Fund Choice: Liontrust Sustainable Future Global Growth (GB0030030067)

Unit price: 261.93p (03/03/21)

Fund size: £1.2bn (03/03/21)

While this is rapidly becoming a stereotype, research suggests younger investors are among those pushing for investments with a positive social and environmental impact. A diversified ESG fund may therefore be a good fit for young professionals.

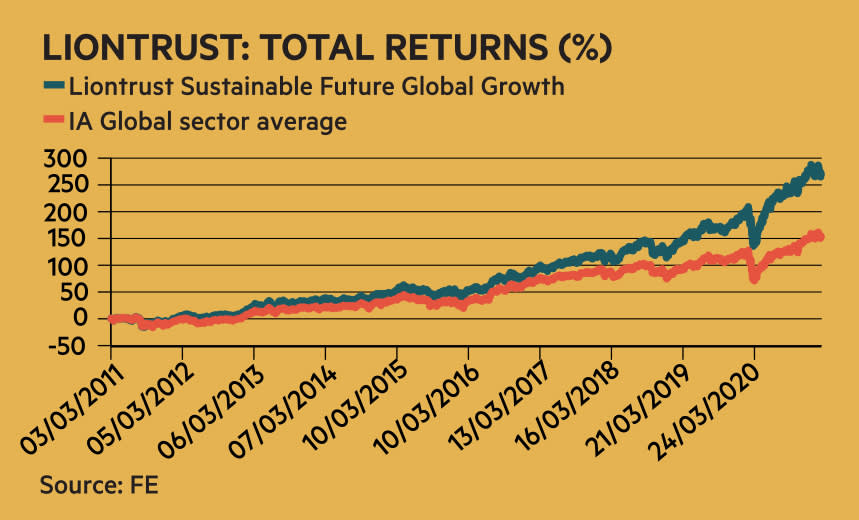

Given the risk of both companies and fund managers overstating their ESG credentials, it makes sense to back established portfolios. One name that stands out here is Liontrust Sustainable Future Global Growth.

Two of the fund’s managers, Simon Clements and Peter Michaelis, have worked on the Sustainable Future range in some form for many years. They seek to identify “key structural growth trends that will shape the global economy of the future”, before seeking well run companies that capitalise on these shifts.

The team focused on 21 different themes across the range as of December 2020. Within this fund, financial services name Charles Schwab (US:SCHW) fits the theme of 'saving for the future'. One of the fund’s semiconductor holdings, Cadence Design Systems (US:CDNS), fits a theme of improving the efficiency of energy, given its innovation in chip design. Among other themes, the team focuses on moves to improve transport safety, and to improve industrial and agricultural processes.

Share choice: PayPal (US: PYPL)

Share price: $255

Market cap: $299bn

For many young investors, the heady world of cryptocurrencies has proven unavoidably attractive in recent months and as the price of bitcoin has surged skywards, investors who have not converted their pounds or dollars have been left ruing their indecision.

But buying into the fast-moving world of digital payments, doesn’t mean you have to invest directly in bitcoin. PayPal (US:PYPL) – which entered the crypto market in October when it announced that customers could use their accounts to buy, sell and pay for things with bitcoin – is one way of entering the market indirectly. The company also offers a digital wallet that can be used to store bitcoin and other virtual currencies.

And even before its shift to cryptos, PayPal was at the forefront of innovation in the digital payments space. In 2013, the group acquired Venmo and its parent company Braintree, which allowed it to offer in-app payment services for the first time. Its older cousins in the payment provider space – Visa (US:V) and Mastercard (US:MA) – have been attempting to play catch-up, with their own stream of acquisitions ever since.

| Payments providers deliver profits | |||

|---|---|---|---|

| PayPal | Mastercard | Visa | |

| Revenue | 21.50 | 15.30 | 21.80 |

| Operating Profit | 5.39 | 9.70 | 14.10 |

| Operating Margin | 25.07 | 63.40 | 64.68 |

| Net Profit | 4.20 | 8.10 | 10.90 |

| Net Profit Margin | 19.53 | 52.94 | 50.00 |

| Source: Company annual results (FY2020) | |||

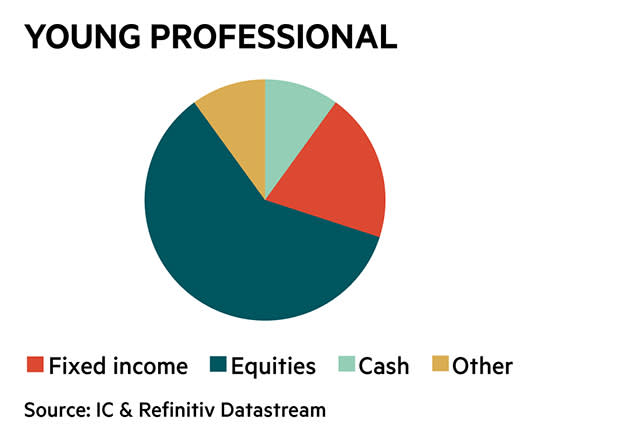

IC model asset allocation – young professionals

Our model asset allocation is adventurous – aimed at young professionals with no financial dependents or immediate need for cash. That is because, as young savers you have a long time to let your investments grow. So, if that holiday, house or wedding is expected within the next two to five years, make sure you have a big enough pile of readily available cash to match your spending needs.

Young professional investors might sit anywhere on a broad spectrum in terms of their understanding of risk, portfolio size and spending requirements. There is plenty of scope to flex these model allocations and find what’s right for you.

We are assuming that this model includes a young professional’s entire portfolio of savings, including money in or set aside for a house, inherited money and salary.

What’s in it?

Cash: 10-30%

If you’re saving for a house deposit and you expect to buy within the next five years, it might be best to sit on a larger pool of cash.

Other: 0-20%

This varies, as young investors' circumstances depend to a large extent whether they are on the housing ladder. It's worth remembering, if you do own a home, then your equity exposes you to the UK property market already, so you might want to consider this when choosing the types of investments you fill your 'other' allocation with.

We also include high risk investment in the ‘other’ category, including investment in unlisted companies. Young investors with a long time horizon can afford to invest in these higher risk assets.

Fixed income: 10%

As most younger investors will have jobs, this asset class is less significant than for other age groups in terms of income, but it is useful for managing risk – investment in bonds is lower risk than equities, but also likely lower reward.

Equities: 60%

This asset class will generate strong returns when times are good but in a long bear market (a period when the trajectory of share prices is down) your portfolio value can stay below its previous peak for a while. Remember not to be afraid of periods of weakness though, because if your time horizon is long enough, your investments should bounce back.