- Bill wants to reduce his IHT liability and cut the number of investments he holds

- It could be worth writing off loans he has made to his children

- Not having more than one fund covering the same area could help to cut his number of holdings

Sipp and Isas invested in shares and funds, cash, residential property.

Reduce IHT liability, mitigate pensions lifetime allowance breach, reduce number of investment holdings, invest in green assets.

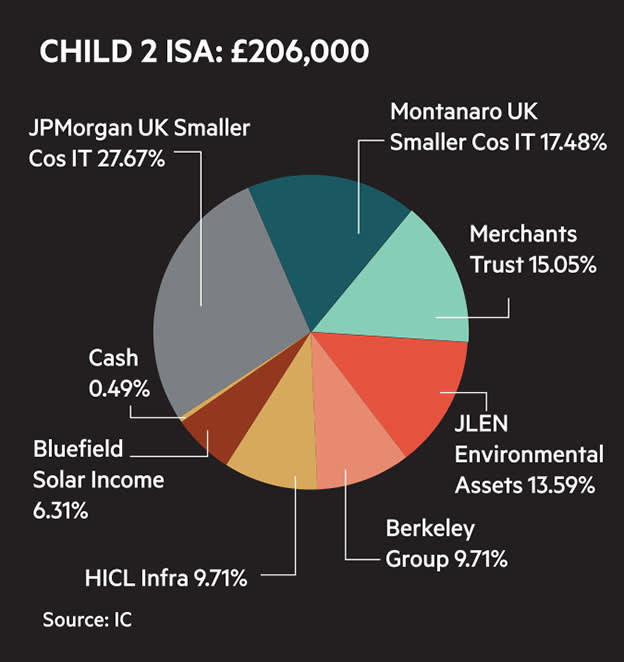

Bill is age 69 and retired. He receives the full state pension, and although his investments generate an income of about £50,000 a year he only takes about half of this. He has made interest free loans to his children of £660,000 in total to help them buy properties. They repay capital each month of approximately £2,200. He also funds and manages Isas on behalf of his children (see charts).

Bill’s home is worth about £500,000 and mortgage free.

“Although I will travel more post-Covid, I envisage only using a fraction of the cash that is generated each month by my investments,” says Bill. “Maybe my children shouldn't pay back the loans I made to them, to reduce my estate’s inheritance tax (IHT) liability. But I think that making a monthly repayment to me is a good discipline for them. That said, I want to minimise my estate’s IHT liability so need to consider other options for doing this, such as gifting.

"I take a level of income that ensures that I pay basic rate income tax. If I need further money I draw it from my individual savings accounts (Isas). Unless markets collapse, I expect that I will have to pay the 25 per cent lifetime allowance charge on my self-invested personal pension (Sipp) at age 75, as it has a value greater than the £1,073,100 limit. But I have not yet drawn all of the 25 per cent tax-free cash entitlement from my pension.

"I would also like to reduce my number of holdings so that my investment portfolios are more manageable. I spent a lot of time looking after my late wife in her final years so was not able to spend as much time as was probably necessary managing the investments. And I was able to live comfortably with the way things were so it wasn’t a high priority.

"I employed an impressive independent financial adviser (IFA) to help me set up my Sipp. But when he retired I couldn’t find another IFA who I felt comfortable working with. So, as I worked in the finance sector and always had an interest in shares, I managed the investments myself, largely guided by tips and recommendations. In particular, I emulated Investors Chronicle columnist John Baron’s ‘Autumn portfolio' with some of my money. So my portfolio is the initial Sipp plus a number of tips and recommendations from over the years.

"I would also like to ‘green’ my portfolio when I rationalise it."

| Bill's total portfolio | ||

|---|---|---|

| Holding | Value (£) | % of the portfolio |

| Cash | 254,000 | 7.91 |

| Stewart Investors Asia Pacific Sustainability (GB00B0TY6V50) | 232000 | 7.23 |

| Monks Investment Trust (MNKS) | 185000 | 5.76 |

| Invesco Perpetual UK Smaller Companies Investment Trust (IPU) | 142000 | 4.42 |

