- This investor wants to boost his state pension entitlement and get an income of £15,000 to £18,000 a year from his Isa

- If he adds some of his cash savings to his investment Isa it could generate the necessary amount

- He could also consider selling portions of investments which have grown

Isa invested in shares and funds, overseas equity holding, cash, residential property.

Boost state pension entitlement, £15,000 to £18,000 annual income from Isa, grow Isa income in line with inflation and protect capital value over the medium term, fund travel and leisure, cover large expenses including possible care costs, not spend much time managing investments when retired.

Richard is age 60 and has not had any income since the outbreak of Covid-19 last year other than what his individual savings account (Isa) has generated. His home is worth about £400,000 and mortgage-free.

“I would like to continue working for the next few years but am not sure if I can find suitable employment,” says Richard. “I am about to start drawing two defined-benefit (DB) pensions, which together should pay out about £16,300 a year. This means that I will also receive a lump sum from an associated with-profits additional voluntary contribution scheme and cash which should amount to around around £50,000. I plan to invest some of this.

"I expect to receive close to the full state pension from 2028, and understand that I could increase it by another four years' credits. A small former workplace pension should pay out £500 a year, also from 2028.

“I would also like income of £15,000 to £18,000 a year from my Isa as I spent a period abroad during which time I didn't contribute to pensions. I had intended to invest until age 65 or at least reinvest all the income I received. But I was made redundant in 2011 and started my own business so have only made very limited additions of new money since then.

"I am able to reinvest a bit of the income I receive, but have used most of it for the past two years to cover living expenses. I will continue to do this until all my pensions start to pay out. But hopefully I will eventually only need to draw from the Isa to cover costs such as travel, life-enhancing opportunities and large expenses such as care costs in later life.

"Since 2011, the Isa's value has increased from about £210,000 to £460,000. Since 2017, the income generated each year has been £12,900, £13,500, £15,150 and £16,100. The income has grown because the holdings have got larger, I’ve reinvested income and new money, and switched out of zero or low-yielding assets into higher-yielding ones.

I have largely done the latter by selling large chunks of iShares Physical Silver ETC (SSLN) and Worldwide Healthcare Trust (WWH), and replacing Baillie Gifford Shin Nippon (BGS) with JPMorgan Japan Small Cap Growth & Income (JSGI). I now aim to grow the income at least in line with inflation while protecting the capital value of the Isa over the medium term.

I like to add some ‘excitement’ to my portfolio with a small number of what seem like more speculative holdings such as Asian Citrus (HK:73) and Tetragon Financial (TFGS).

"I generally don’t invest in large, blue-chip UK companies directly as these are well-represented in the investment trust holdings. But I felt that there was a compelling income case for Lloyds Banking (LLOY) over the long term – despite its dividend being axed last year.

"I expect to have a very long retirement, so do I hold enough growth investments? Or is my Isa excessively risky? I have tried to diversify, but don’t have much exposure to bonds because they offer poor returns with the risk of significant capital losses if interest rates rise.

"Many of the rents my property fund holdings receive are inflation-linked and some are, in effect, government-backed. I also hope that many of the companies my investment trusts hold will have good pricing power if inflation takes hold. But I am still concerned about possible future inflation.

"When I retire I only want to monitor and adjust my portfolio periodically. I like exchange traded funds (ETFs), but are they the most appropriate way to generate income?"

