- Value is in the momentum driving seat

- Strong three-month performance

- 10 new longs and shorts

I’m a bit late with this quarter’s blue-chip momentum update. My quarterly momentum trawl should have appeared a couple of weeks ago. But hopefully it's a case of better late than never as there are some interesting things to glean from the screen.

Over the past six months there has been a very noticeable change of guard among the longs. It has been a case of out with 'quality' and 'growth' names and in with the FTSE 100’s “value” plays. My blue chip momentum screen has done well over the last three months from backing value shares.

| Share price return (15 Dec 2020 - 15 Mar 2021) | |||

|---|---|---|---|

| LONGS | SHORTS | ||

| Rolls-Royce | 2.3% | Sage | 2.2% |

| NatWest | 17% | AVEVA | 7.0% |

| Taylor Wimpey | 13% | DCC | 11% |

| Barclays | 25% | Polymetal Int. | -8.4% |

| British Land | 2.7% | Reckitt Benck. | -2.6% |

| Lloyds Banking | 12% | Ocado | -5.3% |

| Whitbread | 9.8% | HomeServe | 3.4% |

| Evraz | 20% | AstraZeneca | -7.0% |

| RSA Insurance | 0.2% | Hargreaves Lansdown | 4.2% |

| Informa | 3.3% | Fresnillo | -17% |

| Average | 11% | Average | -1.2% |

| FTSE 100 | 3.6% | - | 3.6% |

| Source: FactSet | |||

The most recent three-month performance contrasts with a spectacularly bad final three months of 2020. Back then, 'value' stocks dominated the short picks (shares that had been falling and were backed to continue to do so). These stocks experienced a massive reversal of fortune in that end-of-year quarter, causing the shorts to deliver a mammoth 38 per cent three-month capital return. Over the same period the longs were down 1.3 per cent compared with a 6.7 per cent gain from the FTSE 100.

This kind of whipsaw action is to be expected from momentum strategies when trends change abruptly. Indeed, momentum is a bet that recent trends are more likely to persist than reverse, which leaves the strategy highly exposed to reversals when they do happen. And reversals in trends are an inevitability in investing.

