- Some funds have risked becoming a major part of portfolios, despite their specialist nature

- We look at where position size limits might work well

From diversification to broader allocation rules, any discussion about portfolio construction can seem fairly academic when most assets are on the rise. Hefty falls like those seen this year, however, can expose all manner of vulnerabilities – including the risk that fund holdings with a more specialised approach, many of which have powered portfolios in recent years, prove particularly painful as markets turn.

These outcomes can sometimes happen almost accidentally. For those who follow the core/satellite investment approach of putting the bulk of their money into well diversified holdings while adding smaller, more niche holdings at the margins, it is important not to inadvertently let a more specialist fund become too major a part of a portfolio. Here, we look at those names that may have become too prominent ahead of the sell-off, and the funds that could do so in future.

A growth juggernaut

A fund’s general popularity is not a reliable indicator that it has become a prominent holding in most portfolios: a large number of investors might simply have exposure in relatively small amounts. But Scottish Mortgage Investment Trust (SMT), the biggest UK trust by market cap until very recently, is likely to have been viewed as more of a core holding in recent years given its global remit – or at least been permitted to grow significantly on the back of stellar gains in previous years. While some would argue that it is a core holding, its high-octane characteristics and a focus on select growth sectors means paring back the position size, or avoiding similar holdings, are important factors to consider.

As Charles Stanley chief analyst Rob Morgan puts it: “A typical fund or trust in the global equity sector would make a good core holding, but Scottish Mortgage comes with a high level of volatility owing to its very defined high growth style, plus the gearing and the fluctuations in the discount to NAV on top. That would tend to make it a satellite [position in a portfolio], say around 5 per cent.”

There are nuances, with Morgan acknowledging that Scottish Mortgage could be a bigger holding – in the right context, and with certain provisos.

“Assuming a portfolio is well diversified across various asset classes and geographies, and it is for a long-term investor able to handle a more adventurous level of risk, having Scottish Mortgage as more of a core holding, say 10 per cent, is a possibility,” he explains. “It is at least spread across a variety of sectors, geographies and companies at various stages of development. But if you did this what you wouldn’t want is anything else in the growth/tech space on top.”

Painful as it has been, it’s clear that savage market falls may have already reconfigured portfolios heavily exposed to names like these. A Scottish Mortgage shareholder would be sitting on a one-year paper loss of nearly 40 per cent as of 15 July, likely diminishing its size in many portfolios. And yet the investor who avidly rebalances back to their original allocations after a big market move, or who has started to eye up sold-off growth funds, should still be wary of position sizes.

Could it be a similar story for some other prominent Baillie Gifford funds? Laith Khalaf, head of investment analysis at AJ Bell, notes: “Other Baillie Gifford funds have also been popular, like American (GB0006061740) and Pacific Horizon (PHI). But again they have come off the boil, and haven’t been so popular that you say they’d outgrown where they should be in investor portfolios.”

Sector skews

As Morgan notes earlier, one equivalent problem is simply loading up on similar exposures via different holdings, rather than allowing one individual name to become too prominent. Too many technology funds, or too many funds with some kind of exposure to the sector, can prove equally uncomfortable in the event of a downturn.

