- Government spending on ads soared as it ploughed millions into Covid-19 public information campaigns

- The taxpayer-funded marketing drive boosted Big Tech firms and advertising contractor Omnicom

Government spending on advertising soared last year, lifting revenues for numerous companies across the media and technology sectors, an Investors’ Chronicle review of public documents has found.

As most businesses slashed marketing budgets during the pandemic, the UK government has ploughed millions into Covid-19 public information campaigns, delivering a welcome boost to its advertising contractor, Omnicom (US:OMC), as well as online platforms such as Facebook (US:FB) and Google.

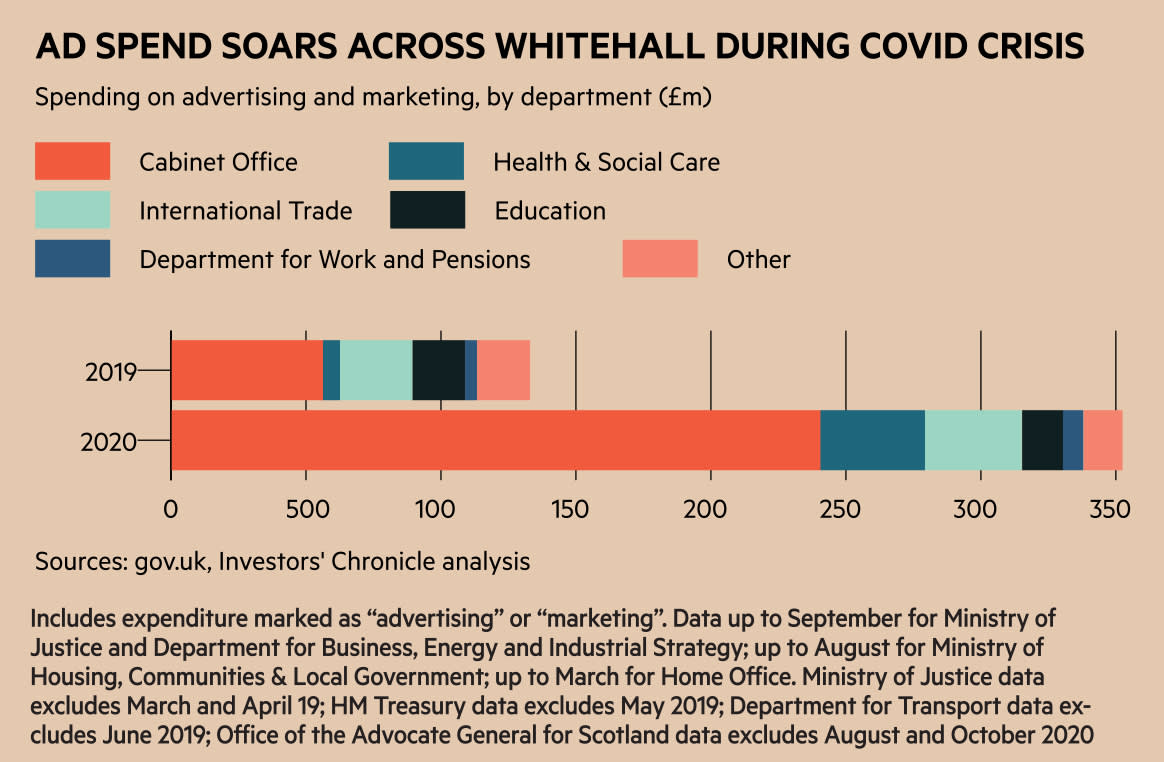

In total, at least £352m of government funds was funnelled into advertising and marketing in 2020, according to the IC’s analysis of public disclosures by ministerial departments. That is 165 per cent more than the £133m spent during 2019 – a year when ad spend was also boosted by the government’s “Get Ready for Brexit” campaigning.

The taxpayer-funded advertising push was driven in large part by the health department, which increased spending more than sixfold in 2020, to £38.7m. Based on the disclosures of all government spending over £25,000, the biggest increase was recorded by the Treasury, where ad spend soared more than eightfold last year, to £2.2m.

Numerous departments across Whitehall have contributed to the advertising drive, as the government sought to keep businesses and the public informed during the pandemic. Of the 17 that disclose information on their expenditure, only three ministerial departments slashed marketing spend last year, although figures for a small number may have been affected by a lack of comparable data for some months in 2019.

The UK is Omnicom’s top government client

According to our analysis, the UK government’s spending with Omnicom and its subsidiaries grew from at least £85.3m in 2019, to at least £275.3m in 2020, representing an increase of 223 per cent. That means that last year, the UK government alone accounted for a modest – but still significant – 2.9 per cent of Omnicom’s overall top line. The group says that the public sector accounts for 3 per cent of its revenue, so it looks like the pandemic has made the UK Omnicom’s top government spender.

