- Sterling rises on back of strong UK inflation number

- FTSE rallies initially, but then runs out of steam

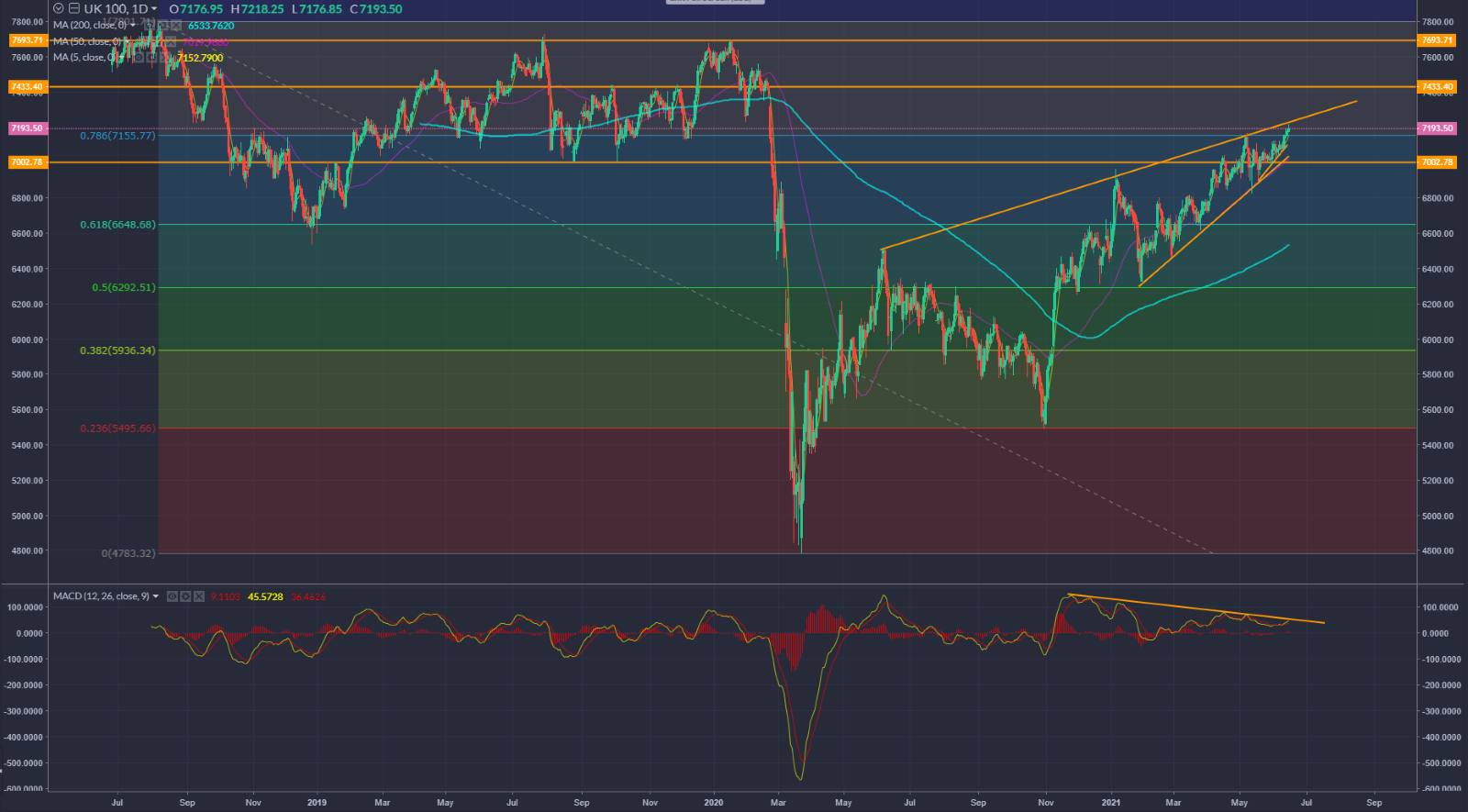

- Few obstacles to blue chips regaining pre-pandemic highs from here

Sterling caught a bid in early trade as UK inflation numbers exceeded expectations and the Bank of England’s target. CPI rose 2.1 per cent last month on an annual basis, up from +1.5 per cent in April. The rate of month-on-month inflation was a racy +0.6 per cent as the economy reopened more. Of course, base effects exert a strong influence but a couple of points similar to the US data to be made: First the core reading of +2 per cent was well ahead of the consensus +1.5 per cent; secondly watch that second consecutive +0.6 per cent month-on-month reading, which is about more than just base effects from last year.

GBPUSD rallied from 1.4080 to 1.4120, running into horizontal resistance at the 78.6 per cent retracement level, immediately after the release of the data as above-target inflation will skew the Bank of England’s reaction more towards tightening sooner. It was not a major move – markets will want to see more data, plus we have the Fed statement and presser later that is likely keeping a lid on the moves. The Bank’s outlook on inflation suggests it is in no rush to raise rates this year – but if we get more readings like this one it may choose to raise rates sooner than currently forecast. Governor Bailey has made it clear the MPC will tighten should inflation consistently exceed the target. Inflation pressures here may not be what they are in the US, but nor does the Bank of England have such a politically motivated employment mandate.

European stock markets were broadly higher in early trade, with the FTSE chasing over 7,200 to a fresh post-pandemic high and the DAX above 15,750 before turning lower in the wake of some softer-than-expected Chinese retail numbers. It comes after a softer session on Wall Street as the Nasdaq and S&P 500 edged back from their all-time highs struck on Monday. All eyes are on today’s Fed meeting and whether the central bank signals it’s thinking about tapering asset purchases any time soon. Minutes from the last meeting in April showed some policymakers are thinking about thinking about tapering – I think Powell will try to stick to that line here and prefer to wait until Aug/Sep to lay out a more formal timetable. Chinese retail sales figures were very strong again at +12.4 per cent, but below the 14 per cent forecast. Industrial production numbers were also a little short of forecast. Copper is down again and trades ~12 per cent below its May peak. WTI trades north of $72 as the bullish momentum continues amid a market that is best characterised by quickly rising demand and stubbornly tight supply. Crude oil inventories later seen at –2.1m after the API reported a huge 8.5m barrel draw that smashed expectations.

The FTSE 100 has now decisively broken the last real hurdle to 7400. With the 78.6 per cent Fib level gone there is an open road back to 7,400 first, thence to 7,700. The long-term MACD divergence needs to be watched, however, whilst the test of the top of the rising wedge may produce a near-term pullback before resumption of the uptrend. Big round number support at the 7k mark. At the end of last year I predicted a return to 7,700 in 2021 – I see no reason to change that view now.

Neil Wilson is chief markets analyst at Markets.com