- Richard wants to grow his own and his wife's investments to a value of £2m in 10 years' time

- His desire for a 9 per cent annual return is unrealistic

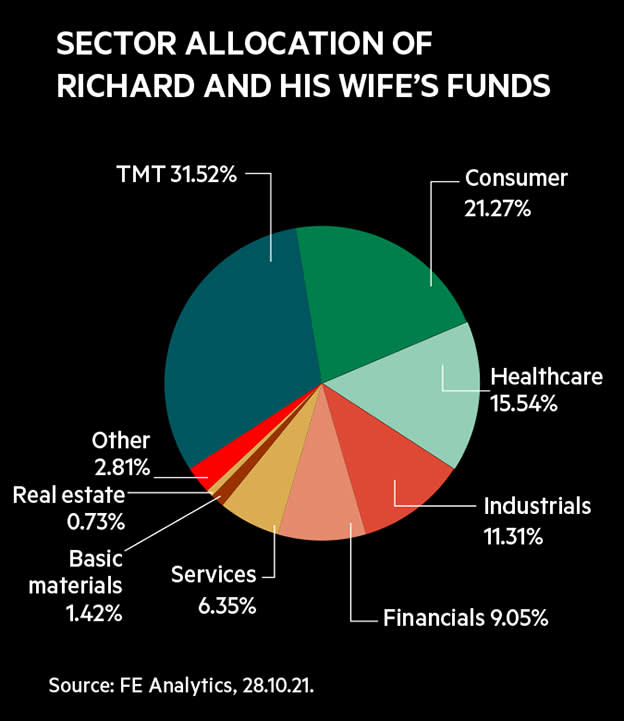

- Their investments are very focused on funds which invest via a growth style so he should add some value funds

Isas, Sipps and general investment accounts invested in funds, pensions, cash, residential property.

Retire and grow investments to value of £2m in 10 years, 9% a year investment return, draw 4%-5% a year from investments in retirement.

Richard is age 47 and earns £205,000 a year. This includes his employer’s contribution to his pension, which he takes as cash due to problems with the pensions annual and lifetime allowances. His wife does not have any income.

They have three children, aged 10 and twins aged seven.

Their home is worth about £1.15m and has a mortgage of £420,000.

“I hope to retire in 10 years’ time,” says Richard. “My defined benefit (DB) pensions should pay out around £25,000 to £30,000 a year, depending on whether I take them early, and cover essential spending. And I plan to draw 4 per cent to 5 per cent a year from our investments to fund luxuries such as holidays.

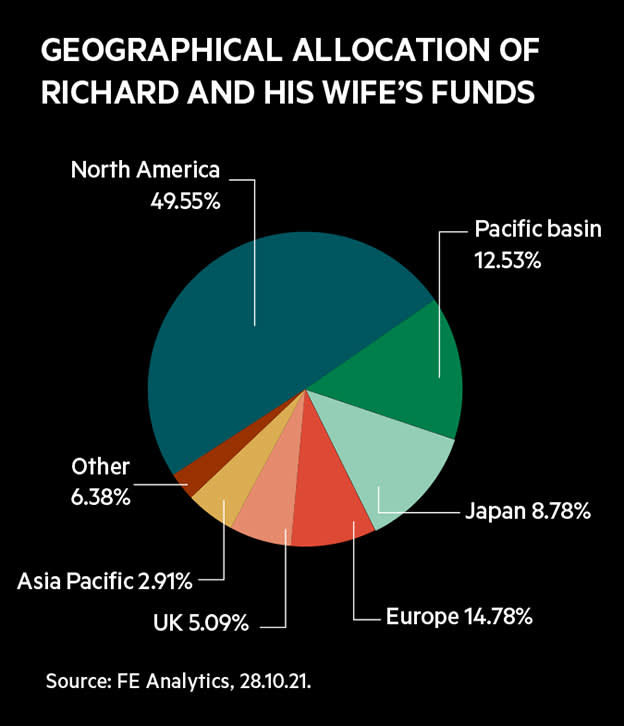

"So I would like our investments to make a return of 9 per cent a year and have a value of about £2m in 10 years. Around £183,000 of these are in my self invested personal pension (Sipp), £12,000 in my wife’s Sipp, £197,000 in general investment accounts held equally by myself and my wife, and individual savings accounts (Isas).

“I use both my own and my wife’s Isa allowances each year, and invest £3,600 a year into her Sipp. I also put £100 a month into each of my children’s junior Isas.

