- Good three-months returns from moment

- Lousy 12 months, though

- But great long-term performance

- 10 new long and short picks

If there is one message coming from my Blue Chip Momentum screen this quarter it is to buy 'quality' companies. Indeed, the line-up of 10 momentum longs includes four of the names that appeared in my High Quality Large Cap screen, which I updated in this column last week.

While screens are entirely unthinking, there is a decent case to be made for buying 'quality' at the moment. Markets have started to get jittery as investors fret that the unravelling of Chinese property giant Evergrande heralds a bout of major volatility that will spread well beyond the country’s lenders and real estate sector. Often quality plays are seen as a good place to hide out at such times of strife.

That said, the high valuations now commanded by many companies with 'quality' credentials brings its own risks. The average forecast next-12-month price/earnings (PE) ratio for this quarter's momentum long picks – made up of the best-performing 10 FTSE 100 shares of the three months to 15 September – stands at a heady 31 times. The average yield meanwhile is just 1.3 per cent. Details can be found in the tables at the end of this article.

The short picks – the worst-performing 10 FTSE 100 shares – are something of a polar opposite in terms of fundamentals. On average they command a derisory forecast PE of 12, with many on single-digit ratings.

While it is often tempting to see 'value' in low valuations, apparent cheapness also inevitably speaks of low-quality businesses with questionable prospects. The average yield of the shorts, meanwhile, stands at a very hearty 3.6 per cent. This average is boosted by the sky-high dividend yields of M&G (MNG) and Polymetal (POLY). These yields are so high, at 9.0 per cent and 7.2 per cent respectively, that it suggests investors do not see historical payouts as sustainable.

While nervousness may now be creeping into markets, on the whole the past three months were relatively benign. The results from the Blue Chip Momentum screen were also very well behaved. The longs did a bit better than the index and the shorts did a bit worse. If only things were always thus.

| 3-month performance to 15 September | |||

|---|---|---|---|

| LONGS | SHORTS | ||

| Name | Share price perf. (15 Jun - 15 Sep 2021) | Name | Share price perf. (15 Jun - 15 Sep 2021) |

