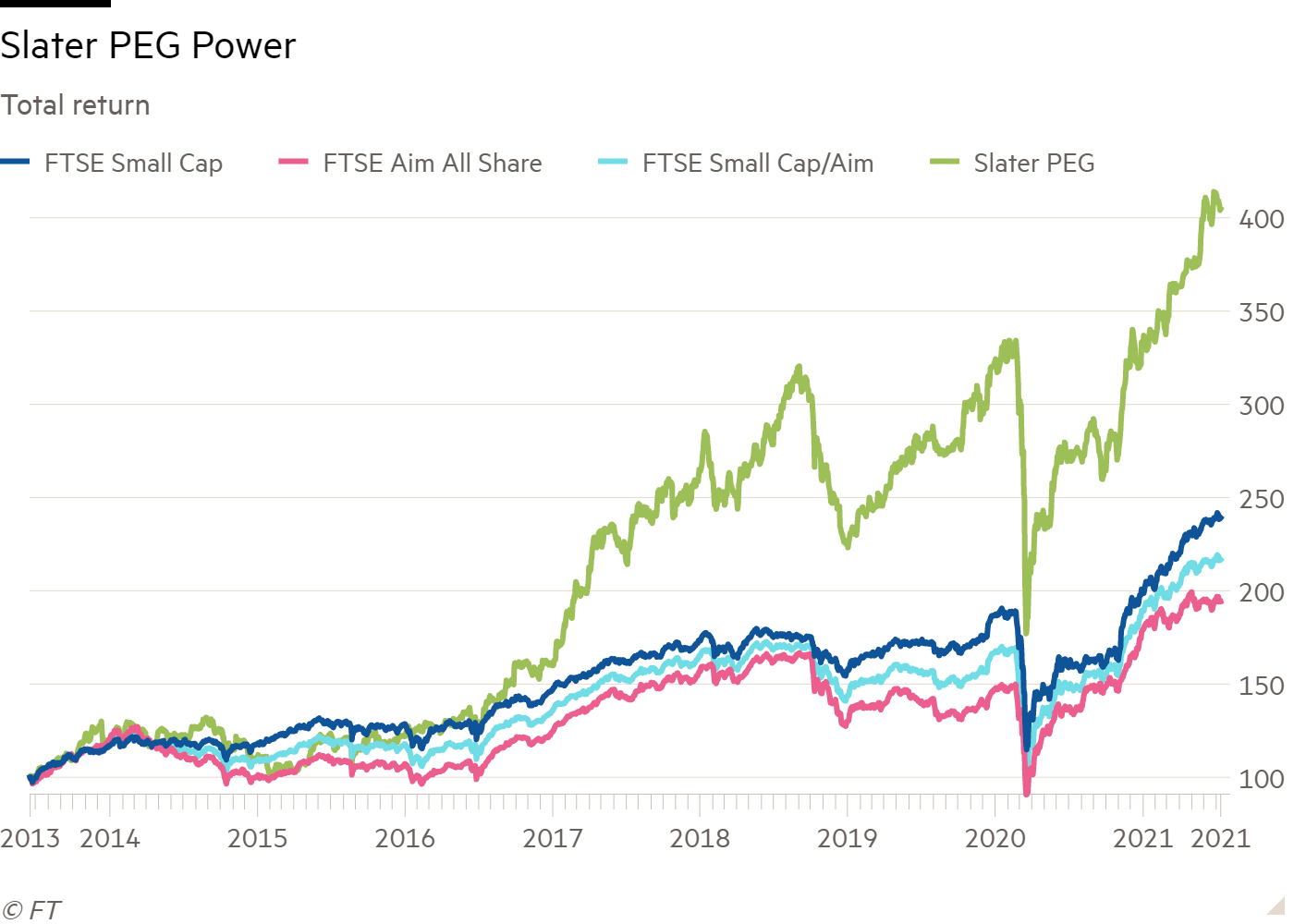

- Another 12 months of outperformance takes cumulative total returns from my Slater-inspired screen to 305 per cent over the past eight years versus 109 per cent from the market

- The screen has identified eight shares for the year ahead

- A detailed look at Best of the Best

Since vaccine breakthroughs were announced in November 2020, it’s been a wonderful time to be a small-cap investor. One of the stand out smaller companies screens that I run in this column is based on the wisdom of Jim Slater, an entrepreneur, investor and the author of classic investment book The Zulu Principle.

