- Long-term demand for commodities looks strong

- Funds can provide diversified exposure to these assets

Commodities have long been out of favour with investors but have had a strong run recently, raising questions as to whether we might be at the start of a new commodities supercycle. While many investors remain cautious, there are structural reasons why some commodities could continue to do well.

In the short term, as economies recover from lockdowns this should boost demand for industrial commodities, including metals, oil and gas, although much good news looks already priced in.

In the longer term, the energy transition should see demand for certain metals accelerate, as we explain in UK-listed lithium prospects firm up (IC, 26.02.21). This metal, as well as graphite, nickel, manganese and cobalt, are key ingredients for lithium-ion batteries, while copper and rare earths are needed in large quantities for electric cars and charging grids. Palladium and platinum are used in catalytic converters to reduce harmful emissions, wind turbines require steel which is produced from iron ore, and silver is needed for solar panels.

Demand for agricultural commodities such as corn, soya beans and pork is also likely to rise as countries build strategic food reserves following supply chain disruptions over the past year, says James Luke, head of commodities at Schroders (SDR). Demand is largely being driven by China, where a lack of arable land is restraining expansion of its agriculture sector.

Despite a recent surge, commodities valuations are cheap by historic standards, Luke says. He likens the under-investment in commodities to the early 2000s, the last time there was a commodities boom. “Now, as then, we have seen significant under-investment in commodity supply with capital expenditure in oil and gas, and global mining sectors falling by around 40 per cent since 2011,” he explains.

Commodities have also historically done well in times of inflation, because they are real assets whose prices rise alongside the goods and services they underpin. This was most notably the case in the 1970s when we had high inflation, surging commodity prices and weak equity markets. Darius McDermott, managing director of research company FundCalibre, says “a lot of investors are currently turning to commodities as an inflation hedge”.

Commodities prices have also been correlated with the US dollar and tend to do better when it is weak. Although most commodities are produced in emerging markets, they are usually priced in dollars. When the dollar is weak, the price of these commodities rises in dollar terms. Luke says that large stimulus packages and a growing deficit in the US have capped the dollar’s appreciation, and he expects this to continue.

However, investing in commodities is not for the faint-hearted and wealth managers take a cautious approach.

“I find it difficult to get too enthusiastic about commodities at the moment,” says Ben Seager-Scott, head of multi asset funds at Tilney, who believes that a lot of good news is already priced into industrial commodities and the ceiling for the oil price is likely to fall as shale oil is becoming mainstream.

Peter Sleep, senior investment manager at 7IM, argues that the very long-term investment case for commodities is generally poor because they do not generate any added value or income like a company can. They also they lose inflation adjusted value over such a time period because productivity gains over the past two hundred years mean that we use commodities more efficiently.