| Richard's total portfolio | ||

|---|---|---|

| Holding | Value (£) | % of the portfolio |

| Cash | 32,300 | 6.64 |

| RIT Capital Partners (RCP) | 24,500 | 5.04 |

| SPDR S&P Global Dividend Aristocrats UCITS ETF (GBDV) | 23,954 | 4.93 |

| Fidelity MoneyBuilder Income (GB00B3Z9PT62) | 22,365 | 4.6 |

| Henderson Far East Income (HFEL) | 21,267 | 4.37 |

| City of London Investment Trust (CTY) | 21,058 | 4.33 |

| TR Property Investment Trust (TRY) | 20,328 | 4.18 |

| Ecofin Global Utilities and Infrastructure Trust (EGL) | 19,950 | 4.1 |

| JPMorgan Japan Small Cap Growth & Income (JSGI) | 18,016 | 3.7 |

| BlackRock World Mining Trust (BRWM) | 17,738 | 3.65 |

| JPMorgan Global Emerging Markets Income Trust (JEMI) | 17,586 | 3.62 |

| Assura (AGR) | 16,917 | 3.48 |

| Worldwide Healthcare Trust (WWH) | 15,915 | 3.27 |

| Edinburgh Investment Trust (EDIN) | 15,825 | 3.25 |

| BB Healthcare Trust (BBH) | 15,184 | 3.12 |

| BlackRock Energy and Resources Income Trust (BERI) | 15,182 | 3.12 |

| BlackRock Frontiers Investment Trust (BRFI) | 13,527 | 2.78 |

| Watkin Jones (WJG) | 13,542 | 2.78 |

| Law Debenture Corporation (LWDB) | 12,665 | 2.6 |

| Chelverton UK Dividend Trust (SDV) | 12,312 | 2.53 |

| Tritax Big Box REIT (BBOX) | 12,160 | 2.5 |

| Tritax EuroBox (EBOX) | 11,651 | 2.4 |

| HICL Infrastructure (HICL) | 11,430 | 2.35 |

| TwentyFour Select Monthly Income Fund (SMIF) | 10,893 | 2.24 |

| Primary Health Properties (PHP) | 9,803 | 2.02 |

| Lloyds Banking (LLOY) | 9,021 | 1.85 |

| Murray International Trust (MYI) | 8,891 | 1.83 |

| European Assets Trust (EAT) | 8,037 | 1.65 |

| CQS Natural Resources Growth and Income (CYN) | 7,725 | 1.59 |

| iShares MSCI USA Quality Dividend UCITS ETF (HDIQ) | 7,026 | 1.44 |

| iShares Physical Silver ETC (SSLN) | 6,559 | 1.35 |

| Raven Property (RAV) | 5,965 | 1.23 |

| Tetragon Financial (TFGS) | 5,059 | 1.04 |

| Asian Citrus (HK:73) | 2,002 | 0.41 |

| Total | 486,353 | |

NONE OF THE COMMENTARY BELOW SHOULD BE REGARDED AS ADVICE. IT IS GENERAL INFORMATION BASED ON A SNAPSHOT OF THIS INVESTOR'S CIRCUMSTANCES.

Chris Dillow, Investors' Chronicle's economist, says:

Like many investors, you need an income from your portfolio. But holding stocks and funds that pay big dividends is not the only way to get this. You can, in effect, create dividends by selling some of your holdings every so often. As long as your assets rise in price, doing this is the equivalent of receiving a dividend. What you should worry about is the total return of your portfolio, not the income. If the total returns are good you can create your own dividends.

This matters because a high dividend sometimes comes at a price. Some shares have high yields to compensate for being especially risky. This risk often takes the form of high exposure to the danger of recession, as is the case with mining and smaller emerging market stocks. Such exposure is good during economic upturns of the sort that we’ve seen in recent months. But upturns don’t last forever.

You are not as heavily invested in these areas as some investors. Instead, your search for income has led you to investment trusts that hold large, mature UK dividend-payers. Until last year, when banks and oil majors suspended their dividends, many of these companies did relatively well. That was because investors overestimated their ability to spot companies that had gone ex-growth and pushed down the likes of AstraZeneca (AZN) and Unilever (ULVR) too far. But investors may now have corrected this error, in which case the income would come at the price of foregone capital gains.

Inflation will be bad for equities if it rises a lot or looks more persistent than the Bank of England expects. This is because it would trigger rises in interest rates which might cause investors to fear slower economic growth, or sell shares and move into cash as returns on the latter rise. I’m not sure that property is protection against this. It has done badly when rates rise, especially if investors fear an economic downturn. But it’s not obvious that anything offers protection: bonds obviously don't and gold doesn't either, as its price tends to fall when bond yields rise.

The best protection might in fact be cash as its maximum possible loss is the real interest rate. But most economists think that serious inflation is a relatively small risk so don’t build your portfolio around this single possibility.

You want a portfolio that only requires periodic monitoring, but this is difficult. If you hold assets that are vulnerable to recession risk or big swings in sentiment, such as mining company and emerging market equities, you must review them regularly. Also, be prepared to sell them if the US yield curve becomes inverted, as this is a warning of recession, or if prices fall below their 10-month average, because doing this could get you out before a long bear market.