“I am tolerant of risk and over the seven years that I have been investing have put all of my investments into equities. I am prepared to see the value of our investments fall by 50 per cent. My focus is on maximising returns over the long term – I’m relaxed about short-term fluctuations.

"That said, when I retire I will hold cash worth around three years' of our expenditure so that I do not have to draw from investments when markets are down. But I will keep all of our invested money in equities.

"I don’t think that bonds are an investment in the future of companies or helpful as a portfolio diversifier. I also don’t like gold as it seems to do nothing, and I view holding it more as speculating than investing.

"We have cash savings worth around £50,000, but I expect to run this down over the next few years to fund family holidays as I'm not getting any bonuses due to the pandemic.

"I don’t invest in direct share holdings because I am not interested in looking through balance sheets and don’t think I could do better than a fund manager. I used to hold around 20 funds but reduced them to nine after a Portfolio Clinic review in 2019 (Build up cash and cut your number of holdings, IC, 11.01.19). The commentators said that I was running something which would produce similar returns to a tracker fund but with the higher fees of active funds. I’m also not a fan of rebalancing and prefer to run my winners. I aim to have a low turnover and not change more than two funds a year.

"The last time I traded was about a year ago when I sold Federated Hermes Global Emerging Markets Equity (IE00B3DJ5K90) and CFP SDL UK Buffetology (GB00BF0LDZ31), and bought LF Blue Whale Growth (GB00BD6PG563) and JPM Emerging Markets (GB00B1YX4S73).

"I am watching Baillie Gifford Shin Nippon (BGS) closely because it is the weakest-performing fund I hold, although it has done extremely well in the past. It is a similar situation with JPM Emerging Markets (GB00B1YX4S73) which I am also keeping an eye on.

“I have been struck by Investors' Chronicle economist Chris Dillow’s comments about defensive and momentum stocks being consistent ways to beat the market. So I am considering switching our entire portfolio into a global momentum exchange traded fund (ETF) such as Xtrackers MSCI World Momentum UCITS ETF (XDEM). This has made a higher annualised return than our investments' overall return over the past five years. Doing this would also have the benefit of reducing the fees I pay for the funds and investment platform I use."

| Richard and his wife's total portfolio | ||

|---|---|---|

| Holding | Value (£) | % of portfolio |

| Scottish Mortgage Investment Trust (SMT) | 115,581 | 14.93 |

| Rathbone Global Opportunities (GB00BH0P2M97) | 105,301 | 13.6 |

| JPM Emerging Markets (GB00B1YX4S73) | 90,346 | 11.67 |

| Baillie Gifford Global Discovery (GB0006059330) | 87,271 | 11.27 |

| Fundsmith Equity (GB00B41YBW71) | 74,822 | 9.66 |

| ASI Global Smaller Companies (GB00BBX46522) | 72,311 | 9.34 |

| Fidelity Global Special Situations (GB00B8HT7153) | 63,346 | 8.18 |

| LF Blue Whale Growth (GB00BD6PG563) | 60,120 | 7.77 |

| Baillie Gifford Shin Nippon (BGS) | 55,126 | 7.12 |

| Cash | 50,000 | 6.46 |

| Total | 774,224 | |

NONE OF THE COMMENTARY BELOW SHOULD BE REGARDED AS ADVICE. IT IS GENERAL INFORMATION BASED ON A SNAPSHOT OF THESE INVESTORS' CIRCUMSTANCES.

Chris Dillow, Investors' Chronicle's economist, says:

Although you own more actively managed funds than I would, you are doing many things right.

You are using your Isa allowances. These are a legitimate tax break and mitigate the risk that pensions will become more heavily taxed, for example via further cuts in the lifetime allowance.

Although it isn't a good idea for many investors to be fully invested in equities, you have a justification for doing this. Your defined benefit pensions are, in effect, a massive investment in a safe asset which means that you can take more risks with your other investments than investors without this kind of pension could.

I also support your running winners as this is a form of momentum investing. A fund which performs well, by definition, holds momentum stocks. So holding onto the fund means holding momentum stocks – unless that fund is cutting its winners.

There’s also a case for being sceptical about bonds. If we get serious interest rate rises in the UK and US, these would sell off – very possibly at the same time that equities fall for fear of the damage done by higher rates. In such a scenario, bonds would not be a good diversifier. I suspect that such a scenario is a low probability. But it cannot be ruled out and would result in sufficiently serious losses to make it necessary to guard against it.

