Traditionally, budding investors have faced the dilemma of not having enough money to buy into a sensible portfolio strategy straight away. Robo-advisers and now longer-established platforms offer ready-made risk-tailored portfolios but many investors are of a mind to be more self-directed.

Fractional ownership options have a future but for my own Isa, started with cash saved in the pandemic, I’m taking a more old-fashioned approach of building towards my ideal portfolio. At a high level, my portfolio strategy is close to where I want it, but I am still some way off having exposure to all the themes I like within asset classes.

One of my disciplines is to have a minimum size for each holding, which means the portfolio is still missing some key ingredients to have the right risk-to-reward profile for me. The fact I have limited resources and must make decisions means the opportunity costs (what I miss out on by choosing one investment over another when in an ideal world I'd buy both) can be felt keenly.

Assessing your situation and deciding objectives

The objective of the portfolio is ostensibly to provide an extra booster for my retirement savings. I don’t want to be too rigid in case I need some money for something big before I’m 55, the minimum age most people can access their pension savings, so the Isa vehicle is the right tax wrapper for me.

Knowing I can afford to ride out periods when my investments are losing value and not have to sell holdings, my approach is to accept downturns, stay invested and build towards my goal.

Having a strategy

Studies, such as by Ibbotson and Kaplan (2001), show up to 90 per cent of the variability in portfolio returns is due to asset allocation. This is the mix of shares, bonds, cash and alternative assets (such as property, private equity, gold, commodities and cryptocurrencies) in your portfolio.

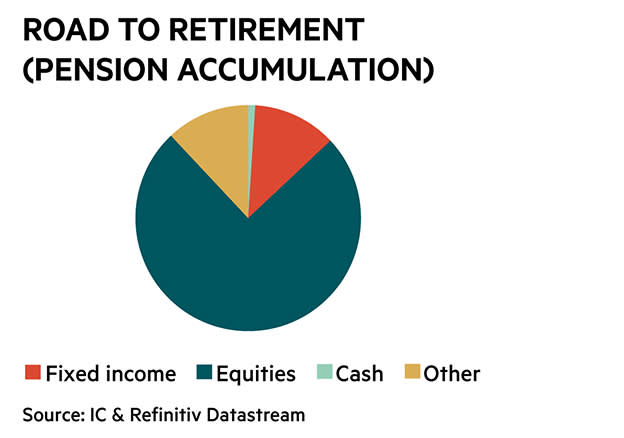

My target strategic asset allocation is pretty similar to the Investors’ Chronicle's 'road to retirement' model. That has 75 per cent in equities (stocks and shares), 12 per cent in fixed income (mostly government and corporate bonds), 12 per cent in ‘other’ investments and 1 per cent in cash.

I estimate that the worst peak-to-trough sell-off for such a portfolio could be around 40 per cent of its value. That will be too much to stomach for a lot of people and I haven’t suffered that yet, so don’t really know how I’ll feel until it happens.

I own investment trusts, exchange traded funds (ETFs) and one mutual fund. There is a remote risk funds wind up and it could take a long while to get my money back (and even then possibly less than invested) but the likelihood of a holding becoming completely worthless is nowhere near as great as buying, say, individual shares in small companies which might go bust.

So, I’m working on the fairly confident assumption that I will only make an actual loss if I sell investments in a downturn. I’m happy taking this level of risk because, although I know my investments will fall in bad times, I believe they will generate money over the long term and grow in value.

At the moment, my asset allocation is roughly 72 per cent in equities, 12 per cent in fixed income and 16 per cent in ‘other’ investments. There is a slither of cash in there but that’s just to pay for dealing. Cash is an essential asset class, as we all need a cushion, but I hold mine elsewhere and keep my investment portfolio for investments.

So far, prioritising my strategic exposure has been a tactical mistake

With a horizon of around 20 years, I’m not too worried about underperforming the market over five months, especially as this isn’t yet my ideal portfolio. It was started on 28 January 2021 and the table shows the performance of funds I owned in the first full three months and also up to the more recent five-month mark, reached on 28 June.

At the end of June, the total return after dealing and platform charges was 1.2 per cent. That’s a significant underperformance of benchmarks such as the PIMFA private investor growth asset allocation, which has made 8.3 per cent in the same period and net 9.1 per cent year-to-date.

Nobody likes looking stupid, especially when divulging their investment choices. Behavioural science teaches us that people have confirmation bias and seek to justify decisions in the short term. The excuse I give myself for recent failings is that I’ve ignored some tactical signals in asset markets because I was building a strategic portfolio.

If you had to pick two dominant topics in asset markets since the start of 2021, they’d be the resurgence of inflation and the recovery of sterling and the UK stock market. I’m not well-positioned for either trend.

My starting point has been to buy funds that give me exposure to long-term themes, but some of my holdings have had a mixed time recently. For example, inflation is bad for technology shares because they are so expensive. If real returns after inflation are lower, then highly priced tech stocks (even with continued profit growth factored in) become worse value.