Funds for commodities exposure

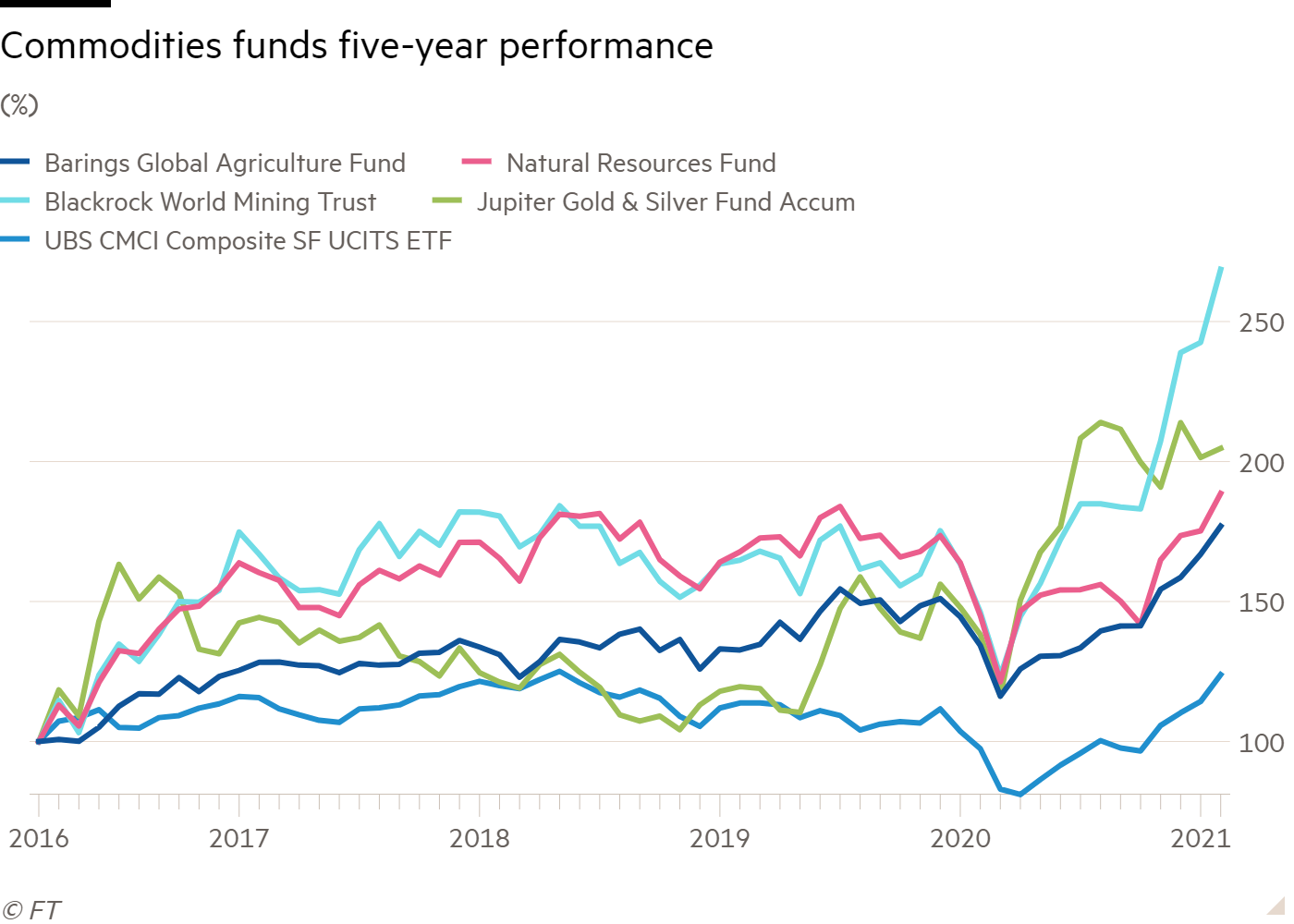

For broad commodities exposure, UBS CMCI Composite SF UCITS ETF (UC90) is one of the largest exchange traded funds (ETFs) focused on this area, with £1.18bn of assets. The ETF provides synthetic exposure to a basket of over 30 types of commodities, with crude oil, copper, aluminium, platinum and soybeans its largest five positions, making up 44 per cent of the fund. It has an annual management fee of 0.34 per cent.

Active fund options for general commodities exposure include JPMorgan Natural Resources (GB00B88MP089), which has assets worth £524m. It invests globally in companies that produce and market commodities, with a bias to mid and smaller companies. Adrian Lowcock, head of personal investing at Willis Owen, says: “The focus is on companies with higher upside potential for miners in the exploration space, which should help manage risk”. The fund has an ongoing charge of 0.9 per cent.

Seager-Scott suggests Ninety One Enhanced Natural Resources (GB00B2QVX896), although this fund has assets worth only £49m. It invests at least two-thirds of its assets in the shares of companies of any size around the world expected to benefit from price increases in commodities over the long term, and related derivatives.

A better performer, focusing on mining and metals only, has been BlackRock World Mining Trust (BRWM), which had assets worth £1.16bn on 4 March. Its net assets have increased by 65 per cent over the past year and 216 per cent over five years. Following a successful run, it was trading at a premium to net asset value of 3 per cent on 4 March. The trust principally invests in listed mining companies, but up to 10 per cent of its gross assets may be in physical metals and up to 20 per cent in unquoted investments. The fund has a yield of 3.7 per cent, according to Winterflood.

For targeted access to precious metals, Jupiter Gold & Silver (IE00BYVJRH94) provides access mainly to gold and silver mining companies, which made up 79 per cent of the fund at the end of January, with 18 per cent of its assets in bullion. The fund has assets worth £863m and an ongoing charge of 0.88 per cent.

If you want targeted metals exposure, you can buy exchange traded commodities (ETCs), which aim to track spot price of a particular commodity. iShares Physical Gold ETC (SGLN), WisdomTree Physical Silver (PHSP) and iShares Physical Palladium ETC (SPDM) are examples. They are physically secured, unlike collateralised ETCs, which are based on swaps.

McDermott suggests Barings Global Agriculture (GB00B3B9VD63) which has performed strongly over the past year. The fund had 34 holdings at the end of January, with machinery the largest sector weighting, making up 20 per cent of the fund. But it is very small, with assets of only with £45.13m on 4 March, and relatively expensive with an ongoing charge of over 1 per cent.

Agronomics (ANIC), an Aim-traded investment firm that launched in 2019, invests in start-ups “with a focus on cellular agriculture and cultivated meat”. Its holdings include Singapore-based Shiok Meats, which grows cell-based shrimp, and German company LegenDairy, which produces cheese without cows. Read our recent interview with its manager Anthony Chow (IC, 19.02.21).