- Darren wants to reduce his working hours when he is 55 so wants his investments to make up an income shortfall of £50,000

- He needs to reconsider his country-specific and broader asset alternatives

Pensions invested in funds and shares, cryptocurrencies, residential property, cash.

Reduce my workload at age 55, generate £50,000 per year from investments between 55 and 70 to help fund holidays and leisure, average investment growth of 5 to 8 per cent a year, reduce risk approaching age 55, cover children's education costs and help them buy homes, make better use of cash.

Darren is age 46, self employed and earns around £120,000 per year. His children are ages 11 and 14. His home is worth about £750,000 and has a mortgage of £280,000. He also has a buy-to-let property worth about £220,000 with a £115,000 mortgage which provides rent of £750 per month.

“I would like to reduce my workload when I am age 55,” says Darren. “I will sell one of my businesses in nine years and expect to get £250,000 for it. I will continue my other business which will generate about £40,000 per year, so I would like my investments to generate £50,000 per year from that time until when I am around age 70. I would generally expect my need for money to reduce at that point, but until then I want 15 years of really good living, going on holidays and world tours.

“Nine more years of full time earning should cover my children’s education costs. They also each have the maximum amount you can invest in NS&I Premium Bonds – £50,000 – to help them buy homes in the future.

“I expect around £50,000 per year to go into my self-invested personal pension (Sipp) each year for the next nine years before I start to withdraw from it, and I would like the investments to grow, on average, 5 per cent to 8 per cent a year.

“I have been investing in my Sipp for two years. Before this a financial adviser managed my pensions as my main focus was building two businesses, although I was spread betting on equities.

“When I started invested I had a high risk attitude, but it is reducing as I get closer to age 55. That said, I have a strong belief that cryptocurrencies are going to grow, so I recently put money into bitcoin and plan to invest more in cryptocurrencies – they may become the new gold for finance!

“I try to keep the number of Sipp investments fairly low. I only have a few direct share holdings and these are companies whose principle business I can quickly understand. If you cannot explain a business within two sentences I am generally not interested in it.

"I have recently invested £5,000 in Hammerson (HMSO) because I expect it to bounce back from Covid-19 related shopping issues within the next few years.

“I believe that Vietnam is going to be a good growth area and have recently added HSBC MSCI Malaysia UCITS ETF (HMYD). But I am concerned that my portfolio is biased to Asia and I would like it to be better balanced.

“My cash isn’t generating much interest so I might use it to clear my mortgages or invest it in equities.”

| Darren's and his family's total portfolio |

| Holding | Value (£) | % of the portfolio |

| Cash | 129,950 | 21.17 |

| Buy-to-let property minus mortgage | 105,000 | 17.1 |

| Children's NS&I Premium Bonds | 100,000 | 16.29 |

| Personal pension | 80,000 | 13.03 |

| Artemis US Smaller Companies (GB00BMMV5766) | 25,525 | 4.16 |

| VinaCapital Vietnam Opportunity Fund (VOF) | 24,297 | 3.96 |

| Stewart Investors Asia Pacific Leaders Sustainability (GB0033874768) | 20,125 | 3.28 |

| Crytocurrencies | 20,000 | 3.26 |

| Jupiter Gold & Silver (IE00BYVJRH94) | 17,795 | 2.9 |

| VT AJ Bell Adventurous (GB00BYW8VG25) | 17,756 | 2.89 |

| Xtrackers FTSE Vietnam Swap UCITS ETF (XFVT) | 15,528 | 2.53 |

| Boku (BOKU) | 12,084 | 1.97 |

| HSBC MSCI Malaysia UCITS ETF (HMYD) | 9,610 | 1.57 |

| Cineworld (CINE) | 9,342 | 1.52 |

| VT AJ Bell Global Growth (GB00BD833W40) | 7,843 | 1.28 |

| Duke Royalty (DUKE) | 6,651 | 1.08 |

| Barclays (BARC) | 6,269 | 1.02 |

| Hammerson (HMSO) | 4,246 | 0.69 |

| Petra Diamonds (PDL) | 1,950 | 0.32 |

| Total | 613,972 |

NONE OF THE COMMENTARY BELOW SHOULD BE REGARDED AS ADVICE. IT IS GENERAL INFORMATION BASED ON A SNAPSHOT OF THIS INVESTOR'S CIRCUMSTANCES.

Chris Dillow, Investors' Chronicle's economist, says:

You should be able to meet your objective of a £50,000 annual income in nine years’ time. If you can contribute £50,000 a year to your investments [within a Sipp and other accounts], sell your business for £250,000 and get a real average return of 5 per cent per year you should have well over £1m by then. That would be enough to take around £50,000 per year without eating into capital, although there’s no reason why you shouldn’t run down your wealth a little.

Your portfolio it is unusually cyclical. In the event of a downturn, it’s likely that smaller companies would do worse than larger ones. Hammerson, Barclays (BARC) and your emerging markets funds would also be very likely to do worse than other large companies. Regardless of their intrinsic merits, emerging markets are sensitive to investors’ appetite for risk, which usually falls in a recession.

You need to be careful here. How cyclical are your own earnings? If these take a dive in a recession, holding recession-sensitive equities means that you are doubling up on risk. While the world economy is growing, such exposure could be beneficial because in good times investors are well rewarded for taking cyclical risk. But good times don’t last, so investors who are laden with cyclicals need an exit strategy.