Slater was a proponent of the investment style that is broadly known as growth at a reasonable price (GARP). He did much to popularise the use of the price/earnings growth (PEG) ratio in the UK. And he was particularly drawn to smaller companies and their growth potential because, in his words, “elephants don’t gallop”.

The kind of trading that many businesses have experienced during the Covid-19 pandemic can make PEG ratios go rather funny. The PEG is a quick and dirty way of weighing up a company’s share price against the growth on offer. Given how quick and dirty it is, it is surprisingly effective. The ratio is calculated by dividing a share’s price/earnings (PE) by its earnings per share (EPS) growth rate.

PEG = PE / EPS growth rate

Either historic or forecast growth rates can be used in the ratio (my screen uses average forecast growth for the next two financial years), but the key idea is that the growth rate is representative of longer-term prospects. That way, the cheap growth the ratio identifies may lead to the market repricing the shares. Indeed, aside from the PEG ratio, Slater suggested investors pay attention to a number of other indicators that growth prospects were genuinely robust, such as director buying and encouraging outlook statements.

The problem PEG fans face today is that growth rates are unlikely to be very representative of long-term prospects because the economy is recovering from a one-off shock.

Many companies have experienced a cataclysmic hit from lockdown which means their historic growth rates paint a far too pessimistic picture. Meanwhile, many forecasts now predict a sharp bounce-back in earnings which means predicted growth looks far too optimistic.

Perhaps the much-derided 'adjusted for Covid' profit numbers that some audacious finance directors have been coming out with do have some uses after all?

Given my screen uses a PEG based on forecast earnings, that means high growth rates are making many PEG ratios look ridiculously low. Indeed, were I to stick with last year’s PEG test which demanded the ratio was in the bottom quarter of stocks screened, qualifying stocks from the FTSE All Small would need a PEG of 0.5 or less to qualify while the same figure for the FTSE Aim All-Share index would be just 0.6.

PEG is only one factor in this screen (see screening criteria below), though. Slater had a number of other characteristics he looked for in shares that were both quantitative as well as qualitative. When these are factored in, only one stock passes all the screen’s tests. So something has to give.

One of the greatest lessons I learned about running this screen came from Jim Slater himself prior to his death at the end of 2015. I had been rigidly sticking with the valuation criteria set out in The Zulu Principle book, which suggested that a PEG of 0.75 or less is what investors should look for. But in order to make sure sufficient numbers of stocks qualified from the screen, I was forced to soften other criteria.

Slater wrote to me with sage advice. I was going about things the wrong way around. His take was that when the market was expensive, investors need to double down on quality and be more relaxed about valuation.

I’ve kept with that spirit this year. I’ve changed the screen’s valuation criteria so stocks only need to have a PEG of 1 or below. This is a commonly used rule of thumb for PEG fans. More importantly, it gives us a decent number of results: eight.

You can see evidence of the wisdom of the great investor’s advice in the chart below. The point at which the screen’s performance breaks away from the performance of the broader indices marks the moment at which I was first able to change the screen in response to Slater's Intervention.

| Name | TIDM | Total Return (21 Jul 2020 - 14 Jul 2021) |

| Cake Box | CBOX | 87% |

| Churchill China | CHH | 76% |

| Tatton Asset Mgmt | TAM | 59% |

| Telit Comms. | TCM | 56% |

| Oxford Metrics | OMG | 48% |

| Stock Spirits | STCK | 18% |

| Arcontech | ARC | -15% |

| Slater PEG Stocks | - | 47% |

| FTSE Small Cap | - | 49% |

| FTSE Aim All Share | - | 41% |

| FTSE Small/Aim | - | 45% |

Over the entire eight years I’ve run the screen it has produced a cumulative total return of 305 per cent compared with109 per cent from a 50:50 split of the FTSE Small Cap and Aim All-Share indices.

