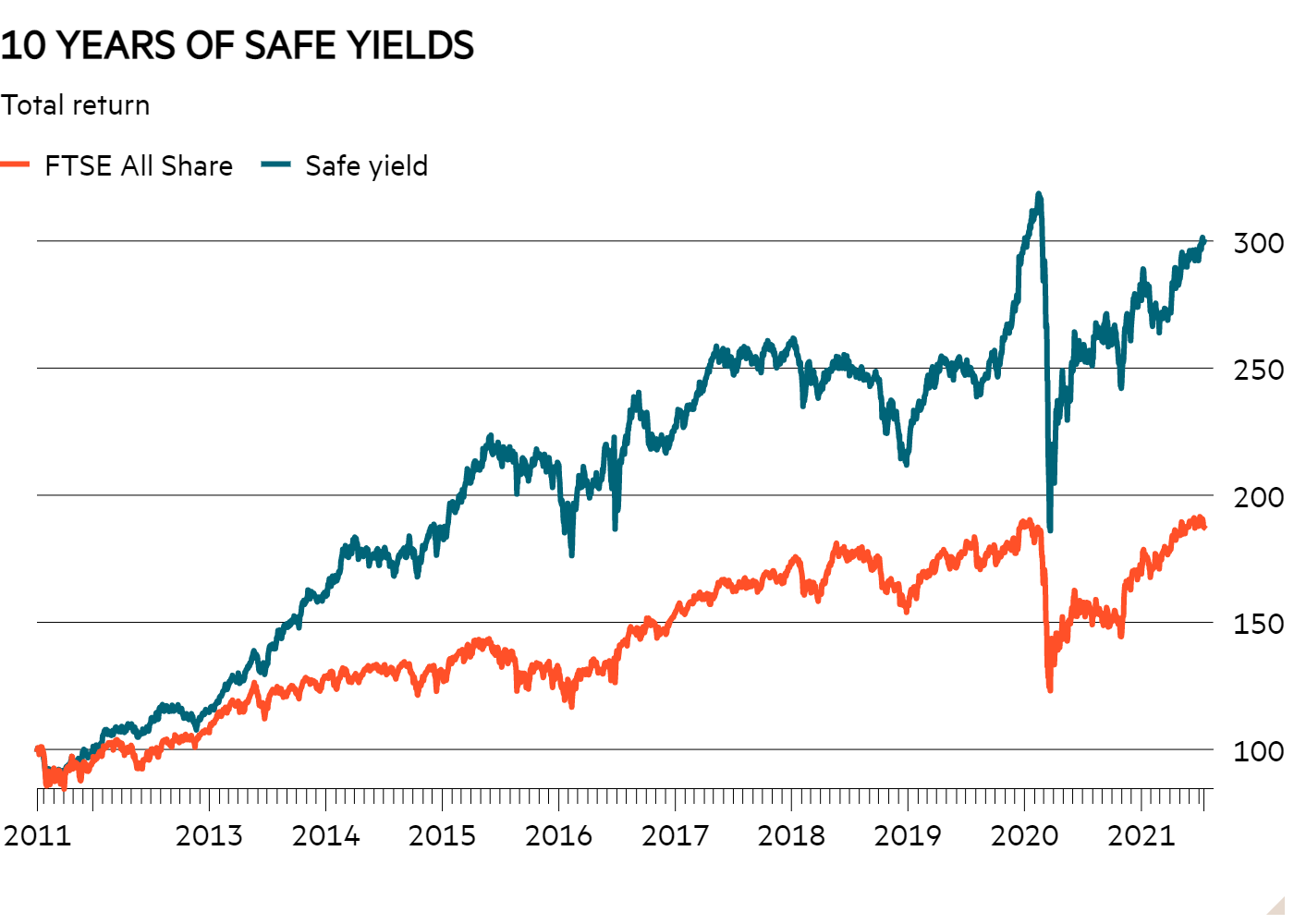

- My Safe Yields screens have produced a 200 per cent total return over 10 years compared with 87 per cent from the FTSE All-Share