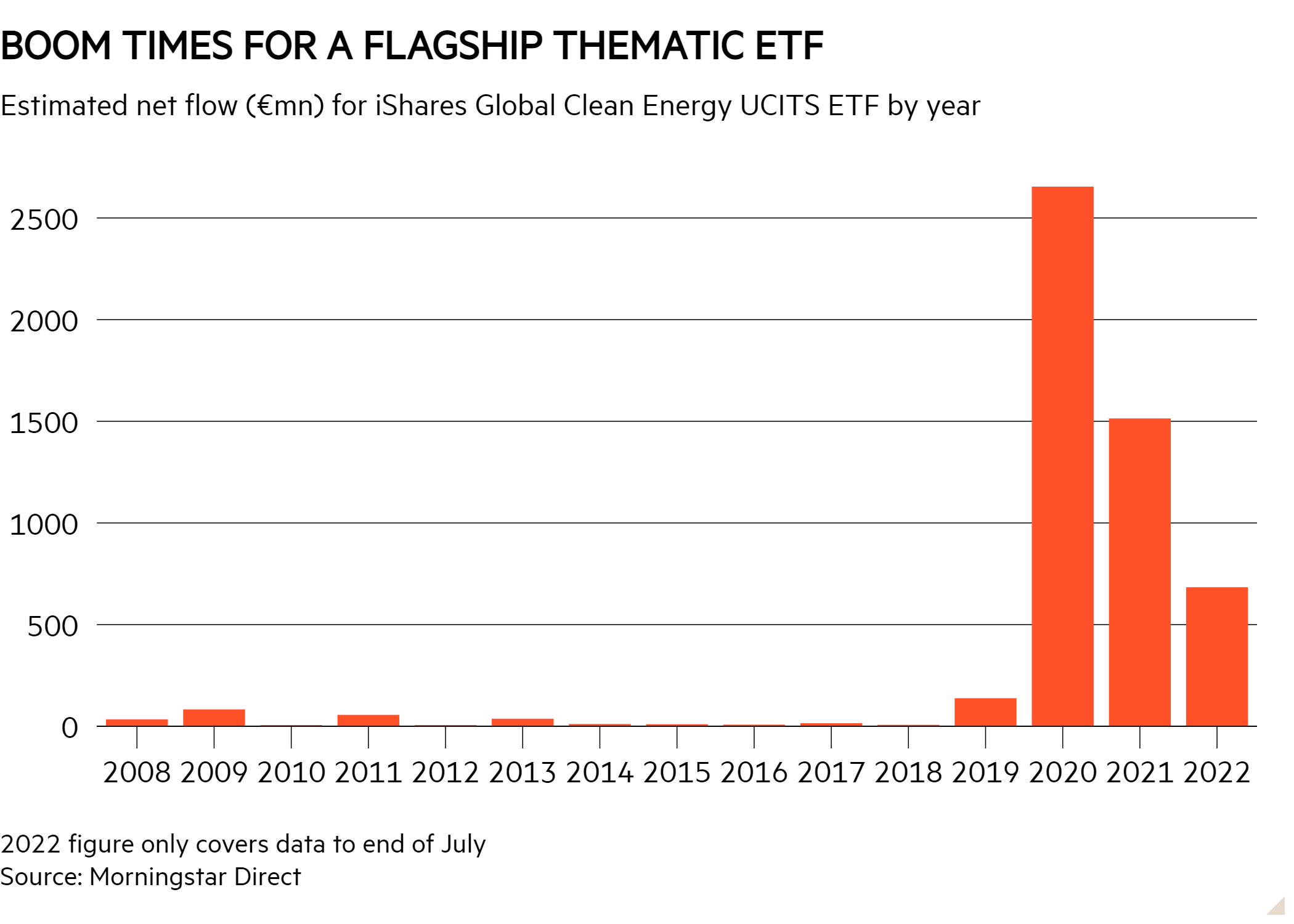

Another popular type of investment fund that may have risked becoming too prominent is the thematic fund. In the ETF space in particular, thematic strategies, which invest in a particular trend or theme as opposed to focusing on a specific region, have taken in billions in inflows over recent years. Names like the iShares Global Clean Energy UCITS ETF (INRG) have been especially popular, but still represent quite a niche holding for all but enthusiasts for this particular sector. While it comes with a higher number of holdings than some rival funds following an overhaul of its underlying index, this iShares ETF, as with its peers, invests in a very niche space.

“Clean energy suffers in that its investible universe is quite small and the opportunities for effective diversification are very limited, therefore it should be a satellite holding,” notes Tom Sparke, investment manager at GDIM. “This would also be the case for other niche themes such as cybersecurity or semiconductors; they are building blocks, not the complete package.”

As with the likes of Scottish Mortgage and funds with an ESG bent, many thematics have taken a drubbing in the recent sell-off. That can provide a potential reset for any investors who have become overly exposed. It's worth noting that deploying new investment into different holdings can be a more sensible way to rebalance away from such holdings rather than selling them at a loss.

Future risks

With investors looking for effective diversifiers and just a select number of funds making gains, there is some risk of another imbalance emerging. When asked about other areas that could become overly prominent in portfolios Morgan points to gold, energy and natural resources funds.

Physical gold funds have had a decent showing in 2022, while resources offerings such as BlackRock World Mining Trust (BRWM) and many others have posted enormous gains over the last year. With other funds racking up losses and investors looking for any sources of positive performance, there is a chance energy plays could become an outsized part of portfolios. However Morgan adds that this trend has only been observable at the margin so far, and “nothing like the mid-2000s when investors suddenly became very enamoured with commodities”.

Similar thinking can apply to other sector-specific plays as they move in and out of popularity, from financials funds to the biotech trusts that have sold off heavily in the last year. Ultimately, portfolio construction rules on diversification and rebalancing can pay off when extreme market moves kick in.

“It’s a case in point for the benefits of rebalancing, not letting positions become too large so that they go onto dominate returns, and for not focusing on past performance too much. People risk buying what has done well rather than what is appropriate for constructing a broad portfolio,” Morgan says.