This is a reason for greatly simplifying your portfolio and where ETFs come in. One ETF that tracks the global equities market could replace many equity funds and you can generate an income by simply selling bits of your portfolio from time to time.

Kay Ingram, chartered financial planner at LEBC Group, says:

You don't have full state pension entitlement and have indicated that you have a shortfall of around four years National Insurance (NI) credits. The state pension is complicated because major changes were made in 2016. There could be a deduction from your entitlement if your workplace pension schemes contracted out of the state earnings-related scheme. You have also worked abroad, during which time you didn't pay NI.

As you are unemployed and looking for work, you are eligible to claim NI credits. If you claim Jobseeker's Allowance this is given automatically. If not, you can apply for NI credits at your local Jobcentre. Each year’s credit buys an additional 1/35th of the state pension so is currently worth an additional £266.80 of state pension per year, from age 67. Alternatively, you could buy Class 3 credits which would fill the gaps in your state pension entitlement and currently cost £800.80 for each year’s credit. You could consider doing this nearer to age 67.

The state pension increases by the higher of consumer price index (CPI) inflation, national average earnings or 2.5 per cent each year. So obtaining extra credits will provide automatic inflation-proofing backed by the government.

You expect a cash sum of £50,000 from your pension schemes, so could invest £20,000 each tax year in your Isa over the next two years. Also consider transferring your £14,000 cash Isa into your investment Isa. The best cash Isa rates are less than half the current rate of inflation so will lose value. You can earn up to £1,000 of interest tax-free due to the personal savings allowance so don't need to use up your Isa allowance on cash. A transfer would have to be made from one Isa manager to another to maintain the tax-free status of these savings.

The remaining £10,000 from your pension schemes, together with your unwrapped cash savings of £13,000, should give you a large enough contingency fund to meet any capital spending needs.

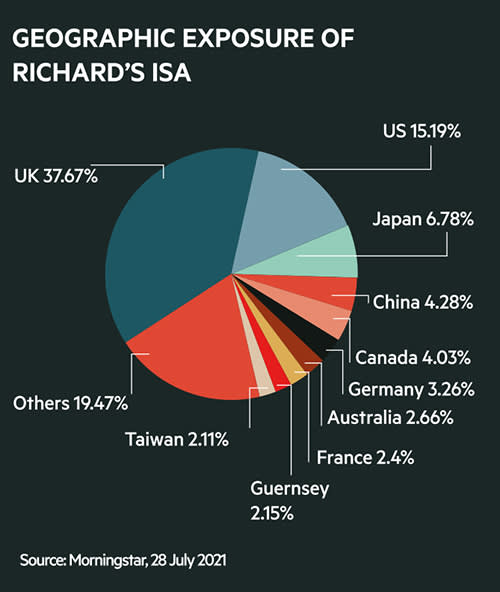

The income yield on your Isa portfolio last year was 3.5 per cent. When you have added the pensions money of £40,000 and cash Isa to your investment Isa, it should be large enough to meet your income target of £18,000 a year, if it still has an annual yield of 3.5 per cent.

Some of your holdings are speculative and higher-risk, which may not be appropriate as your Isa moves from the accumulation phase to decumulation. At least until you work again or your state pension starts, maybe take a lower level of risk and have a return target of matching inflation after charges and a 3.5 per cent income withdrawal. Your portfolio could have a more risk-on position if other income streams become available.

You don't want to spend a lot of time managing your portfolio when you retire. But as your Isa will provide around 50 per cent of your regular income it will need careful management. If you no longer wish to manage it yourself you could seek professional help.

You should execute a power of attorney for your financial affairs so that if you cannot make decisions due to ill health or an accident, someone else will be empowered to take over this responsibility. If you do not put a power of attorney in place, no one can act for you without applying to the Court of Protection. This is a lengthy and expensive process and could leave your portfolio badly positioned.

In the longer term, your home could be used as collateral for a lifetime mortgage to fund your income needs or care costs, if these arise. It is repayable when the property is sold, or you die or go permanently into residential care. The interest can be paid on the loan, or rolled up and repaid with the capital. Although this would reduce any inheritance you leave, it is a way of funding extra living costs if inflation is higher than investment returns or additional costs arise in later life.