- Increased exposure to infrastructure

- The US could account for 80 per cent of profits by 2025

Structural growth and rising infrastructure spending

Growing US exposure

Improving margins

Fragmented markets

Cyclical vulnerability

Dual-listed in London and Dublin, CRH (CRH) is a manufacturer and supplier of building materials, with leading positions in Europe and North America. Operating across 29 countries, the group provides aggregates such as granite and limestone, as well as asphalt, cement, concrete and paving. Its products are used in everything from roads and bridges to schools and houses.

CRH is a popular pick among funds. Baillie Gifford, an investment manager usually associated with capital-light tech plays rather than asset-heavy old industries, is the company’s second largest shareholder. It holds CRH in its Monks Investment Trust (MNKS) and the Baillie Gifford Global Alpha Growth Fund (GB00B3PPZ729).

“The attraction of this industry is its low value to weight ratio, creating local businesses with negligible international competition and regional pricing,” says John Carnegie, partner at Baillie Gifford. (A low value to weight ratio refers to less expensive but heavy goods that tend to be produced locally to reduce transportation costs)

He says “[w]hile this industry can appear to generate fairly dull GDP-like growth, timely acquisitions and synergies offer attractive growth characteristics”.

The nature of CRH’s business means that it does have considerable cyclical exposure to a downturn in construction activity. But the group is better placed to cope with a recession than during the global financial crisis.

“We have made a conscious decision to move our business more and more toward the publicly funded construction area,” says chief executive Albert Manifold. “[W]e've done so because it's more resilient in the down cycle, and it's largely infrastructure. Governments tend to fund construction and infrastructure through the cycle and within cycle.”

Publicly funded construction now accounts for around 50 per cent of CRH’s sales, while 40 per cent comes from the more resilient ‘repair, maintenance and improvement’ (RMI) market.

Diversified exposure

CRH’s activities are split across three divisions – Americas materials, Europe materials and building products. The Americas materials business is largely US-focused, and accounted for 41 per cent of total revenue and 52 per cent of cash profits (Ebitda) last year. With half of its sales are derived from infrastructure projects, this is CRH’s highest margin segment. Price increases and good cost control enabled the cash profit margin to expand by 2.6 percentage points in 2020 to 21.3 per cent. So, while pandemic disruption saw the division’s revenue dip by 3 per cent to $11.3bn (£8.2bn), cash profits jumped by a tenth to $2.4bn.

Meanwhile, the Europe materials business generated a third of CRH’s revenue and 23 per cent of cash profits last year. While it is fairly evenly spread across the residential, commercial and infrastructure markets, it is weighted more towards new-build schemes. Cash profits from this division slipped by 13 per cent last year to $1.1bn as activity in Western Europe – in particular the UK – was affected more severely by Covid-19. The margin is also the lowest across the group, contracting by 0.2 percentage points in 2020 to 11.5 per cent.

The remainder of CRH’s earnings come from its building products segment which provides architectural products and window glazing. It is the group’s fastest growing business. Like-for-like cash profits have risen by 10 per cent annually over the past five years. Thanks to robust demand from the residential RMI sector in North America, the division’s cash profits rose by 9 per cent last year to $1.2bn.

The US is key

CRH is benefiting from long-term growth trends in construction caused by population growth and urbanisation. According to the United Nations, almost 70 per cent of the world’s population will live in cities by 2050, necessitating more housing and infrastructure. There is also the need to upgrade aging infrastructure in developed countries. This has become a focus of post-pandemic recovery spending for many governments.

What happens in the US is likely to be a catalyst for several London-listed companies, including equipment rental group Ashtead (AHT), plumbing and heating products distributor Ferguson (FERG) and also CRH.

As we recently explored in our analysis of road and safety products specialist Hill & Smith (HILS), US infrastructure is in desperate need of modernisation. The American Society of Civil Engineers rates the condition of the country’s infrastructure as ‘C-', which equates to “mediocre”. Just to improve this to what it deems “adequate for now”, the trade body estimates that almost $6tn of investment will be needed by 2029, of which only $3.4tn is currently funded.

The Biden administration has proposed more than $2tn of spending on US infrastructure over the next decade, but so far, the plan has yet to obtain the required 60 votes in the Senate, and certain Democrats are also blocking the simple majority required to pass a bill through the ‘budget reconciliation’ process.

Some headway has been made on a slimmed down bipartisan framework that would entail $1.2tn of spending over the next eight years, including a $109bn investment in roads and bridges. As negotiations over a broader infrastructure package continue, the ‘Surface Transportation Reauthorisation Act of 2021’ is in the works as a successor to a previous five-year federal highway spending programme. It is proposing $304bn of investment in roads and bridges over the next five years.

