- These readers want to supplement their pensions income tax efficiently and pass on assets to their children

- They plan to do it by investing in a diversified portfolio of funds

- It is worth still holding some cash because bonds might not continue to be such a good diversifier to equities

Pensions, Isas and trading account invested in funds and shares, cash, residential property

Additional annual income of £36,000, average annual net return of 4 per cent from investments, invest cash, maximise tax efficiency, pass on Sipps to child and grandchildren.

Michael is age 67 and has recently retired following the sale of his business, although he is considering doing consultancy work for a few years. His wife is 66 and has been retired for six years. Their state pensions and a former workplace pension give them an annual income of £30,000.

Their home is worth about £950,000 and is mortgage free.

“We would like to generate additional annual income of £36,000 net by having around £940,000 invested in a mix of funds diversified across different geographies and sectors. This will include putting to work cash worth about £870,000 held in bank accounts, NS&I Premium Bonds and individual savings accounts (Isas). We would like an average net return of 4 per cent a year.

"We will try to maximise our returns using the tax-efficient allowances available to us and plan to move £40,000 of our investments into Isas each year. And I have recently realised a gain on some Barclays (BARC) shares.

"The problem is, we aren't experienced investors so don’t know where to start when choosing funds. Although we have been investing for 20 years it has not been in a hands on way – we only started looking more seriously at a plan since the recent sale of my business. I have, for example, opened an investment Isa with a digital wealth manager and purchased Rathbone Global Opportunities Fund (GB00B7FQLN12) to try and learn a bit more about investing.

"We could invest via the financial adviser who manages our self-invested personal pensions (Sipps), but that firm uses a limited range of funds and we don't want to have all our eggs in one basket. Their fees for this would also be higher than what they charge us for our pension investments. And my Isa with a digital wealth manger invested in passive funds has returned 5.62 per cent net over the past 12 months – more or less the same as my actively managed pension's 5.67 per cent return – even though both have the same risk factor.

"Having worked hard to achieve our gains we have a limited attitude to risk, although feel that we should tolerate a decline in the value of our investments of up to 20 per cent in any given year.

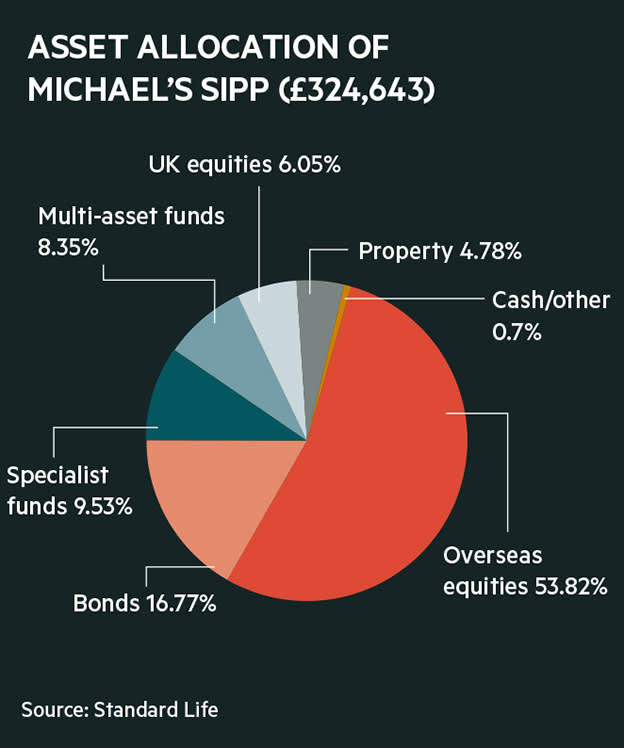

"Our Sipps are chugging along nicely, with an average annual return of 4 to 5 per cent a year. We do not plan to draw from these as we intend them to be an inheritance for our daughter and grandchildren, unless we need them to fund care costs. But we are currently active and healthy.

"However, we are not sure how or when to take our 25 per cent tax-free entitlement from our Sipps, or whether to leave them to continue growing.