I also bought into tech-based Chinese growth stocks, which have not only suffered from some valuation risk, they are subject to the scrutiny of the Communist Party. Capitalism in China won’t have a smooth ride and faces different challenges than in the west.

My bet is that although China won’t accept the winner-takes-all model that has seen US tech companies become ubiquitous, companies such as Alibaba (HK:9988) and Tencent (HK:0700) (important holdings for my Asia fund) have a big future in the Middle Kingdom and beyond.

My fixed-income (bonds) exposure has been under water all year. I chose short-dated inflation-linked US Treasury bonds, so I’ve suffered as bond prices, even inflation-linked, sold off on the basis that inflation would overshoot targets. This has been amplified by the US dollar losing value, further hurting my unhedged position.

This explanation comes across as justifying a mistake, but the holding was always designed as a shock absorber should things take a turn for the worse in the pandemic. US dollars are the global reserve currency and US treasuries are the world’s best-supported sovereign bond market, so my ETF provides a stake in a haven asset.

A trend I’m following that has gone well for the portfolio is its global real estate holding. This is a fund-of-funds but isn’t too expensive despite its structure. The mutual fund buys into real estate investment trust (REIT) shares around the world, giving liquid (easy to buy and sell) exposure to an international asset class that offers diversification.

Implementing choices with active managers

Returning to my tech holdings, I was always wary of how the FANMAG stocks – Facebook (US:FB), Apple (US:AAPL), Netflix (US:NFLX), Microsoft (US:MSFT), Amazon (US:AMZN) and Google’s parent Alphabet (US:GOOGL) – were dominant in the US and global indices.

Going forward I expect these world-class companies to be important, but they are expensive. Discernment as to which best justify their valuation is required, hence the choice of active managers. I also believe that with new technology having an ear to the ground and buying in on some of the best opportunities (and knowing when to sell out of incumbents) is invaluable.

Controlling errors along the way

Like most people, my big problem is the emotional and cognitive biases I carry with me. Firstly, the holdings I have prioritised could be seen as anchoring expectations to what has happened in recent history. Certainly, I prefer quality stocks and missed much of the value rally.

The mental shortcut (what behavioural scientist Daniel Kahneman calls heuristic decision-making) I have been guilty of is to just avoid thinking about valuation until I have my strategic holdings all in place. What you pay for investments matters but my philosophy is to start worrying about that once I’m deciding which long-term positions to top up first.

This disregard for valuation saw me caught out when I bought my green energy holding. The ETF was heavily weighted towards stocks that were in bubble territory and the readjustment of growth stocks on inflation fears hit it hard. I’m hanging on in there with the holding, which could be an example of loss aversion.

One manifestation of loss aversion is clinging on to losers for too long in the forlorn hope they will come back. This may be true, but I do believe in the prospects for green energy. The lesson I should really take is not to be ruled by a fear of missing out when a story I like is hot. Pullbacks happen, so in future I’ll try to be more disciplined and wait for better entry points.

| Holding (Ticker/SEDOL) | Asset Class (Sub asset class/style) | Date added | Total % return (to 28.04.2021) | Total % return (to 28.06.2021) | % Weight (28.06.2021) |

| Schroder Global Cities Real Estate Fund Z Acc GBP (B1VPTY7) | Global real estate | 26.03.2021 | 5.3 | 10.8 | 13.26 |

| HAN ETF Digital Infrastructure and Connectivity (PIGI) | Equities (Developed markets/growth) | 28.01.2021 | 4.1 | 7.3 | 12.82 |

| iShares $ TIPS (ITPS) | Fixed Income (U.S. Treasuries inflation linked) | 28.01.2021 | -0.02 | 0 | 11.76 |

| iShares Global Clean Energy (INRG) | Equities (Developed markets/growth) | 01.02.2021 | -22 | -24.7 | 4.45 |

| Legal & General Battery Value Chain (BATG) | Equities (Developed markets/growth) | 28.01.2021 | 5.9 | 6.7 | 12.75 |

| HAN ETF Royal Mint Physical Gold ETC (RMAP) | Commodities (gold) | 26.02.2021 | 2.4 | 2.5 | 3 |

| Allianz Technology Trust (ATT) | Equities (Developed markets/growth) | 28.01.2021 | 1 | -2 | 11.6 |

| Blackrock World Mining Trust (BRWM) | Equities (Developed markets) | 04.05.2021 | n/a | -4.6 | 5.71 |

| Murray International Trust (MYI) | Equities (Developed markets) | 28.01.2021 | 13 | 11 | 13.21 |

| Polar Capital Technology Trust (PCT) | Equities (Developed markets/growth) | 15.02.2021 | -3.7 | -3.4 | 5.6 |

| Schroder AsiaPacific Fund (SDP) | Equities (Emerging markets/growth) | 01.02.2021 | -0.2 | -3 | 5.8 |

| Total % portfolio performance | 1.9 | 1.9 | |||

| Total % return (after all charges) | 1.2 | ||||

Source: FactSet and Investors' Chronicle