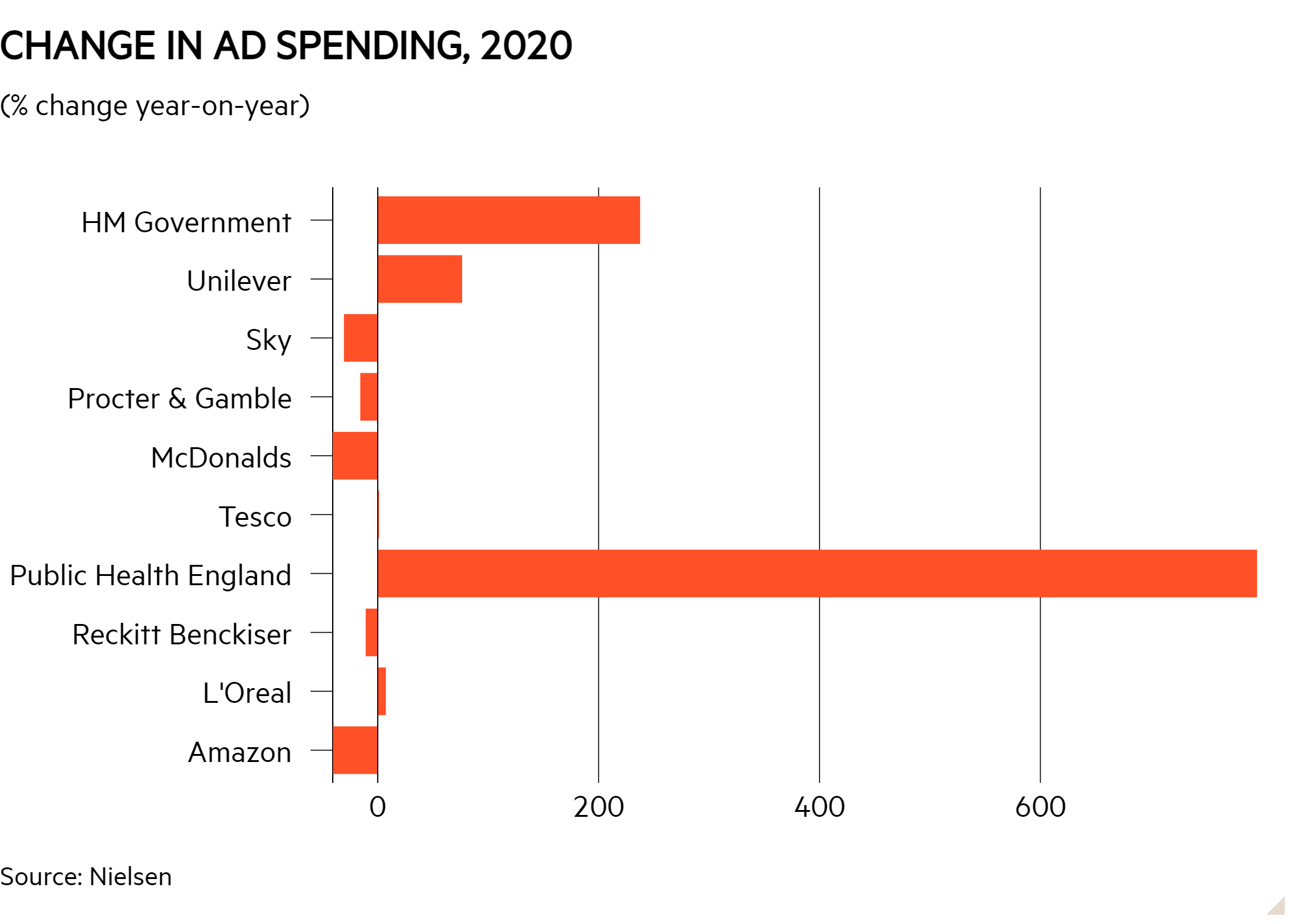

The Department of Health and Social Care ramped up its spending with Omnicom by the most in 2020, growing it by more than fourfold to £15.3m, which accounts for around two-fifths of its total advertising spend. Our findings align with research from Nielsen (US:NLSN), which estimates that the UK government was the nation’s biggest advertiser in 2020, with Public Health England logging the highest budget growth of any organisation.

But while public health campaigns may have boosted Omnicom’s business with government clients last year, the wider market still looked bleak. Organic revenue dropped 12 per cent in 2020, as the pandemic squeezed discretionary spending across the private sector. Overall spending on ads in the UK dropped by almost a fifth, according to Nielsen.

First-quarter results suggest that Omnicom could be staging a comeback this year, however. Organic revenues dipped 1.8 per cent in the three months ended in March, but still beat expectations of a 6 per cent decline. By contrast, organic revenue fell by almost a tenth in the preceding quarter.

