- Oil supply to fall in coming months as Saudi Arabia's 1m bopd cut outweighs Opec increase

- Georgia Senate runoff results bring on greater stimulus hope and worry for tech investors

Saudi Arabia has once again shocked the oil world, this time by cutting supply in the face of high Covid-19 case numbers and deaths across Europe and North America. When the virus first hit, the oil giant went for market share and upped output, contributing to the oil price crash.

The latest meeting between the Organisation of the Petroleum Exporting Countries (Opec) plus Russia saw members hold onto the previous plan of gradually increasing supply. This would have increased global supply by 75,000 barrels of oil per day (bopd) in February and March. But Saudi Arabia said it would cut 1mbopd from its own production following the meeting, calling it a “voluntary” move in the face of falling demand.

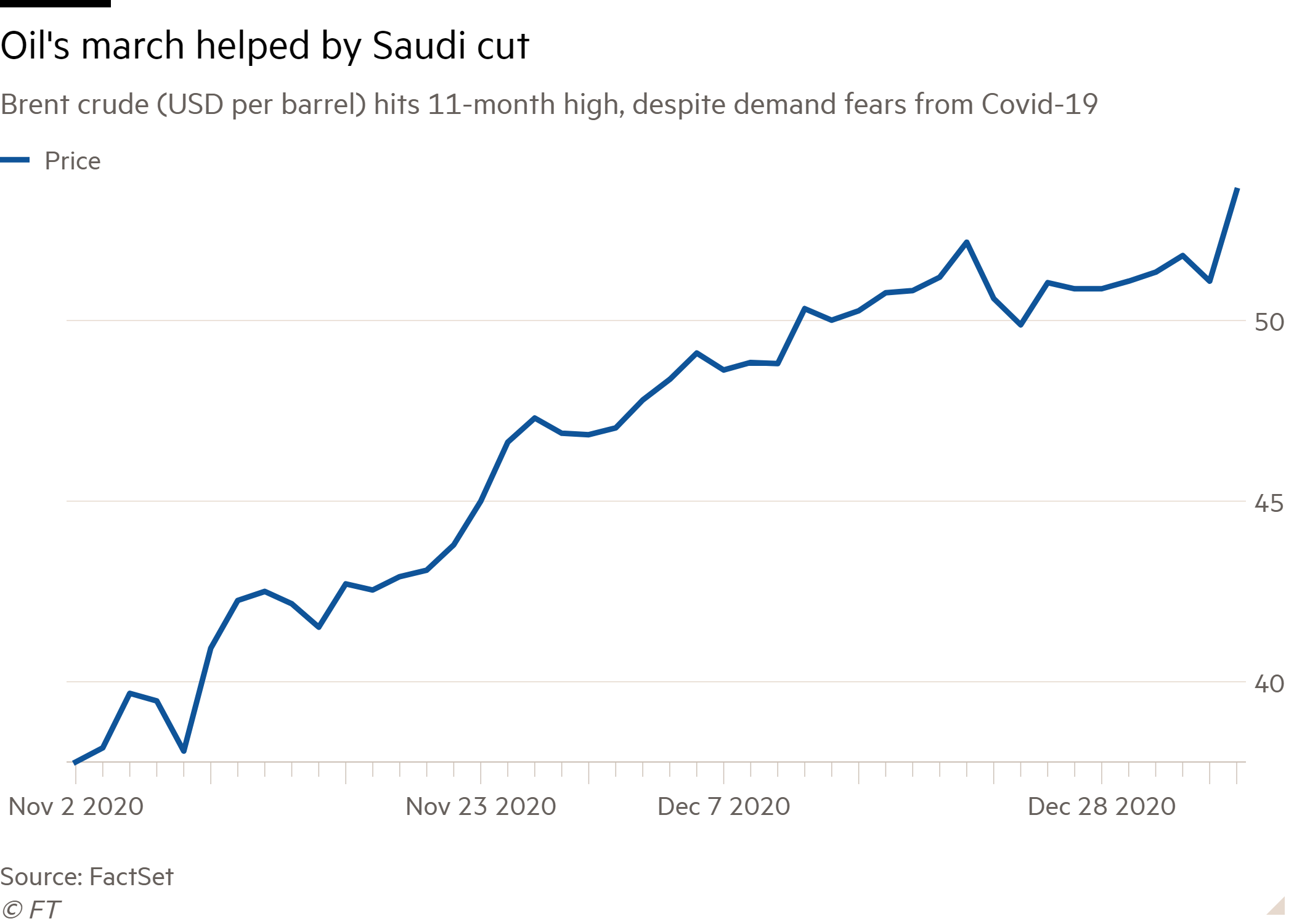

Brent crude – the world's oil benchmark – jumped to $54 (£39) per barrel (bbl) on the news, a 10-month high. Bjornar Tonhaugen, head of oil markets at consultancy Rystad Energy, said the move was a welcome surprise for the rest of the oil market. “Instead of an increase in crude production from the alliance in February, [Opec+] will now collectively cut production from current January levels,” he noted. Mr Tonhaugen did express some doubt about the cut, saying it was “too good to be true” and the actual cuts could be “blurry and subject to changes” once they come due.

There is a still question mark over 2021 demand given the deep uncertainties around the pandemic's economic effects, but the oil majors saw immediate gains from the supply cut, after a strong start to trading for the year. Shares in UK oil majors, BP (BP.) and Royal Dutch Shell (RDSB), climbed 5 and 6 per cent respectively on Wednesday, while shares in US giants Exxon-Mobil (US:XOM) and Chevron (CVX) also rose.

This was the second day in a row of positive price moves for the industry, taking Shell and BP's gains for 2021 over 10 per cent each as of Wednesday afternoon.

Looking further out, the Democrats’ victory in the Georgia Senate races raises the incoming Biden administration's chances of turning its promises around energy and climate into law. With the election of Raphael Warnock and Jon Ossoff to the two Georgia seats all but assured as this magazine went to press, the Democrats and the Republicans would both have 50 votes in the Senate. Vice president-elect Kamala Harris can cast a tie-breaking vote, although bills often need 60 votes to get past a filibuster.

