- Complaints about investment platforms surged last year

- Regulatory complaints data and review sites can help you assess platforms

We write a lot about investment platform fees, but for many people service is more important than cost. In studies assessing the importance of different platform features, ease of use often comes out on top. Customer service is a critical part of this, but beyond the merits of a company’s marketing operation, it can be difficult to tell how an investment platform holds up before you become a customer.

To dig below the surface, we have analysed the Financial Conduct Authority’s (FCA) complaints data over the past five years. All financial firms have to send the regulator a report twice a year regarding all the complaints they have received from eligible complainants over the period. The regulator then publishes a report showing the complaint numbers for all firms about which there were more than 500 complaints.

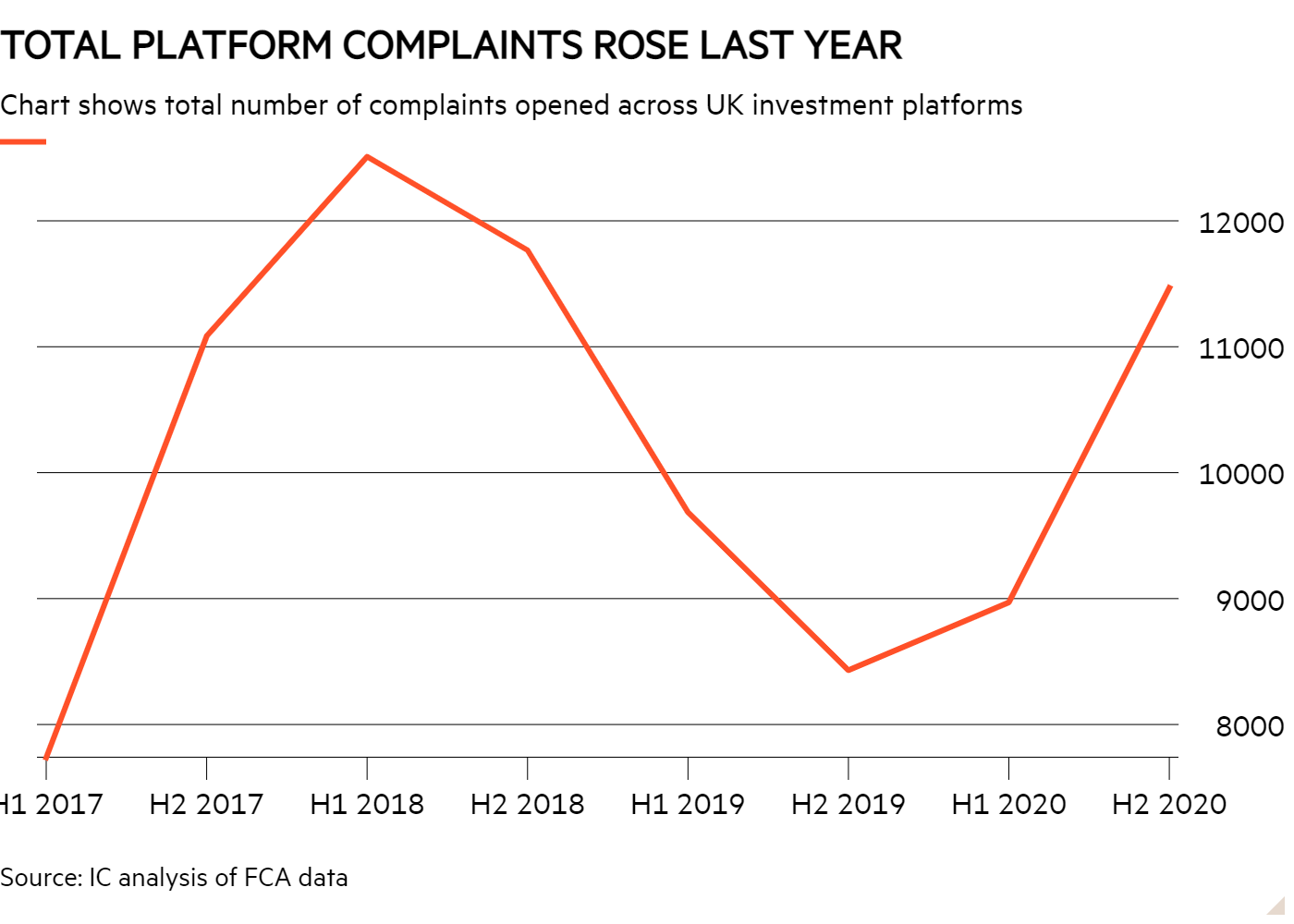

The chart below shows how complaints on investment platforms picked up last year following a period of decline. As lockdowns upended platforms’ operations in 2020, this may not come as a surprise. It also spans a period when there was a substantial rise in the total number of customers. However, it is important to look at platform performance in the wider context. The total number of complaints about all financial institutions in 2020 was 14 per cent lower than in 2019, not including complaints relating to payment protection insurance, which fell by 77 per cent. Investment platforms, however, had a rise in complaints of 13 per cent over the period.

The FCA also publishes firm-level complaints data for institutions about which there were more than 500 complaints, as split by product type: banking and credit cards, decumulation and pensions, home finance, insurance and investments. For this analysis, we have only assessed the pensions and investment complaints as they are most relevant to private investors.