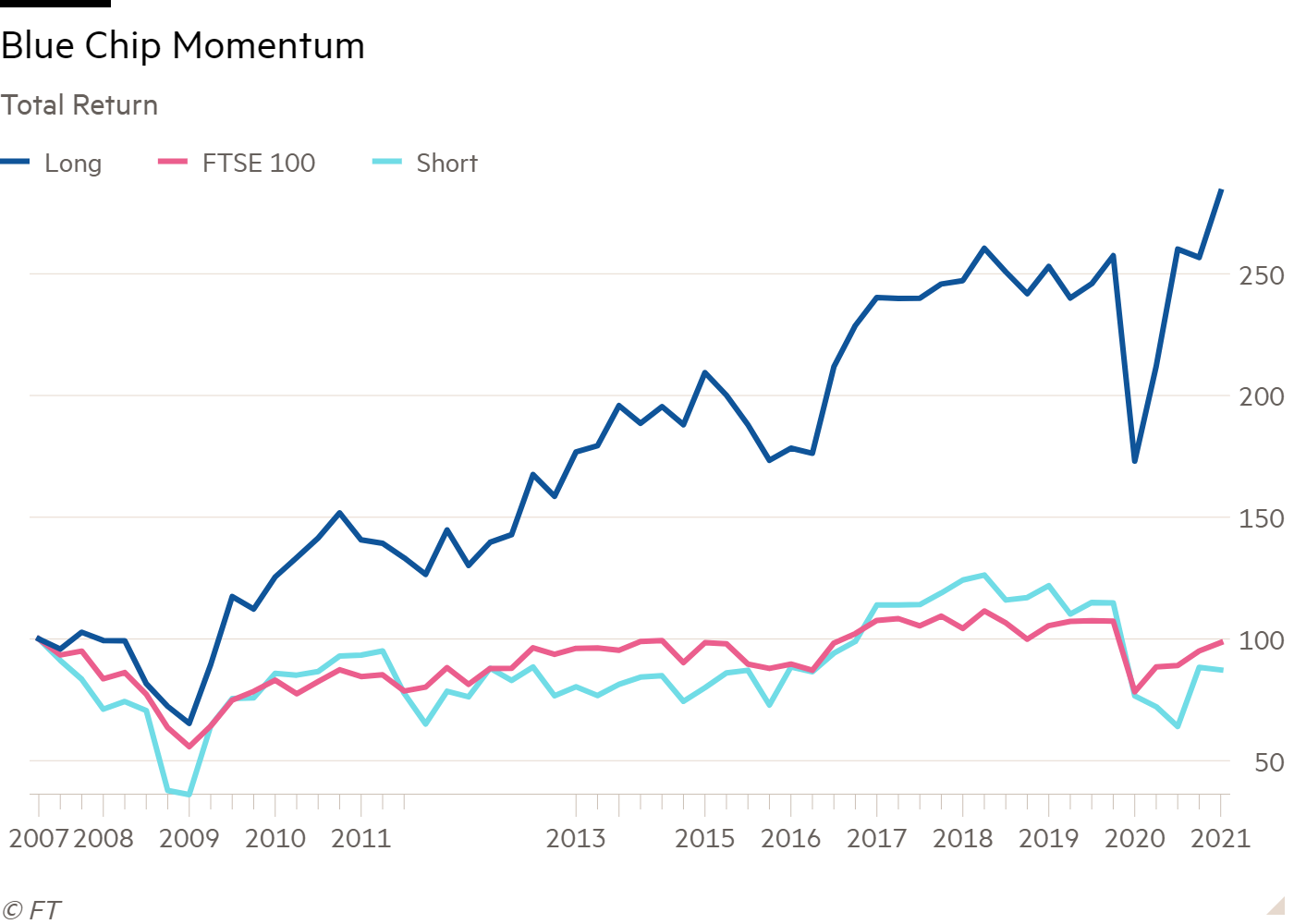

However, over the long term periods of pain tend to be outweighed by the moments of ecstasy, and this has been the case with my Blue Chip momentum screen over multiple time periods (see table).

| Price performance | |||

|---|---|---|---|

| Long | Short | FTSE 100 | |

| Since June 2007 | 184% | -13% | -1.5% |

| 10-yr | 102% | -6.5% | 16% |

| 5-yr | 59% | -1.4% | 10% |

| 3-yr | 15% | -30% | -5.6% |

| 1-yr | 64% | 14% | 26% |

| Source: Thomson Datastream/S&P CapitalIQ/FactSet | |||

Still, this screen is one of the more theoretical strategies I monitor because the heaps of evidence amassed about momentum strategies suggests the level of stock turnover needed means real world costs would seriously crimp returns from the strategy. And, unlike all the other screens I monitor, the performance figures used are based only on share price returns while ignoring dividends and costs.

Because I’ve missed the official reshuffle date for this screen, as well as providing the names of stocks which will be used in my ongoing monitoring of performance, I’ve also provided more detailed lists of the 10 shares showing the best (Longs) and worst three-month momentum over a more up-to-date period. I’ve taken a brief look at the five Longs showing the best momentum below.

