- Some UK smaller companies funds command huge volumes of money

- We look at how they maintain performance and liquidity

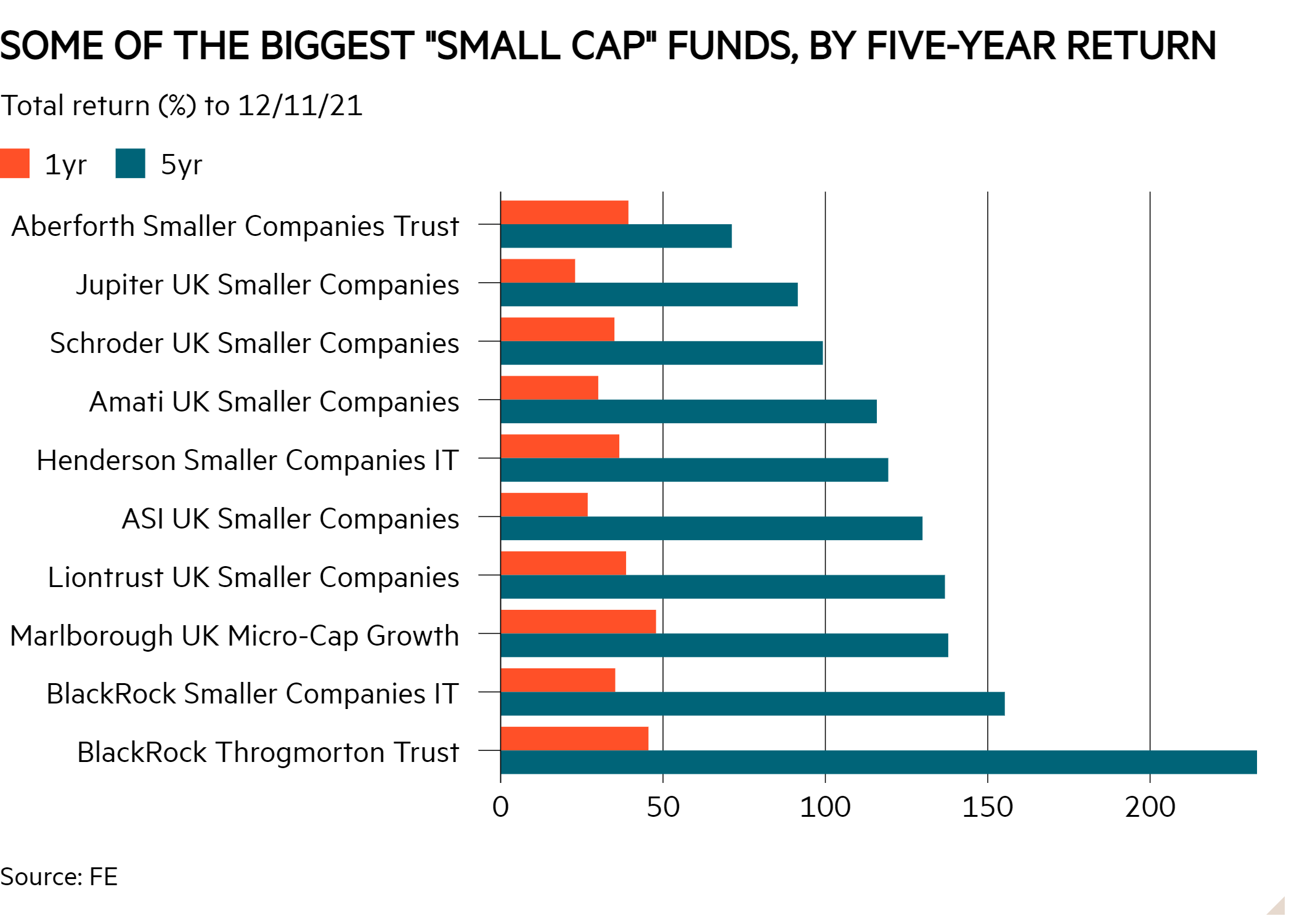

UK smaller companies funds have had an enviable run of performance in the past year that few mainstream equity portfolios have been able to match. But while such funds have delivered strong returns recently and in the longer term, success has brought a complication of its own. Having grown their assets and taken on new money, multiple funds in the Investment Association (IA) and Association of Investment Companies (AIC) UK Smaller Companies sectors now command hefty volumes of money. At the time of writing, 15 funds in the IA and AIC UK Smaller Companies sectors had more than £500m in assets, according to FE data and six funds had more than £1bn.

This is not necessarily a problem, but it can potentially limit the extent to which funds are able to build significant positions further down the market cap scale. And for open-ended funds, it may also mean that greater liquidity management is needed. Such funds, therefore, are more likely to hold larger companies, have higher numbers of holdings and keep some cash on the side.

