The United States’ economic recovery from the pandemic is a two-part story. The first chapter, which played out in 2021, was about returning the economy to full employment. The Federal Reserve kept the funds rate below 0.1 per cent throughout the year to achieve this.

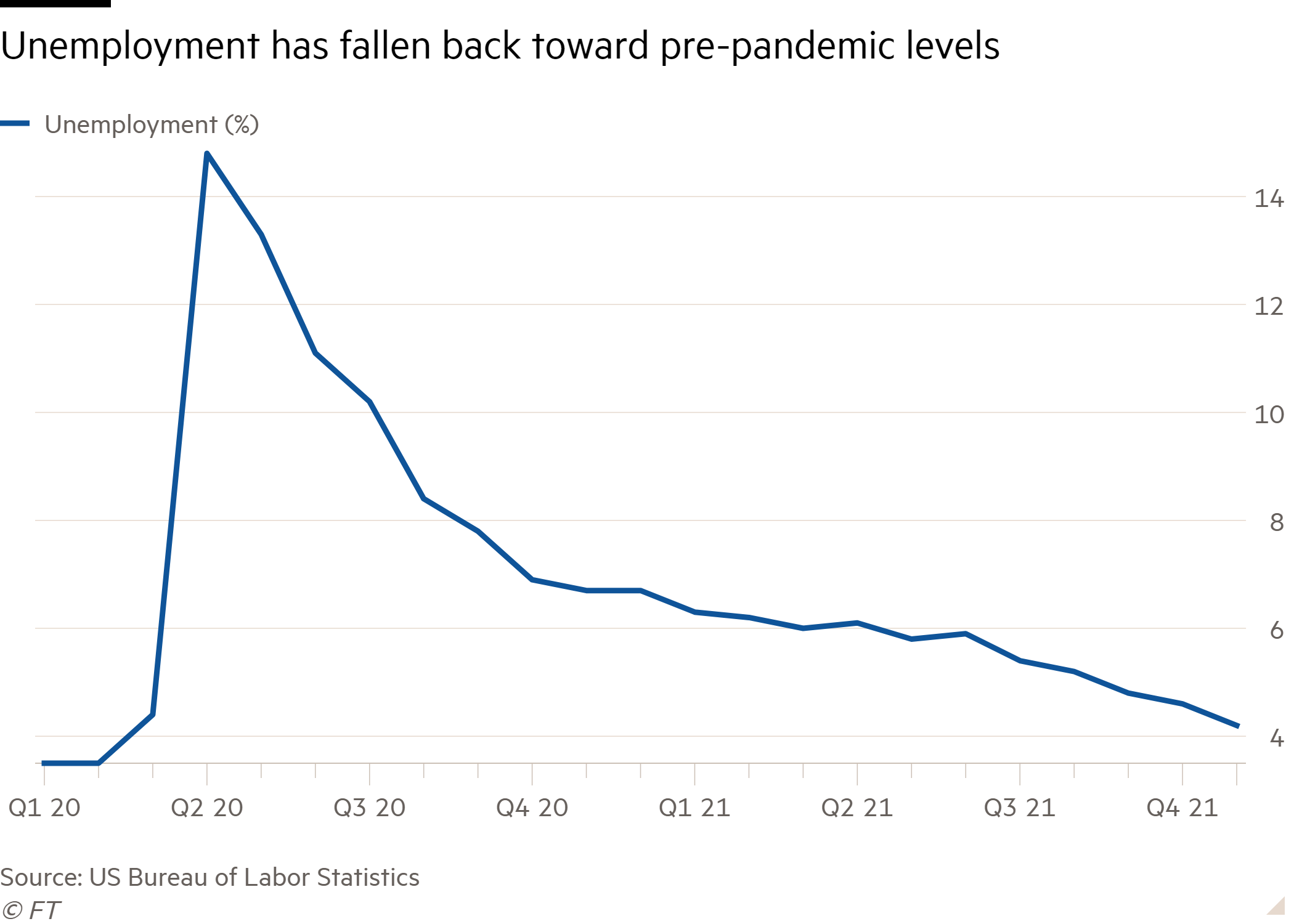

Despite a few bumps in the road caused by new Covid-19 variants, the central bank has nearly achieved its target of full employment. In November, the unemployment rate for non-farm jobs was 4.2 per cent, according to the US Bureau of Labour Statistics – far short of the 14.8 per cent peak in April 2020 and almost level with pre-pandemic levels.