"We have loaned our daughter, who lives abroad, £264,000 to help her and her husband buy their third buy-to-let property in the UK. They are paying back the loan via repayments and interest, and may sell this property when they return to the UK in five years. At this point, the cash from this will be available to invest.

"But any income from possible consultancy work would be a bonus."

| Michael and his wife's total portfolio |

| Holding | Value (£) | % of the portfolio |

| Professionally managed Sipps | 820,493 | 46.38 |

| Cash | 772,079 | 43.64 |

| NS&I Premium Bonds | 100,000 | 5.65 |

| Robo adviser Isa | 20,841 | 1.18 |

| Aviva Investors Continental European Equity (GB0004457973) | 11,384 | 0.64 |

| Aviva Investors Corporate Bond (GB0004459359) | 10,567 | 0.60 |

| BNY Mellon Global Income (GB00B8BQG486) | 8,113 | 0.46 |

| Artemis Global Income (GB00B5ZX1M70) | 6,661 | 0.38 |

| Aviva Investors UK Index Tracking (GB0004459797) | 6,770 | 0.38 |

| Aviva Investors UK Listed Small and Mid-Cap (GB0004456900) | 6,360 | 0.36 |

| Rathbone Global Opportunities (GB00B7FQLN12) | 3,082 | 0.17 |

| Aviva (AV.) | 1,580 | 0.09 |

| Marks and Spencer (MKS) | 1,296 | 0.07 |

| Total | 1,769,226 |

NONE OF THE COMMENTARY BELOW SHOULD BE REGARDED AS ADVICE. IT IS GENERAL INFORMATION BASED ON A SNAPSHOT OF THESE INVESTORS' CIRCUMSTANCES.

Chris Dillow, Investors' Chronicle's economist, says:

You want to shift your cash into a diversified portfolio of funds. Insofar as history is a guide, this is very easy.

A simple portfolio of just five assets – global equities, gilts, gold, and cash in US dollars and sterling – would have delivered an average annual return of over 6 per cent before inflation since 2000. And it would never have lost more than 10 per cent over a 12-month period – it’s worst fall would have been just over 15 per cent in the early 2000s, when the tech bubble burst and US dollar fell.

You could replicate such a portfolio using just four exchange traded funds (ETFs). You might object on the grounds that it is not diversified. But, in one sense, you'd be wrong. Think of ETFs that track, say, MSCI World index as being funds of equity funds. They diversify perfectly across developed equity markets, sectors and styles.

Diversification is not simply a matter of how many assets you hold – you can be better diversified with a handful of assets than with dozens.

But in another sense you would be right. Such a tracker wouldn’t give you exposure to emerging markets, except to the considerable extent that these rise and fall with developed markets. And it only gives you market-weighted exposure to exciting sectors such as green technology. So if you hold only trackers you might fear missing out on investment opportunities.

You can easily address these problems, however, by holding one or two specialist funds alongside a tracker fund. I prefer investment trusts because the holding costs for these on some investment platforms are cheaper than for open-ended funds. And investment trusts' discounts to net asset value relative to their own history can tell us something useful: a relatively high discount can be a sign that sentiment is depressed, hence a buy signal.

But the sort of diversification that’s worked in the past might not continue to do well. This kind of diversification has done well because equities and gilts (UK government bonds) have usually been negatively correlated. When shares have done badly, gilts have done well, resulting in stable returns for a balanced portfolio.

But this might not continue to be the case. There’s a danger that equities and bonds might both do badly, in which case the diversification that has served us well for years would let us down. The most likely way in which this could happen would be if global inflation expectations rise significantly, triggering fears of higher interest rates.

There’s no easy solution to this, as fears of higher rates could hit equities around the world – perhaps especially in emerging markets. But you could hold cash as this is perhaps the only asset certain to benefit from rising rates. Although gold might benefit from higher inflation expectations it does badly when bond yields rise, so we cannot rely on it to protect investment portfolios.