| iShares Core FTSE 100 UCITS ETF (CUKX) | 122000 | 3.80 |

| JPMorgan Chase (US:JPM) | 109000 | 3.40 |

| F&C Investment Trust (FCIT) | 106000 | 3.30 |

| Henderson Far East Income (HFEL) | 93000 | 2.90 |

| HICL Infrastructure (HICL) | 89000 | 2.77 |

| Invesco Bond Income Plus (BIPS) | 89000 | 2.77 |

| Prudential (PRU) | 81000 | 2.52 |

| Fidelity China Special Situations (FCSS) | 73000 | 2.27 |

| Unilever (ULVR) | 73000 | 2.27 |

| Regional REIT (RGL) | 66000 | 2.06 |

| Blackrock World Mining Trust (BRWM) | 65000 | 2.02 |

| Witan Investment Trust (WTAN) | 61000 | 1.90 |

| Edinburgh Worldwide Investment Trust (EWI) | 60000 | 1.87 |

| BB Healthcare Trust (BBH) | 57000 | 1.78 |

| JPMorgan Japan Small Cap Growth & Income (JSGI) | 56000 | 1.74 |

| Aviva (AV.) | 55000 | 1.71 |

| Dunedin Income Growth Investment Trust (DIG) | 54000 | 1.68 |

| Legal & General (LGEN) | 54000 | 1.68 |

| Temple Bar Investment Trust (TMPL) | 54000 | 1.68 |

| JPMorgan Emerging Markets Investment Trust (JMG) | 53000 | 1.65 |

| Bluefield Solar Income Fund (BSIF) | 51000 | 1.59 |

| Merchants Trust (MRCH) | 51000 | 1.59 |

| Utilico Emerging Markets Trust (UEM) | 46000 | 1.43 |

| Finsbury Growth & Income Trust (FGT) | 45000 | 1.40 |

| Personal Assets Trust (PNL) | 45000 | 1.40 |

| CQS New City High Yield Fund (NCYF) | 44000 | 1.37 |

| Edinburgh Investment Trust (EDIN) | 44000 | 1.37 |

| Henderson Diversified Income Trust (HDIV) | 44000 | 1.37 |

| North American Income Trust (NAIT) | 41000 | 1.28 |

| SEGRO (SGRO) | 40000 | 1.25 |

| City of London Investment Trust (CTY) | 39000 | 1.21 |

| Compass (CPG) | 35000 | 1.09 |

| UK Commercial Property REIT (UKCM) | 35000 | 1.09 |

| Standard Life Investments Property Income Trust (SLI) | 33000 | 1.03 |

| Phoenix (PHNX) | 32000 | 1.00 |

| 3i (III) | 31000 | 0.97 |

| National Grid (NG.) | 31000 | 0.97 |

| CQS Natural Resources Growth and Income (CYN) | 30000 | 0.93 |

| Hill & Smith (HILS) | 30000 | 0.93 |

| Bellway (BWY) | 29000 | 0.90 |

| Murray International Trust (MYI) | 26000 | 0.81 |

| AEW UK Reit (AEWU) | 23,000 | 0.72 |

| BMO Real Estate Investments (BREI) | 23000 | 0.72 |

| GCP Infrastructure Investments (GCP) | 21000 | 0.65 |

| Templeton Emerging Markets Investment Trust (TEM) | 21000 | 0.65 |

| Schroder European Real Estate Investment Trust (SERE) | 20000 | 0.62 |

| Tesco (TSCO) | 17000 | 0.53 |

| Total | 3,210,000 | |

NONE OF THE COMMENTARY BELOW SHOULD BE REGARDED AS ADVICE. IT IS GENERAL INFORMATION BASED ON A SNAPSHOT OF THIS INVESTOR'S CIRCUMSTANCES.

Chris Dillow, Investors' Chronicle's economist, says:

You want to rationalise your portfolios. One way to do this is to change your perspective.

Firstly, you can change from a short-term to a long-term perspective. From a short-term perspective, there will always be many shares and funds that seem attractive because hundreds of them beat the market each year and not all tips are wrong. But what’s true over the short term, which can be as long as a few years, is not true over longer periods. Hendrik Bessembinder, professor of competitive business at Arizona State University WP Carey School of Business, has shown that most shares not only underperform the market over their lifetimes, but cash as well. He shows that the long-term rise in stock markets is all due to the 1 per cent of shares that deliver stellar long-term performance. Hundreds of stocks have periods in the sun, which can last quite a while, but they then go into decline.

From this perspective, you should simplify, because the chances of anybody spotting that 1 per cent of great performers is small. But a tracker fund guarantees some exposure to them.

Secondly, you can change perspective from 'bottom up' to 'top down'. From a bottom-up perspective there are hundreds of attractive short-term investments. From a top-down point of view there are not. Conventional economic theory says that you need only two assets – a global equity tracker fund and cash.

So you shouldn’t be embarrassed because you have so many holdings – it’s the natural result of having been an active investor for years with a particular and very common perspective on the market.

When considering how to simplify your portfolios, however, there are some complications. Momentum is a significant force, so run your winners and cut your losers. Selling any asset that’s fallen below its 10-month average price isn’t always the right course of action – you might be selling on a dip. But doing this protects against the big long-term falls that really destroy wealth. So I would start my simplification with this.

Secondly, history and theory tell us that defensives do better than they should over the long run: this is consistent with Bessembinder’s research because particular stocks’ defensiveness comes and goes. And you have nice defensive exposure via stocks such as Unilever (ULVR) and National Grid (NG.), and funds such as Dunedin Income Growth Investment Trust (DIG) and Finsbury Growth & Income Trust (FGT).

Thirdly, listed stocks are not the limit of the investment universe. It’s possible that a lot of future growth will come from unlisted companies so you should continue to hold private equity funds.

As for going green, I suspect that at this juncture it might be wise on narrow investment grounds. Growth in the Chinese money stock has slowed sharply this year, which has in the past been a lead indicator of falling commodity prices, and a reason to dump polluting stocks such as oil and miners. And buying green companies – perhaps via private equity funds – might be a way of getting into a bubble at the very early stages. Sometimes, morality and self-interest really do coincide.

