When luxury powerhouse LVMH (EUR:MC) reported its first-half profits were almost €1bn (£850m) ahead of the consensus forecast of €4.4bn, it was clear that analysts had missed the scale of the resurgence of extravagant spending by those who were able to save cash through various lockdowns.

The French conglomerate - full name LVMH Louis Vuitton Moët Hennessy - reported organic revenue growth of 53 per cent on last year’s pandemic-constrained first half. LVMH was still in an “excellent position” to grow even from its perch atop the luxury world, said chief executive Bernard Arnault.

Watches and jewellery led the growth, with sales soaring from €1.3bn to €4bn thanks to the purchase of Tiffany & Co., a deal that completed in January. Organic growth - without Tiffany - was still 27 per cent in this division compared to 2019. LVMH’s largest division, fashion and leather goods - think Louis Vuitton, Fendi and Kenzo - saw organic revenue growth of 38 per cent compared to 2019.

US and Chinese consumers fuel explosion in luxury buying

Watches of Switzerland (WOSG), which also owns the Goldsmiths chain, said in its financial year results earlier this month that its customers had turned on the spending taps in the UK as well.

“UK sales growth was driven by high-end luxury watches with higher average selling price, but with reduced volume overall,” said Watches of Switzerland finance chief Anders Romberg. The company’s underlying cash profit for the 53 weeks to 2 May climbed over a third to £105m.

LVMH - for whom Watches of Switzerland sells the Tag Heuer, Hublot and Bulgari products - also noted changes in spending habits as more countries came out of lockdown. China and the US led the spending spree, although LVMH was hesitant to mark the Chinese gains as a win given it is often Chinese tourists who drive luxury spending elsewhere.

“Despite the fact that we are doing very, very good business with the Chinese clients, the share of the Chinese clientele is not increasing,” said LVMH finance chief Jean-Jacques Guiony. There was “very strong growth” with American clients, he added, while European sales showed that locals had stepped up to cover some of the lost tourist spending.