You are already enormously weighted in cash – more than can be justified by your apparent attitude to risk. And if you only put £20,000 a year each into Isas, you’ll remain cash-heavy for a very long time. So think about moving cash outside tax-efficient wrappers into investments, especially as you have an annual capital gains tax allowance – £12,300 for the current tax year. This allows you to realise gains up that value tax free.

That said, don't let the tax tail wag the portfolio dog. Think first about asset allocation and then about tax allowances.

Wealth planner Barry Summers and investment manager Eilidh Anderson, of Kingswood

Barry Summers

As your circumstances have changed significantly, transitioning to retirement and selling your business, it is an ideal time to make a full assessment of your current circumstance and consider both your short- and long-term goals.

You have previously used your Isa allowances for a portion of your investments. Going forward transitioning your non-Isa capital to use your full annual Isa allowance, currently £20,000 each, will make the investments as tax-efficient as possible, reducing the tax you pay on future income and growth.

Over 25 per cent of your total wealth is held with the current Sipp provider. The product may have been appropriate when they were opened, however, the market has changed and there may be more suitable alternatives available. Are the costs still competitive? A product with costs that are 0.5 per cent lower could save over £4,000 per year. Compounded over a number of years, this could represent significant savings over the long term.

Although neither of you are working, you are still able to make contributions to your pensions for additional tax efficiencies. But consider the pensions annual allowance. If you do some consultancy work, consider increasing pension contributions but ensure that you do not breach Money Purchase Annual Allowance rules.

Your estate carries a potential inheritance tax (IHT) liability. Your property, investments and cash mean you have an estate worth over £2m which reduces your nil-rate band. Annual gifting and pension contributions could ease this burden.

Trusts can also be an effective way of reducing potential IHT bills. They allow you to keep an element of control over what happens to the assets in them and how they are distributed. Given your current age, planning now should give ample time to manage your IHT.

Ensure that you have wills in place that reflect your wishes an are in line with your financial strategy. If not in place, consider setting up Lasting Power of Attorneys (LPA). An LPA covers decisions about your financial affairs, or your health and care. It comes into effect if you lose mental capacity or no longer want to make decisions for yourself.

Eilidh Anderson

Robo advisers are great services that provide low-cost, easy access to a diversified portfolio, particularly for smaller investors who do not meet the minimums required for a full discretionary service. However, these strategies usually use passive investments to track the broader market and as much as 15 to 20 per cent of the assets you hold with a robo adviser can be invested in one ETF.

And the use of multiple providers means that no one is looking at your overall asset allocation, sector exposure or bottom-up company exposure.

Your investments, excluding the pensions, are mainly invested in cash and bonds, which in this low rate environment no longer provide the same level of income or protection. An infrastructure fund could provide you with some income through stable cash flows while also providing inflation protection. This is particularly the case with those exposed to the transition to a sustainable economy as they are likely to be beneficiaries of increased government expenditure. Examples include Foresight UK Infrastructure Income (GB00BF0VS815).

However, to meet your objective of a 4 per cent net income with your capacity for loss of 20 per cent, you should consider increasing your equity exposure. A globally diversified portfolio would include investments in Japanese, emerging and Asian markets, which have cheaper valuations and arguably better long-term growth prospects. Also consider funds which address themes that are likely to outperform over the long term due to their relevance in society, such as Polar Capital Global Technology (IE00B433M743) and Pictet Global Thematic Opportunities (LU1437676809).

As most of your funds are outside Isas, your portfolio will require some capital gains tax management to maximise your annual allowances and meet your income targets. Having a dedicated investment manager look after this for you would take the pressure off and allow you to focus on enjoying your retirement.

Most bigger investment houses offer passive, active and ethical portfolios that can be tailored to your specifications, including keeping your cherished holdings. These focus on investing in quality funds often via cheaper institutional share classes. This gives you a balanced exposure to both value and growth areas of the market.

An investment manager would also be able to build a risk-adjusted portfolio for you that achieves your 3.8 per cent yield requirement by investing in high dividend investments or drawing on capital, working in conjunction with your financial planner who would provide tailored pension advice, cash-flow analysis and tax planning.