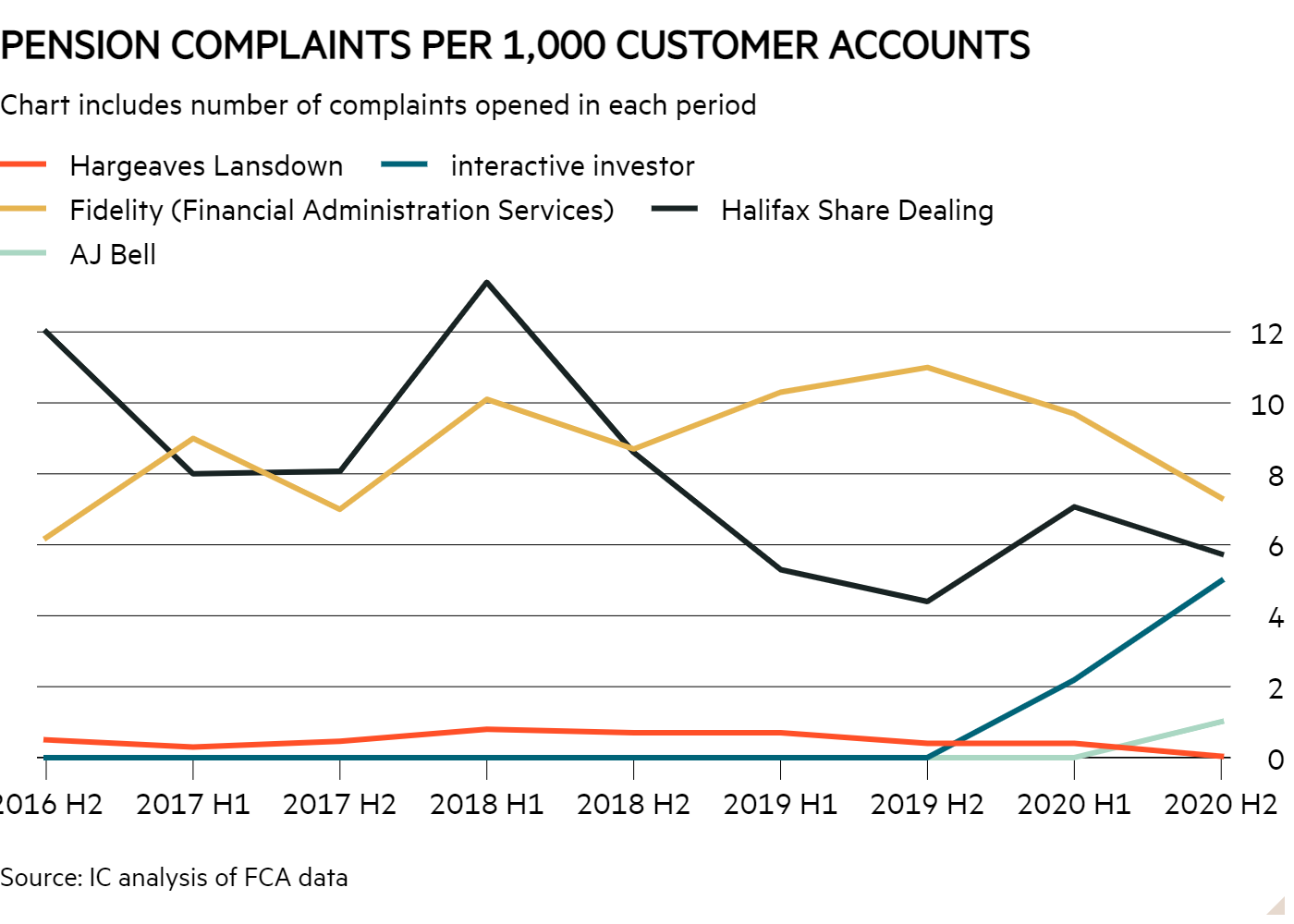

To compare providers, it is best to look at complaints per 1,000 customers. Confusingly, firms are permitted to report either on a 'provision' basis – complaints over the reporting period per 1,000 accounts or an 'intermediation' basis – complaints per 1,000 products they sell over the reporting period. For decumulation and pensions, the major do-it-yourself platforms report on a provision basis, as shown by the chart below. Because the firms offer slightly different services the data does not show a direct like-for-like comparison, but it does highlight trends in complaints.

Fidelity’s UK branch and Halifax Share Dealing have had a significantly higher number of pension complaints relative to their customer base than the other three major do-it-yourself investment platforms. And interactive investor’s complaints have picked up significantly over the past year.

Jemma Jackson, head of public relations at interactive investor, says that this uptick is largely down to a change in reporting, as self-invested personal pension (Sipp)-specific complaints were classed as ‘general admin’ before interactive investor became its own Sipp scheme operator. She adds that last year was challenging and that it is likely that the uptick in complaints was due to the knock-on effects of the pandemic and more customers getting in touch following interactive investor's takeover of the Share Centre.

Equiniti Financial Services had the highest number of pension complaints per 1,000 customers in the second half of last year at 16.84. interactive investor will complete its takeover of Equiniti’s direct-to-consumer platform EQi later this year.

