- The volatility of recent weeks has been bad news for classic growth plays

- It has also exposed other less obvious vulnerabilities

If broad market sell-offs leave very few places to hide, certain trades can seem more painful than others at the time. That was the case in January, shen interest rate worries weighed heavily on tech and growth stocks, and the more speculative plays that have won favour during the pandemic.

In the context of funds this has meant some high-profile victims, with Baillie Gifford’s US and global portfolios among the hardest hit as of late January. For example, Baillie Gifford American (GB0006061963) was down by nearly 30 per cent just three-and-a-half weeks into the year. And Baillie Gifford-managed investment trusts such as Schiehallion Fund (MNTN), Edinburgh Worldwide (EWI) and Scottish Mortgage (SMT) were down by around a fifth or more over this period.

Growth stalwarts with a focus outside the US have also suffered substantially, from Chrysalis Investments (CHRY) to Montanaro European Smaller Companies Trust (MTE), and health and tech funds have taken a beating. Growth-heavy global funds such as Fundsmith Equity (GB00B41YBW71), Rathbone Global Opportunities (GB00BH0P2M97) and LF Blue Whale Growth (GB00BD6PG563) were nursing their own heavy losses, too.

This is perhaps unsurprising, given that inflation and higher interest rates threaten the value of growth stocks’ long-term cash flows, challenging their rich valuations.

As ever, staying calm and avoiding knee-jerk reactions during a sell-off can often be the best option. But two relevant questions are: what now looks attractively valued and what vulnerabilities have become apparent in your portfolio?

When it comes to bargains, some professional investors have already been in on the act, with Pershing Square's (PSH) manager Bill Ackmann announcing an investment in Netflix (US:NFLX) on the back of the steep fall in its share price. When it comes to what vulnerabilities have become apparent, some correlations are worth noting.

The ESG complex

A focus on governance can lead environmental, social and governance (ESG) funds to have a bias to quality growth stocks, while even ESG portfolios with a global focus tend to bet heavily on US and tech shares. As a result, many have been exposed to the areas hit hard in the past few weeks. ESG has also arguably become something of a crowded trade, leaving it more vulnerable to an exodus when investors panic.

This explains why the ESG funds most popular with UK investors have tanked this month. The funds run by Baillie Gifford’s Positive Change team were in the doldrums at the time of writing, as were names such as Montanaro Better World (IE00BYWFFF02), Impax Environmental Markets (IEM), Liontrust Sustainable Future Global Growth (GB0030030067) and WHEB Sustainability (GB00B8HPRW47) – as well as many regional ESG funds.

Keystone Positive Change Investment Trust (KPC) has struggled the most this year, with the fund down by around a fifth between the start of the year and late January. Moderna (US:MRNA), its biggest holding which accounted for 9.4 per cent of its portfolio at the end of 2021, has dropped by around 40 per cent in recent weeks after seeing turbocharged gains for much of last year. From ASML (NETH:ASML) to Taiwan Semiconductor Manufacturing (TW:2330) and Tesla (US:TSLA), other holdings have had lesser falls.

Funds like WHEB Sustainability, by contrast, have some not as well-known holdings and less concentrated positions, making them potentially less vulnerable to any investor exodus. Liontrust Sustainable Future Global Growth's top 10 holdings are much more familiar, with names such as Alphabet (US:GOOGL), Visa (US:V) and PayPal (US:PYPL), although the fund is spread across multiple different investment themes.

Thematics

Much like generalist ESG funds, thematic funds have taken on substantial assets in recent years, especially exchange traded funds (ETFs). They also tend to have a high exposure to the US and often a high exposure to tech. As such, many of these names have also run into trouble, registering higher losses over the first three-and-a-half weeks of the year than the tech-heavy Nasdaq 100 index.

Some of these have inevitably been focused on hotter parts of the tech space. One of the most troubled thematic ETFs has been ETC Group Digital Assets and Blockchain Equity UCITS ETF (KOIP), a name with big allocations to the likes of Coinbase Global (US:COIN) and Riot Blockchain (US:RIOT). The Global Online Retail UCITS ETF (PBUY) was also down by more than 20 per cent between the start of the year and late January and WisdomTree Cloud Computing UCITS ETF (KLWD) has had similar troubles.

Other thematics such as healthcare-orientated funds, like L&G Healthcare Breakthrough UCITS ETF (DOCG), and clean energy plays have struggled. The poster-child of the clean energy sector and thematic funds more generally, iShares Global Clean Energy UCITS ETF (INRG), was down by around 16 per cent between the start of the year and late January.

However, a small number of thematic funds have held up much better. The L&G Battery Value-Chain UCITS ETF (BATG) was down by less than 4 per cent at the time of writing, with HANetf ICAV - Airlines, Hotels, Cruise Lines UCITS ETF (TRIP) doing even better. But many thematic funds have suffered heavily. This has also been evident among investment trusts, for example, Seraphim Space Investment Trust (SSIT) was trading at an enormous premium to net asset value (NAV) not long after its launch last year. In January its share price tumbled and it recently traded at a discount to NAV.

Style back in style

If last year's market rotations reminded us that diversification by investment style can protect your portfolio, events of recent weeks have only helped to reiterate that argument. Energy funds are well up so far this year, as are certain commercial property trusts including BMO Commercial Property Trust (BCPT). Value-orientated names such as Temple Bar Investment Trust (TMPL) and Schroder Recovery (GB00BDD2F190) have also racked up healthy gains so far.

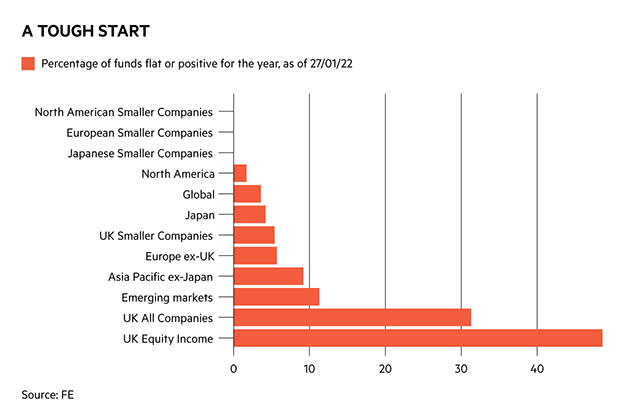

More generally, many UK equity funds have fared well, as shown in the chart, probably because of their focus on value sectors in the UK such as energy and financials. This includes active funds such as City of London Investment Trust (CTY) and dividend ETFs such as the iShares UK Dividend UCITS ETF (IUKD).

While some cyclical forms of exposure have rewarded investors for now, smaller companies funds have had a painful start to 2022. As the chart shows, none of the funds in the North American, European or Japanese smaller companies sectors have eked out a positive return amid the sell-off, although the picture has been slightly brighter for those focused on the UK.