While the screens in this column are meant as sources of ideas rather than off-the-shelf portfolios, if I factor in a 2.5 per cent annual charge to reflect notional dealing costs the total return drops to 231 per cent. I keep the notional charge high with this screen because small-caps can be very expensive to deal in due to wide spreads between the price at which shares are available to buy compared with what they can be sold for.

The full screening criteria are:

■ A PEG ratio of 1 or less (nb FTSE All-Share, All Small and Aim have been screened separately).

■ Market cap of less than £500m but more than £10m.

■ Net-debt-to-cash-profits ratio of less than 1.5.

■ Cash conversion of 90 per cent or more (nb this is based on operating cash to operating profit rather than the operating cash to Ebitda metric used in the table below).

■ Return on equity of more than 12.5 per cent or an operating margin of 15 per cent or over.

■ Three-month momentum higher than the median average, or forecast EPS upgrades of 10 per cent or more over the past year.

■ Forecast earnings growth in each of the next two financial years and average forecast growth of more than 10 per cent but less than 50 per cent (anything above 50 per cent is considered an unsustainable growth rate for the purposes of this screen).

A wonderful thing about Slater’s investment wisdom is that it not only lives on in his writing (and that of fans like myself) but also in the fund management business of his son Mark Slater. Slater Investments runs a range of funds with knockout performance records that employ the family investment approach.

As it happens, Slater Investments has recently bought a 9 per cent stake in one of the companies highlighted by the screen. The investment has started out as a bit of a bumpy ride, but the business itself is certainly interesting and I’ve taken a look at it in some detail below.

Fundamentals relating to it and the other stocks highlighted by the screen can be found in the table at the end of this article. There is also a more detailed downloadable version of the table available.

Best of the best

The pandemic has been a crazy time for the share price of dream-car-giveaway competition organiser Best of the Best (BOTB). Since the start of 2020 the shares are up an astronomical 360 per cent. But they are also down by more than 50 per cent from their March high. A high that was hit shortly before directors offloaded £61m-worth of shares.

The rollercoaster ride really got under way shortly before the pandemic struck. In September 2019 the company completed a shift from hocking tickets in airports and shopping malls to conducting all its competitions online. Given the closures caused by Covid-19, the timing was incredibly lucky.

As 2020 got under way, BOTB made two announcements in quick succession reporting better than expected trading. It seemed the shift online was working. The share price more than doubled from 395p at the start of 2020 to 810p by mid-June.

The fun was only getting started, though. Next came the news that BOTB had received approaches from interested bidders and was entering a formal sales process. That led to another surge. The shares had doubled again before June was out with the price hitting 1,620p at the end of the month.

The excitement about the offer was accompanied by full-year results that again suggested business was booming.

At this point, private investors were starting to flock to the BOTB story in their droves. Given over three-quarters of the company was owned by directors – chiefly founder William Hindmarch – the illiquidity of the shares made for rapid price gains.

The trading news continued to get better with many individuals bored, stuck at home and looking for diversion due to lockdown.

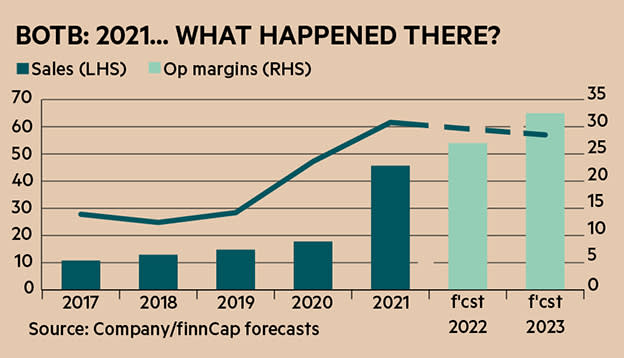

Sales in the six months to the end of October were nearly a quarter ahead of those achieved in the entirety of the previous financial year. And when full-year results to the end of April 2021 were published, sales were ahead by a staggering 157 per cent at £45.7m and profits were up 236 per cent at £14.1m.