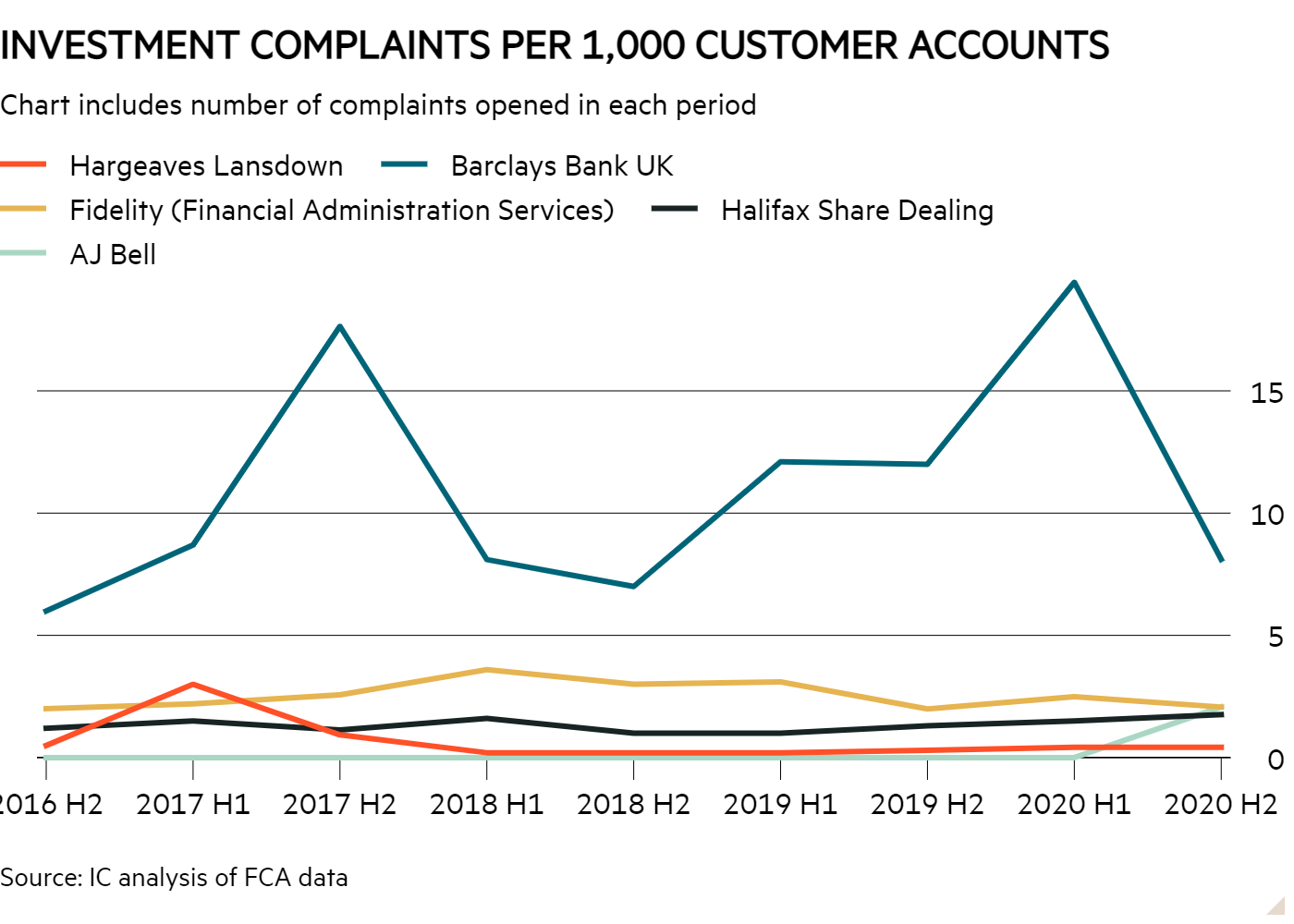

When looking at complaints for investment products, banks come out worse than investment platforms. Bank of Scotland, Barclays UK and HSBC all had 6.9 complaints per 1,000 customers or higher in the second half of last year, although it is important to note that they have a wider remit than the platforms. For example, Barclays UK offers investment bonds, funds and structured products across Barclays Wealth Management & Investments, including Smart Investor. I only included Barclays in the chart below because Barclays Smart Investor is available to everyone rather than just its banking clients.

interactive investor does not feature in this chart because it reports investment complaints on an intermediation basis. It received 0.93 complaints per 1,000 sales in the second half of last year, up from 1.4 in the same period in 2019. Across all products in the second half of 2020, AJ Bell reported 567 complaints. interactive investor, by comparison, received 2,611 complaints and Hargreaves Lansdown received 5,009, according to FCA data. Of complaints made about investment products, 22 per cent of Hargreaves Lansdown’s were upheld compared with 34 per cent for both interactive investor and AJ Bell.

