- On the Beach has swung to a loss as Covid-19 halted travel

- While the online business is better positioned for a recovery than its peers, bigger turbulence is ahead for packaged holiday providers

The 1959 post-apocalyptic flick On the Beach sees Gregory Peck's character washed up in San Francisco Bay to find most of mankind wiped out by nuclear war. While the coronavirus pandemic has not been as devastating for the human population, it has left beaches similarly deserted.

Online travel agency On the Beach (OTB) has felt the impact of the seaside exodus more heavily than most. With Brits unable to travel to many destinations, while being required to quarantine if they fly to others, the company has seen demand for its package holidays plummet.

The group, which lumps together flights and hotels from other providers, this week reported revenues dropped more than 75 per cent in the 12 months to September, to £33.7m. From profits before tax of £19.3m last year, it nosedived to a £46.3m loss.

Brits love the beach. But with sunny resorts bereft of red-skinned Englishmen, the company is not the only one suffering a financial shipwreck.

German travel agency Tui (TUI), which became the world’s largest tourism group after merging with its British subsidiary Tui Travel in 2014, also said this week that revenues in the year to September fell by more than half to €7.9bn, swinging from a profit in 2019 to a €3.2bn pre-tax loss.

Both companies suggest they will be well-placed to pick up on resurgent demand once customers start packing their beach towels again. Tui’s board stressed the recent progress made on the availability of vaccines would “initiate the transition into this new normality”.

Indeed, for almost a year, many have rarely left the house. Consumers have transitioned to online shopping and streaming movies, but they haven’t been able to find a real digital alternative to going abroad. A pent up demand to get away is undoubtedly brewing.

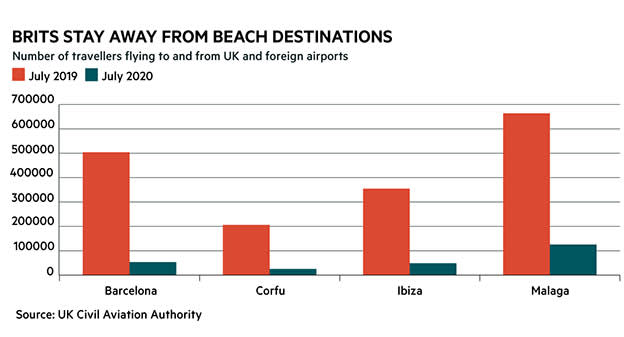

Yet seesawing by governments on coronavirus restrictions has hurt consumer confidence. Despite the rollout of vaccines, it's unclear when most travellers will want to brave the risk of forced quarantine, or be able to avoid this danger altogether. Even when restrictions were originally lifted in July, the number of passengers flying to and from Spain, the UK’s favourite beach destination, was barely a seventh of the number during the same month last year.

The question looming over the travel industry is whether companies will have enough cash to arrive safely on the other shore. Online business On the Beach, which does not have its own line of planes and hotels to maintain, could be better placed to weather the storm than its older peers. Tui, which has about 150 aircraft and 17 cruise ships, is burdened with €6.4bn in debt.

Earlier this year, On the Beach chief executive Simon Cooper also lambasted the old business model of tour operators, which uses customer deposits to fund day-to-day costs. The online holiday provider ringfences prepayments until customers travel, leaving it better prepared for a run on the banks. This means On the beach largely shielded itself from the kind of reputational damage suffered by Tui, which was investigated by the UK regulator after thousands of customers complained they had not been refunded on time for cancelled trips.

But even if On the Beach emerges from the Covid-19 crisis more popular and less burdened with debt than its competitors, it will increasingly look like an outdated product. Travel agency giant Thomas Cook collapsed last year, in part because of its cash-burning physical assets, but also after seeing relative demand for packaged holidays drop in the years since their heyday.

With the mammoth IPO of Airbnb (US:ABNB) also arriving this week, investors are apparently betting that customers want more control over where, when and how they spend their vacations. In the age of the internet, the amount of time On the Beach saves customers by rolling plane tickets and hotels into one bill is limited.

At the end of On the Beach, Mr Peck's character and his character's mistress, played by Ava Gardner, go on a fishing trip as they await the extinction of the human race. On the Beach – the business – will be hoping that a similar desire to get away persists in the face of ongoing health risks. But while it may be able to fly higher than its peers once the pandemic ends, bigger turbulence is ahead for packaged holiday providers generally. With shares already returning near their January value and investors apparently pricing in a nascent recovery, we say sell at 357p.

| ON THE BEACH (OTB) | ||||

| ORD PRICE: | 358p | MARKET VALUE: | £ 563m | |

| TOUCH: | 355.5-358p | 12-MONTH HIGH: | 500p | LOW: 113p |

| DIVIDEND YIELD: | Nil | PE RATIO: | NA | |

| NET ASSET VALUE: | 97p* | NET CASH: | £36.5m | |

| Year to 30 Sep | Turnover (£m) | Pre-tax profit (£m) | Earnings per share (p) | Dividend per share (p) |

| 2016 | 71.3 | 17.0 | 11.0 | 2.2 |

| 2017 | 83.6 | 21.1 | 13.8 | 2.8 |

| 2018 | 104 | 26.1 | 16.5 | 3.3 |

| 2019 | 140 | 19.3 | 11.9 | 3.3 |

| 2020 | 33.7 | -46.3 | -27.6 | 0.00 |

| % change | -76 | - | - | - |

| Ex-div: | na | |||

| Payment: | na | |||

| *includes intangible assets of £80m, or 51p a share | ||||