| Spirax-Sarco Eng. | 20% | Int. Cons. Airlines | -30% |

| SEGRO | 14% | Ocado | -4.3% |

| Ashtead | 14% | Just Eat Takeaway.com | -2.4% |

| Halma | 6.5% | Rolls-Royce | -2.3% |

| Smurfit Kappa | 5.0% | Antofagasta | -0.2% |

| Entain | 4.9% | Taylor Wimpey | 0.0% |

| AstraZeneca | -2.6% | Renishaw | 0.3% |

| Intermediate Capital | -3.6% | Fresnillo | 1.2% |

| Royal Mail | -18% | Melrose | 4.5% |

| BT | -22% | Flutter Ent. | 8.5% |

| LONGS | 2.0% | SHORTS | -2.4% |

| FTSE 100 | -2.2% | FTSE 100 | -2.2% |

| Source: FactSet | |||

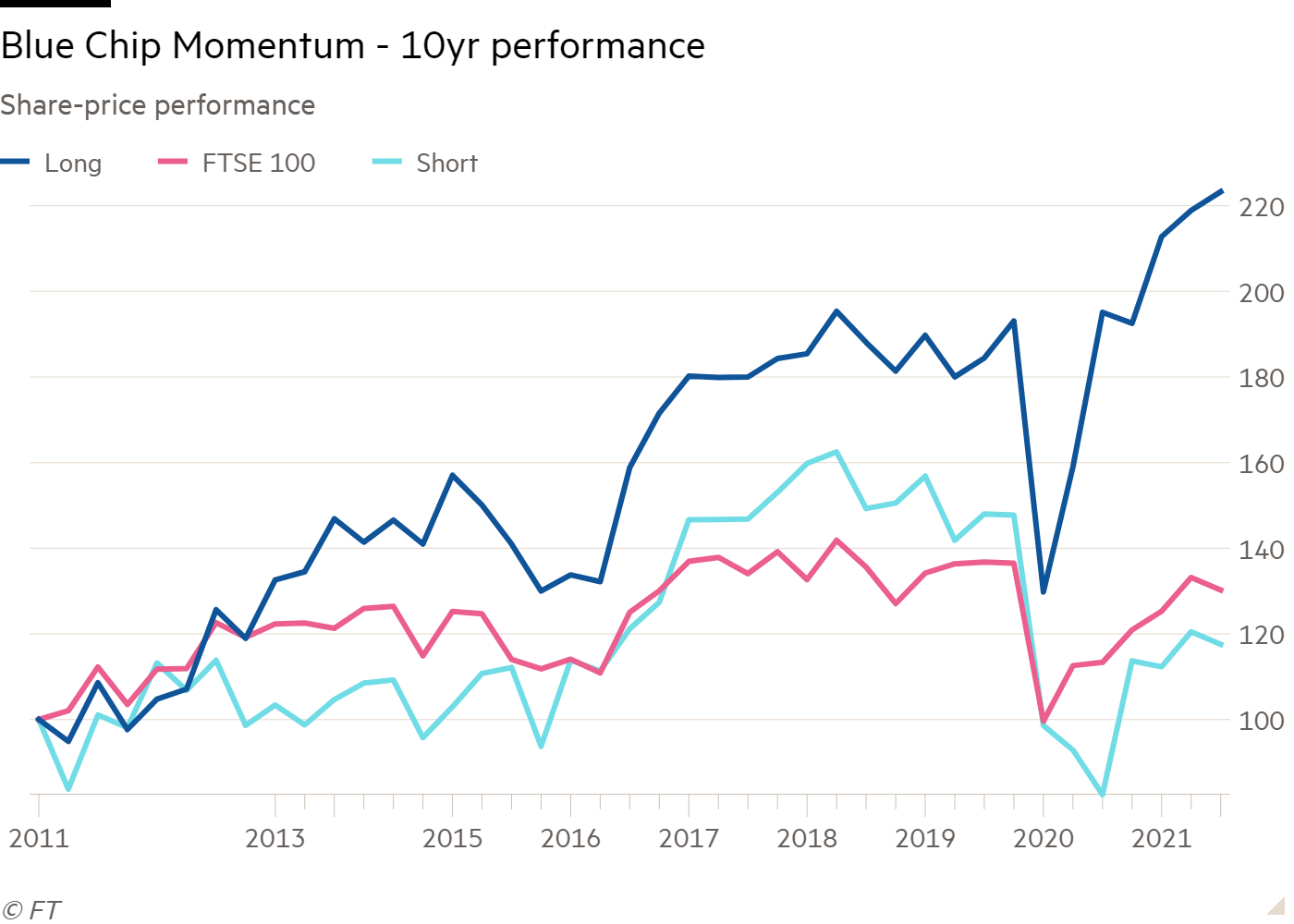

For the past year as a whole, the screen results have been anything but well-behaved. The sharp rally in the price of the market’s most downtrodden shares when vaccine breakthroughs were announced last November means the shorts have substantially outperformed the FTSE 100 over the past 12 months (see table). The longs have underperformed a little over that period. However, momentum is only ever meant to work over prolonged periods and over multi-year timeframes the results from the strategy continue to look impressive.

| Share price performance | |||

|---|---|---|---|

| Long | Short | FTSE 100 | |

| Since June 2007 | 198% | -8.7% | 2.4% |

| 10-yr | 123% | 18% | 30% |

| 5-yr | 41% | -3.0% | 4.2% |

| 3-yr | 19% | -21% | -3.9% |

| 1-yr | 14% | 43% | 15% |

| Source: Thomson Datastream, S&P CapitalIQ, FactSet | |||

Even more than with my other screens, the Blue Chip Momentum screen is of interest not as an actionable strategy but as a source of ideas and simply for the fun of observing the incredibly powerful and well-documented market force that is 'momentum' work in real time. And unlike the other screens run in this column, the performance figures in the chart and tables take no account of either notional dealing costs or dividends. In particular, the cost of implementing high-turnover momentum strategies is often regarded as a barrier to their real-world implementation. Still, the results from the screen since I began following it do help underline why momentum should be an important consideration for most investors.

