It’s been a month now since my last article ‘A soft commodity opportunity’ (30 March 2022) and those who followed me in to Anglo-Eastern Plantations (AEP) at 757p potentially did well. I say potentially, because the share price collapsed from 930p to 770p in less than half an hour of trading last month on news that Indonesia would be banning exports of palm oil.

This meant that the company wouldn’t be able to achieve the lucrative international prices and so both long and short traders sold the stock in a hurry.

You always need to be wary of changes. For example, governments may decide they want the commodity for themselves and take action to keep it. The problem with government risk is that nobody ever seems to think it can happen, until it actually happens. Ask the shareholders of Evraz (EVR), where oligarch Roman Abramovich held a large shareholding (now suspended), or Petropavlovsk (POG), which is down around 90 per cent since the start of the year.

Trading commodity stocks comes with all sorts of risks. It’s important that anyone who trades commodity stocks (and indeed any other stocks) is prepared to lose 100 per cent of their position. Is this likely? No. But can it happen? Absolutely. We’ve seen FTSE 100 companies fall from grace in just a few days.

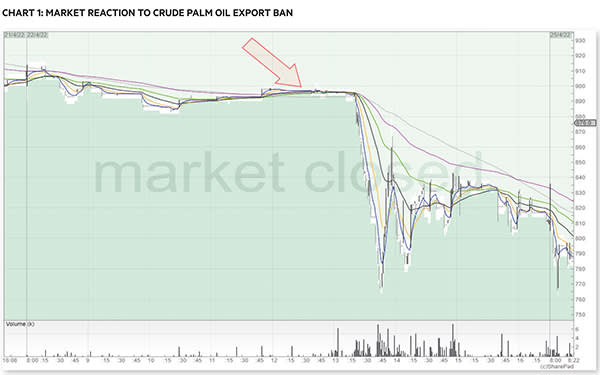

Looking at Chart 1, we can see the intraday price chart of AEP. I’ve marked an arrow as to when the news first dropped into the market about the ban on CPO exports, and we can see it took some time before the market reacted sharply to the downside.

The stock then rallied sharply as a result of traders coming in to buy the oversold bounce, before falling again. This volatility is typical as the price was discovering a new range, having digested new information.

Those waiting with alarms for RNS announcements didn’t get a notification as this news wasn’t released to the market through the RNS – this is why stop-loss orders are crucial to get you out of a position. That said, one of the reasons for the heavy fall could have also been a triggering of stop-losses. This is one of the downsides of placing actual stops in the market, but if you’re not at the screens throughout the day then using stop-losses can be an effective way of covering your downside risk. As with all things in trading, it’s a discretionary decision which is dependent on your own unique situation.

Another theme that I think we’ll continue to see play out is that of the decline in consumer discretionary spending. We’re seeing more and more pointers come through that the cut back has already started – with the recent article in the IC's sister publication the Financial Times on the cancellation of streaming services (which preceded Netflix’s profit warning by a few days) and polls showing that consumer confidence is near all-time lows.

There are plenty of ways to trade this. Leisure and hospitality are the obvious choices, along with retailers, and even gyms. Anything that the consumer may notice when they look at their bank statements is in the firing line – and the zombie members who join gyms with noble intentions that go unacted upon will surely be looking to finally quit.

A good way to trade this is to look at sectors and identify weak companies or companies with poor balance sheets. If you’re not comfortable picking single companies, you can create a basket trade and go short smaller positions on several stocks in the sector. The downside here is that your commissions will be increased, but the volatility in the account will be reduced. This is important because if a company does beat its expectations against the market and rallies sharply (or even squeezes – it happens), then your exposure will be reduced as it’s part of a basket of stocks.

One stock that I’ve added to my shorting watchlist is Deliveroo (ROO). I’m a regular customer of this company as it delivers groceries within half an hour – although the markups don’t go unnoticed. This is where Deliveroo makes its money – adding to the price of everything ordered on the app and taking it as a commission.

For example, it’s cheaper to actually go to the restaurant and eat rather than get the food delivered to your home, so long as you don’t go heavy on the drinks. Deliveroo Plus offers customers a monthly fee in exchange for no delivery fees – this reduces friction on customers paying fees for each delivery and so encourages them to order more as the mark-ups are not shown in the final bill. It’s a good model, and the company is still growing, but I believe it’s at risk of seeing cancellations as belts tighten.

There is, of course, the argument that as Deliveroo takes a percentage cut from the total order, its revenues will actually increase as supermarkets and restaurants put their prices up.

But that also means the price through Deliveroo will rise more in proportion to the actual cost rises. Obviously, the best time to short this stock was near 400p, and not when it's taken a near 75 per cent bath to 110p.

But shorting the all-time low worked well (top arrow) previously, and the trend is clearly down. There is also a big round number at 100p – this is a psychologically strong level. The bottom arrow marks this support and I’d be tempted to take a short position if the price fell through this.

Deliveroo is again traded on SETS so has the benefit of the electronic order book; it’s liquid and relatively easy to get in and out. This is an advantage when shorting as being reliant on market makers to get out of a position means you’re at the mercy of their prices. With the order book, you can become the market makers and display a price and size to the market.

Finally, I’d be watching the close price here. It’s common for stocks to fall through support or break through resistance intraday only to then move back for the close. That means I’ll be watching for a closing price of Deliveroo below 100p, as I feel this would give a stronger signal.