Some regular readers may remember when this monthly column first started reporting on our Growth and Income portfolios in 2009. The aim was to share with readers their progress, successes and failures over time – both portfolios being ‘real’ (ie they exist in fact). While never complacent, it is therefore pleasing to report both have done well. 10 years is hardly the long term, but it is long enough to start gauging a portfolio’s ‘mettle’ when assessing performance.

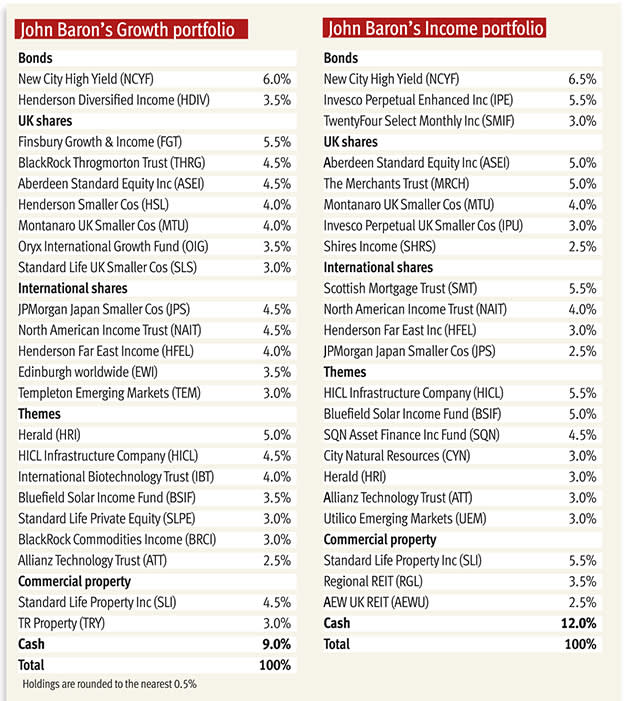

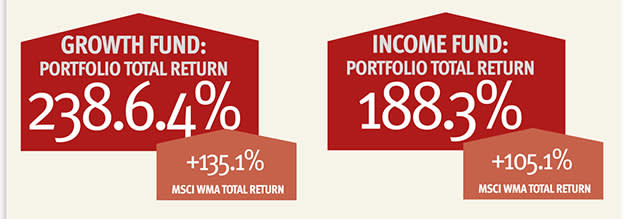

Despite modestly underperforming benchmarks in 2018, over the 10 years from 1 January 2009 the Growth portfolio has gained 238.6 per cent compared with 135.1 per cent for its MSCI WMA Growth benchmark, while the Income portfolio gained 188.3 per cent compared with 105.1 per cent for its equivalent Income benchmark. All figures are total return and rounded to one decimal place. And reflecting on some of the highlights over this period, there are reasons to remain optimistic despite current concerns about market prospects.

Tunnel and light

Markets have entered a tunnel of gloom. Certain valuations, high and growing debt, possible trade wars, geopolitical risk and Brexit are just a few of the reasons. Some are real, some less so. Some have appeared before during the past decade, some are more recent. But there is little evidence to shake our fundamental belief in the power of well-chosen equities to produce superior returns over cash and bonds over the long term.

Short-term market setbacks are an inevitable characteristic of investment. As highlighted on previous occasions, investment trust portfolios in particular should maintain decent cash levels in order to capitalise, particularly when discounts widen as they did during the final quarter of 2018. But as long as there are entrepreneurs and businesses willing to embrace risk in order to generate returns in excess of cash, then shareholders should share in this success over time.

A key component of the portfolios’ approach over the past decade has been to adhere to tried-and-tested disciplines. When deciding the portfolios’ strategy, little attention is paid to short-term market ‘noise’. The most important determinant is the ability of companies to create wealth and add value, and the conditions that sustain such an environment. The focus remains on the longer term when assessing sentiment and fundamentals, and volatility is therefore seen as an opportunity.

