- Landlord rules out further rent waivers

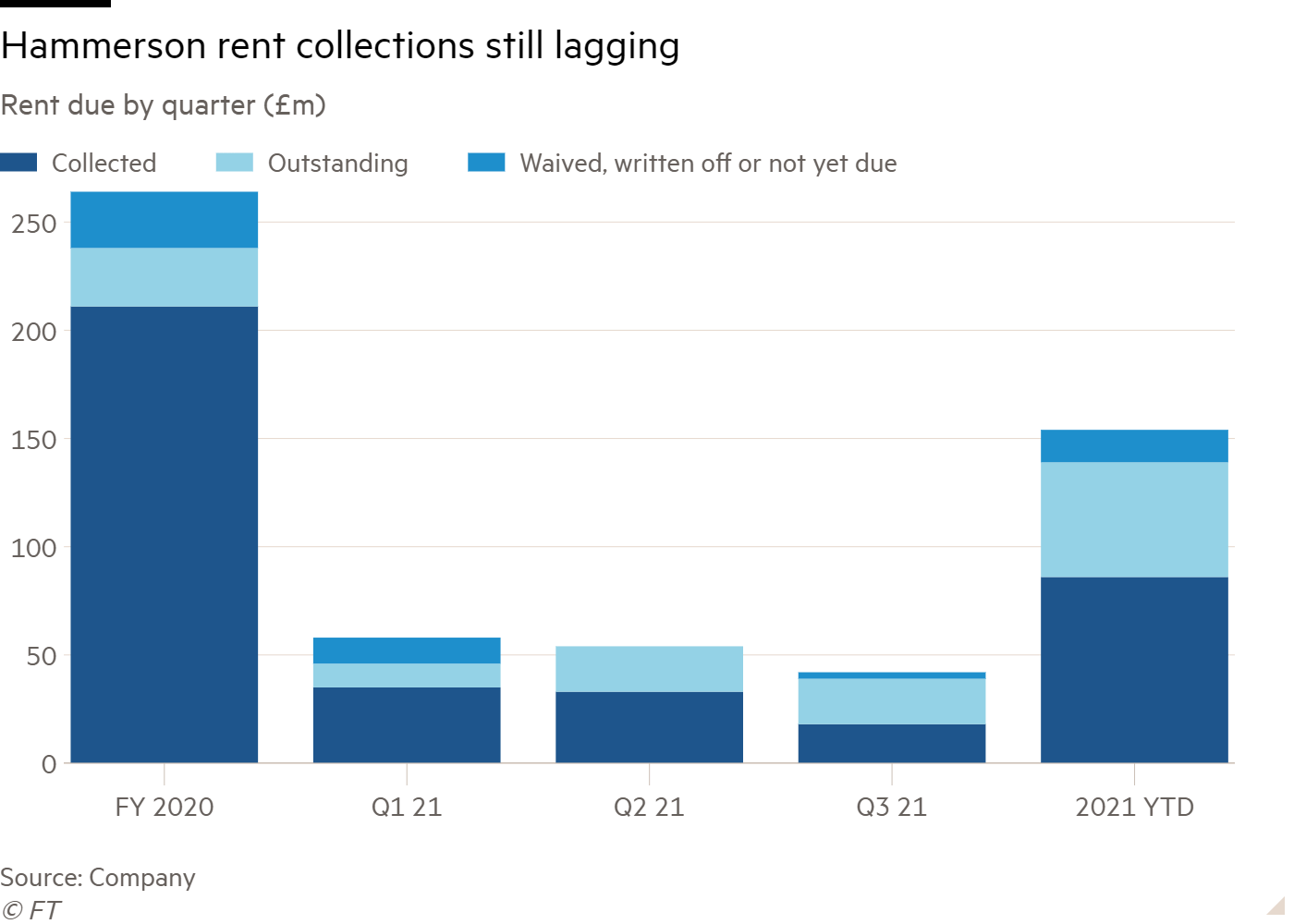

- Just 62 per cent of 2021 rents have been collected

On Monday – christened ‘Freedom Day’ in the tabloid press – equity markets showed little sign of celebration. Growing concern at rising cases of the Delta coronavirus variant around the world sent equity investors heading for the exits everywhere.

In the UK, the FTSE All-Share index dropped 2.3 per cent, with retail and leisure stocks particularly hard hit. Faring even worse was the shopping centre landlord Hammerson (HMSO), which fell 5 per cent as shareholders weighed the likelihood of declining shopper footfall and another period of protracted misery among the group’s retail tenants.

This magnification of sentiment has played out repeatedly over the past year for lots of companies at the sharp end of lockdown rules and consumer sentiment.

The so-called ‘beta’ in Hammerson shares – a proxy for both a stock’s volatility and its risk-reward trade-off – stands at 2.4 for the last 12 months, meaning it is much more volatile than the broader index. The effect cuts both ways: trough to peak, the group’s share price rose 130 per cent in the 20 weeks to 14 June, when market optimism was climbing.