- Why dividends are irrelevant to returns but should still matter to investors

- 10 new Safe Yield stock picks

What’s the point of dividend yield? Many of the perceived attractions of dividends are illusory. When a dividend is paid it is simply the transfer of cash from one party to another. Cash goes from the company's bank account to the shareholder’s bank account. The loss of value to the company nets out the cash gain to the shareholder. There is no clearer illustration of this than the fact shares fall by an amount equivalent to the dividend being paid once shareholders’ rights to the payment become binding.

Many investors do not see things this way, though. There is evidence that we tend to regard dividend income as something separate to share price returns. This causes us to misunderstand how we are being rewarded for holding an investment. It’s a phenomenon psychologists refer to as the “free-dividend fallacy”. In reality, both dividends and share price movements contribute to total returns and it is total returns that determine the growth in one’s wealth regardless of what makes the biggest contribution.

Given the dubious logic involved in making distinctions between dividend income and share price gains, it may seem odd that I run several screens in this column that focus on dividends. However, while the role of dividends in total returns may technically be irrelevant when it comes to building wealth, the dividend records of companies can tell us very important things about those companies as investments.

A strong dividend record coupled with a healthy yield can suggest a company has a defensive, financially-robust and cash-generative business. A healthy level of yield may also suggest these attractions are being overlooked by the wider market.

Essentially, screening for dividends can help identify a certain type of quality business, which may be underappreciated because it is perceived as dull. After all, really exciting businesses have better things to do with their money than hand it back to owners. But shares in these types of dull-but-dependable companies have been found to have a tendency to outperform. This tends to be especially true when the shares of such a company have displayed low levels of volatility (low beta) in the past. That’s because low share price volatility is also often a marker of the type of defensively positioned businesses that the market has a habit of overlooking.

The combination of hunting for solid dividend records, healthy yields and low betas has worked well for my Safe Yield stock screen over the past decade. Since I started to follow it 10 years ago it has clocked up a cumulative total return of 200 per cent compared with 87 per cent from the FTSE All-Share. That’s a pleasing result given many value-focused income strategies have fared poorly over the same period.

While the screens run in this column are meant as a source of ideas rather than off-the-shelf portfolios, if I add in a 1.5 per cent charge to account for notional dealing costs, the return drops to 158 per cent.

The decade has ended on something of a lacklustre note, with last year’s selection of 10 shares failing to match the performance of the index.

| 2020 performance | ||

|---|---|---|

| Name | TIDM | Total Return (10 Aug 2020 - 19 Jul 2021) |

| Sirius Real Estate | SRE | 64% |

| Imperial Brands | IMB | 40% |

| Spectris | SXS | 35% |

| Rio Tinto | RIO | 33% |

| British American Tobacco | BATS | 21% |

| Chesnara | CSN | 1.6% |

| Unilever | ULVR | -1.0% |

| Glaxosmithkline | GSK | -2.9% |

| Moneysupermarket Com | MONY | -12% |

| Polymetal Int | POLY | -17% |

| Safe Yield | - | 14% |

| FTSE All Share | - | 22% |

| Source: Thomson Datastream | ||

The exceptional circumstances of the past year have created problems for this screen and I’ve made a number of small amendments to the criteria to try to account for the fact that some otherwise reliable companies will have experienced nasty one-off hits due to the pandemic. Also, to boost results I’ve allowed shares to qualify that fail one test as long as they have passed the dividend yield, dividend cover and beta tests. Three stocks passed all the tests, while details of the test failed by the remaining seven are given in the accompanying table. The full screening criteria are:

■ Historic dividend yield of at least 2 per cent or next-12-month forecast yield of over 3 per cent (a bit above the median for dividend-paying FTSE All-Share constituents in both cases).

■ Dividend cover of at least two times – historical or forecast.