| Official selection | |||

|---|---|---|---|

| LONGS | SHORTS | ||

| Name | TIDM | Name | TIDM |

| International Consolidated Airlines Group SA | IAG | Fresnillo PLC | FRES |

| Entain PLC | ENT | London Stock Exchange Group plc | LSEG |

| Ashtead Group plc | AHT | Rightmove plc | RMV |

| Johnson Matthey Plc | JMAT | Experian PLC | EXPN |

| Barclays PLC | BARC | Avast Plc | AVST |

| Anglo American plc | AAL | Bunzl plc | BNZL |

| Antofagasta plc | ANTO | Hikma Pharmaceuticals Plc | HIK |

| Pearson PLC | PSON | Imperial Brands PLC | IMB |

| Barratt Developments PLC | BDEV | Polymetal International Plc | POLY |

| Aviva plc | AV | Unilever PLC | ULVR |

| Hot-off-the-press longs and shorts | ||||||

|---|---|---|---|---|---|---|

| LONGS | ||||||

| Name | TIDM | Price | Market Cap | 3mth Mom* | NTM PE | DY |

| Entain PLC | ENT | 1,525p | £8.9bn | 34.4% | 24 | - |

| Ashtead Group plc | AHT | 4,265p | £19.2bn | 26.0% | 25 | 1.0% |

| DCC Plc | DCC | 6,476p | £6.4bn | 24.0% | 16 | 2.3% |

| Kingfisher Plc | KGF | 315p | £6.6bn | 22.5% | 13 | 2.6% |

| Johnson Matthey Plc | JMAT | 2,955p | £5.7bn | 21.7% | 14 | 1.7% |

| Aviva plc | AV | 398p | £15.6bn | 21.4% | 7 | 6.8% |

| Barclays PLC | BARC | 181p | £31.4bn | 20.0% | 10 | 0.6% |

| International Consolidated Airlines Group SA | IAG | 187p | £9.3bn | 17.9% | - | - |

| Glencore plc | GLEN | 272p | £36.2bn | 17.7% | 10 | 1.6% |

| Antofagasta plc | ANTO | 1,660p | £16.4bn | 17.3% | 20 | 2.4% |

| AVERAGE | - | - | - | 22.3% | 15 | 2.4% |

| SHORTS | ||||||

| Name | TIDM | Price | Market Cap | 3mth Mom* | NTM PE | DY |

| London Stock Exchange Group plc | LSEG | 7,260p | £35.5bn | -19.9% | 26 | 1.0% |

| Fresnillo PLC | FRES | 928p | £6.8bn | -20.0% | 16 | 2.0% |

| Just Eat Takeaway.com N.V. | JET | 6,862p | £10.2bn | -17.1% | - | - |

| Polymetal International Plc | POLY | 1,466p | £6.9bn | -14.2% | 8 | 6.5% |

| Hikma Pharmaceuticals Plc | HIK | 2,229p | £5.1bn | -12.8% | 16 | 1.6% |

| Weir Group PLC | WEIR | 1,743p | £4.5bn | -12.1% | 22 | - |

| Experian PLC | EXPN | 2,460p | £22.6bn | -11.8% | 30 | 1.5% |

| Smith & Nephew PLC | SN | 1,348p | £11.8bn | -12.0% | 20 | 2.1% |

| Avast Plc | AVST | 479p | £4.9bn | -11.3% | 18 | 2.5% |

| Ocado Group PLC | OCDO | 2,104p | £15.8bn | -8.4% | - | - |

| Average | - | - | - | -14.6% | 19 | 2.5% |

| Source: FactSet | ||||||

Entain

International gambling group and Ladbrokes owner Entain (ENT) – formerly named GVC – has had a storming three months. Possibly the biggest positive for investors is the progress being made by its US joint venture BetMGM. Relaxation of regulations in the US means a massive new market will potentially emerge, which BetMGM is capturing a significant share of. In the 12 US states it currently operates in it has captured a share of about 18 per cent. The operation is live in 20 states by the end of the year. Meanwhile, BetMGM’s performance was ahead of expectations in Entain’s financial year to the end of January, which was reported on at the start of the month.

Acquisitions are seen as another key opportunity for growth. There was progress on this front, too, over the last three months. The business agreed the purchase of Sweden’s Enlabs for £316m. The bid price had to be increased following push-back from Enlabs’ shareholders. Given where Entain’s debt is, further deals are likely to require a fundraising. The appetite from shareholders seems to be there.

It’s not all plain sailing, though. The company’s high street operations have been hit hard by lockdown. What’s more, tightening regulation remains an ever present threat. Tougher rules in Germany are expected to put pressure on profits there. Meanwhile, a review of the UK’s 2005 gambling act could put the squeeze on domestic operations. But for now, investors seem more focused on huge opportunities in a deregulating US market rather than the threats from tightening regulation elsewhere.

Ashtead

US-focused construction equipment rental specialist Ashtead (AHT) looks exceedingly well placed to benefit from a post-pandemic recovery. The company reduced investment during lockdown and 'aged' its fleet. This resulted in the company strengthening its balance sheet, which puts it in a good position to grow as demand cranks up.