Ben Yearsley, co-founder of consultancy Fairview Investing, has mixed views on the issue. “Though £500m wouldn’t bother me in a UK small-cap fund, £1bn is the level at which I start to wonder about the impact,” he says. “It does matter how the fund is managed, as small cap can go up to companies with a market cap of £2bn. Liquidity is the most important thing.”

With some arguing that smaller funds are more nimble, it can be worth looking at how the biggest funds have fared. Some of these have generated especially strong gains this year but may not seem as 'pure' a play on small-caps as some of their peers.

Micro machine

Some of the biggest winners in the AIC and IA UK Smaller Companies sectors over the year to 12 November have been microcap specialists, which invest well down the market cap scale. They include River and Mercantile UK Micro Cap Investment Company (RMMC), Miton UK MicroCap Trust (MINI), Liontrust UK Micro Cap (GB00BDFYHP14) and Marlborough UK Micro-Cap Growth (GB00B8F8YX59), with Marlborough Nano-Cap Growth (GB00BF2ZV048) also among the top performers.

One notable name here is Marlborough UK Micro-Cap Growth, which looks to beat the FTSE SmallCap (ex-investment companies) index after charges over a five-year period. With assets worth around £1.7bn, this was recently the second-biggest fund in the IA UK Smaller Companies sector. Its size has not hindered performance but its investment process is still worth understanding.

Perhaps unsurprisingly, its portfolio spans different parts of the market cap spectrum. Its allocation to microcap stocks, defined by the fund as companies with a market cap of less than £250m, accounted for 39.2 per cent of its assets at the end of September. Small-caps, defined as companies with a size of £250m to £1bn, made up 34.1 per cent of assets, with 16.5 per cent of the fund in mid-caps – companies with a market cap of £1bn to £5bn.

Marlborough UK Micro-Cap Growth's managers also spread its assets extremely widely, with 185 holdings in the portfolio. The fund's position sizes are relatively limited with no holding making up more than 3 per cent of its assets. Recent top 10 holdings include S4 Capital (SFOR) and Future (FUTR).

Middle ground

Another large fund in the AIC UK Smaller Companies sector that has outperformed, spreads its assets widely and has a decent focus on mid-caps. BlackRock Throgmorton Trust (THRG) listed 125 long equity positions at the end of September, including relatively large companies such as Electrocomponents (ECM), Gamma Communications (GAMA) and Watches of Switzerland (WOSG), which had market capitalisations in excess of £1bn.

The trust reported that at the end of its half-year in May, 35 per cent of its portfolio was in companies with a market cap of more than £2bn with another 35 per cent in companies sized between £1bn and £2bn, and 24 per cent in ones with a market cap between £400m and £1bn. Around 42 per cent of its portfolio was in FTSE 250 companies.

BlackRock Throgmorton’s stated focus is on 'emerging' small and mid-cap companies rather than just smaller names, but you should understand how it operates. Another relatively large fund run by the same management company, BlackRock UK Smaller Companies (GB00B4LHDZ30), predominantly focuses on small-caps, defined as companies smaller than £2bn. It has similar returns over one year but BlackRock Throgmorton’s performance has been much stronger over longer periods, demonstrating the benefits of a multi-cap approach. Impressively, BlackRock Throgmorton has also significantly outperformed UK equity funds and trusts with an explicit focus on mid-caps over five years.

Others take a similar mixed approach. Aberforth Smaller Companies Trust (ASL) has a notable focus on mid-caps, with 67 per cent of its assets in FTSE 250 companies at the end of September. The trust is spread across 78 stocks, with a 3.8 per cent weighting to its largest holding, Reach (RCH), and allocations of 2.9 per cent to each of Provident Financial (PFG) and Robert Walters (RWA).

If bigger funds that invest in smaller companies can move up the market cap spectrum and increase their number of holdings, they can also keep cash for liquidity purposes. One example is Liontrust UK Smaller Companies (GB00B8HWPP49) whose cash allocation we discussed in 'The equity funds stashing the cash' (IC, 19.11.21). This fund has continued to perform strongly despite its size.

Size constraints

Investors looking for a purer play may welcome the fact that some funds limit their own size. River and Mercantile UK Micro Cap is a good example. This investment trust periodically uses a redemption mechanism to return capital to shareholders and bring its net asset value back down to £100m, a level at which its board believes that the trust is “best able to exploit fully the underlying investment opportunity available in Aim-listed stocks”.

We have previously noted that River and Mercantile UK Micro Cap Investment Company takes a quantitatively-led approach. Its manager, George Ensor, and his team screen companies via various metrics in search of those that have “potential, valuation and timing”. These are names that trade cheaply and have the potential for substantial growth, and a possible catalyst to trigger earnings upgrades and strong returns. Ensor and his team back companies with a market capitalisation of less than £100m, favouring names with a free float of between £20m and £100m. That said, they can run their winners and companies larger than £100m made up just over half the trust's assets at the end of October.