Knock-on effect for diamonds

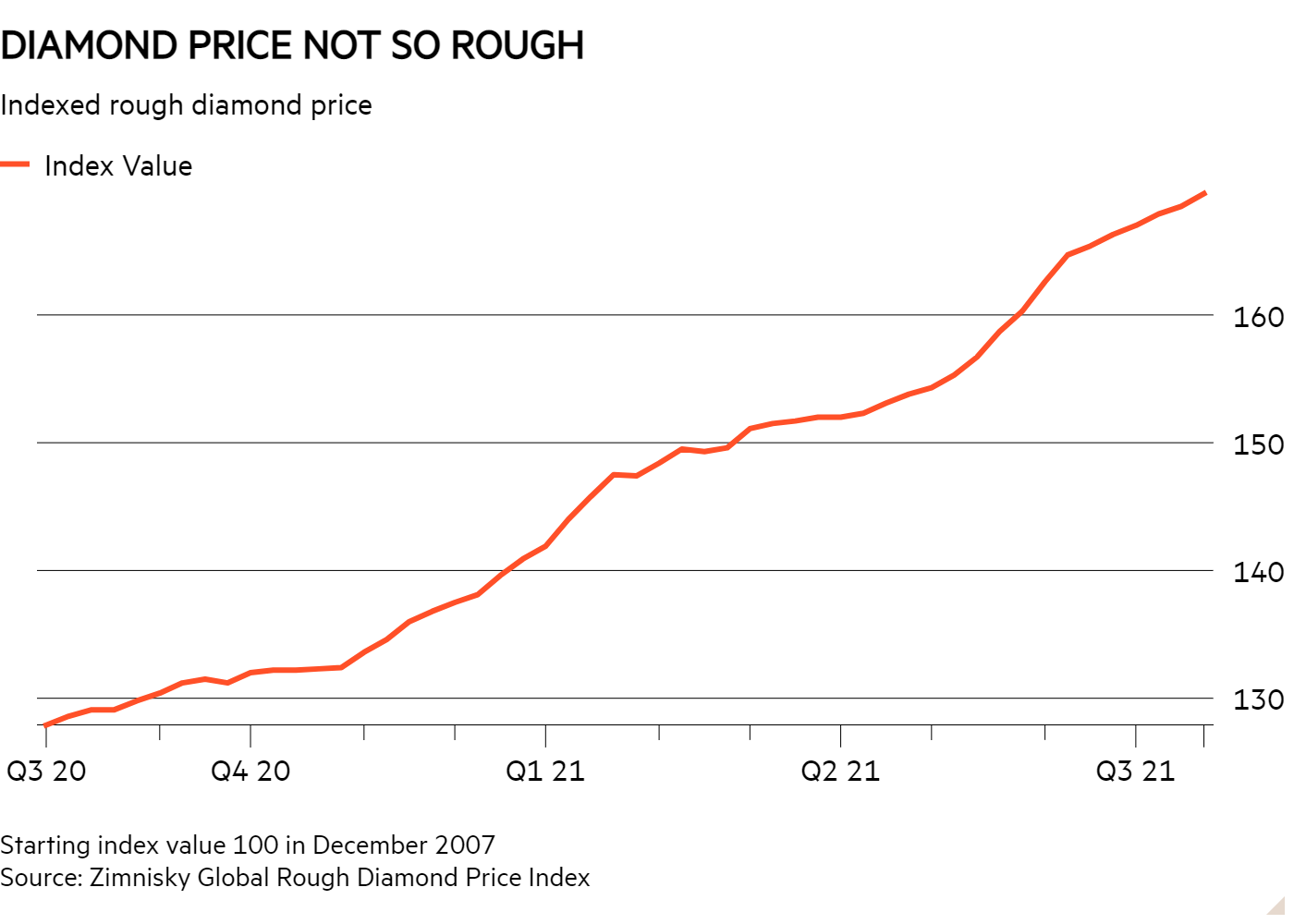

This rush into luxury buying has reverberated down the supply chain. Even the diamond sector, which has faced weak rough diamond prices for years due to market oversupply, has seen a turnaround. This was helped by the supply and demand stars aligning, says diamond industry expert Paul Zimnisky.

“We had curtailed supply, which was good, we had demand from consumers that weren't spending money on experience, and then you had that underlying trend of normalising supply, and that continued growth in China,” he said.

On the demand side, Zimnisky said there was a clear switch from “experiential luxury” spending, like holidays, to “material luxury” spending.

London’s diamond miners have reported the positive impacts of this shift in the first half, which was helped by mine closures cutting supply.

Anglo American (AAL) subsidiary De Beers said “strong demand” for rough diamonds had seen prices improve this year, with the realised rough price up 13 per cent on last year to $135 a carat. This is nowhere near the gains seen in other mining segments, like copper and iron ore, but the diamond market has been in oversupply for years and a shift into positive territory is a real change.

The diamond industry was largely insulated from the terrible impact of the pandemic in India, which is a major hub for diamond polishing and cutting, Zimnisky said, as the government kept workshops open.

Petra Diamonds (PDL) and BlueRock Diamonds (BRD) reported better per-carat prices for their rough diamonds as well, with a “tightness on the rough diamond supply side and a growing retail sector”, in the words of BlueRock’s executive chairman Mike Houston.

Gemfields (GEM), the ruby and emerald miner and owner of the jeweller Faberge, said this consumer appetite had also extended to coloured stones, reporting its highest auction revenue in five years for a recent run of emerald sales.

The question is whether this spending will continue now that hospitality has reopened and travel is returning, albeit with a stutter in the UK.

Guiony at LVMH said it would, given the experience in China. “We have not seen demand slowing down and the shift from luxury renminbis into other categories, including experiences [as China moved out of lockdown],” he said, although leisure travel between China, Europe and North America is still limited.

Major US retailer Signet Jewelers (US:SIG) said last month that it would ramp up its marketing spend to try and keep some of the luxury dollars coming into shops. At the same time, it raised its revenue guidance for the 12 months to the end of January, from $6bn-$6.14bn to $6.5bn-$6.65bn off the back of its first quarter results.

Plenty of sparkle to come.