However, your return expectation of 9 per cent a year is too high – even including inflation. It might be feasible for a short while if you buy at the bottom of the market. But you are not doing this, in fact, quite the opposite. Several of your holdings are funds which invest in richly valued US big tech companies.

The issues here are trickier than merely the problem of duplicate holdings. Such stocks and your funds might be sensitive to rising bond yields. These naturally increase the discount rate investors apply to future cash flows, which devalues stocks offering lots of these. This wouldn’t be a problem if higher yields were accompanied by increased appetite for risk or optimism about growth. But it would be if they are seen as simply a result of tighter monetary policy.

Fashions also change. For years, investors have sought monopoly-type stocks with entrenched market positions such as Microsoft (US:MSFT), Apple (US:AAPL) and Facebook (US:FB). But one day they might decide that these are more than fully valued. Momentum can cause stocks to become over priced and when sentiment changes even good companies get dragged down. For example, in the 2000-2002 tech crash Apple and Amazon (US:AMZN) fell more than 70 per cent.

Nobody knows if or when this change will happen. But you must be on guard against it so need some kind of selling rule.

Running winners is good, but the counterpart of that is to cut losers. There is lots of evidence that selling when prices fall below their 10-month average protects against really nasty bear markets. You don’t necessarily need to follow that particular rule but should have some kind of exit strategy.

Alex Brandreth, chief investment officer at Luna Investment Management, says:

ASI Global Smaller Companies (GB00BBX46522), Baillie Gifford Global Discovery (GB0006059330) and Baillie Gifford Shin Nippon, which account for over a quarter of your portfolio, are biased to smaller companies. Is this a deliberate preference? We often find that portfolios have more significant smaller companies exposure than people expect because fund managers tend to go fishing further down the market cap spectrum to add alpha to performance. These funds have had a good bounce over the past 18 months so it might be a sensible time to take profits.

The funds you hold are largely global and have a growth bias. So I suggest looking to combine these with more value orientated funds. You could do this by adding a global fund which invests via a value style or by diversifying geographically with a UK value fund. We are seeing a lot of opportunities in the UK at the moment. We favour a handful of global and UK value funds within the portfolios we run.

Having a growth bias in portfolios is now is very common. This is because over the past 10 years this style of investing has performed very strongly, and investors often have a recency bias so expect that future performance will be similar to recent historical performance.

However, value investing has been a 'graveyard' for fund managers over the past 10 years, leaving valuations cheaper and causing one of the biggest valuation differentials between this and growth style investing. The Covid-19 pandemic has polarised this situation further.

Adding some value funds alongside your growth holdings would make your portfolios a lot more balanced. You are long-term equity investors so can afford to wait for change to come through.

The main argument in favour of value is the valuation differential with growth, which is at one of its widest points. Short term momentum also appears to be favouring value. Central banks are starting to change direction, and some expect an interest rate rise in the UK or the Federal Reserve to taper in the US. This is pushing up bond yields so is a short term positive for financials stocks and other more value orientated sectors.

Value orientated companies are also more exposed to economic reopening, which has already happened in the UK and is starting to happen globally. 2021 has been a strong year for economic growth and it looks likely that this momentum can continue into 2022. So having exposure to value orientated businesses that are bouncing back from depressed valuations looks like an attractive entry point.

The UK also appears to be at an attractive entry point. The UK equity market and sterling have both been unloved since the vote for Brexit in June 2016 – a date which will long live in our memory. Since then, the UK has been going through a long, torturous divorce. It has been an easy decision for overseas investors not to invest in the UK because of the uncertainty that Brexit created.

However, in 2021 – despite ongoing teething issues – Brexit has now happened. But investors' minds are plagued by the events of the past five years and it will take time for these memories to be replaced with better thoughts.

The valuation discount that the UK trades at is illustrated by the fact that global fund managers are returning to the UK equity market and have gone overweight in it for the first time since 2014. At time of writing, this market was trading at a 40 per cent discount to global peers – the greatest in 30 years.

It looks like a good time to review your allocation to value and add some specific exposure to the UK equity market which looks cheap relative to other global stock markets. This is starting to be noticed by overseas investors and there has been an increase in merger and acquisition activity.

Also, activist investors are building significant stakes in large UK companies to unlock shareholder value.