- Dividends cut to new base levels

- Oil demand is likely to slow in the next decade

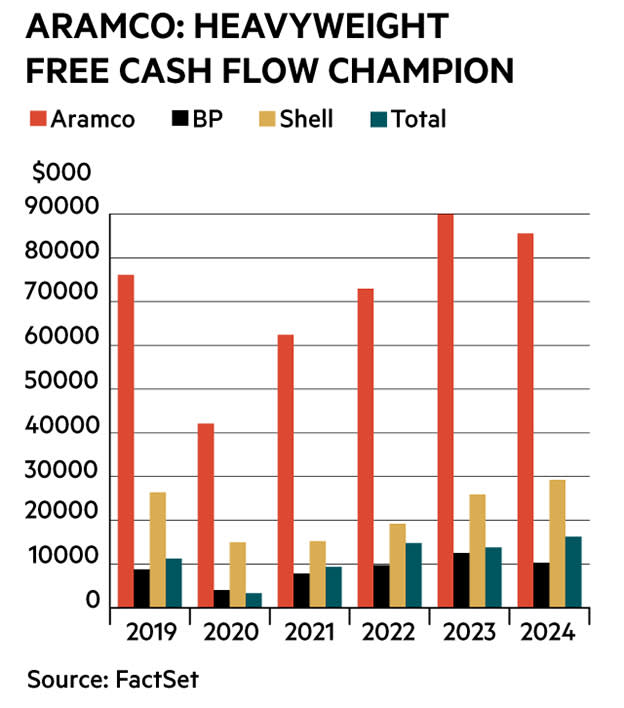

The future of oil and gas became clearer in 2020. As most supermajors stressed about plunging oil prices, managing debt and transforming their businesses into something palatable to environmentally-minded investors, Saudi Aramco (Sa:2222) chose to pay its $75bn (£56bn) dividend by adding debt and taking the hit to free cash flow.

BP (BP.) and Royal Dutch Shell (RDSB) acted more aggressively than other Covid-19-hit companies, cutting dividends to new base levels, so there will be no make-up payouts once conditions stabilise. BP shareholders could be waiting some time for buybacks to come from growing cash flow, given management has said net debt needs to be under $35bn for this to happen. RBC Capital Markets forecasts that this will take another three years.

Shell has already increased its rebased payout, putting it up 4 per cent to 16.65¢ after its third-quarter results. Chief executive Ben van Beurden optimistically said this marked the start of a “new era” of dividend growth, after handing investors a payout worth 35 per cent of what they were given a year ago. Shell will follow BP in announcing its grand green plan in early 2021.

On top of dividends, companies have also cut thousands of jobs – almost 20,000 combined at Shell and BP – in an effort to lower costs. The successive positive vaccine announcements have given the industry a shot in the arm, however, and there are plenty of analysts who see oil demand recovering quickly.

That would see payouts coming back fairly quickly if the majors’ priorities were the same as a year ago. But this ‘build back better’ philosophy has also arrived in the boardrooms of the European oil majors, who have as a group pledged some form of net zero carbon emissions and will oversee production waning as some portion of capital spending moves to renewables and other greener options.

RBC analysts Biraj Borkhataria and Erwan Kerouredan wrote in November that investors seemed unsure of what to make of the new majors. “All European majors are trading at substantial discounts to their histories, and carving out low-carbon businesses makes this look even more extreme,” they said, warning that this transition would pose “clear challenges for shareholder returns”.

An industry divided

A Saudi government run by Crown Prince Mohammed bin Salman may be a more demanding shareholder than Shirley from Surrey, but the divide between BP and its cohort and Aramco is indicative of how the oil world will split further in coming years.

Saudi Arabia’s decision to increase oil production earlier this year encouraged the oil price crash. Oil-exposed companies were the losers of this move, which was eventually wound back after a meeting of the Opec-plus-Russia cartel, but not before share prices all over the world crashed. Saudi Arabia itself was less affected, given Aramco’s decision to maintain its $75bn payout, 98.5 per cent of which goes to the state.

Macquarie Bank sees the unbalanced nature of the market holding back price growth, which would rev up payouts from London’s mid-cap producers such as Kosmos Energy (KOS) and Tullow Oil (TLW). Being in a cyclical industry is not always pleasant – see each commodity’s price crashing at some point for proof – but the possibility of bull markets being a thing of the past takes away the main driver of investment.

The Australian bank’s long-term forecast for Brent crude is $56 a barrel, and $50 a barrel next year.

Aside from being subject to Opec ups and downs, oil demand is likely to slow in the next decade because of the shift to electric vehicles, while capital will get more expensive for the heavy polluters in the industry. This scenario falls somewhere between the ‘business as usual’ and ‘net zero’ prospects laid out by BP in its 2020 Energy Outlook.