Swimming in cash, the company also announced a special dividend of 90p for the year (50p at the year-end and 40p at the interims) alongside the 5p regular payment. A 34p special was awarded the previous year.

However, there was a bitter sting in the tail of the 2021 financial results. Especially for anyone who bought at the March high of 3,440p or those who paid 2,400p a pop in April when 2.5m shares belonging to directors were placed.

The sting was this painfully worded profit warning: “In contrast to the summer 2020 period, we have experienced somewhat of a reduction in customer engagement since the latest easing of lockdown restrictions on 12 April, 2021, specifically relating to the understandably long-awaited reopening of hospitality and non-essential retail.”

Indeed, while EPS forecasts may be up over the year (one of the screen’s tests the stock passes), the trend could be set to turn negative. Shareholders that had made heady gains ran for the exit. Given the limited liquidity of the shares – even after the placing – the price nosedived.

High performance

A big question now is how realistic are current forecasts? Trading at 11 times next-12-month expected earnings, the shares definitely look very good value if broker expectations are kosher.

The company has a slick little operation. Getting out of physical spaces has significantly reduced overheads as the company previously had to rent pitches and the cost associated with this tended to be jacked up by landlords every year. Going online has also allowed the group to launch new games, such as its Midweek Car competition, and take more control over pricing – it can offer lower ticket prices.

The business also requires very little capital, although Best of the Best does have to pay for virtual real estate through a hefty marketing spend.

Still margins are high, with the operating margin last year rolling in at 31 per cent, buoyed by the online transition but also exceptional demand during the pandemic. The level of margin has raced ahead over recent years. The cost of giveaway cars are a key fixed expense, so profitability is very sensitive to the strength of ticket sales. Marketing is the group's other big cost, which is more flexible.

BOTB's cash generation is impressive too. Revenues roll in weekly as tickets are bought and it brings cash in sooner than it has to fork out on associated expenses – so-called 'negative working capital'. Indeed, at the end of April the company was sitting on £11.8m of net cash. Since then it has paid out £5.2m in special and regular dividends.

The price of success

In addition to BOTB’s own words of caution, signs from other companies in the gambling sector suggest many of those consumers that were entertaining themselves by having a flutter during lockdown now have better things to do. For example, 888 (888) said that its UK daily revenues dropped by a fifth following the retail and leisure reopening on 17 May.

There are levers BOTB could pull to mitigate falling ticket sales, such as reducing marketing spend and putting less cash in the boots of the cars it gives away (yes, that's a thing!). But at its heart the business’s profits are quite sensitive to movements in sales so the very high margins of 2021 could prove vulnerable.

There are other reasons to be circumspect about BOTB’s recent success beyond questions about the impact of the hard-to-quantify lockdown bump. BOTB’s so-called “competitive moat” is not the deepest despite it being very well-established in its market.

Pretty much anyone with the budget to give away a luxury car can set up a rival online competition because BOTB operates outside the regulation of the 2005 Gambling Act (while regulation can cause complications for companies, the flipside is that it's a great barrier to new entrants).

All the same, the niche nature of the market and the limited demand for such competitions does give BOTB a scale advantage. Ticket sales need to cover the cost of an expensive prize which acts as a deterrent to new entrants. Ironically, though, after such a bumper year, there’s more incentive for others to have a go. Competing against a company with almost £50m in revenue and 30-plus per cent operating margins (the BOTB of 2021) is a lot more tempting than competing against one with £13m revenue and a 12.4 per cent margin (the BOTB 2018 version).

The recent growth experienced by BOTB does highlight the fact it is a company with noteworthy marketing pizzazz, though. What’s more, it has put significant work into building a community of loyal petrolheads. All the same, should serious competitors emerge, the easiest way to flex the scale advantage in order to keep any threat at bay would be to increase the value of prizes and up marketing spend. Either would squeeze profit. Such a threat has yet to materialise, but this should still be a consideration.