■ Interest cover of at least five times.

■ Dividend growth over the past three years.

■ Forecast earnings growth in each of the next two financial years.

■ An average return on equity over the past three years of at least 12.5 per cent.

■ Cash conversion (measured as cash from operations to Ebitda) of over 90 per cent.

■ A market capitalisation of at least £250m.

■ Beta of 0.75 or less.

I’ve taken a closer look at one of the shares passing all the screen tests below. It is an interesting example of a company where it is important to pay attention to cash returns beyond the headline dividend payout. For online readers, I’ve also added in a table of fundamentals relating to the stock, a format I plan to stick with in the column when I focus on a single stock. Much of this data is also available for the other stocks passing the screen in the downloadable version of the screen results table which can be found with the abridged table of this year's Safe Yield stocks at the end of this article.

Ferguson

| Company Details | Name | TIDM | Desription | Price |

| Ferguson Plc | FERG | Wholesale Distributors | 10,125p | |

| Size/ Debt/ Cash conv. | Mkt Cap | Net Cash / Debt(-)* | Net Debt / Ebitda | Op Cash/ Ebitda |

| £22,523m | -£1,656m | 1.1 x | 91% | |

| Valuation | Fwd PE (+12mths) | Fwd DY (+12mths) | FCF yld (+12mths) | PEG |

| 20 | 1.9% | 4.7% | 1.7 |

| Quality/ Growth | EBIT Margin | ROCE | 5yr Sales CAGR | 5yr EPS CAGR |

| 7.6% | 20.2% | 5.4% | 25.1% | |

| Forecasts/ Momentum | Fwd EPS grth NTM | Fwd EPS grth STM | 3-mth Mom | 3-mth Fwd EPS change% |

| 7% | 7% | 10.0% | 16.2% |

| Year End 31 Jul | Sales* | Pre-tax profit* | EPS* | DPS* |

| 2018 | £16.0bn | £1.07bn | 342p | 139p |

| 2019 | £18.0bn | £1.19bn | 423p | 171p |

| 2020 | £17.0bn | £1.12bn | 398p | 159p |

| f'cst 2021 | £16.6bn | £1.40bn | 470p | 173p |

| f'cst 2022 | £17.6bn | £1.50bn | 499p | 191p |

Source: FactSet. *$'s converted to £ & p.

As a Safe Yield pick, US-focused plumbing products distributor Ferguson (FERG) certainly has some attractions. I will come to those in a minute. However, there is one glaring issue with the shares as a dividend play. The forecast dividend yield for the coming 12 months is less than 2 per cent.

The screening criteria avoids using an aggressive dividend yield test. However, the forecast level of the payout looks uninspiring even by the screen’s modest standards (the stock qualified due to its historical yield not forecast yield).

But things are more promising than they may first appear. Ferguson’s dividend needs to be seen in light of its record for share buybacks.

From a shareholder return perspective, there is very little difference between the benefit of receiving and reinvesting dividends, and the same amount of money being put into a buyback. The very little difference involved is that buybacks tend to be better for shareholders due to savings on dealing costs and taxes.

To factor in the benefit of cash returns through buybacks, investors can use something called the 'shareholder yield'. This calculates yield based on dividend per share plus net buybacks per share (difference between shares bought back and shares issued in a year). Buybacks tend to be a bit more lumpy than dividends, but Ferguson has been relatively consistent in its policy bar a brief freeze in repurchases due to the pandemic. Indeed, over the past three years, even with the freeze, the average shareholder yield has been double that of the dividend yield. What’s more, having suspended buybacks during 2020 due to the pandemic, a new $400m programme began in March.

I also think consensus dividend forecasts could be on the low side given the excellent year the company is experiencing. In addition, cash from the sale of the group’s UK business to private equity for £308m was returned to shareholders in May via a 180c special dividend; not included in the dividends listed in the table.

Coming to America!