As the largest asphalt paving company in North America, CRH would benefit from any increased funding for roads and Manifold is upbeat about the US spending outlook. “Infrastructure funding remains a bipartisan issue and while there are some uncertainties regarding the quantum and the timing of any such funding plans, we're confident that a viable multi-year programme can and will be put in place,” he said in April.

CRH first entered the US in 1978 through the acquisition of concrete products company Amcor and now operates across 46 states. It is pivoting towards higher growth southern and western US states where rising populations are fuelling demand for buildings and building materials.

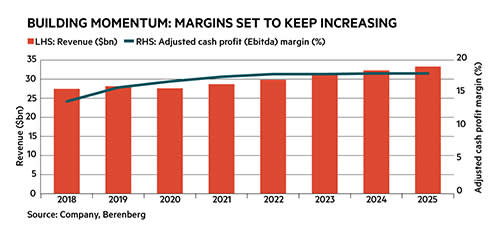

The Americas accounted for around 60 per cent of the group’s cash profits in 2014, and Berenberg estimates that this contribution will reach 70 per cent in 2021 and 80 per cent by 2025. The broker also believes that it will keep climbing from there, which should aid margin expansion. It is forecasting that the cash profit margin will advance from 16.8 per cent in 2020 to 18 per cent in 2025.

CRH’s margin progression also reflects its transition from the days of just making “big rocks into small rocks”, to valued-added and integrated building solutions. For example, it doesn’t just provide the asphalt for laying roads, but also the concrete piping for water drainage.

“[W]e don't just supply the base materials, we supply the full road from the rock, all the way to the finished road, and then, we maintain that road for five or seven years,” says Manifold. “And in maintaining that road, we know we have a high probability of getting the concrete to relay that road.”

The group estimates that this approach has generated an additional $1bn of cash profits each year versus a pure play proposition, boosting margins and generating repeat business.

The next Ferguson?

Activist investor Cevian Capital could have some influence in the ongoing ‘Americanisation’ of CRH. It was a large shareholder in peer Ferguson, with its investment coinciding with the period in which the plumbing and heating specialist rotated towards the US.

Cevian bought into CRH in February 2019 and has since become the company’s largest shareholder with a 3.5 per cent stake. The private equity firm’s managing partner, Christer Gardell, told Reuters in 2019 that CRH had “become too complex, both structurally and operationally, which hampers performance and traps value”. He also said that “far-reaching structural and operational improvements are needed for the group’s assets to reach full potential”.

CRH has been divesting some of its businesses to tighten up its portfolio. For example, it exited its distribution activities in 2019 with the sale of its European distribution arm to Blackstone for €1.6bn. It sold $307m-worth of assets last year and a further $300m in the first quarter of this year alone. This includes the disposal of its Brazilian cement business for $200m.

The parallels with Ferguson are therefore mounting – CRH is increasing its US exposure, divesting non-core assets and has also switched to reporting in US dollars. Berenberg believes Cevian will maintain pressure on CRH to “unlock the full value of the asset base, which could involve discussing a US primary listing”, which is what Ferguson ultimately did. CRH currently has American depositary receipts in New York, but has yet to publicly discuss shifting its primary listing there.

The environmental conundrum

ESG-orientated investors may have concerns about CRH given the environmental impact of the quarries from which aggregates are derived and the cement industry. The latter is responsible for 7 per cent of global carbon dioxide emissions.

But as countries look to meet their climate change targets, permits for new quarries and cement plants are likely to become more scarce. This should favour the likes of CRH with its existing footprint and make it more difficult for new market entrants.

While efforts are being made to make cement more ‘green’, there is not yet a commercially viable solution.

“Is there another product we can use off the shelf? There isn’t,” says Manifold. “Unfortunately, we need cement, we need concrete in our world to live because we have to build shelter, we have to build modes of transportation for our modern life to exist.”

CRH is aiming to reduce scope 1 and 2 emissions from its cement products by a third from 1990 levels by 2030 to below 520 kilogrammes of CO2 per tonne. The group is also hoping to be carbon neutral across its cement and concrete value chain by 2050. In the meantime, it is increasing the use of recycled materials, which account for 25 per cent of every mile of road it builds in North America.

Acquisitions aplenty

Net debt dropped by just over a fifth last year to $5.9bn. Equivalent to 1.3 times cash profits, this is CRH’s lowest leverage multiple in over a decade. The group also has a solid track record of generating free cash flow, which, according to FactSet, increased by 16 per cent in 2020 to just under $3bn.