“It’s taken some time to turn the corner, and we’re now on a clear path to return to growth,” said chief executive John Wren during an analyst call. He flagged that the impact of the virus on clients’ marketing budgets appeared to be “moderating in certain major markets”, and that the group now anticipates that it will return to positive organic growth in the current quarter and for the full year.

Wren added that he expects Omnicom to grow at a faster pace than in previous years – an easy message to buy into, given that 2020 will not make an especially difficult comparator.

And, like rival WPP (WPP), the ad behemoth is becoming more aggressive in acquiring marketing technology businesses. Just last month, Omnicom agreed to buy a majority stake in Areteans, which will strengthen its data and digital consulting unit Creder.

From Madison Avenue to Silicon Valley

But the ad giants of yesteryear may have some way to go before they can compete in the online advertising space with Big Tech companies, which according to separate figures obtained by this publication have also been significant beneficiaries of the government’s campaign drive.

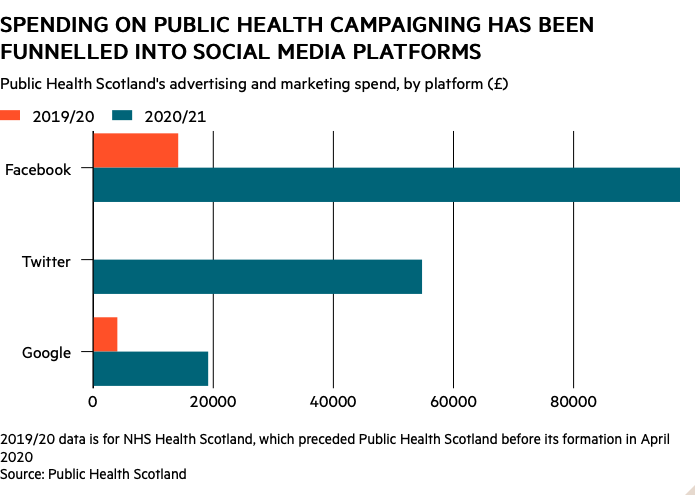

The IC sent freedom of information requests to each department and the UK’s public health agencies, asking how much they had spent on advertising with Facebook, Twitter (US:TWTR) and Alphabet-owned (US:GOOGL) Google during the past two years. While most said they were unable to provide this information, a small number revealed they had been investing far more in ad space with the Silicon Valley giants during the Covid crisis.

Public Health Scotland, the country’s health messaging organisation, has spent thousands on digital advertising during its long-running £2.1m “Test and Protect” campaign. In the 12 months to March, spending with Facebook increased almost sevenfold, to £97,717. Having purchased no ad space on Twitter during the previous year, the organisation spent £54,765 on the site.

Similarly, while the Home Office said its total ad spend fell 14 per cent in 2020, its spending on Google, Facebook and Twitter soared 47 per cent, to £2.3m. The Ministry of Defence also said its overall spending declined, but investment in Facebook more than doubled to £18,236, as it launched a £10,000 “Covid Support Force” campaign to pay tribute to the Armed Forces’ support for the NHS.

Although individual departments may have had a minimal impact on the multibillion dollar revenues of Silicon Valley giants, their shift to digital reflects a broader trend in the advertising industry over the past year, as lockdown prompted most companies to divert funding away from out-of-home advertising. Nielsen data show overall spending on all traditional marketing channels, from TV to out-of-home, was slashed in 2020; cinema advertising saw the biggest decline, plunging 82 per cent to £54.9m.

Advertisers “have had to think carefully about how to adapt their ad strategies to continue connecting with consumers,” Nielsen’s UK managing director Barney Farmer said in the report. As a result, the biggest players “honed in on data” to ensure spending was as effective as possible.

Following a lull for their ad-reliant businesses in the early stages of the pandemic, this increasing focus on online marketing helped lift Big Tech companies to a hugely successful year. In the most recent quarter, Google’s total ad revenue increased 32 per cent, while Facebook’s leapt 46 per cent, making the period their strongest three months for advertising growth in years.

With the pandemic likely prompting long-term changes in how much time we spend online, experts now suggest the growth gained during the Covid crisis could be here to stay.

“How many years can Google’s advertising keep growing at 30 per cent? There’s no sign of [it] hitting the wall yet,” Jim Tierney, fund manager at AllianceBernstein, recently told the Financial Times.

Responding to the IC, a government spokesperson said its communications are kept “under continuous review to ensure value for money”.

“We work hard to communicate a large number of important and complex issues effectively to the public,” the spokesperson added. “In the past year, these have included communications around unprecedented events such as the Covid-19 pandemic and EU transition.

“We’ve used every means possible to give people the information they need, including through TV, radio, social, print and other advertisements.”

A spokesperson for Omnicom declined to comment.