The sale of the UK business largely completes a move by the group to focus on North America. The shares also now have a joint US listing. Given the Stateside ambition, it’s also of note that Geoff Drabble, the man who saw the hugely successful expansion of equipment hire group Ashtead (AHT) in the US, has recently been installed as non-executive chairman.

One of the surprise outcomes from the Covid-19 pandemic has been a booming US housing market. With around half of sales coming from residential projects, Ferguson has been a major beneficiary of this. One worry investors currently have is that these gains could prove fleeting. But the group’s success during the pandemic, and especially market share gains, has shown the strength of the business model.

Ferguson’s key attraction is a competitive advantage built on its scale. In the US, the company is the leader in four of its nine end markets. At its year-end, prior to completion of the UK disposal, it operated 2,194 branch outlets with a fleet of 5,700 vehicles. This means it can offer its 39,000 suppliers distribution into highly localised markets across 50 US states. Customers meanwhile benefit from a wider range of products and competitive prices thanks to the company’s buying power.

Buying power also benefits Ferguson’s own margins. The size of the operation creates other cost efficiencies in its distribution network that allow it to outcompete smaller rivals. The scale of the operation has also underpinned a push into own-brand products. Meanwhile, the company is very focused on maintaining high levels of customer service by incentivising staff, investing in ecommerce and ensuring the products its customers want are in stock.

Indeed, the group’s long-term commitment to maintaining 100 per cent availability of its top-selling 3,000 products has been credited as a key reason for strong market share gains during the pandemic; a period of strong demand for building materials and tight supply.

Measuring up

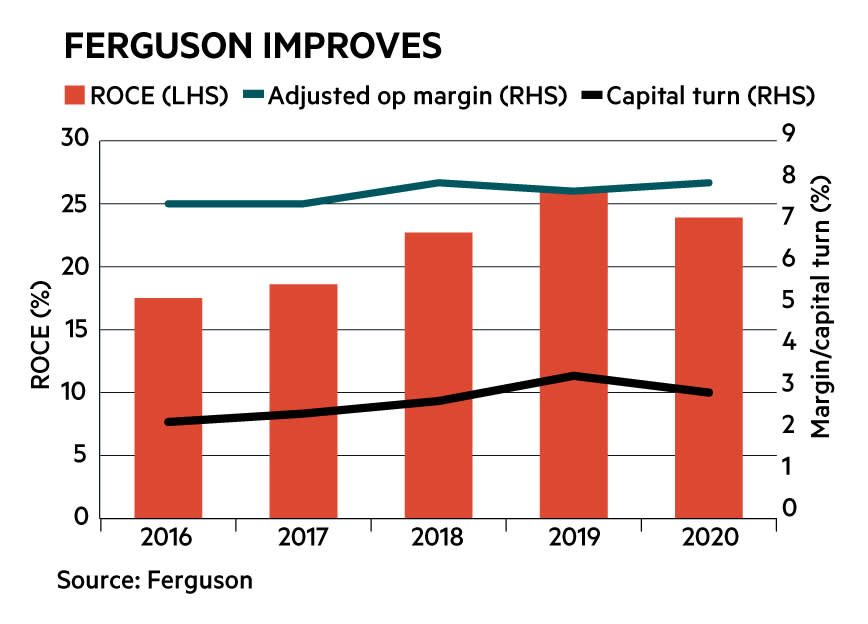

A number of financial measures also suggest the group’s strategy is working. Return on capital employed (ROCE), adjusted for recent changes to accounting rules on leases, has generally marched up over the past five years, although a temporary slowdown when Covid first hit meant a small blip last year (see chart).

As can be seen in the chart below, while margins have been creeping higher, it has been the success of the group at selling more product through its network (measured by turnover/capital employed or capital turn) that has been key to the improvement in ROCE.

