A lot has happened in the past two weeks. The invasion of Ukraine looked likely, then unrest in Kazakhstan diverted the world’s attention, and now an invasion is looking likely again. In that period, the unrest spiked the price of uranium. Kazakhstan was responsible for 41 percent of the world’s supply in 2020. Brent also now trades above $87, a level not seen since October 2014.

Despite the calls for green energy, the price of oil clearly incentivises companies to supply it. And whilst other companies look to boost their green credentials, such as Anglo American (AAL) giving Thungela Resources (TGA) back to shareholders, others are happy to hold dirty fossil fuel assets and utilise them as much as possible.

The funny thing about divestment, though, is that a company becoming greener doesn’t necessarily make the world greener. Just because you dump your waste somewhere else doesn’t mean it ceases to exist. Now if we’re talking virtue signalling, then yes, offloading the trash on somebody else’s doorstep works fine. But the real world doesn’t work that way.

Regardless, I’ll continue to trade and put my capital with the stocks that I believe will serve my purpose of going the way I want them. This is what any trader should be doing, because we must remember that (for traders) a company is simply nothing more than an entity that provides a tradable instrument. Private companies are of no use to us.

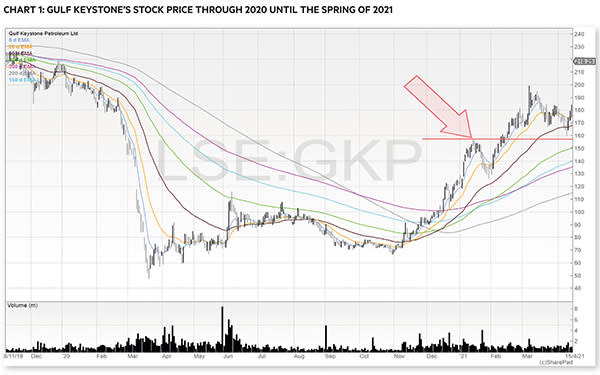

One company that I have been watching is Gulf Keystone Petroleum (GKP). This company is the first company to feature twice in this column, as we looked at it in ‘GameStop, set and match’ (27 January 2021). Back then, the company was looking to break out of the high set at 157p. The stock went right through the level with a small pullback and roared all the way to 200p before taking a breather. It’s also worth noting that Gulf Keystone was once the subject of a trading mania, with people bidding up the stock to unworldly highs before the stock crashed more than 99 per cent. Stocks come and go; they have their periods of boom and bust. It’s easy to romanticise about buying and holding wonderful companies for extended periods of time. Yet, this fantasy assumes that wonderful companies are firstly both easy to find, and secondly easy to hold on to. Most companies are anything but wonderful – and even Amazon had several drawdowns which would give the most patient of investors sleepless nights.

The current price of Gulf Keystone is printing at 217p in the market. But the company had an excellent year in 2021. A total of $283 million was received from the Kurdistan Regional Government (KRG) and the company now has a significantly improved balance sheet. As of December 2021, the company maintained a cash position of $176m and net cash position of $56m. This is after capital expenditures of $55m (this was down from the guidance of between $75m and $85m) and also after payments of $100m in shareholder dividends.

Gulf Keystone Petroleum’s goal now is to lift production to 55,000 bopd (barrels of oil per day) from the Shaikan field (FY21 guidance was 42,000-44,000 bopd) in Kurdistan. In Gulf Keystone’s half-year results, the company’s gross operating costs per barrel were $2.40. That means every dollar increase in oil drops straight through the bottom line.

Canaccord Genuity has a forecast Brent oil price of $72.50 for 2022, dropping to $62.50 in 2023 and 2024. Should the Brent price remain where it is or go higher than these forecasts we would have solid risk to the upside.

But let’s not forget that the company is not exactly operating in the North Sea. This company has always traded to a discount to its peers as the perceived risk from the market is higher.

Chart 1 shows the company’s stock price through 2020 until the spring of 2021. We can see that within just a few weeks the stock gave up almost 75 per cent of its value. As well as the company’s geographical risk, it also has the oil price risk (though that appears to be an opportunity at the moment).

Chart 2 shows the stock’s fortunes from the rally at the end of 2020 to the current day. Notice how the stock traded below its 200 moving averages for a few days in September (middle arrow). We then saw the stock reverse on increased volume and move to new highs, before jostling with the moving averages again.

I’m long the stock as of this week, coinciding with Berenberg upgrading the stock – the consensus target price now being close to 300p. Once again, the stock is close to printing new multi-year highs: a breakout from the 220p resistance zone would see the stock move into a price area not seen since the autumn of 2019. The next significant area of resistance I see on the chart is around 300p. With the stock currently on a single digit PE and the trend of Brent in Gulf Keystone’s favour, that may not be such a lofty target. Let’s see.

My belief is that oil prices could stay at this level for some time yet. When multi-year highs are taken out, the price is sending a signal that the trend is changing. And with energy prices soaring to the point where energy providers are now sending out free pairs of socks and nutritional advice for staying warm, the trend could continue for a while yet.

- You can trial some of Michael’s stock trading course at https://www.shiftingshares.com/online-stock-trading-course/

- Twitter: @shiftingshares

- New subscribers to SharePad can claim a free month of data with the code: Michael