Last month’s column (‘Staying invested’, 7 July 2017) explained why the portfolios were remaining invested despite many commentators’ nerves as markets hit new highs – they were adhering to a tried and tested investment principle, while the investment climate generally is supportive of markets. But what is sometimes forgotten in the heat of debate and ‘noise’ about the markets’ direction is that staying invested also allows the full harvesting of dividends, which over time account for the vast majority of total returns.

Accordingly, portfolio discipline is required to ensure adequate diversification when sourcing income – whether by company size, geography or theme. This is particularly important now when the dividend cover of the UK’s bigger companies is looking a little stretched.

Counting the pennies

The cumulative effect over the long term of reinvested dividends on total returns can often be forgotten. A favourite statistic relates to the legendary investor Jeremy Siegel, who calculated in 2005 that, over the previous 130 years, 97 per cent of the total return from stocks came from reinvested dividends. A sum of $1,000 invested in 1871 would have been worth $243,386 by 2003. Had dividends been reinvested, the figure rises to $7,947,930 – a staggering difference! Studies of other markets report a similar story.

Reinvesting dividends is the best way of growing wealth over time – much better than moving in and out of the markets in the hope of crystallising capital gains. To fully access these dividends, investors need to remain invested. The portfolios leave wiser investors to time the markets, instead preferring to seek out those companies that can create wealth and add value – and then hold them for the long term.

Spreading the happiness

During the second quarter of 2017, UK companies paid shareholders a record £33.3bn in dividends – representing a healthy 14 per cent year-on-year increase. However, scratch below the surface and not all is necessarily well. Research suggests that the ability of the UK’s largest 350 companies to sustain and grow their dividends is at a seven-year low – and low enough to cause concern.

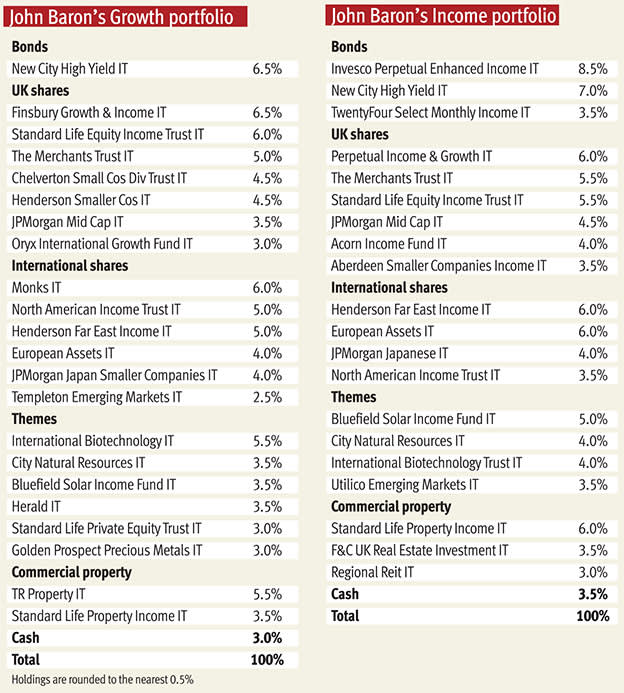

This does not mean that dividends are about to be cut – profit growth should be helped by the global economy moving forward. But, once again, it is a reminder that, where income is a consideration, sources should be diversified by way of company size, geography and theme. This is a constant discipline of the seven real investment trust portfolios run on my website www.johnbaronportfolios.co.uk, two of which are covered in this column, which helps them achieve sustainable and growing dividends with yields of up to 6.0 per cent.

Starting with the UK, it is important that dividends are sought from smaller companies which in general have better cover ratios – particularly when compared with the FTSE 100 companies. This is why the portfolios hold trusts such as Chelverton Small Companies Dividend (SDV), Acorn Income Fund (AIF) and Aberdeen Smaller Companies (ASCI) – the latter being introduced last month. These possess good performance track records and decent yields, and have produced handsome dividend growth over the years.

Portfolios should also be cognizant of more ‘mainstream’ income trusts that have the expertise and flexibility to source income from smaller companies. For example, Standard Life Equity Income (SLET) has a near 50 per cent exposure to FTSE 250 and FTSE Small Cap companies, and is supported by an excellent in-house small companies team. Meanwhile, The Merchants Trust (MRCH) has recently changed its benchmark from the FTSE 100 to the FTSE All-Share, in recognition it is sourcing more of its income from smaller companies.

The portfolios also seek income from overseas via Henderson Far East Income (HFEL), North American Income Trust (NAIT) and European Assets (EAT). The latter is one of the original trusts to distribute dividends from capital, being domiciled in the Netherlands. Such an approach allows it to invest in lower-yielding companies in order to achieve good total returns, some of which it then returns to shareholders each year – this distribution being 6 per cent of the net asset value (NAV), as calculated at the end of each calendar year.

Recent changes in regulation now allow UK-domiciled companies to do likewise. This is important because it means investments and sectors with low or non-existent yields are now happier hunting grounds for portfolios seeking income. International Biotechnology Trust (IBT) is a good example – biotechnology remaining an exciting theme, yet typically yields very little. A change in IBT’s policy now allows it to distribute 4 per cent of its NAV as at the end of August, which makes it easier to hold within the Income portfolio.

Other themes held by the two portfolios also provide a rich source of income. Standard Life Private Equity Trust (SLPE) has adopted a similar dividend policy to IBT, while holdings in Bluefield Solar Income Fund (BSIF), City Natural Resources (CYN) and Utilico Emerging Markets (UEM) presently offer approximate yields of 6.3 per cent, 5.1 per cent and 3.0 per cent, respectively. My website’s other portfolios hold other trusts whose yields range from 5.7 per cent to 7.8 per cent.

Finally, commercial property is not neglected by the portfolios. TR Property (TRY), Standard Life Property Income (SLI), F&C Real Estate Investment (FCRE) and Regional Reit (RGL) presently offer yields ranging from 2.9 per cent to 7.5 per cent – all but FCRE have recently increased their dividends, particularly TRY. This sector, together with some of the ‘thematic’ holdings mentioned above, can also help portfolios diversify their assets in general – not just by way of income – as time passes.

In short, investors are spoilt for choice when seeking income. Of course, the usual considerations apply: the underlying investment case must be in place, otherwise income can quickly turn to sand; decent revenue reserves help sustain dividend growth; expensive debt can weigh on the ability to distribute; a portfolio’s bond exposure should consist of a range of fixed-interest instruments. But, overall, the market can satisfy those willing to do the necessary research, without hindering performance – as the Income portfolio testifies.

Portfolio changes

In July the Income portfolio increased its overall exposure to higher-yielding UK smaller companies. Aberdeen Smaller Companies (ASCI) was introduced because, in addition to a sound long-term track record, relative performance has been improving under its new lead manager and yet the company’s discount had drifted out to 23 per cent when purchased. This was partly funded from the modest top-slicing of Acorn Income Fund (AIF) when on a 3 per cent discount – AIF will remain a core holding given its excellent track record.

Otherwise, there were no changes to the Growth portfolio during July.