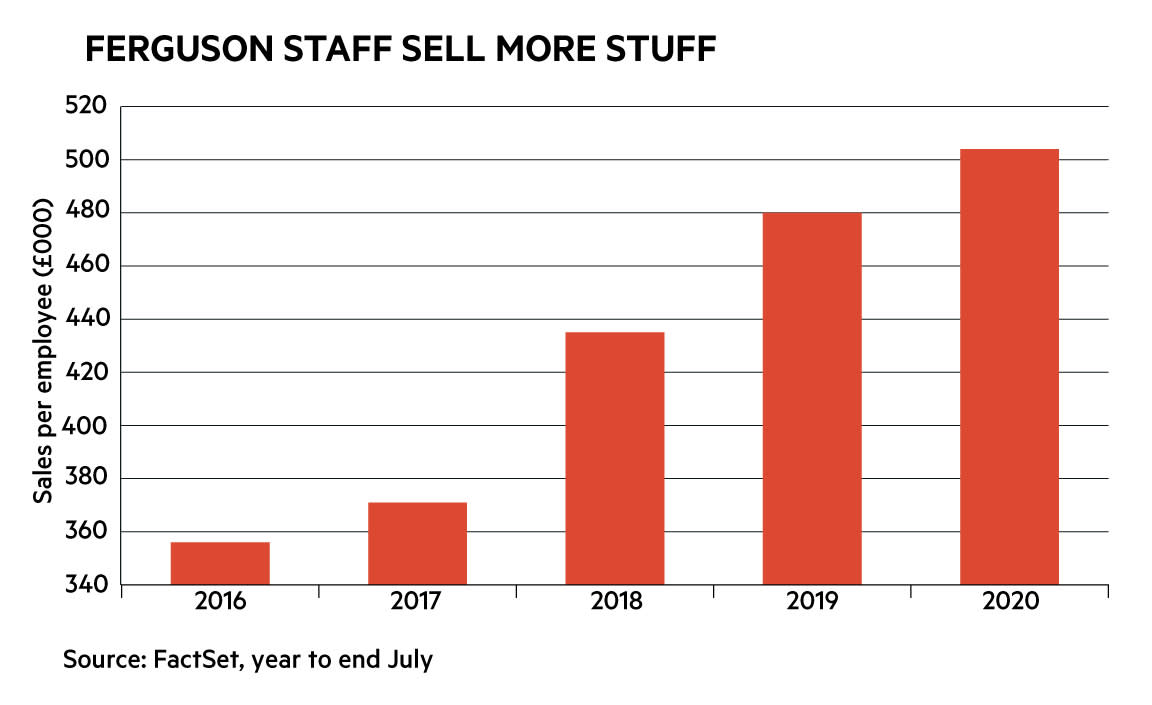

The company’s sales success is also evident in the growth in sales per employee (see chart).

The company plans to continue to capitalise on its success by: becoming more involved with suppliers around product design; increasing own-brand sales; becoming more involved with customers by offering more project-related advice; and investing more heavily in technology.

The focus on the US also exposes the company to a number of structural growth trends based on population growth, high disposable incomes and the country’s aging housing stock. The fragmented nature of the market means bolt-on acquisitions are also helping to power growth. It spent $2bn on deals over the five years to the end of July 2020.

Cycle ride

But while Feguson’s end markets may be broad, ranging from residential repairs to large industrial projects, they are also generally cyclical. A drop in group margins in 2019, for example, was the result of tighter market conditions during the second half of that financial year. And while the group has changed substantially since the great financial crisis, it is still of note that the shares lost about 90 per cent of their value during the market carnage from mid-2007 to spring 2009.

As such, exceptionally strong trading so far this year can be seen as a potential double-edged sword. Ferguson has not only benefited from sales growth but general price inflation in its end market and tight supply means its margins have been boosted. Such strong conditions are unlikely to last for that long and the current US housing boom could even turn to bust.

Another negative is that the company’s accounts have carried a number of exceptional charges relating to restructuring over recent years. Over the past three years such charges have accounted for about 7 per cent of operating profit.