The portfolios remain invested and seek to add value over time – wiser investors are left to try to time the markets. Such an approach also allows the full harvesting of dividends, which become an increasingly important contributor to total returns – the portfolios’ higher yield, relative to benchmark, acknowledging the significant contribution made by reinvested income to overall returns over time.

In helping to protect past gains as time passes and the investment journey progresses, the portfolios also recognise the importance of rebalancing and diversification – both essential but undervalued disciplines. Furthermore, and most importantly, investment is best kept simple to succeed. Complexity usually adds cost, risks confusion and hinders performance.

In the round, adherence to such disciplines makes for perspective when assessing markets and companies, particularly when they overshoot. They will continue to guide Equi, our company, when reporting on our eight real investment trust portfolios run in real time on the website www.johnbaronportfolios.co.uk, including the two covered by this monthly column.

But such disciplines also require sound investment strategies – so where are the current opportunities? We continue to believe in the power of well-chosen equities. While acknowledging a natural bias to ‘growth’ and smaller businesses, in part because of our continued faith in humankind to innovate to overcome obstacles, we also acknowledge valuations suggest certain ‘income’ strategies look good value. Accordingly, portfolios should be cognisant of both relative to remit.

Meanwhile, good quality corporate bonds will continue to assist those portfolios seeking diversification. Other less correlated and inflation-friendly assets such as renewable energy, commercial property and infrastructure also have a role to play. The extent of each being dependent on the level of diversification required.

As for geographical allocation, while geo-political concerns prevail, the last decade and beyond suggests business and trade usually prevail. Complex supply chains embrace various trading blocs, customs arrangements and political hurdles. Close to home, concerns about Brexit are largely responsible for the UK market looking attractive. We believe this presents an opportunity and are therefore gradually increasing exposure for appropriate portfolios.

We should remember the UK profitably trades with the rest of the world on World Trade Organization (WTO) terms. Meanwhile, investment is about relative advantage – witness the current strength of the UK economy despite the perceived uncertainty about a ‘no deal’ Brexit. And there are many upsides to leaving on WTO terms, including a one-off bonus of around £38bn no longer paid to the European Union (EU, an annual bounty of billions of pounds courtesy of 3-5 per cent tariffs, and cheaper supermarket prices as EU tariffs would no longer need to apply to imported foodstuffs.

Outside the UK, we believe emerging markets and Japan look good value. The former stands on a cyclically-adjusted price/earnings (PE) ratio of 13 times compared with 30 times for the US. The EU is our least favoured market given key problems remain, including the lack of a mechanism to transfer surpluses from rich to poor and policies that make for poor relative growth rates and high unemployment. As for the US, while underweight generally, our exposure is focused on key ‘growth’ sectors such as technology and biotechnology.

Markets may continue to be volatile and cash levels are held in readiness. But history suggests volatility should be seen as an opportunity for the long term. And portfolio disciplines allied to sound investment strategies help make for calm assessment at such times. Our experience suggests there is indeed light at the end of the tunnel.

Portfolio changes

During December, the Growth portfolio reduced its holdings in Allianz Technology Trust (ATT) and Standard Life UK Smaller Cos (SLS), and added to its existing holding in Herald (HRI) while introducing Henderson Diversified Income (HDIV). Prices achieved were £13.06, £4.07, £10.96 and £0.76, respectively.

After its strong run in recent years, the time had come to modestly rebalance the portfolio given the level of diversification required courtesy of its place in the wider investment journey – hence the introduction of HDIV. Both HDIV and HRI were bought when standing on attractive discounts.

Meanwhile, the Income portfolio sold its holding in International Biotechnology Trust (IBT) and added to its holdings in The Merchants Trust (MRCH) and Scottish Mortgage Investment Trust (SMT) for essentially the same reasons – the changes having the net effect of both raising the portfolio’s cash level as part of its rebalancing and increasing its UK exposure. Prices achieved were £6.01, £4.49 and £4.75, respectively.