Rosie Hooper, chartered financial planner at Quilter, says:

You have done a sterling job of setting yourself up financially, but could do with help to structure your finances for the future, particularly as [your heirs] could face a hefty IHT bill. Look again into finding an adviser that’s right for you as there are plenty of good ones out there.

A good start would be to conduct a cash-flow analysis. This is the cornerstone of financial planning, and would you to figure out how much money you have which will never be burnt through, even if you have to pay for expensive care later in life.

This would also help you to decide whether you need your children to pay back the £660,000 you lent them, or whether the loans could be written off and treated as gifts instead. If you do write off the loans, it will reduce the amount of money going back into your estate by £2,200 each month and reduce your heirs potential IHT bill by £264,000 – 40 per cent of £660,000. This is assuming that you survive for another seven years from the date at which the loans become gifts.

The last thing you want to pass onto your children is a financial headache, so focus on simplifying your estate so that you can plan for the future in a tax-efficient way. This should be done prior to a major shake-up of your assets. Also, before you under take a major rationalisation of your assets, make sure that they are held in tax-efficient structures to prevent you incurring capital gains and other tax liabilities.”

Poppy Fox, investment manager at Quilter Cheviot, says:

Have a look at your asset allocation. Your investment portfolios have an exposure to equities of around 66 per cent, which is an acceptable allocation for a medium risk balanced portfolio. But they have a very low exposure of around 6 per cent to the US and much higher exposure to the UK of around 35 per cent. So consider rebalancing your portfolios to increase their geographical diversification.

You have around 60 holdings across the portfolios which isn’t necessary excessive, but is certainly a large amount for one person to keep track of. So some consolidation may be necessary, particularly where you hold a few funds that target similar sectors or themes. For example, you hold both Utilico Emerging Markets Trust (UEM) and JPMorgan Emerging Markets Investment Trust (JMG). Also be aware of doubling up on holdings across your various portfolios and ending up with large overall holding sizes. A case in question is Stewart Investors Asia Pacific Sustainability (GB00B0TY6V50) which accounts for over 7 per cent of your combined portfolios, so increases the risk of adverse market movements in various portfolios.

James Norrington, associate editor at Investors Chronicle, says:

Don’t be hard on yourself. With a mortgage-free home, a £1.8m Sipp, Isas and plenty of money to help your children onto the property ladder, you’ve achieved an impressive set of financial goals.

Have you applied for individual or fixed lifetime allowance protection for your Sipp? Maybe you did this years ago when higher limits were available but, if not, it could still give you a higher lifetime allowance of up to £1.25m for when you’re 75 and tested against the lifetime allowance. Taking the excess amount over the limit as income attracts a charge of 25 per cent which is lower than the 55 per cent charge for taking it as capital.

For IHT purposes, it would be better to gift your children the money for their homes rather than them paying back the loans. You make a valid point about instilling financial discipline, but why not get your children to make a minimum saving into their Isas or Sipps each year instead? Although that’s based on trust and is unenforceable, the alternative isn’t great. Forty per cent of anything within an estate not covered by IHT allowances goes to the government.

How you manage your portfolio depends on a number of factors. It has become unwieldy and, in its current form, would take a huge amount of time to stay on top of.

Start by writing down what your objectives are, and think about how you’re using your Sipp and Isas.

In your Sipp, there is added incentive to reduce risk due to the tax position. A professional investor wouldn’t do this because they are paid to have a portfolio invested. But in your case, there is no reason not to have 20 or 30 per cent in cash. Inflation will erode its value, but if you instead hold riskier investments any upside on them will be reduced by the charges on the amount in excess of the lifetime allowance. So instead of paying this charge on your reward for taking risk, why not pay an inflation charge as your insurance premium in case markets sell off violently?

With the rest of the Sipp, keep your asset allocation simple and investment charges to a minimum. There is no point holding expensive funds which invest in high risk, high return asset classes such as private equity or emerging markets equities given where your Sipp is.

If 30 per cent of your Sipp was in cash, you could hold another 20 per cent of it in shorter duration strategic bond funds and inflation-linked government bond funds. Shorter duration bonds have less price sensitivity to interest rates. And although longer duration index-linked bond funds could lose capital value suddenly if interest rates rise, over the longer term they help to dilute the impact inflation will have. This would be especially useful if a large chunk of your Sipp is allocated to cash.

The remaining 50 per cent of the Sipp could be in riskier assets such as equities, but stick to blue chips and defensives. Listed infrastructure investments are to a certain extent a hybrid asset class which could benefit from the transition to a greener future. Healthcare is also a sector which has secular tailwinds behind it. These are good equity themes that you may want to beef up your allocation to, but you would achieve the best diversification by putting the lion’s share of the equity allocation into a cheap global tracker fund.

This doesn’t mean that you shouldn’t invest in private equity, emerging markets, real estate, small-cap equities or any other things you are interested in. But you should hold these investments in your Isas so that they will be tax-free, enabling you to get the full reward for taking on their risks.

Think of your wealth holistically and, if you enjoy investing, maybe even have a little 'fun pot' of money for taking punts on shares in a few exciting companies.