Full details of the 10 long and short picks for the coming three months can be found in the table at the end of this article and I have taken a closer look at the top three momentum stocks (those showing the biggest share price gains over the past three months) for the coming quarter.

Croda

Croda (CRDA) has come out as top of the pops from the FTSE 100 for share price performance over the past three months. The run was helped by a knockout set of half-year results in mid-July. It wasn’t just that the numbers were strong and that the group said it expected to smash forecasts for the full year. Trading in the six months also helps provide vindication of the group’s long-term strategy.

The Yorkshire-based company has earmarked its two least profitable and most cyclical divisions for sale – industrial chemicals and performance technologies, which account for about 15 per cent of underlying earnings. This will give it a clearer focus on more profitable, growth markets. It is seeking to build and support its competitive advantage in these areas through product innovation, canny bolt-on acquisitions and university partnerships.

Of particular note during the first half was the performance of its health division. Broker Liberum expects this business to generate about a quarter of profits for the year. That excludes slower-growth crop activities, which are bundled into the company’s official divisional mix. A key focus for the health business is lipids. These are vital raw materials in mRNA-based treatments and Croda has profited during the pandemic from a contract with Pfizer to supply lipids for its mRNA vaccine developed with BioNTech.

But more significantly, mRNA is seen as a potentially revolutionary technology in drug development. Many drug companies are now working to develop a multitude of treatments based on this approach to gene-editing. What’s more, close customer relationships and the relatively low cost of lipids as a percentage of overall production means lipid sales could potentially prove very profitable for Croda as well as a source of significant growth. The division is also benefiting from the £137m acquisition of mRNA lipid specialist Avanti last year which has performed “significantly ahead” of expectations.

Other business areas are also performing strongly. In particular, Croda’s largest business, personal care, which accounts for nearly half of its profits, looks well-placed to prosper from its entry into the fast-growing fragrance market thanks to the acquisition of a company called Iberchem last year.

The shares don’t look cheap, but for the growth and quality on offer one wouldn’t expect them to.

JD Sports Fashion

There were always grounds to hope that JD Sports Fashion (JD.) may do better than other UK retailers in its attempt to crack the US market. Earlier this month, investors saw evidence the American dream may be turning into a reality.

A key source of JD’s competitive advantage lies in the strength of its relationship with major brands, such as Nike. Over the past decade, powerful brand owners have focused on selling their top-end products exclusively through a small and select group of retailers. JD is one of the chosen few.

With its acquisition of US chain First Line in 2018 and then Shoe Palace at the end of last year, the hope was that JD would be able to use the patronage of big brand owners to replicate its success in the UK and Europe stateside. That includes its track record of boosting gross margins by selling more apparel and accessories alongside fashionable trainers.

If the first six months of the current financial year are anything to go by, the JD magic is working with the kids of America. This in turn should keep its brand overlords happy. With stimulus cheques fuelling demand, First Line, which has now been under JD’s ownership for three years, reported a 130 per cent first-half profit surge.

Trading back in the UK is also strong. Customers have flocked back to its shops and online orders are storming ahead.

Overall, and helped by comparisons with pandemic trading, JD reported a seven-fold increase in first-half profit before tax to £440m. And while performance should moderate in the second half as stimulus-cheque bounty runs dry, the company said it still expects full-year pre-tax profits of at least £750m. Broker Peel Hunt described the one-third upgrade it made to earnings forecasts in response to the half-year results as “verging on the embarrassing”.

Rumours have also surfaced that JD could bid for online fast fashion group Missguided. This would represent an intriguing strategic shift for the group into a more mainstream fashion market.

There was also some bad news over the past three months. It looks as though the competition regulator may force JD to sell the Footasylum chain, which it acquired for £90m in 2019. Footasylum itself was founded by one of JD’s co-founders.

But this bad news was not enough to overshadow the exceptional first-half performance and the prospect of success in the US.