But the balance sheet looks robust, cash generation is strong and cash returns are an indicator that management is focused on shareholder value rather than getting too carried away with growth ambitions. In all, Ferguson looks like a quality business with attractive growth prospects, but a cyclical one.

| Ferguson's 10-year valuation range | |||

|---|---|---|---|

| PE +12mth | EV/Sales +12mth | FCF Yld +12mth | |

| Now | 21 | 1.4 | 4.6% |

| 10 Yr Min | 8.4 | 0.4 | 3.5% |

| 10 Yr Median | 15 | 0.7 | 4.9% |

| 10 Yr Max | 22 | 1.4 | 7.6% |

| Source: FactSet | |||

There is no getting around the fact, though, that the valuation looks high based on a number of measures (see table). Arguably, the high ROCE, growth prospects and cash returns can justify this. But there is also the risk of a derating should trading disappoint. The cyclical nature of end markets means a major determinant of trading is out of the company’s own sphere of influence.

10 Safe Yield plays

| TEST FAILED | Name | TIDM | Mkt Cap | Net Cash / Debt(-)* | Price | Fwd PE (+12mths) | Fwd DY (+12mths) | FCF yld (+12mths) | Net Debt / Ebitda | Op Cash/ Ebitda | EBIT Margin | ROCE | 5yr Sales CAGR | Fwd EPS grth NTM | Fwd EPS grth STM | 3-mth Mom | 3-mth Fwd EPS chng |

| None | Big Yellow | BYG | £2,537m | -£341m | 1,381p | 29 | 2.8% | - | 4.1 x | 104% | - | 4.8% | 5.9% | 9% | 8% | 14.1% | 5.8% |

| None | Safestore | SAFE | £2,127m | -£505m | 1,009p | 26 | 2.4% | 3.9% | 5.9 x | 124% | - | 5.9% | 9.1% | 11% | 7% | 20.2% | 14.7% |

| None | Ferguson | FERG | £22,523m | -£1,656m | 10,125p | 20 | 1.9% | 4.7% | 1.1 x | 91% | 7.6% | 20.2% | 5.4% | 7% | 7% | 10.0% | 16.2% |

| F'cst EPS Grth | IG Group | IGG | £3,537m | £456m | 820p | 12 | 5.4% | - | - | 106% | - | 29.4% | 9.1% | -24% | 10% | -13.0% | 0.4% |

| Int Cov | LondonMetric Property | LMP | £2,216m | -£791m | 243p | 24 | 3.7% | - | 7.2 x | 113% | - | - | 11.1% | 4% | 5% | 7.6% | 0.8% |

| RoE | Stock Spirits | STCK | £504m | -£28m | 252p | 13 | 3.6% | - | 0.3 x | 108% | 17.5% | 13.0% | 9.5% | 5% | 7% | -11.0% | 1.7% |

| F'cst EPS Grth | Sirius Real Estate | SRE | £1,226m | -£356m | 116p | 17 | 3.2% | - | 5.8 x | 123% | - | 5.1% | 29.2% | 26% | -2% | 18.1% | 10.2% |

| F'cst EPS Grth | B&M Euro. Value Retail | BME | £5,595m | -£1,814m | 559p | 16 | 2.5% | 4.9% | 2.2 x | 93% | 13.1% | 22.0% | 18.7% | -15% | 9% | -1.7% | 2.1% |

| RoE | PZ Cussons | PZC | £1,093m | -£30m | 255p | 20 | 2.3% | 4.9% | 0.7 x | 132% | 12.1% | 11.7% | -6.4% | 5% | 5% | -4.7% | 0.9% |

| Cash Conv | Computacenter | CCC | £2,808m | £51m | 2,460p | 18 | 2.2% | 6.0% | - | 82% | 4.0% | 27.4% | 12.2% | 4% | 2% | -4.3% | 4.7% |

source: FactSet