Carbon Tracker senior analyst Mike Coffin, formerly a BP geologist, told Investors’ Chronicle that for net zero carbon emissions to be realistic, oil demand and production would have to fall around 5 per cent “for the next couple of decades”. A shrinking market would be likely to leave mid-cap and major producers competing with the national oil companies (NOCs) for market share. “Those that [end up being] sanctioned, the ones we see as potentially being economic, will be the lowest-cost projects,” he said, giving Middle East onshore and shallow-water projects largely in the hands of states as examples.

Moody’s said producers struggling to raise cash this year would not find an easier time of it next year. “Capital markets access will remain tight and unlikely to improve in 2021—a particular concern for lowest-rated [exploration and production] companies as near-term debt maturities approach,” the agency said.

Premier Oil’s (PMO) recent fortunes capture this idea well. At the start of the year, the producer announced a major acquisition of BP project stakes in the North Sea that would have required hundreds of millions of dollars from investors, plus permission from its creditors to push back impending payments.

That plan fell apart when Premier’s share price crashed in March, even as management insisted it was still on the cards. Now private producer Chrysaor is taking over the almost-70,000 barrel of oil equivalent per day (boepd) Premier in a deal that will leave shareholders with 5 per cent of the combined 250,000boepd company.

At mid-cap and junior level, there were also success stories in 2020. Gas-focused explorers and producers did well. Diversified Gas and Oil (DGOC) watched as US drillers collapsed by the dozen, but its model of buying mature wells in the Appalachian basin proved resilient. Touchstone Exploration (TXP) proved buyers still love a big discovery (or four), climbing from 22p at the start of the year to 126p in December.

Mr Coffin said life was not going to get easier for mid-caps and juniors, though. The sector has often relied on majors’ cast-offs for production and often selling assets to bigger fish for cash flow. “There are fewer people willing to provide the capital [needed], either the companies themselves or asset owners being unwilling to invest in companies who are buying these assets,” he said.

“The cost of ownership for these projects goes up, and ultimately, the economics of those projects then become increasingly challenged.”

What’s next

Alongside investors changing their tune on oil and gas companies, access to commercially viable reserves could soon slow down as well. Denmark has been a leader in changing the sector in the past, by changing Dong Energy to wind company Ørsted (Den:ORSTED). The country has now stopped offering licences for its North Sea territory, and will stop production completely in 2050.

“We intend to show what an ambitious yet balanced phase-out of fossil fuel production might look like, taking into account both the urgency of climate change and the very real concerns of workers employed in the fossil sector,” said Danish climate and energy minister Dan Jørgensen.

This is unlikely to be repeated in the Middle East, but those countries can restrict access to projects to just NOCs, further shrinking the availability of profitable assets. Of course new jurisdictions can come along. Uruguay, Argentina and Guyana have auctioned off plenty of exploration blocks in recent years and discoveries are being made.

The question is whether the usual process of juniors exploring in the hope of being taken out by bigger fish will continue if BP, Shell and others do not have the same hunger for reserves as before. At the microcap level, speculation will surely continue, but the question is whether retail investors can still dip a toe in oil and gas companies in the hope of multiplying their money or getting a healthy payout.

We have been bearish on the majors for some time, given the difference between past returns and future prospects. The transition to more general energy companies is likely to be painful. The smaller producers don’t have anywhere to pivot to, however, and their future is also questionable. And by selling crude into a market where there may not be a bull market like 2008 or 2011 again means profits and financing will be tougher to come by, especially as banks tighten lending practices for climate reasons.

Forecasting the long-term decline of a commodity is obviously dangerous, but so is any future increase in oil demand, which would mean attempts to move to a greener economy had failed.

The consensus is that oil demand will be around pre-Covid-19 levels of 100m barrels a day (bopd) for at least the next decade. As the advanced economies shrink their oil use, the developing economies are still going to be growing. At the same time, supply is abundant, with most of it in the hands of state actors, who provide 80 per cent of the oil and gas produced in the world. The question then is who is going to deal with the other 20 per cent.

Will it be absorbed by the states or will the international oil companies (IOCs) continue? My prediction is that the oil and gas majors will continue producing oil and gas. There is no doubt. That is where the cash flow is coming from. Even if they’re diversifying into other forms of energy, notably renewable energy and storage, it’s going to take time.

They will probably stumble, and because it is new, investors will be looking really carefully at them. There’s a saying: these plants will be taken up by the roots, and the roots will be inspected frequently by investors, because they won’t be quite sure what they’ve let themselves in for. It may well be that investors say ‘it’s all too complicated, this is just like tobacco, defence, we just don’t want to be there because we’ve got so many other choices’.

A long time ago, I said we should move BP beyond petroleum. I moved myself beyond petroleum at the same time.