The strong balance sheet has enabled CRH to undertake share buybacks, which were resumed in March. The group had repurchased $300m-worth of shares by the end of June and will buy back a further $300m by the beginning of October. By that time, it will have returned $2.6bn to shareholders since May 2018.

As well as buybacks, the balance sheet has also facilitated investment in earnings boosting mergers and acquisitions (M&A). CRH has spent a whopping $8bn on acquisitions since 2016. Some of this spending has been on big purchases – such as the $3.5bn acquisition of US cement manufacturer Ash Grove in 2018 – but there have also been numerous smaller bolt-on additions.

The group has already invested $200m in acquisitions so far this year, the largest of which is a pipe and precast concrete business that has expanded its infrastructure footprint in the Midwest of the US. With a “strong pipeline of opportunities”, M&A is expected to ramp up over the rest of the year.

Carnegie says that CRH’s proclivity for “counter-cyclical deals will deliver strong returns over the longer term, resulting in the next cyclical peak outstripping the last”.

Berenberg estimates that if the group pushes net debt to 1.5 times cash profits to fund further M&A, it could grow its cash profits by 4 per cent annually over the next five years. The broker believes that the fragmented US aggregates market is a particularly attractive area for acquisitions.

CRH is currently the joint leader in US aggregates alongside Vulcan Materials (US:VMC), but still only has an 8 per cent market share. Two-thirds of the market is comprised of over 5,000 smaller operators, meaning that there are plenty of consolidation opportunities. The group has scale advantages over these smaller competitors and could use this to eke out efficiencies. Berenberg believes that CRH could more than double its market share in this space over the medium-term.

The road ahead

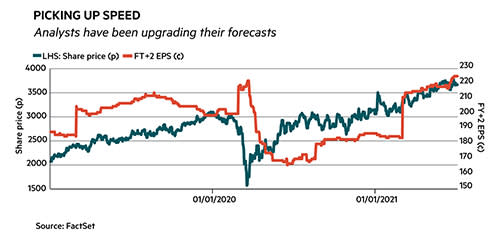

The first quarter of 2021 has seen CRH’s like-for-like revenue rise by 3 per cent as growth in the building products businesses – particularly from residential construction – offset the impact of harsh weather conditions in Europe and North America. The group is guiding that cash profits for the first half of this year will be “well ahead” of the $1.59bn recorded in same period last year. As the outlook improves, analysts have been upgrading their forecasts.

While many companies have been flagging inflation concerns, Robert Gardiner, analyst at Davy Research, believes that “strong demand and pricing trends are more than offsetting cost inflation” for CRH. Indeed, the group is used to passing cost increases onto its customers and so this shouldn’t become a significant issue now.

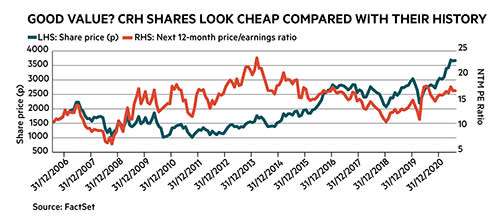

CRH’s shares have bounced back strongly from the ‘Corona crunch’ and are hovering around an all-time high. Yet they are not overly expensive, currently trading at 16 times consensus 2022 earnings, which is lower than the peak price/earnings (PE) ratio of 24 seen back in 2014. With the US economy running red-hot and offering long-term growth opportunities, now could be a good time to build a position in CRH.

| CRH (CRH) | |||||

| ORD PRICE: | 3,675p | MARKET VALUE: | £29bn | ||

| TOUCH: | 3,673-3,677p | 12-MONTH HIGH: | 3,805p | LOW: | 2,577p |

| FORWARD DIVIDEND YIELD: | 2.4% | FORWARD PE RATIO: | 16 | ||

| NET ASSET VALUE: | 2,593ȼ* | NET DEBT: | 31%** |

| Year to 31 Dec | Turnover ($bn) | Pre-tax profit ($bn)*** | Earnings per share (ȼ)*** | Dividend per share (ȼ) | |

| 2018 | 27.4 | 1.97 | 346 | 85.0 | |

| 2019 | 28.1 | 2.18 | 214 | 92.0 | |

| 2020 | 27.6 | 1.66 | 143 | 115 | |

| 2021*** | 29.3 | 2.94 | 287 | 120 | |

| 2022*** | 30.3 | 3.23 | 316 | 125 | |

| % change | +4 | +10 | +10 | +4 | |

| *Includes intangible assets of $9.4bn or 1,194ȼ per share | |||||

| **Includes lease liabilities of $1.6bn | |||||

| ***Davy Research forecasts | |||||

| £ = $1.39 | |||||

Last IC View: Buy, 2,940p, 20 Aug 2020