What’s more, the industry as a whole pulled in its horns in response to the Covid-19 crisis, meaning the overall level of rental fleet is down 5 per cent. This has helped keep a healthy amount of equipment out on hire and has supported rental rates. The tight industry capacity also provides a great set-up for positive earnings surprises as a recovery kicks in.

Ashtead continues to look a class act and third-quarter results at the start of the month demonstrated the business continues to take market share and lead the industry in terms of profitability. The company seems optimistic about prospects, too. It has lifted its guidance on capital expenditure for the current year to the top end of its previously announced range.

It is also re-commencing the opening of new sites and bolt-on acquisitions. This should help it to continue its push into new specialist areas and support its strategy of creating clusters of rental shops that allow it to dominate targeted areas.

The company is holding an investor shindig (known as a capital markets day in the trade) on 20 April. This could help keep sentiment moving in the right direction and could also add to a cycle of forecast upgrades that has been established since the initial pandemic panic has faded.

DCC

Specialist marketing and distribution business DCC (DCC) has roots as a venture capital firm that later became an operating company. Given the background, it seems fitting that it’s used the pandemic to go on an acquisition spree – to be fair, acquisitions are par for the course with this company. When it announced third-quarter results in early February it had done £230m-worth of deals since it unveiled full-year results in May 2020. Since then it has announced another €80m healthcare acquisition. That compares with £170m spent in its financial year to the end of March 2020, although it still does not match up to the deal binge a few years prior. Still, this level of activity during the pandemic could set it up well for a recovery in some of its key end markets.

There has been mixed trading at the company’s fuel business. Distributing natural gas accounts for 46 per cent of cash profits while distributing heating oil and operating petrol stations accounts for 28 per cent. While higher-margin domestic demand has been strong across these operations, industrial and commercial demand has been weak due to lockdown. There’s been better trading at the company’s healthcare and audio-visual equipment operations.

All in all, third-quarter trading showed a solid improvement on the previous year and the company has said it expects to beat broker forecasts for its next financial year. All those acquisitions should help.

Kingfisher

It seems gauche to talk about the upside of the pandemic, but for DIY retailer Kingfisher (KGF) it really could not have come at a better time. The change in consumer habits that have resulted from lockdown have played to a recovery strategy put in place by chief executive Thierry Garnier, who was appointed in late 2019.

The group has benefited from 'essential retailer' status during lockdown as well as increased DIY activity by home-bound consumers. The pandemic has also boosted Kingfisher’s drive to increase online ordering and helped it attempt to reduce stock levels following several years of build up. The other key plank in the turnaround plan is to decentralise decision making.

Garnier’s ability to deliver on the turnaround strategy will be helped by the fact that £700m of exceptional items have been announced over two years to the end of January 2020. This should have cleared the decks of nasties and made it easier to report progress in future periods. The market got a taste of this in March when the company announced full-year results that benefited from 7.1 per cent like-for-like growth at stores.

While some are hoping the company will benefit from the activation of a whole new generation of DIY enthusiasts due to lockdown, as 2021 unfolds investors will get to see if such hopes can become reality. The same is true of the turnaround plan, with the benefits from Covid-induced demand making it hard to distinguish underlying progress.

Johnson Matthey

Materials specialist Johnson Matthey (JMAT) is occupying a weird position in the story of energy transition from dirty fossil fuels to electricity and hydrogen. The company currently makes much of its money from supplying components for catalytic converters. While these make internal combustion engines greener, they will go as vehicles become electric. This leaves a key source of profit looking moribund.

However, the company also has invested heavily in battery technology and is a major player in the hydrogen market. Both these areas could have significant potential. However, investors remain uncertain about how significant this market will be for the group.

That leaves Johnson Matthey’s shares changing hands on a mid-teens multiple of earnings. That could prove very cheap should it become a major player in the market for sustainable energy, but it could prove a value trap if it goes down with the gas-guzzlers. Sentiment may have been helped by the very recent announcement of a project with Siemens to create the world’s first climate neutral methanol plant.