- The dividend yield points to low long-term returns on equities.

- There's a lot we can do to mitigate this problem, such as not being a buy-and-hold investor.

We should prepare ourselves for years of low returns – and one way to do this is to take market timing more seriously.

One way to see the problem is to recall that the dividend yield on the All-Share index has for years been a great predictor of longer-term returns. With the yield now well below its long-term average, at 2.8 per cent, it is pointing to tough times for equities. Post-1986 relationships predict total returns on the All-Share index after inflation of only 0.6 per cent a year for the next five years. That implies a capital loss in real terms: all the returns will come from yield.

Another approach is to estimate equity returns by simply adding a risk premium to long-term gilt yields. Economic theory tells us that it’s difficult to justify a premium of much more than three percentage points. With real gilt yields below minus two per cent, this too points to low returns on equities.

All of which implies low returns on balanced portfolios. Investors have for years enjoyed good capital gains on bonds, but we cannot rely upon these continuing.

Of course, the future is radically uncertain and so these expectations must be weakly held. But they suggest that it would be prudent to budget on long-term returns being modest. Before the pandemic, western economies were mired in what Harvard University’s Larry Summers calls secular stagnation. There’s no strong reason to suppose that the pandemic has ended that. After a post-pandemic bounce we might well therefore revert to such stagnation – which means weak returns.

What can we do about this? We can change our life strategy or our investment strategy.

One life strategy option for younger people is simply to work longer. Thousands of us are doing just this: since 2006 the proportion of 50-64 year-olds in work has risen from 65 to 71 per cent. For older people, an option is to leave smaller bequests and run down your wealth faster. And for all of us, another option is to live more frugally. There are countless fulfilling ways to pass the time cheaply: reading, walking, learning a language or musical instrument and so on. One of the great errors we make is to assume that skills are something we need only at work. But this is silly: we must also develop our leisure skills.

As for our investment responses, there is one we must resist – to shift from equities to property. One problem with this is that housing is even more expensive by historic standards than equities. Another is that the same weak economic growth that holds back equities would also depress rental growth. A third is that, given the strong correlation between house prices and interest rates, even small rises in the latter would kill off capital appreciation. And on top of all this, the same caveats that have always applied to housing still do – that it is illiquid, and exposed to recession risk.

Another temptation we must resist is to become more active stock-pickers in the hope that we can beat the market. There’s no reason to suppose that a stagnant market is a more informationally inefficient one than a rising market. In fact, it might even make things harder for stock-pickers. Disappointment with economic growth would disproportionately hurt smaller stocks, which would cause most shares to underperform the market. Those are circumstances in which stock-pickers typically do poorly. Yes, there are proven ways in which you can beat the market, by holding defensive and momentum stocks. But there’s not much evidence that these do better in stagnant markets than others.

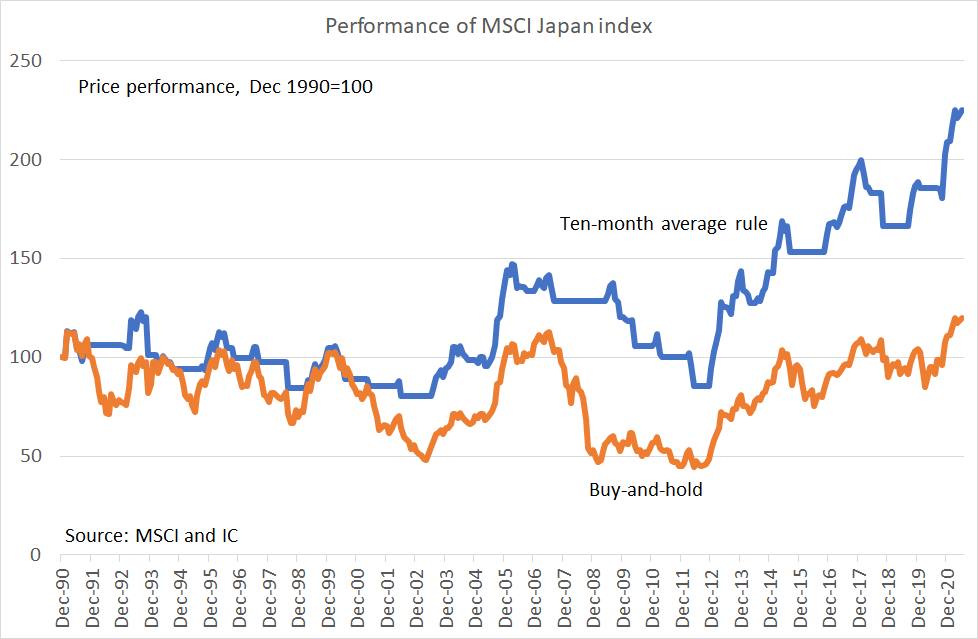

There is, however, something we can do to improve our chances. To see it, bear in mind a lesson from Japan – that poor long-term returns are not the same as a flat market. From December 1990 to October 2019 equities delivered zero capital gains in nominal terms. But this period saw some big rises between big falls. Shares rose 50 per cent from 1998 to 2000, doubled between 2003 and 2007, and doubled again from 2012 to 2015.

Which poses the question: can we get exposure to bull markets while avoiding the slumps in between them?

Yes – to some extent. Somebody who had rigidly followed the rule to sell when prices are below their 10-month average and to buy when prices are above it would have made 60 per cent between 1990 and 2019 even if they had made nothing in the periods they were out of the market. This is because the rule would have got them out of the market for much of the tech crash and financial crisis, but in for a good part of the rallies of 2003-07 and 2012-14.

And, of course, Japan is not the only example of the 10-month rule working. We know that it has worked in the UK, US and in emerging markets. Of course, the rule is imperfect, and following it incurs dealing costs (if you do so outside a unit-linked pensions) and sometimes missing out on dividends. But in stagnant markets there is a risk of large losses, and we need some strategy for avoiding these.

Yes, I know that market timing has a bad reputation. But this is a legacy idea. It’s a hangover from an era when equities suffered only brief dips amid a rising trend and so buy-and-hold investing worked nicely. In an age of low returns, however, we do need market timing. And the evidence – as opposed to old wives’ tales – shows that it can, albeit imperfectly, be done.