Rentokil Initial

Covid brought mixed fortunes for international pest control and hygiene group Rentokil (RTO). It was a major beneficiary in the early stages of the pandemic of the belief that the virus could be caught from surfaces. Trading at its disinfection business boomed. But as consensus has grown that the key contagion risk is airborne, disinfection revenues have rapidly dropped off. Indeed, having generated £76m of sales in the first quarter of the year, the business is expected to achieve less than half that in the final three quarters.

However, the interim results at the end of July pointed to the decline in disinfection revenue coinciding with a recovery across other divisions. Its largest geographic market, North America, staged a particularly strong bounce-back. So too did its largest business division, pest control.

Overall, first-half ongoing sales rose 18.3 per cent to £1.46 bn, 11.7 per cent of which was organic growth. The company’s relatively fixed cost base causes profits to be particularly sensitive to increased turnover. Accordingly, underlying pre-tax profit leaped 60 per cent to £194m.

A key plank in the company’s growth strategy is the acquisition of small competitors. There was strong progress here, too. Rentokil bought no fewer than 24 businesses in the first half and parted with £261m. In total, these deals represent £148m of annual turnover.

The strong dealflow prompted management to increase its guidance for full-year acquisition spend from £400m-£450m to £500m. The company also said profits were likely to be £10m-£15m above brokers’ expectations.

The recovery in key markets is very welcome. It also helps put investors’ focus back on Rentokil’s long-term growth story. This centres on several well-entrenched structural trends including climate change (more pests), urbanisation and the growth of the middle class in developing countries.

| Blue-chip longs | ||||||

|---|---|---|---|---|---|---|

| Name | TIDM | Price | Market Cap | 3mth Mom* | NTM PE | DY |

| Croda Int. | CRDA | 9,072p | £12.7bn | 26.5% | 36 | 1.0% |

| JD Sports Fashion | JD | 1,142p | £11.8bn | 25.6% | 23 | 0.1% |

| Rentokil Initial | RTO | 597p | £11.1bn | 21.0% | 33 | 1.3% |

| Spirax-Sarco Eng. | SPX | 16,230p | £12.0bn | 20.5% | 48 | 0.8% |

| Experian | EXPN | 3,299p | £30.4bn | 20.2% | 36 | 1.0% |

| Avast | AVST | 580p | £6.0bn | 19.6% | 21 | 2.0% |

| SEGRO | SGRO | 1,258p | £15.1bn | 14.5% | 41 | 1.8% |

| Ashtead | AHT | 5,854p | £26.2bn | 14.4% | 28 | 0.7% |

| Rightmove | RMV | 735p | £6.3bn | 13.9% | 31 | 1.0% |

| J Sainsbury | SBRY | 286p | £6.7bn | 12.6% | 13 | 3.7% |

| AVERAGE | - | - | - | 18.9% | 31 | 1.3% |

| Source: FactSet. *to 15 Sep | ||||||

BLUE CHIP SHORTS

| Blue-chip shorts | ||||||

|---|---|---|---|---|---|---|

| Name | TIDM | Price | Market Cap | 3mth Mom* | NTM PE | DY |

| Int. Cons. Airlines | IAG | 137p | £6.8bn | -29.6% | - | - |

| Associated British Foods | ABF | 1,853p | £14.7bn | -21.7% | 13 | 0.3% |

| BT | BT.A | 155p | £15.4bn | -21.5% | 8 | - |

| Burberry | BRBY | 1,780p | £7.2bn | -20.8% | 20 | 2.4% |

| Polymetal Int. | POLY | 1,345p | £6.4bn | -18.3% | 8 | 7.2% |

| Royal Mail | RMG | 485p | £4.8bn | -18.0% | 8 | 2.1% |

| M&G | MNG | 205p | £5.3bn | -16.3% | 9 | 9.0% |

| Pearson | PSON | 726p | £5.5bn | -15.8% | 19 | 2.7% |

| ITV | ITV | 109p | £4.4bn | -15.4% | 8 | 3.0% |

| Smith & Nephew | SN | 1,321p | £11.6bn | -14.8% | 18 | 2.0% |

| AVERAGE | - | - | - | -19.7% | 12 | 3.6% |

| Source: FactSet. *to 15 Sep | ||||||