The reason BOTB does not need a gambling licence is that its competitions are classified as a game of skill. Each ticket bought requires the player to enter a spot-the-ball contest which is judged by a panel of sports experts.

A risk with operating on the fringes of regulated activities is that rules may change. Uncertainty about the future is currently being created by the ongoing Gambling Act review. There is the possibility this could tighten the definitions over what types of competitions require a gambling licence to operate. However, this possibility looks slight. “My best guess is the review will not look at the boundaries between games of skill and games of chance,” says Peel Hunt gaming sector analyst Ivor Jones. “Having said that, [the regulator] can always surprise you.”

Reassurance about the strength of the model and margins can be taken from the shrewd institutional investors who bought shares off the selling directors at 2,400p in the March placing. These included funds run by Mark Slater.

Will there be better from the Best?

The simplicity and capital-light nature of this business is very attractive. And a portion of the gains made by the group last year are doubtless a reflection of becoming an online-only business.

However, investors in BOTB should brace themselves for possible broker downgrades. That’s not to say downgrades are guaranteed, but how post-lockdown trading will pan out is simply unknowable. It is not hard to imagine a scenario where both revenue and margin see some noteworthy shrinkage.

There is also a perplexing consideration for growth investors (Jim Slater was one, remember). The bigger the market proves to be for BOTB’s games, the more likely it is to attract competitors which could push down profitability. That’s a funny dynamic. Operating on the regulatory fringes also brings risk.

So while the shares tick a lot of boxes, the apparent bargain price may not prove as great a deal as it first appears.

| 8 Zulu Principle, low-PEG stocks | ||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Name | TIDM | Mkt Cap | Net Cash / Debt(-)* | Price | PEG | Fwd PE (+12mths) | Fwd DY (+12mths) | Op Cash/ Ebitda | EBIT Margin | ROCE | 5yr Sales CAGR | 5yr EPS CAGR | Fwd EPS grth NTM | Fwd EPS grth STM | 3-mth Mom | 12-mth Mom | 3-mth Fwd EPS change% | 12-mth Fwd EPS change% |

| Sureserve | SUR | £132m | -£1m | 82p | 0.4 | 11 | 2.3% | 136% | 4.8% | 16% | -10% | 16% | 24% | 8.8% | 2.5% | 89% | 17% | 45% |

| UP Global Sourcing | UPGS | £180m | -£5m | 202p | 0.7 | 15 | 3.4% | 160% | 7.9% | 37% | 14% | 23% | 34% | 6.4% | 22% | 170% | 28% | 89% |

| RM | RM | £204m | -£31m | 243p | 0.7 | 13 | 2.2% | 120% | 7.4% | 14% | 1.2% | -11% | 28% | 21% | 10% | -5.8% | 9.4% | 47% |

| Brickability | BRCK | £292m | -£9m | 98p | 0.8 | 12 | 2.2% | 61% | 8.4% | 16% | - | - | 34% | 10% | 15% | 128% | - | - |

| Somero Enterprises | SOM | £264m | £25m | 470p | 0.8 | 14 | 4.8% | 145% | 27% | 40% | 8.5% | 14% | 19% | 3.2% | 17% | 109% | 35% | - |

| Best of the Best | BOTB | £154m | £12m | 1,640p | 0.8 | 11 | 0.4% | 107% | 31% | - | 35% | 66% | 17% | 12% | -46% | -2.4% | 3.3% | 111% |

| Record | REC | £193m | £19m | 97p | 0.8 | 19 | 2.6% | 100% | - | 22% | 3.6% | 1.5% | 48% | 4.8% | 27% | 176% | 23% | 117% |

| Nucleus Financial | NUC | £145m | £14m | 189p | 1.0 | 18 | 3.6% | 65% | 7.9% | 16% | 12% | -5.7% | 47% | 17% | 0.3% | 29% | 24% | 89% |

| Source: FactSet | ||||||||||||||||||