But even before the latest bout of volatility, there were fresh signs that Hammerson’s emergence from 16 months of disruption remains fraught.

On 15 July, the FTSE 250 group disclosed its latest rent figures and said that collection rates have “continued to improve”. Rents for all four quarters of 2020, which had all been billed by October last year, are now 89 per cent accounted for. That’s up from 75 per cent at Hammerson’s January update, but it still means that £27m of last year’s rent is yet to paid, with a further £26m waived, written off or not yet due.

Here, the company appears to be putting its foot down. “We do not anticipate granting future concessions and all avenues to collect rents due are being pursued,” the group now says, despite having granted some level of concession to £15m of the £154m rent so far demanded in 2021.

One can only assume legal action is now a possibility. Given the strain on cash receivables, this kind of veiled threat is understandable.

Indeed, the group’s assertion that collection rates are improving appears dubious. Halfway through January, Hammerson had collected 73 per cent of the £68.6m rent it was due for the third quarter of 2020. Three bills later, and just 61 per cent of the £54m demanded in the second quarter of 2021 have made it into Hammerson coffers. The result is that £32m of rents remain outstanding for the first of 2021, with a further £21m yet to be paid for the current quarter.

A collection rate of just 47 per cent as of mid-July is said to be ahead of the same points in both the first and second quarter, but investors betting on a sharp swing in Hammerson fortunes were probably hoping for greater assurance than the expectation that rent collections will “improve as remaining Covid-related restrictions are lifted”.

Shopper behaviour offers – or perhaps ‘offered’ – one source of encouragement. Hammerson said that seven-day footfall trends across its shopping centre portfolio were between 70 and 80 per cent of pre-pandemic levels, after an initial spike on reopening. Reflecting the anecdotal evidence from several retailers’ trading updates, this shortfall is being compensated by strong sales and higher conversion rates.

Either mindful of additional infection risks in public or simply cashed up and ready to spend, centre visitors are now more inclined to “shop with purpose”. Hammerson reports this trend has been particularly strong in France, where five of its flagship destinations are located.

Whether local shoppers can alone compensate for the gaps left by tourists, particularly in destinations such as Paris, Barcelona and Dublin, remains uncertain. “It will take time for levels to recover to pre-pandemic trading and still have concerns on whether levels will be reached without international visitors returning,” argues Tom Musson, a real estate analyst at investment bank Liberum.

Clearly, the lifting of domestic pandemic restrictions isn’t the only factor in improving rent collection levels. Even restrictions aren’t a one-way street. In France, which has higher levels of vaccine scepticism than much of Europe, the government has introduced a compulsory health pass for access to leisure venues. Analysts also fear inflation could hurt trading.

This is a worry, as the strength and speed of the recovery in the retail market was cited by Hammerson in its 2020 annual report as one of two “material uncertainties” around its ability to operate as a going concern. The fear remains that a sluggish return to ‘normal’ shopping habits, coupled with a further rise in vacancies, could result in breaches of the group’s unsecured gearing and interest cover ratio covenants.

The second uncertainty involves the acquiescence of lenders, particularly around the group’s debt financing. Though shareholders should expect support from debt markets, the facilities’ focus on three joint ventures means Hammerson is not entirely in control of its capital management.

At least April’s disposal of stakes in seven retail parks to Brookfield, together with several other discounted sales, has raised more than £400m in cash to pay down debt. But the drawback to selling higher-quality assets today means a greater reliance on wobbly rents tomorrow.

| Leverage improved by rights issue and sales, for now | ||||||

|---|---|---|---|---|---|---|

| £m | FY19 | /EBITDA | FY20 | /EBITDA | FY21e | /EBITDA |

| Current debt | - | - | 115 | 0.84x | 117 | 0.99x |

| Long term debt | 2,505 | 9.34x | 2,259 | 16.49x | 1,797 | 15.14x |

| Long term debt, less current portion | 2,505 | 9.34x | 2,144 | 15.65x | 1,680 | 14.15x |

| Net debt | 2,777 | 10.36x | 2,163 | 15.79x | 1,420 | 11.96x |

| Source: FactSet, Investors' Chronicle | ||||||

But appetite for large shopping centre assets remains damp, and options look limited. “We remain cautious on Hammerson’s ability to fix its balance sheet through achieving materially more disposals,” says Musson. “It doesn’t yet appear there is enough liquidity in large shopping centre transactions and Hammerson’s JV structures may put some buyers off.”

With the dust barely settled on last year’s rights issue – in which new shares were issued at a 95 per cent discount to their market value and a 41 per cent below their ex-rights price – the turnaround many investors have been banking on still looks very shaky. Broker target prices vary widely, in part due to Hammerson’s sink-or-swim business model, though consensus rests on fair value at 30p a share. We remain more pessimistic: sell at 35p.