Customer reviews

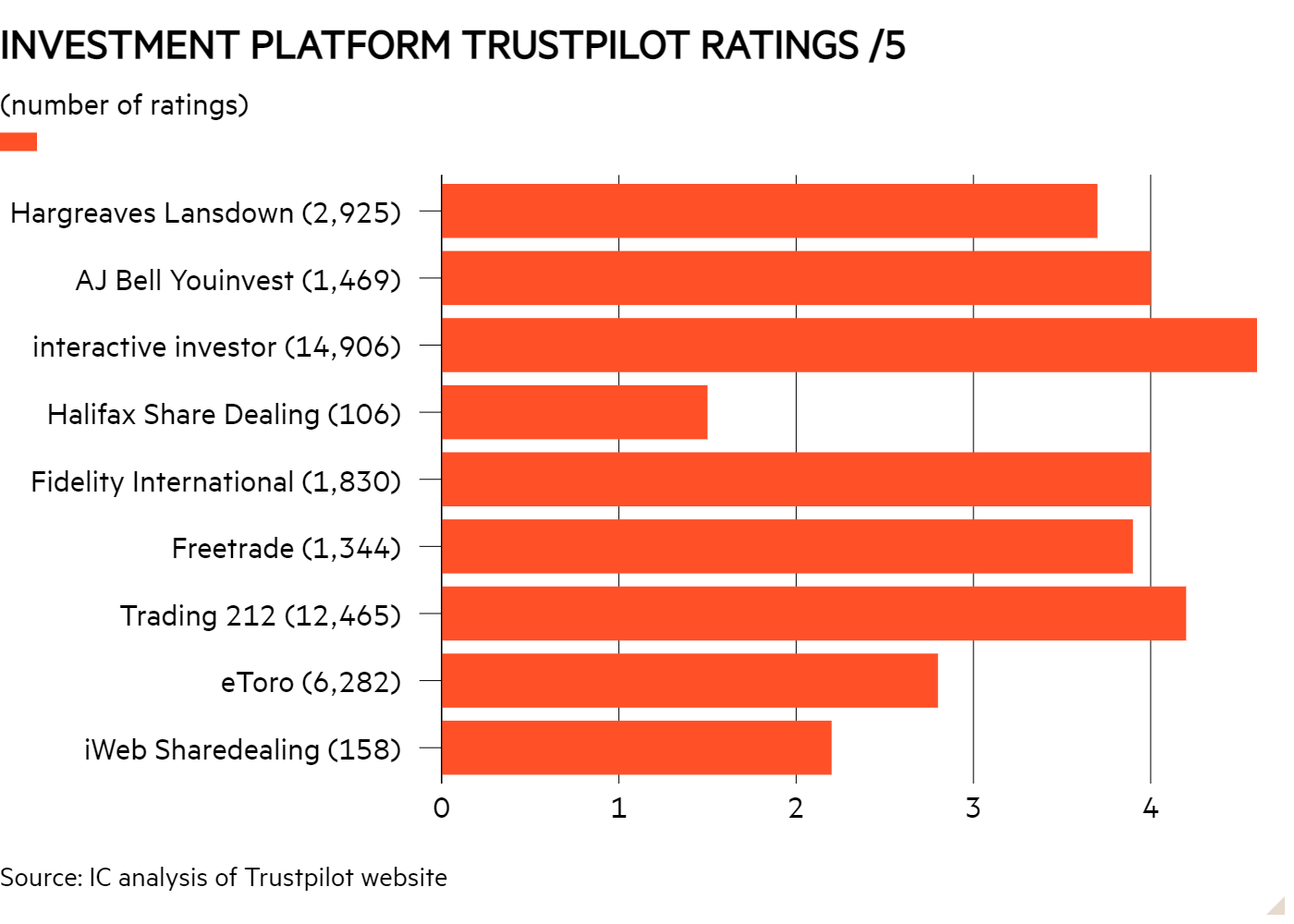

Review websites such as Trustpilot, founded in 2007, can also help give a feel of how happy customers are with a service.

The chart below shows an analysis of Trustpilot reviews. You can see interactive investor comes out top while Halifax Share Dealing, iWeb and eToro lag. It’s important not to take these results too literally as platforms with disproportionately large numbers of ratings could be encouraging their customers to rate them.

Trading 212 also ranks highly. It had such a large rush of customers last year that it had to temporarily close to new accounts in January when it became the most downloaded app in the UK. While there are reviews of service issues, customers appear to enjoy the very low-cost service it offers.