Joe Biden has said he would pivot the US, the world’s largest oil producer, to a greener economy and block new oil and gas wells on public land. This could lead to falling output over time, but is unlikely to have an immediate impact on an industry which already finds itself in a weak spot. Last year's oil price crash sent US producers into crisis, resulting in tens of thousands of job losses and dozens of bankruptcies, according to law firm Haynes and Boone.

In the June and September quarters, there were 35 industry bankruptcies, compared with 28 in the same period in 2019, while debt levels climbed significantly.

There was little reaction in WTI crude – the US oil price – following the Georgia results, although Mr Tonhaugen suggested marginal US shale producers would welcome the Saudi cuts for putting a floor under prices.

“Expect to see upside surprises to shale output for the third cycle in a row, which is the ever-lasting dilemma of Saudi oil market balancing,” he said. Immediately following news of Saudi Arabia's cuts on Tuesday, WTI got close to $50/bbl for the first time since February 2020.

Elsewhere, signs of an impending Democrat win were greeted as another lurch to a 'risk-on' environment in financial markets. The yield on 10-year US Treasuries, seen as the risk-free rate, rose above 1 per cent for the first time in nine months, as investors sold out of bonds and bet on the prospect of additional stimulus from a unified US government. Futures tied to the Nasdaq 100, a tech-dominated index, were down 1.5 per cent, as the possibility of Mr Ossoff winning grew clearer.

Beyond the immediate impact on the energy sector, US companies face a tax hike as Mr Biden has promised to raise the corporate tax rate from 21 to 28 per cent. Outgoing president Donald Trump cut the rate from 35 per cent. A massive green-themed stimulus programme focused should balance out this outcome.

Randeep Somel, manager of the M&G Climate Solutions Fund, said the likely Senate results “represent a huge opportunity for climate focused sustainability companies as the full force of the US government gets behind net zero”.