Just this week, Aviva (AV.) launched its own portal, suggesting the 75 per cent uptick (£4.5m) in Hargreaves marketing spend seen in the first half of FY2021 may not be a one-off. But as the market leader, Hargreaves has already stolen a march on new entrants, with large footholds in multiple asset classes. Numis analysts go one further, arguing that Active Savings represents “another staging post in HL evolving to provide a comprehensive financial platform”.

Even in structural growth markets, competition is always a threat. So while investors can expect Hargreaves to adapt, no one can say for certain which segment of DIY investment will be in the ascendency in five years’ time. The challenge from low-cost passive funds isn’t going away, and we expect robo-advice to gain traction as Goldman Sachs adds an investing platform to its popular Marcus account later this year in the UK.

Has Hargreaves invested enough in this future? The hugely cash-generative nature of the business has been good for dividends and the corporate bank account, but the coming years might require a more creative recycling of cash should market share come under pressure.

Then again, the end-game – the sort of AI-powered consolidated platform which Numis reckons Hargreaves could build and eventually render traditional financial advice obsolete – sounds like a prize worth pursuing. After all, if there’s one thing Hargreaves has shown, it’s that people are happy to pay up for convenience.

Thrones can be both a target and their own peculiar source of power.

Last IC View: Buy, 1,541p, 17 Feb 2021

| Hargreaves Lansdown (HL) | |||||

| ORD PRICE: | 1,516p | MARKET VALUE: | £7.2bn | ||

| TOUCH: | 1,515-1,517p | 12-MONTH HIGH: | 1,923p | LOW: | 1,147p |

| FORWARD DIVIDEND YIELD: | 2.9% | FORWARD PE RATIO: | 28 | ||

| NET ASSET VALUE: | 106p | NET CASH: | £373m* | ||

| Year to 30 Jun | Turnover (£m) | Pre-tax profit (£m)** | Earnings per share (p)** | Dividend per share (p) |

| 2018 | 448 | 292 | 49.8 | 40.0 |

| 2019 | 481 | 306 | 52.2 | 42.0 |

| 2020 | 551 | 340 | 57.9 | 54.9 |

| 2021** | 576 | 333 | 56.8 | 44.9 |

| 2022** | 565 | 315 | 53.8 | 44.4 |

| % change | -2 | -5 | -5 | -1 |

| NMS: | ||||

| Beta: | 0.6 | |||

| *Includes lease liabilities of £20.1m | ||||

| **Berenberg forecasts, adjusted PTP and EPS figures | ||||