One possibility is the strategy proposed by Meb Faber, chief executive officer of Cambria Investment Management, which involves selling assets when their prices fall below their 10-month or 200-day moving average. This rule works especially well with assets which are driven by sentiment, such as emerging market equities.

Also watch the US yield curve. If you want to know whether a recession is likely or not, ignore every opinion bar one – that of the US bond market. When 10-year bond yields fall below the Fed funds rate, it's a sign that a recession is likely in the coming months and a warning to offload cyclical assets.

Right now, yields are above the Fed funds rate, suggesting that there is little chance of a recession. But this could change in the next two or three years. When it does, listen to the bond market and ignore everything else.

I’m wary of your enthusiasm for Vietnam. This isn’t because its economy lacks potential, but rather because for years there has been no correlation between countries' longer-term growth and equity returns. For example, China’s economy has grown well in the past 10 years. But its stock market has under performed that of the Netherlands, Switzerland and Japan – among others – during this time.

One reason for this lack of correlation is that medium-term economic growth can be discounted by equities in advance. And growth doesn't necessarily benefit currently-listed companies. It might instead be good for private or overseas companies, or ones that don't currently exist. It might even be good for workers!

I’m even warier of your enthusiasm for cryptocurrencies. It’s not at all obvious to me why these should displace ordinary currencies. That said, there’s not much wrong with having a small hedge against the fear of missing out or the tiny possibility that cryptocurrencies will become more widely used. Nor is there anything wrong with riding bubbles – as long as you have an exit strategy such as the 10-month rule.

Just don’t believe stories.

Poppy Fox, investment director at Quilter Cheviot, says:

I believe that you are almost on track to meet your goals with your current strategy, but there are some improvements you could make.

You plan to add £50,000 a year to your Sipp over the next nine years but you can usually only contribute up to £40,000 to a pension in any given year. You may be able to carry forward unused allowances from previous years, so speak to a financial adviser on whether this is possible for you. Also consider investing the remaining £10,000 in an individual savings account (Isa) which is another tax-efficient way of saving for retirement. Your existing Sipp, future contributions and Isa savings should add up to £629,000 in nine years' time, assuming no growth.

Also consider whether to consolidate your £80,000 personal pension into your Sipp. If you move this pension into your investment pot and it achieves a 5 per cent growth rate, you could have a retirement pot of £1m after nine years. A withdrawal of £50,000 per year equates to around a 5 per cent a year, which is achievable, and could taken from a combination of natural income and capital growth.

However, this doesn’t leave much room for manoeuvre if there is a prolonged period of market negativity. So consider using up the remainder of your annual Isa allowance, which for the 2021/2022 tax year is £20,000 in total, to make things are tax efficient as possible. This would take some pressure off the Sipp if it doesn’t perform as you hope.

I agree that you should try to reduce risk as you near retirement. But to achieve the necessary growth to meet your goals you need to take a reasonable amount of risk.

Diversify your investments further by increasing the number of holdings and broadening the asset allocation. You have too much exposure to Vietnam, which accounts for over 20 per cent of the Sipp. I suggesting switching the two funds focused on this market and HSBC MSCI Malaysia UCITS ETF (HMYD) into a diversified emerging markets fund.

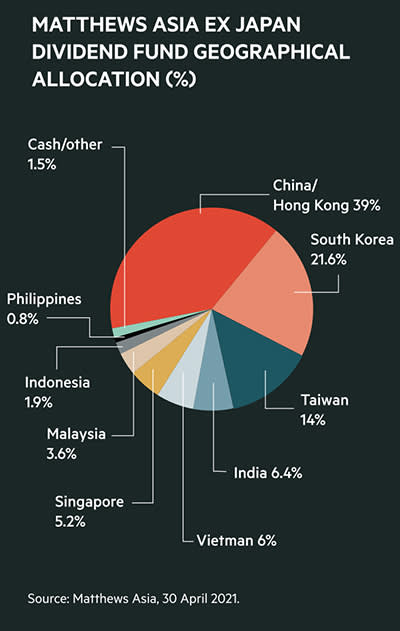

If you want to retain some exposure to Vietnam, you could add Matthews Asia ex Japan Dividend Fund (LU1311311515). This gives some exposure to that market without so much country specific risk [see chart].

Also reassess how you get your US exposure. Your only dedicated holding in this area is a smaller companies fund which accounts for 15 per cent of your Sipp so, again, you don’t have much diversification. You could also get some of your US exposure via an index tracker fund and some diversified large-cap funds.

I think that you should have some exposure to non-equity assets such as fixed interest and alternative investments. At this stage it could be a small exposure but as you near retirement consider reducing the equity allocation further to reduce the portfolio's risk.

I am concerned that you plan to put more of your assets into cryptocurrencies. These are a speculative asset and putting money into them seems more like trading than investing. Cryptocurrencies are an unregulated area and although at the moment many investors' have made gains on them, problems may arise when they want to realise them. I suggest keeping your existing holdings in cryptocurrencies as a punt but don’t invest any more.

You have quite a high allocation to cash. Although holding some as an emergency fund is prudent, with interest rates where they are and concerns about inflation, I suggest reducing your allocation to it. Investing in markets is higher risk than holding cash but should give a greater return over longer time periods.