A combination of exceptional circumstances is giving the life assurance majors a new lease of, well, life. A combination of better actuarial assumptions - i.e. more people dying earlier because of the pandemic - alongside excellent market returns and disposals have left sector bank balances groaning with cash to distribute to shareholders. Both Aviva (AV.), and to a more limited extent Legal & General (LGEN), have benefited from retrenchment in their home markets and have committed themselves to raising pay-outs and enacting share buybacks.

The structure and habits of UK life assurance companies means they offer investors little other than the security of high yielding dividends. This is dependent on their ability to measure and offset risk – effectively making them a mental arithmetic exercise with a nameplate on the door. Importantly, the need to balance risk within certain regulatory-defined parameters limits the ability of life assurers to grow their balance sheets, meaning that capital returns rising equity prices are much harder to achieve.

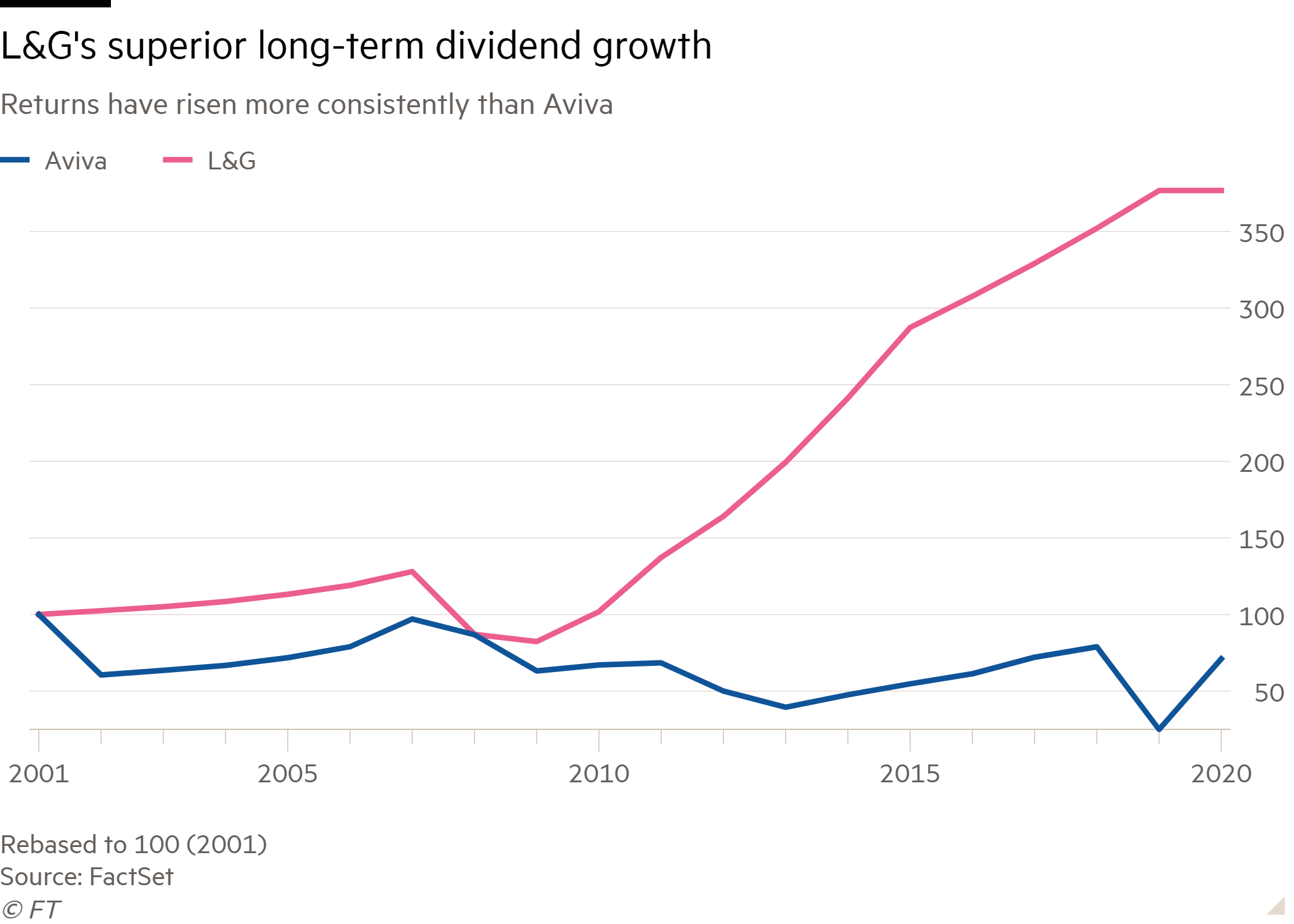

Therefore stolid, solid stability is the name of the game, and it is these qualities, along with the long-term security and stability of the dividend, that makes L&G our pick of the income majors in this sector.

For our purposes, we can discount share buybacks as a form of compensation, if only for the paradoxical idea that investors should be paid to go away. That view automatically disqualifies Aviva from dividend major status as the company is paying out the £4bn in loot from its business sales mostly in buyback form. Yes, these are admittedly more tax-efficient, but the major problem is that unless they are part of a routine capital distribution plan, buybacks only ultimately represent the one-time return of shareholder equity; it is the equivalent of giving up the lease on a shop, selling the stock at a discount, and ultimately leaving no shop and nothing to sell.

By contrast, growing dividends are a more tangible sign of ongoing business momentum. This is especially true of L&G, which is why they have long been a favourite for UK income seekers.

If we compare the two businesses' records on dividend pay-outs, Aviva has had, to put it charitably, a mixed record on this over the past 20 years. As you can see from the graph, with its frequent bumps and dips, the dividend rather accurately reflects the company’s often mediocre performance. By contrast, L&G has grown steadily since the lows in the immediate aftermath of the 2008 financial crisis and seems to focus more consistently on raising the payment, even if by smaller increments.

Another factor to consider is that L&G’s basic dividend enjoys much better cover on a trailing 12-month basis – 1.89 compared with Aviva’s slim looking cover of 1.1. In the case of both companies, cover is forecast to rise next year.

See our other Income Majors:

AstraZeneca payout looks well-protected

Shell remains cautious, even as returns rebound

Tobacco cheers income investors