Trading is often famine and feast. From February 2020 to the start of this summer it’s been one big feast. If you missed a trade you didn’t have to worry – another 10 would be along tomorrow.

One of the dangers with a feast period is that it can see traders become complacent. Traders will often chase entries, be more lax with their stops and start to slip from doing what worked in the tough times.

Beware a change of sentiment

The problem is that it can change from feast to famine in an instant. We saw what happened last February. Global equity markets had completely failed to discount the fact that the coronavirus was a real thing. It only took a few days. This is why I believe traders should operate in two modes: survival and expansion. In survival, the downside risk is of utmost importance. Positions are smaller, risk limits are tighter and trades are more selective. In survival mode, the hatches are battened down and the goal is to survive and grow the account with minimal drawdowns.

When times are tough, survival mode gets you through the period with capital of both types intact. First of all, your physical capital grows and isn’t in decline. It can be tough watching trade after trade fail. Trading with bigger size and risk limits only increases this frustration, which in turn places pressure on us and induces us to do the wrong thing, such as chase losses or abandon our discipline.

Secondly, our psychological capital remains sufficient. Losing money hurts our trading account balance but losing too much money can also make us trigger-shy. It means we don’t size up on trades where the opportunity is higher, it can mean we avoid taking risks completely and ultimately it means we miss out because we can be too scared to get involved. All of this can spiral into further decline.

Survival mode

The advantage of survival mode is that when trades are plentiful and the market is frothy, we’re in the right position and headspace to be able to expand our account and take on more risks than usual. We focus on not losing money when the market is tough and we focus on making it when times are good. The key is to know which period the market is in and act accordingly.

Over the past year, you could take any placing and make money. Prior to Covid-19, placings would regularly struggle to achieve their desired amount and often see the price revised downwards due to lack of demand. There was little point taking a placing too because the price would always trade under the price.

However, over the past year, lots of new money has entered the market. People bored at home with disposable income they can’t spend have instead spent it on stocks. You could take placings knowing that much of the market either didn’t know or care what a placing was and they would push the price up. When Cellular Goods (CBX) came to the market, some broker platforms only listed the stock to deal for its clients after lunch, yet many were still buying. The stock hit a high of 28p but is now printing close to 6p.

Reversion to the mean?

I believe we’re now seeing a reversion to the mean and more normal trading sessions are now the reality. It’s been a great 18 months, but I believe it’s now time to start thinking about survival mode. MaxCyte (MXCT) is a company that I’ve traded in and out of over the past year. But it’s a company that I wished I’d spotted and held in early 2020. MaxCyte operates in the US healthcare sector and develops proprietary electroporation technology.

What this means, in layperson speak, is that it uses electricity to transport medical gene therapies into specific cells, which increases safety and efficacy.I am no expert in this field, which caused me to sell 4BaseBio (4BB) because I couldn’t understand what it actually did or the value in it. I was happy to take my 350 per cent profit – but now having seen the price rise since selling I do wonder if I should’ve been more patient in understanding what I own. MaxCyte grew revenues at 21 per cent in 2020 (albeit from a small base) and it boasts 89 per cent margins. Its systems are also used by all 10 of the world’s top pharmaceutical companies as well as 20 of the top 25.

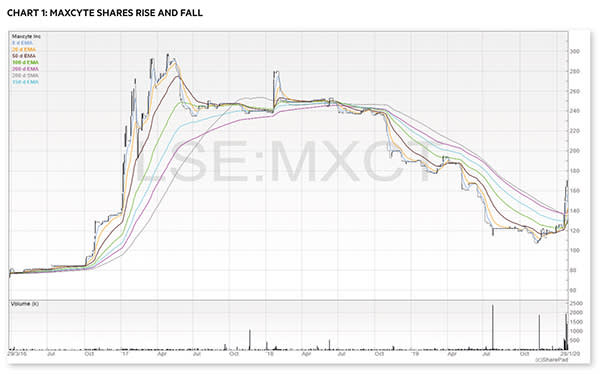

Chart 1 shows the first few years of the stock’s history as a listed company on the London Stock Exchange. The stock ran up quickly more than 200 per cent before sliding more than 50 per cent over the coming years. This volatility must’ve been painful for long-term holders, but when the stock failed to break out and started gently trickling down it was a warning sign to sell. Of course, at this point the market cap was much smaller and the stock illiquid. This is why buying material amounts in smaller companies is both an opportunity and a risk. With limited supply, demand can propel prices higher. But it’s a double edged sword.

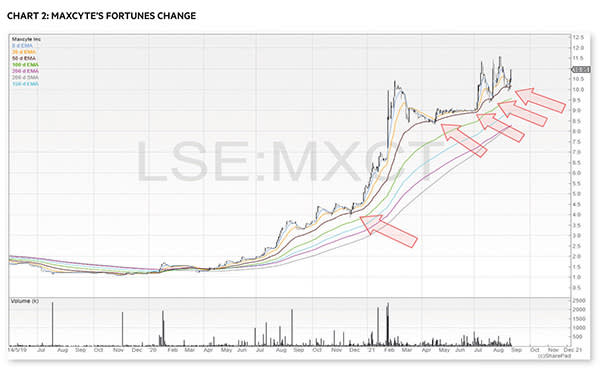

Chart 2 shows a change in the company’s fortunes.

The moving averages started to turn up and volume started increasing in the stock. We can see that the 50-day exponential moving average (black line) (EMA) provided support for the stock several times.

There are two ways to trade MaxCyte. You can either wait for a pullback and try to buy at or just below the 50 EMA, or wait for the stock to make a clean breakout at 1,150p.

On a final note, I’ve now moved to a bi-weekly column. My next article will be two weeks from now.

- You can trial some of Michael’s trading course at https://www.shiftingshares.com/online-stock-trading-course/

- Twitter: @shiftingshares

- New subscribers to SharePad can claim a free month of data with the code: Michael